- अगस्त 12, 2023

- के द्वारा प्रकाशित किया गया: विदेशी मुद्रा विकी टीम

- वर्ग: विदेशी मुद्रा व्यापार प्रणाली

Advanced Divergence Trading Review

Trading in the forex market demands knowledge, precision, and sometimes a bit of intuition. Every trader is always on the lookout for strategies that can enhance their profitability. The "Advanced Divergence Trading" system seems to be one of the potential strategies catching the attention of many. Built around the core concept of divergence, this strategy offers a fresh perspective to seasoned traders and newbies alike.

सर्वश्रेष्ठ दलालों की सूची

Advanced Divergence Trading works with any broker and any type of account, लेकिन हम अपने ग्राहकों को इनमें से किसी एक का उपयोग करने की सलाह देते हैं शीर्ष विदेशी मुद्रा दलाल नीचे दिये गये:

The Foundation: Understanding Divergence

Before diving into the specifics of the strategy, let's first understand divergence in the context of forex trading. Simply put, divergence happens when the price of an asset is moving in the opposite direction of an indicator. In our case, we're focusing on the RSI (सापेक्ष शक्ति सूचकांक) as our leading indicator. Divergences, especially on the RSI, can often suggest potential reversals, making them a valuable tool for traders.

The Tools: Zig Zag & आरएसआई

For this strategy, we’ll employ two primary tools:

- Zig Zag Indicator (with Depth 50): This tool highlights significant highs and lows in the price chart. It offers a clearer picture of market swings, aiding in identifying potential breakout or breakdown points.

- आरएसआई (period 140): An extended period RSI, as opposed to the more traditional 14-period version, offers smoother curves, making divergences easier to spot.

The Strategy in Action

Buy Setup:

- Spot the Breakdown: The first step is to observe the price breaking below the most recent significant low, as identified by the Zig Zag indicator.

- RSI Divergence Check: Once the price breaks down, look at the RSI. If the RSI forms a higher high (while the price is making a lower low), it's a signal of positive divergence. If no divergence is observed, it's best to stay out of the trade.

- Trade Entry: Post the RSI divergence, wait for the price to close above the latest low. This is your green light to enter the trade. The stop loss (क्र) should be set at the latest high, while the take profit (टी.पी) can be flexible but is typically set at twice the distance of the SL.

Sell Setup:

- Spot the Breakout: This time, wait for the price to surge above the most recent high pinpointed by the Zig Zag tool.

- RSI Divergence Verification: Upon the price breakout, monitor the RSI. A lower low on the RSI while the price makes a higher high signals a negative divergence. Absence of this divergence is a cue to abstain from the trade.

- Positioning the Trade: After confirming the RSI divergence, await the price to close below the latest high before taking the trade. The SL should be at the latest low with the TP typically being twice the SL distance.

Visual Learning

As the saying goes, "A picture is worth a thousand words." For a more detailed walkthrough, please refer to the attached images. They will provide a visual representation of the setups described above, ensuring you grasp the strategy comprehensively.

जोखिम प्रबंधन: The Golden Rule

The Advanced Divergence Trading strategy boasts an impressive win rate. तथापि, it's essential to remember no strategy is foolproof. Always adhere to stringent risk management principles. It's advisable to risk only 1% को 3% of your capital on any single trade. By following this rule, even a series of losing trades won't significantly dent your trading capital.

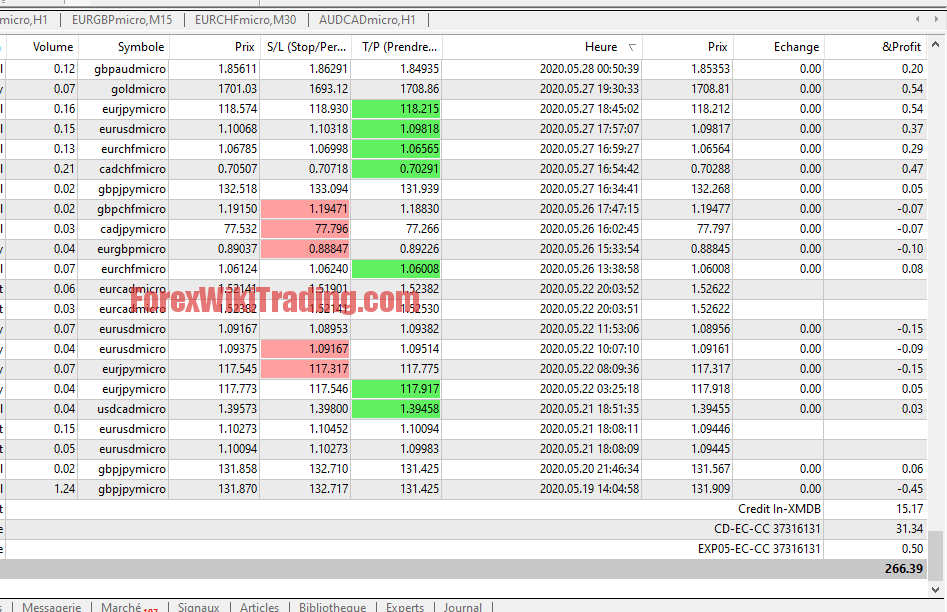

Purchase Setup:

Promote Setup:

I did take this commerce

After the worth shut under the road i take a promote commerce however it went up and hit my SL

so i waited the worth to shut once more under the road and that i seemed into the the RSI and nonetheless bearish divergence so i've my affirmation to take one other promote commerce and at last hit my TP

i dont all the time use final bottoms and tops on this commerce he didnt hit hit the final backside

commerce on GBPJPY there was a setup on M5 chart

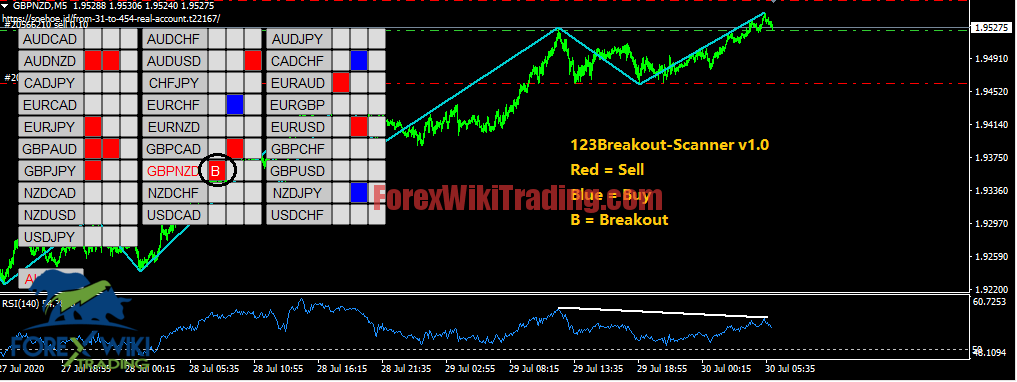

GBPNZD M5 Bullish setup

Scanner Device:

In Conclusion

The "Advanced Divergence Trading" strategy, based on its principles and win rate, is a worthy addition to any trader's arsenal. Remember, trading is as much about discipline and patience as it is about strategy. Equip yourself with the right knowledge, stick to your risk management rules, and happy trading!

Download Advanced Divergence Trading

कृपया कम से कम एक सप्ताह तक प्रयास करें एक्सएम डेमो अकाउंट. भी, अपने आप को परिचित करें और समझें कि यह कैसे होता है free forex tool works लाइव अकाउंट पर इसका उपयोग करने से पहले.