- 六月 2, 2013

- 投稿者: 外国為替Wikiチーム

- カテゴリー: 外国為替取引システム

Hi I'm using the price momentum trading system since last six month and earning from it consistently. It is very easy system and one of the successful indicator which i am using. The only Momentum Indicator. I got this idea from somewhere then mold it from time to time by keep changing and testing. I am sharing my trading system as below.

[table] [tr][td]Chart:[/td][td]Candle Stick[/td][/tr] [tr][td]時間枠:[/td][td] 4HR - DAILY[/td][/tr] [tr][td]Momentum Indicator:[/td][td]28 Candle bars[/td][/tr] [/table]

SHORT ENTRY:

Prices are usually move in the direction of momentum but if momentum leads price and then begins to decline while price is moving up then there is possibility that at some point in the future market will place a top and prices move down.

1. Draw divergence line on Price bar as well as momentum Indicator. (for best result use 8-28 candle bars divergence).

2. Mark Highest Price in divergence line as C

3. Mark Lowest value of Momentum in divergence Line as F.

ENTRY POINT

When Point F penetrated enter into trade on close of the bar with two Lots.

STOPLOSS:

When price hits at price C exit all trades.

TAKE PROFIT:

TP1: Difference between Point C and Entry Price. (Exit one lot and raise stop loss to Break Even).

TP2: 2 time of TP1 (at this point use trailing Stop of 50% of the Profit after close of ever candle lower;

TP3: Four Time of TP1. (When Price reach TP3 then use Stop loss of 75 % of Profit untill stoploss hit)

LONG ENTRY:

Same as if the prices are moving down in the direction of momentum and then momentum is going up while price is declining then there is possibility that market will place a bottom in near future and price will go up.

http://charts.mql5.com/1/377/usdchf-...t-oracle-2.png

1. Draw divergence line on Price bar as well as momentum Indicator. (for best result use 8-28 candle bars divergence).

2. Mark Lowest Price in divergence line as C

3. Mark Highest value of Momentum in divergence Line as F.

ENTRY POINT

When Point F penetrated enter into trade on close of the bar with two Lots.

STOPLOSS:

When price hits at price C exit all trades.

TAKE PROFIT:

TP1: Difference between Point C and Entry Price. (Exit one lot and raise stop loss to Break Even).

TP2: 2 time of TP1 (at this point use trailing Stop of 50% of the Profit after close of ever candle Higher;

TP3: Four Time of TP1. (When Price reach TP3 then use Stop loss of 75 % of Profit until stop loss hit).

I will give the chart and example of trades in next post to understand this momentum system better. In my past experiments this is the best money management with two lots one for TP1 and other for trailing. Any improved money management with better risk /reward will be most welcomed

