- मई 24, 2013

- के द्वारा प्रकाशित किया गया: विदेशी मुद्रा विकी टीम

- वर्ग: विदेशी मुद्रा व्यापार प्रणाली

A easy practise technique to assist higher perceive Worth Motion in MotionOn this technique we'll use the Candle Shadow Consolidation Zone (CSCZ).

Allow us to check out the next state of affairs:

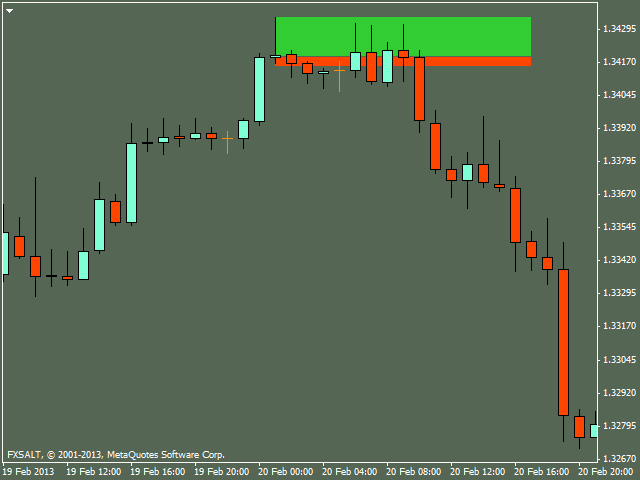

On the EURUSD H1 we see that after a robust Bullish Development the worth, clearly Consolidated.

After an extended Bullish Candle, virtually with out Shadows, the subsequent Candle Closed with a brief Physique,

an extended higher Shadow and a shorter backside Shadow.

With assistance from the Rectangle software we will draw the CSCZs on the H1 Candle, as seen on the above image.

Remembering the rule that the worth can all the time do 3 issues when within the Consolidation Zone:

1. Proceed Consolidating,

2. Proceed the present development,

3. Reverse the development and go in the other way,

we don't assume something, wheather up or down, or some other path.

We solely assume that we have no idea, and don't have to know what the worth goes to do!

We solely want to have the ability to learn the chart, to learn Worth Motion!

इस प्रकार, we watch the worth:

- Within the subsequent hour, the worth tried to go upwards somewhat, nevertheless it bounced of the inexperienced CSCZ and went down.

It created a brand new Low, ie. the Low of this Candle was decrease than the Low of the earlier Candle, और

it Closed under the Open of the earlier Candle. इस प्रकार, we've got a sign of a Bearish Development.

We don't open any trades at this second, as a result of the lengthy Bullish Candle has not been opposed, so

we have no idea, or fairly, the Bullish Development continues to be legitimate. OK, OK, only a darn second!

We aren't alleged to assume something! We aren't purported to predict!

The worth can all the time do 3 issues, keep in mind?!

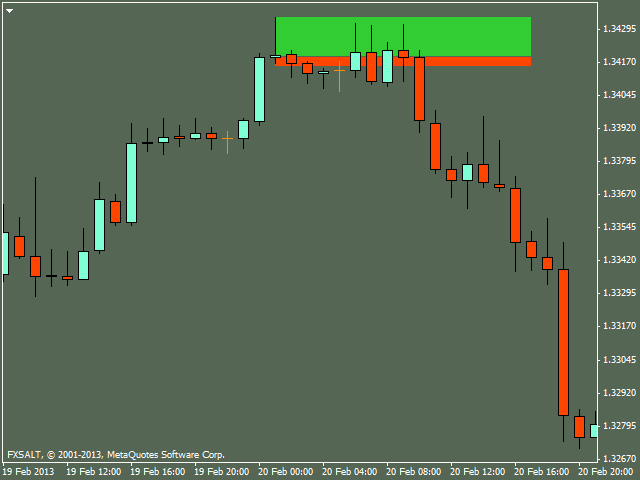

- Within the following hour, the worth created a brand new Low and Closed under Open of the earlier Candle.

इस प्रकार, signaling a Bearish development, once more. On the similar time we see that the worth Brokedown the pink CSCZ,

which tells us that the worth tends to go down.

- Within the hour after that, the worth created a brand new Low, and although it Closed as a Bullish Candle,

its Excessive was Decrease than the Open of the earlier Candle

- The subsequent Candle created a brand new Low and Closed as Doji (within the common sense).

A pure Consolidation within the given hour interval.

- The next Candle, and right here an essential second, was a Bullish one. It didn't create a brand new Low.

Its Excessive plunged into the inexperienced CSCZ, however it didn't Breakout of the inexperienced CSCZ, and didn't create a brand new Excessive

in relation to the sooner Excessive of the Bullish development.

