- May 28, 2013

- Posted by: Forex Wiki Team

- Category: Free Forex EA

Seasonal patterns are some of the most powerful and least understood forces in financial markets.

Some of the most well-known seasonal trends in Forex point to US dollar losses in the month of December and Japanese yen moves through the end of the Japanese fiscal year as exporters repatriate profits. But how can we turn these into winning strategies?

What most people lack is a clear and simple way to analyze the Forex market and see in real time if a currency pair is following a specific seasonal pattern or not.

Well that’s where we are here for!

We just developed a new set of indicators that will let you do that kind of analysis over different timeframes.

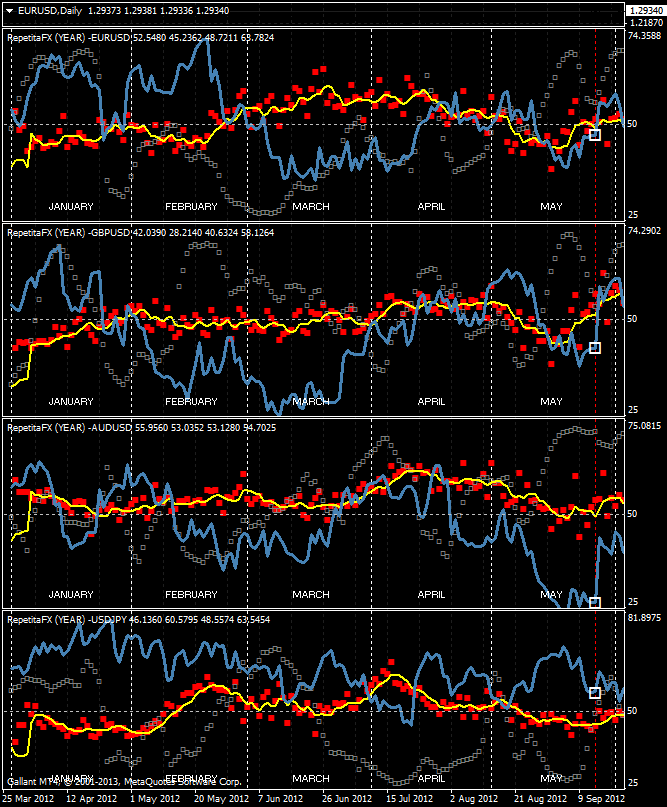

Here’s what the yearly seasonal trend indicator looks like:

In brief…

- The red dots are the calculated values from all the past years.

- The yellow line is the smoothing of the red dots and can easily identify the seasonal trend.

- The blue line is the actual trend (that is not used to calculate the seasonal trend).

- The grey dots show the correlation between the seasonal trend (yellow line) and the blue line (actual trend). When the grey dots are rising (possibly above the middle line) it means that the correlation is increasing and so the currency pair is following the seasonal pattern.

- The white square and the red dotted line shows you where in the time period you are actually.

Seasonality is basically an analysis over a specific period of time (usually one year) but we developed indicators able to analyze lower timeframes like a month, a week and the 24 hours.

That will let us discover and use “hidden” patterns over different timeframes:

- Are there specific months over several years when pairs tend to gain/lose?

- Are there particular days of the month (example: third Friday of each month, etc) that show a statistically tradable pattern?

- Are there days of the week when most of the performances are made?

- What’s the impact of the open/close of each major markets (London, New York and Tokyo) during the day?

These are the questions that the set of indicators RepetitaFX was made to answer for each of the instruments you decide to analyze and – most importantly – in real time!

But how can we use them? Here are a couple of simple examples:

Filter

The first option is to use seasonality to filter our trades/trading strategies. What we do is to trade only when the instrument is following a seasonal pattern and in the main direction of the seasonal pattern.

If you want to keep on trading, what you can do is lower/increase the lot size based on the fact that the pair (or more in general “instrument”) is in a seasonal pattern or not.

Seasonal Trend

A second option is to completely rely on the seasonal patterns and trade based on the statistical prediction coming from the pattern.

Trading is mostly a matter of timing. Seasonality analysis can give a great help in that, thus improving a lot your trading performances.

RepetitaFX statistically it calculates how the instrument tends to behave during the year, during the month, during the week and during the day. It’s made up of 4 indicators each dedicated to analyze a specific timeframe.

