- November 22, 2024

- Geplaas deur: Forex Wiki-span

- Kategorie: Gratis Forex EA

TwinSync EA : A Forex Pair Trading Tool

The TwinSync EA is an innovative Expert Advisor (EA) designed for pair trading in the forex market. This EA compares two instruments (currency pairs or assets) and identifies divergences in their movements. It capitalizes on this divergence by opening opposite positions and closing them once convergence is achieved, securing a profit. This review delves deep into the functionalities, voordele, and drawbacks of the TwinSync EA to help traders understand its potential.

Tegniese spesifikasies

Weergawe: 5.02

Jaar van uitreiking: 2024

Werkende pare: Major pairs with stable correlations (bv., EURUSD and GBPUSD).

Aanbevole tydraamwerk: Enige

Minimum deposito: $1000

Gemiddeld van rekening: 1:30 Om 1:500

Beste makelaarslys

TwinSync EA works with any broker and any type of account, maar ons beveel aan dat ons kliënte een van die gebruik top forex makelaars hieronder gelys:

Key Features of TwinSync EA

1. Pair Trading Mechanism

The TwinSync EA analyzes the correlation between two instruments, such as GBPUSD and EURUSD, and opens opposite positions based on divergence. Once the instruments converge, the EA exits positions in profit.

2. Flexible Instrument Selection

The EA allows trading on any two instruments. Traders can set up a "bundle" of pairs, with the EA requiring deployment on just one of the pairs in the bundle.

