- abril 28, 2022

- publicado por: Equipo Wiki de Forex

- Categoría: Indicadores Forex gratuitos

Best Forex Trend Indicator Review

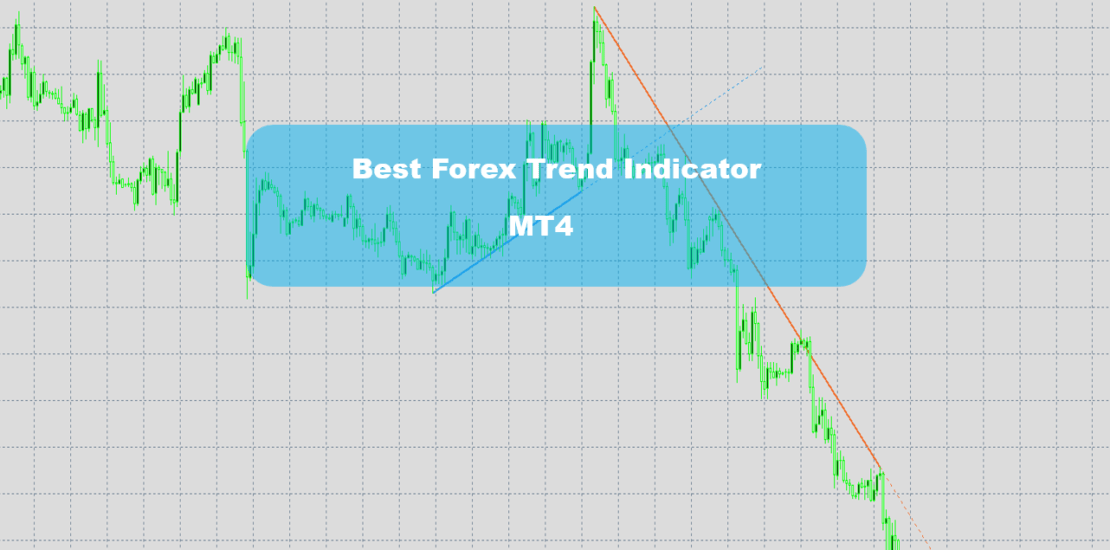

Best Forex Trend Indicator is an MT4 indicator that detects the most precise trend lines and shows them on the chart automatically.

Si utiliza líneas de tendencia con frecuencia en su operación, the provided indicator will make it much easier to deal with them and eliminate the need to manually locate and draw the lines every time.

Only the most recent trend lines are shown in the indicator. If the line's interaction with the price is no longer predicted, it will be deleted from the chart.

When fresh extremes occur, el Mejor indicador de tendencia de Forex does not redraw, but it might adjust the angle of the lines. It's great for short-term and mid-term Forex trading.

Sistema: AutoTrendLines v1.06

Categoría: Indicador

Plataforma: MT4

Par de divisas: All pairs

Tiempo de negociación: Todas las sesiones

⏳ Timeframe: All timeframe

⭐️ Grade: B / ★★★✩✩

Lista de mejores corredores

La Trader Tool funciona con cualquier corredor y cualquier tipo de cuenta., pero recomendamos a nuestros clientes utilizar uno de los principales corredores de divisas enumerados a continuación:

Who is this indicator for?

Trend lines (TL) are a fundamental analytical tool that may be used with any indicator or trading strategy.

This Best Forex Trend Indicator will explain what a trend line is if you're a beginner trader. Además, by viewing the indicator in action, you will learn how to build trend lines on your own.

The approaches listed below will assist you in learning how to interpret trend lines and use them in practice.

For experienced traders, the Best Forex Trend Indicator will recommend trend line options and save time while setting them up.

Technique for Drawing Trend Lines

The Best Forex Trend Indicator begins by attempting to detect all possible trend lines on the chart. It will then exclude more than half of the lines detected using a few crude filters. The surviving ones are then checked for quality, and the two best trend lines are displayed on the graph.

Como resultado, there can only be two lines on the chart at once:

- Downtrend line (red);

- Uptrend line (blue) (orange).

Projection of the Trend

After you've installed the indicator, you'll see that trend lines are divided into two types: solid and dotted lines.

The Best Forex Trend Indicator was able to determine a trend line, which is shown by the solid line.

The dotted line indicates the projected direction of trend continuance as well as the region of probable price-trend line interactions.

As you can see in the diagram above, the indicator accurately distinguishes between actual and false breakouts.

What is the best way to trade using the Trendlines Indicator?

The majority of trend line trading strategies may be divided into two categories:

Price reversal (reversal) from trend line;

- breakout of the trend line

- Trend lines are only utilized as a price movement vector on rare occasions.