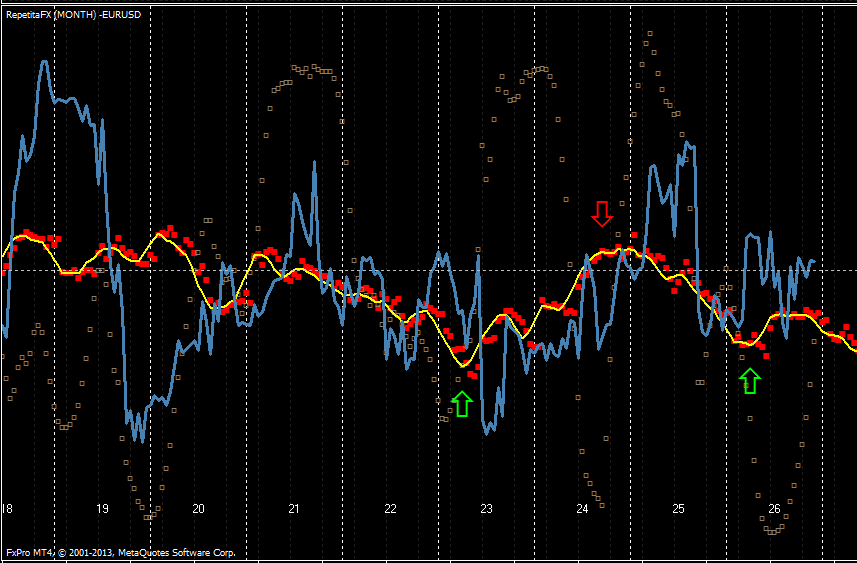

In this case we had a chance to trade an inverted V “swing” pattern that usually forms between day 23 and day 26/27 of the month of April 2013.

Here’s the pattern:

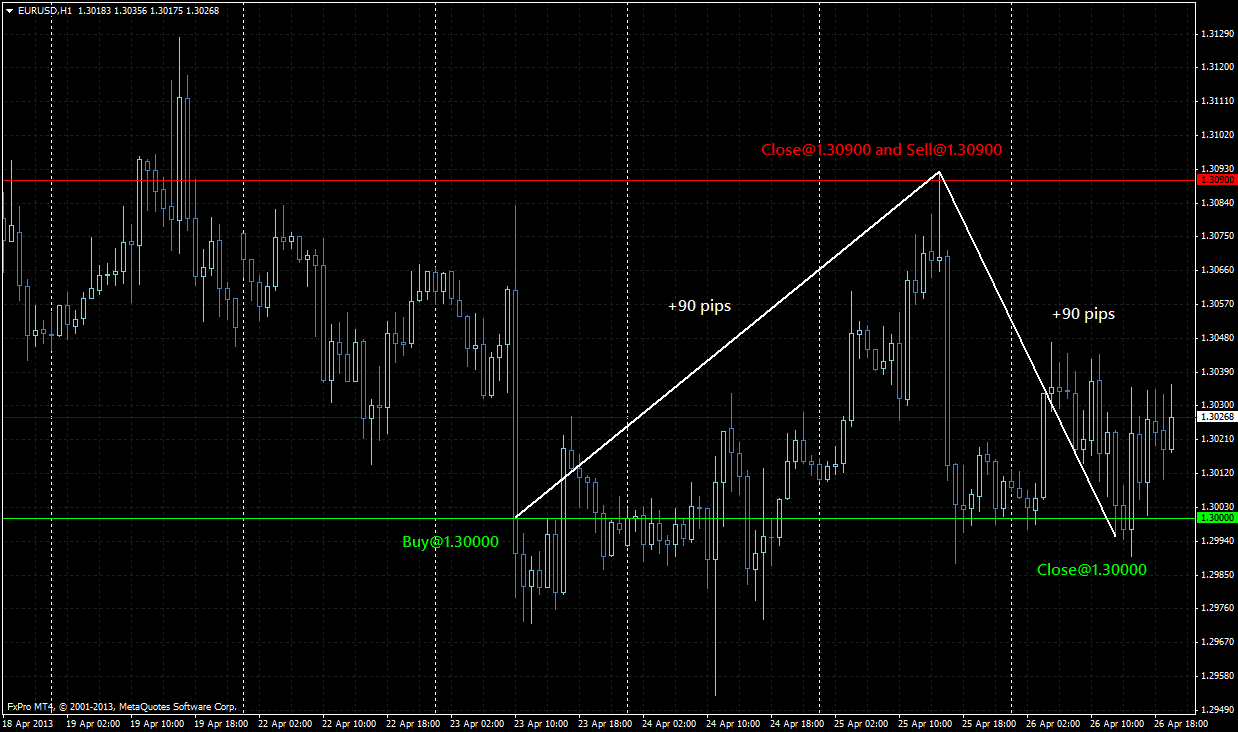

So we placed a buy limit ordern on EURUSD to touch a key level at 1.3000 the 23rd hopefully with a target at 1.3100. The day after (24th) we decided to lower the take profit to 1.3090 as we saw that the EURUSD wasn’t strong enough to reach the first target (the Diver indicator showed us a series of resistances there). We then closed (with 90 pips profit) and reversed the first trade waiting for the EURUSD to reach another low on 26/27.