3. Customizable Parameters

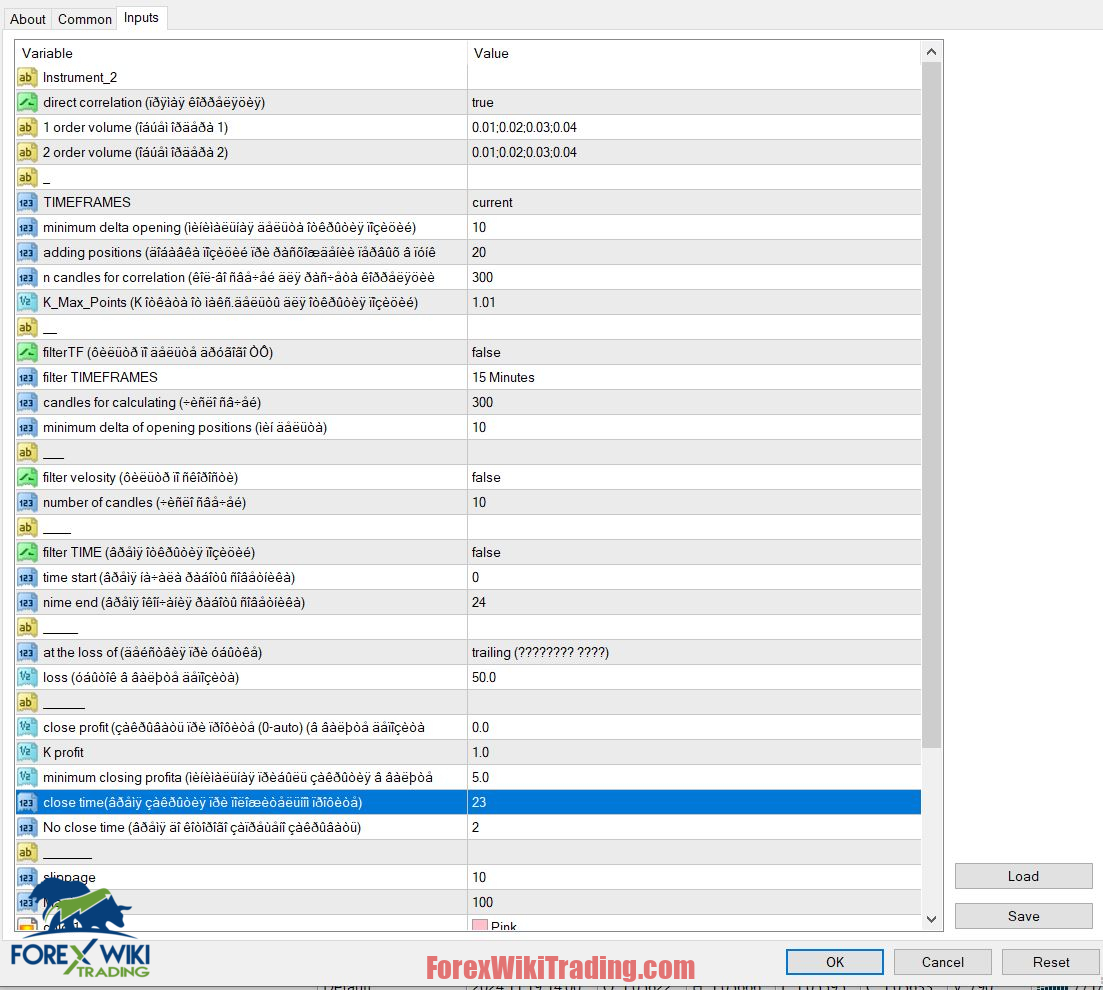

Traders can fine-tune various parameters to align the EA with their trading strategies:

- Lot Sizes: Define volumes for both orders.

- Correlation Settings: Set direct or inverse correlation.

- Delta Parameters: Adjust divergence thresholds for initiating trades.

- Profit/Loss Management: Enable profit/loss close thresholds or use automatic settings.

- Trailing Stop and Slippage: Enhance control over trade exits and minimize entry delays.

4. Visualization and Alerts

The EA draws both instruments’ price movements on the chart and uses color-coded bars to display divergence levels. Alerts notify traders of key actions, ensuring better monitoring.

5. Gevorderde filters

Filters for timeframes (TF), velocity, and correlation over specific periods enable refined entry/exit points. These tools help avoid false signals during volatile market conditions.

Advantages of TwinSync EA

1. Unique Trading Strategy

Pair trading is less common in retail forex but offers opportunities to profit from mean reversion while reducing directional market risk.

2. Multi-Asset Capability

The EA is compatible with any instrument pair, making it versatile for different market conditions and strategies.

3. Risk Management Features

Customizable parameters like stop loss, slepende stop, and minimum profit thresholds allow traders to manage risks effectively.

4. Visual and Informative Interface

Graphical overlays and divergence indicators make the EA intuitive for traders. Alerts ensure traders remain informed about market conditions and EA activities.

5. Aanpasbaarheid

The wide range of adjustable parameters gives traders flexibility to align the EA with their unique strategies and risk appetites.

Drawbacks of TwinSync EA

1. Incompatibility with MT4 Tester

One major limitation is the EA’s inability to function in the MT4 tester due to the platform’s lack of support for pair trading. This prevents users from backtesting strategies, increasing reliance on forward testing.

2. Complexity for Beginners

The abundance of parameters may overwhelm novice traders, requiring a steep learning curve to fully understand and optimize the EA.

3. Dependence on Accurate Correlation

The success of the EA relies heavily on accurate correlation calculations. Unforeseen market shocks or fundamental events can disrupt correlations, leading to unexpected losses.

4. Latency Risks

High-frequency divergence monitoring and trade execution require low latency. Traders with slower connections or high spreads may face reduced profitability.

5. Potential Overtrading

When the divergence increases after initial entries, the EA opens additional trades. This can lead to overexposure, especially in trending markets where divergence persists.

Gevolgtrekking: Is TwinSync EA Worth It?

The TwinSync EA presents a unique opportunity for traders looking to explore pair trading strategies. Its ability to profit from instrument convergence offers a novel way to diversify trading approaches.

Ultimately, the TwinSync EA is best suited for experienced traders who can dedicate time to monitor and optimize its performance. Beginners should approach cautiously, as its complexity and risks may outweigh the benefits without proper understanding and testing.

Download TwinSync EA

Probeer asseblief vir ten minste 'n week ICMarket demo rekening. Ook, vertroud te wees met en verstaan hoe dit gratis forex Tool werk voordat u dit op 'n lewendige rekening gebruik.

Risiko-vrywaring

Trading forex dra aansienlike risiko's en is dalk nie geskik vir alle beleggers nie. Vorige prestasie waarborg nie toekomstige resultate nie. Die statistieke en prestasiemaatstawwe wat aangebied word, is gebaseer op historiese data en verteenwoordig dalk nie toekomstige prestasie nie. Handelaars moet hul finansiële situasie en risikotoleransie noukeurig oorweeg voordat hulle enige outomatiese handelstelsel gebruik