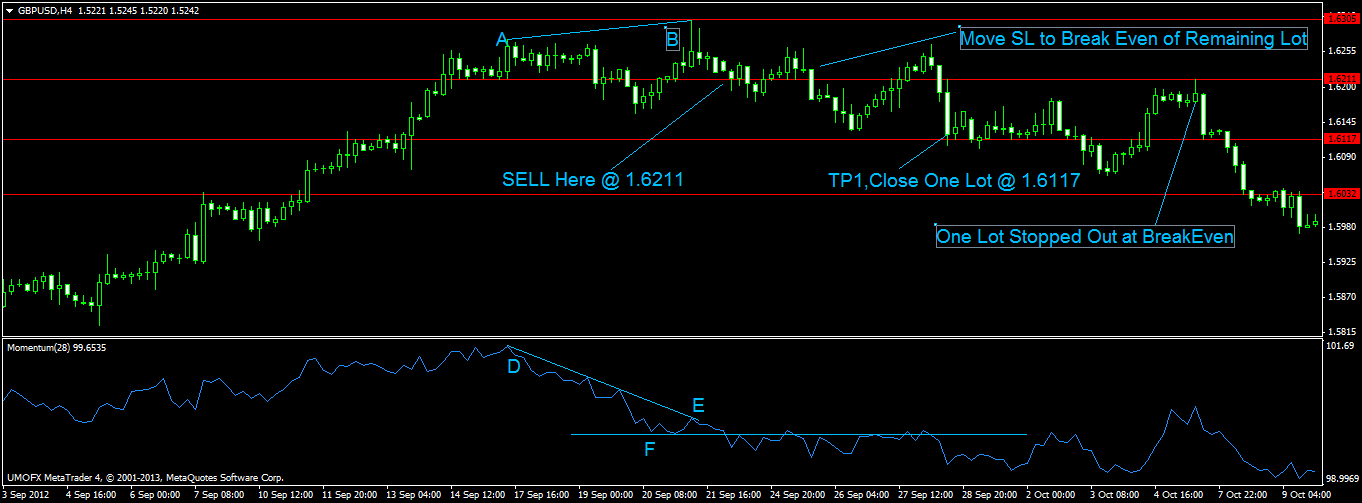

SELL EXAMPLE

In the following chart, we identified divergence. We sell two lots on Break of Point F below at (1.6211) with Stop Loss of 1.6305. On 1.6117 TP1 is hit and we exit one lot and move our stop loss of remaining lot at break even(162.11). On 5th October our second lot stop hit and we gain overall 94 pip profit.

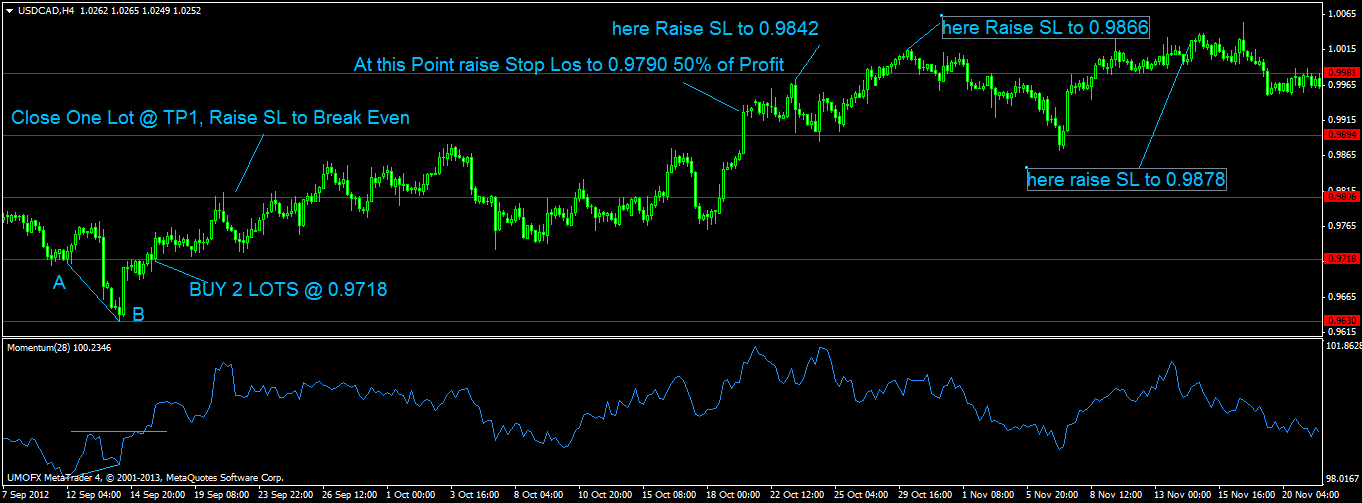

BUY EXAMPLE

In the following chart we identified buy setup (divergence) and we buy 2 Lots @ 0.9718. On 0.9806 we exit on lot with profit of 88 pips and raise our stop loss to Break Even(0.9718). After TP2 hit, we raise stop loss to 50% on close of every candle above until we stopped out @ 0.9878 with on 7th December with 160 ピップス. Total we earned 248 pips on this trade.