It Closed barely contained in the inexperienced CSCZ.

- The Candle after that, opposed the earlier one and Closed under Open of the earlier Candle.

At this second we already see that the worth refuses to go up, there's some apparent resistance.

फिर भी, the vary of Worth motion nonetheless suggests Consolidation. There isn't a seen Bearish development,

nor a visual Bullish development. That's the place we'd like endurance.

It has been 6 hours, and we've not opened a single commerce.

तथापि, that's the way it must be completed.

Patiently wait out the suitable second, see it on the Closed Candles, with out rush.

A really aggressive investor, taking the danger under consideration, and together with the danger within the technique,

might look out for a Brief contained in the inexperienced CSCZ simply now, seeing what's going on, with a brief SL,

ie. a couple of Pips above the inexperienced CSCZ, about 10 - 15 Pips.

A cautious investor ought to wait till the development varieties. इस प्रकार, till we see that the worth has opposed

the earlier lengthy Bullish Candle, as seen on the image under:

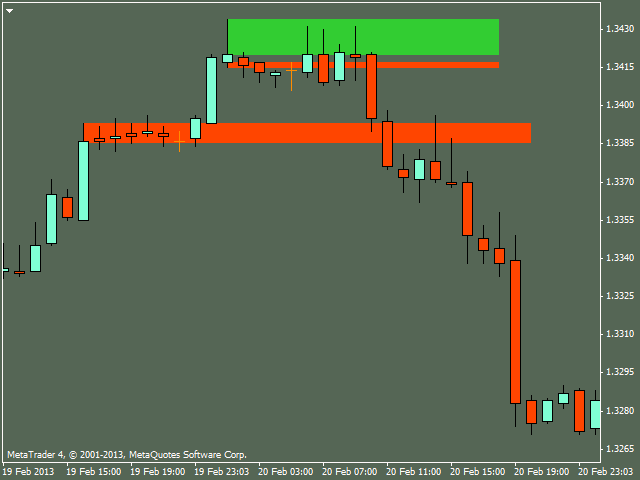

Okay. however decelerate, we nonetheless want extra endurance!

We will see that the worth bounced of the inexperienced CSCZ.

We will see that the lengthy Bearish Candle opposed the lengthy Bullish Candle.

We keep in mind the rule:

1. Go Brief on the prime.

2. Go Lengthy on the backside.

इस प्रकार, we watch for the worth to retrace, to return up.

On the left, we see that the worth was Consolidating for a couple of hours at the exact same degree

it's now. We draw this CSCZ with the Rectangle device.

On this approach we visualize the potential Zone for opening a Brief commerce.

We purpose to open the Brief when the worth plunges again up into the CSCZ,

or as near the Zone as attainable.

Our SL must be a number of Pips above the CSCZ.

इस मामले पर, round 10 - 25 Pips.

Is the worth going to go down, for positive? That, we have no idea, and we will by no means know for sure.

That's the reason we use SL and set our TP at the very least 2xSL, thus protecting a constructive Danger to Reward ratio, (R/R).

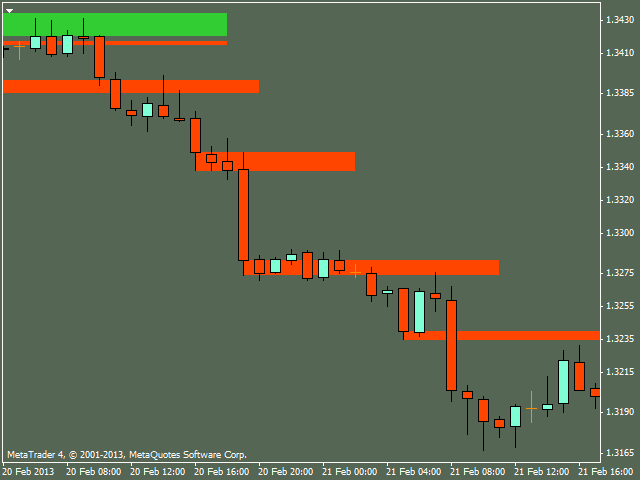

With the exact same process, drawing CSCZs on Candle Shadows, we will watch Worth Motion

in relation to these Zones and make selections when to shut a commerce and/or open a brand new commerce.

Earlier than you determine to make use of this technique investing actual cash, practise on a Demo account.

Take as a lot time, as it is advisable grasp the technique, which suggests you'll be able to consitently

create revenue over loss, and your account Stability is constructive.

This technique is the early stage of my realizations.

The subsequent faze - The Zone Candle Idea - might be discovered right here:

http://www.forexfactory.com/showthre...ninety six#post6528596