- diciembre 13, 2023

- publicado por: Equipo Wiki de Forex

- Categoría: EA de Forex gratis

Tokyo Bank EA Review

En el dinámico mundo del comercio de divisas, staying ahead of the curve requires innovative strategies and tools. The Tokyo Bank EA emerges as a promising solution, leveraging unique insights into USDJPY price movements. This article delves into the product's description, backtesting results, and detailed settings, providing a comprehensive guide for traders considering this EA.

Tokyo Bank EA: Unveiling the Product

Product Description: Tokyo Bank EA Fixing EA is designed to capitalize on price movement anomalies specific to USDJPY, focusing on the average price determination time. El trading algorithm employs timing or RSI indicator calculations for trade entries, avoiding risky methods like martingale. Notablemente, the EA executes only one trade at a time and employs take profit and stop-loss mechanisms for risk management.

Versión: 7.0

Lista de mejores corredores

Tokyo Bank EA works with any broker and any type of account, pero recomendamos a nuestros clientes utilizar uno de los principales corredores de divisas enumerados a continuación:

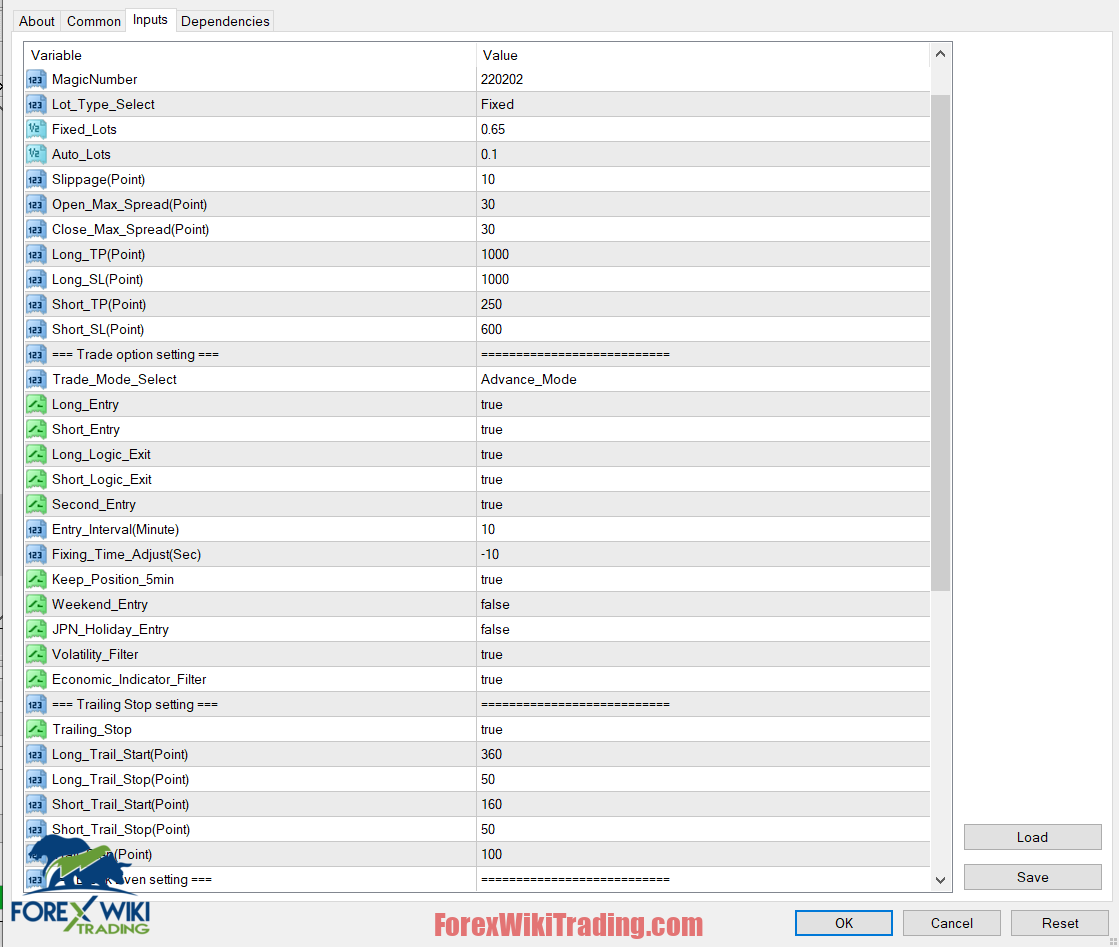

Understanding Tokyo Bank EA Settings

Key Settings:

- Número mágico: Unique identifier for trades

- Lot Type Select:

- Fixed Lots

- Auto Lots

- Sippage Point: Settings for slippage control

- Open/Close Max Spread Point: Managing maximum spread

- Long/Short TP (Saca provecho) y SL (Detener la pérdida de):

- Long/Short Puntos de entrada

- Logic for Entry and Exit

- Second Entry

- Entry Interval (Minutos)

- Trading Time Adjustment (Seconds)

- Position Retention Time

- Weekend Entry

Trade Option Ajustes:

- Trade Mode Select:

- Long Entry

- Short Entry

- Logic and Entry Interval:

- Long/Short Logic

- Second Entry Interval (Minutos)

- Funding Time Adjustment (Seconds)

- Position Retention Time

- Weekend Entry

- JPN Holiday Entry

- Volatility Filter

- Economic Indicator Filter

Trailing Stop Settings:

- Parada final:

- Long/Short Trailing Start Points

- Long/Short Trailing Stop Points

- Paso final (Puntos)

Break Even Setting:

- Break Even:

- Long/Short Break Even Points

Understanding and customizing these settings is crucial for optimizing Tokyo Bank EA's performance based on individual trading preferences and market conditions.

Backtesting Insights

Backtesting Overview: The Tokyo Bank EA has undergone meticulous backtesting with a minimum deposit, utilizing both fixed lot and auto lot settings. The EA showcases commendable results with a low percentage of maximum drawdown.

- Performance Summary:

- Beneficio neto: $29.50 encima 76 vientos alisios

- Tasa de victorias: 64.47%

- Relación de Sharpe: 0.14

- factor de beneficio: 1.38

- Largest Winning Trade: $6.09

- Largest Losing Trade: -$13

- Consecutive Winning Streak: 7 vientos alisios

- Consecutive Losing Streak: 3 vientos alisios

- Trading History:

- Profitable in 5 fuera de 7 meses

- No losses in the last 3 meses

Análisis: The EA exhibits robust performance over the past 7 meses, demonstrating ganancias consistentes, a favorable win rate, and minimal drawdown. Sin embargo, traders must exercise caution, recognizing that past performance does not guarantee future results.

Conclusión

The Tokyo Bank EA stands out as a robust tool for USDJPY trading, offering a unique approach to market anomalies. Traders are encouraged to conduct thorough research, consider the backtesting results, and customize settings judiciously to align the EA with their trading goals. Como con cualquier herramienta comercial., risk management remains paramount, and past performance should be viewed as one of many factors influencing trading decisions.

Download Tokyo Bank EA

Inténtalo durante al menos una semana y cuenta demo de XM. También, Familiarícese y comprenda cómo funciona esto. La herramienta Forex gratuita funciona antes de usarlo en una cuenta real.