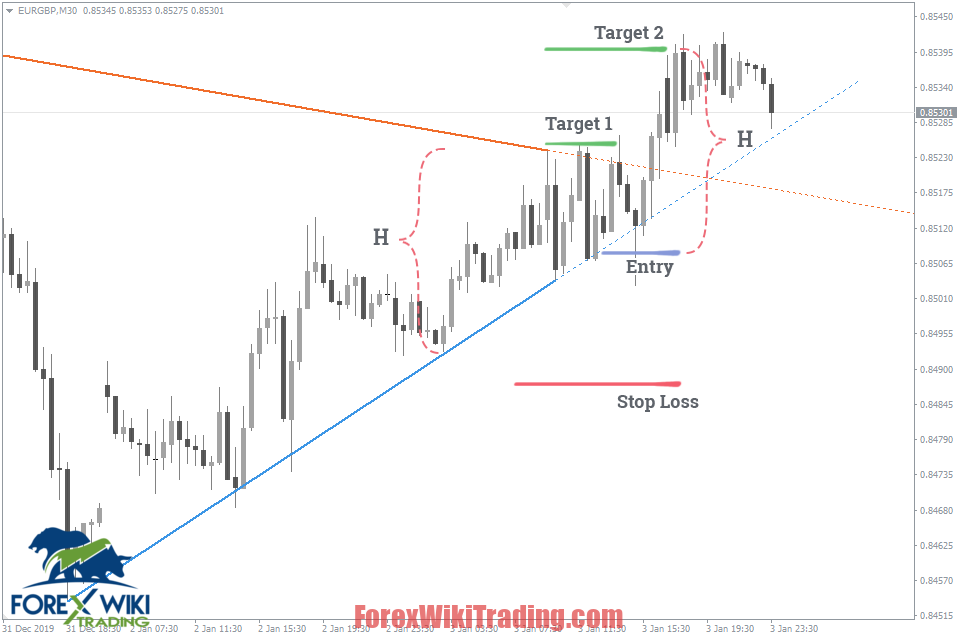

From TL, the price has risen.

You've probably heard that trading with the trend is the most profitable strategy. This is due to the fact that the asset price tends to keep moving in the same direction as the trend, but a reversal is less likely.

Based on the rationale above, the next time the price reaches the trend line, it's advisable to make a trade. You'll also obtain the best reward-to-risk ratio if you combine this with a potentially winning trade.

Como resultado, el "Price bounce from TL" method implies:

When the price approaches or touches the uptrend line, buy;

when the price approaches or touches the downtrend line, vender.

Let's look at the theory behind Stop Loss orders using the market scenario in the image above as an example:

- To avoid being triggered by a false breakout, position your Stop Loss order below the previous low by a significant number of points.

- Take Profit can be set at the highest price level within the trend line's range (TP1), or at the distance equivalent to the preceding wave's height (TP2).

The idea behind sell trading is the polar opposite of buy deals.

We've already explained how to correctly place Stop Loss and Take Profit orders, regardless of the strategy you've chosen.

Breakthrough TL

All trend lines will eventually break. Comerciantes, por otro lado, do not overlook the possibility to earn even in this situation. That is why a technique for trading when the trend line breaks out exists.

Conditions for entering the market:

- If the price has stabilized above the downtrend line after it has been breached, you should consider purchasing if the price also reaches the line from the opposite side.

- If the uptrend line has been broken and the price has settled below it, sell if the price meets the line again from the opposite side.

Both techniques use the same rationale when placing Stop Loss orders. Let's look at the Buy trade as an example:

-

- A stop-loss order should be set below the lowest price level within the trend line's range.

- The level of the highest price obtained at the moment of the trend line breakout should be used to place a Take Profit order.

In the same way, Sell deals may be analyzed using the opposing approach.

The Indicator Preferences

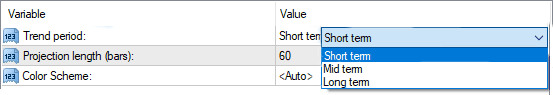

Trend lines are reliably detected thanks to a successful algorithm. Como resultado, just one option has been added:

the depth of the studied price history.

Period of Trend

- Short – 300 velas;

- Mid – 600 velas;

- Long – 1200 velas

The color of the lines is determined by the backdrop color of your chart.

The length of the expected trend line in bars is known as the projection length.

Descargar Best Forex Trend Indicators

Recomendamos encarecidamente probar este sistema comercial durante al menos una semana con Cuenta demo de ICMarket. También, Familiarícese y comprenda cómo funciona este sistema antes de usarlo en una cuenta real..