We didn’t expect it to reach the target one our later and so we didn’t place any target at first on the trade. We did it the day after and fortunately it reached our target again giving us another 90 pips.

Notice how the EURUSD correlation (grey dots) to the pattern was growing giving us confidence when placing orders.

That is just an example of how to profitably use “seasonal” patterns and possibly integrate them into your trading systems, for example with other of our indicators like we did with the Forex Diver.

As you can see we can’t expect perfect timing but knowing the general trend for the next weeks, days, hours is a great edge.

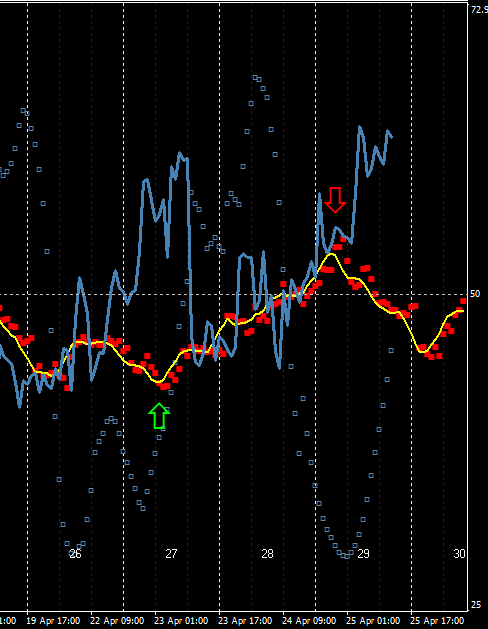

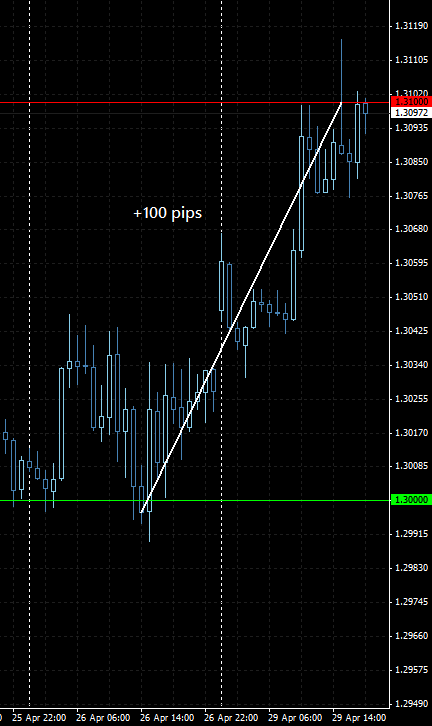

Well, we didn’t simply close the trade on Friday but we reversed and went long to close in the next Monday at 1.3100 level with another 100 pips profit.

Here’s the signal we had:

Signals were confirmed by the rising correlation between the actual score and the seasonal one.

And here’s the next trade we closed out for a profit:

As you can see, after the deep on April 26th, we were expecting a new high for the beginning of following week (April 29th) and that’s exactly what happened!

We know that the “seasonality” concept was applicable to Forex as well, but we’ve been surprised about how many times a pair behaves following these patterns.

RepetitaFX in reality is a set of indicators: 1 indicator for each of the 4 timeframes we want to analyze.

Each of them shows 4 “lines”: a series of red dots that are the average values for that bar over the period taken in exam, a yellow line that is an average of the red dots values and it’s made to simplify the reading of the trend, a blue line that is the actual value of the trend for the specific timeframe and finally a series of grey dots showing the correlation between the “historical” average values (red dots/yellow line) and the actual score (blue line). The correlation is fundamental to understand if the instrument is behaving following a seasonal pattern or not.

One important thing is that the current values are NOT used to calculate the average scores! As an example “RepetitaFX Year” – which must be applied to a daily chart – does not take into account the days of the current year when calculating the average scores of previous years. In this way we can really compare this year’s price action with the seasonality of previous years. The other three RepetitaFX indicators – namely “Month“, “Week“, and “Day” – follow this very same rule on their appropriate timeframe.