- junio 14, 2019

- publicado por: Equipo Wiki de Forex

- Categoría: Sistema de comercio de divisas

Quiere una ruta común para el comercio en, desea descubrir un movimiento en el valor que ocurre una y otra vez, y lo más importante, este movimiento quiere ofrecer oportunidades suficientes para lograr un buen regreso.

An ideal instance of that is the value breaking its earlier excessive and low of the final week.

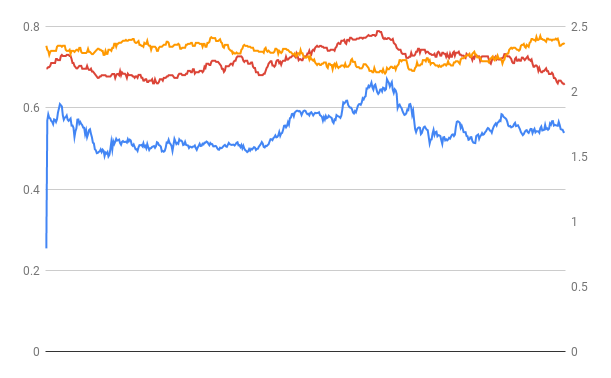

Take the 2 graphs beneath.

The blue in is the weekly closing value. The purple line is the likelihood of breaking final weeks excessive when the final week closed optimistic on the week. The orange line is the likelihood of breaking final weeks low when the final closed adverse on the week.

The primary graph is of EURUSD, the second is of GBPCAD.

The possibilities are basically the identical. The hit charges oscillate between 65%-80% relying on how stylish the market is in a single route or the opposite, however normally hangs round 67%-72%.

So this provides us a route to commerce every week, and a revenue goal that has at the least a 65% likelihood of being reached finally.

Subsecuente, we have to have a look at a smaller time-frame, one thing just like the 1 gráfico de horas. At this level, you should use no matter conventional indicators/entry sign you would like. No matter you employ, you wish to search for setups that meet 2 necessities:

1. The danger reward ratio is 2 o más grande.

2. The entire vary of the setup is 100 pips or higher.

The explanation you we require a threat reward ratio of 2 or bigger is this implies we solely should be proper greater than 33% of the time to earn money in the long run, buying and selling in direction of a goal that has a 65-70% likelihood of being hit finally. This provides us at the least 2-3 alternatives to seize that transfer, and nonetheless earn money over the long run.

Junto con esto, I additionally prefer to think about fundamentals and market sentiment and solely commerce within the route of these as effectively. I'll breakdown how I strategy this at a later date.

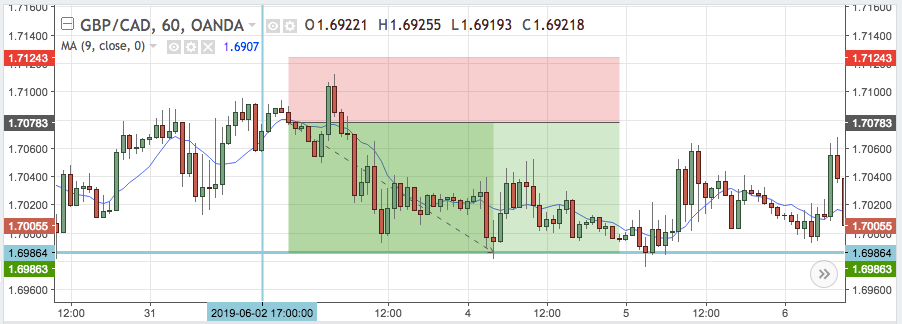

Right here is an instance commerce from a couple of weeks in the past on GBPCAD utilizing a 2 bar engulfing sample with a threat reward ratio of 2. The entire vary of the setup was about 130 pepitas. The blue horizontal line is the low of the earlier week, which had at a minimal, a 66% likelihood of being hit the next week. The blue verticle line is the beginning of the following week.

As soon as the week begins, begin stalking the marketplace for an entry value towards your goal, and ONLY commerce in direction of your goal, ensuring your setup meets the 2 necessities listed above.

I'll get round to posting stats on all 28 main pairs.

I can even be posting the setups every week I'm going to be stalking.

Tenga en cuenta, you'll be able to't predict value. All you are able to do is perceive its habits and stalk it like a cheetah chasing a gazelle.

¿De cuánta utilidad te ha parecido este contenido?

¡Haz clic en una estrella para puntuarlo!

Promedio de puntuación 1 / 5. Recuento de votos: 1

Hasta ahora, ¡no hay votos!. Sé el primero en puntuar este contenido.

¡Siento que este contenido no te haya sido útil!

¡Déjame mejorar este contenido!

Diez centavos, ¿cómo puedo mejorar este contenido?