- 5月 31, 2017

- 投稿者: 外国為替Wikiチーム

- カテゴリー: 外国為替取引システム

QUAD CANDLE SYSTEM METHODOLOGY

The QUAD CANDLE SYSTEM (QCS) is designed for trading the higher time frames only !

QCS システムは以下に基づいています。 4 以下に関してD1キャンドルフォーメーションによる:

ある) 2 強気のローソク足に続いて 2 bearish candles looking to go short the market

または

b) 2 弱気のローソク足に続いて 2 bullish candles looking to go long the market

ENTRY (基本的な基準)

Enter short after the Short Quad Candle Pattern (SQCP) has completed and price is currently trading in the Upper Octive extreme zone.

または

Enter long after the Long Quad Candle Pattern (LQCP) has completed and price is currently trading in the Lower Octive extreme zone.

Since the trigger for entry must occur after the close of a daily candle, be sure to realize that this does not suggest an entry in the early Asian session and indeed an entry may occur at any time within the current D1 candle (QCS trigger candle).

An advantage of this is in the situation where a pullback occurs allowing a trader to get into the market at a 'better' price.

The traders reward to risk ratio may also be more ideal because the SL will typically be smaller.

The disadvantage is in the event that price does not pull back and the trader is left behind resulting in a missed opportunity.

It is not advisable to enter too late into a trade but this is at the discretion of the trader and in any case the TFs traded are higher making late entries a possibility.

ADDITIONAL ENTRIES

Quads -

1st entry in a 設定 should follow the Quad pattern entry criteria as posted above;

2nd and subsequent entries of the same Quad Setup can follow a Quad Pattern but they do not need too.

The addition of trades is at the discretion of the trader and can be based on the following:

ある) サポート + Resistance;

b) Fibonacci ratios;

c) 高調波;

d) Daily Range ratios (pip count);

e) Quad Patterns (next in series or in confluence with S&Rレベル);

f) Gann octive levels; または

注記 1: The addition of all trades that form a Quad Setup must be designed such that the sum total of all the SLs is less than the total assigned risk.

注記 2: The assigned risk per trade is typically in the range 0.5% - 5%.

注記 3: The total assigned risk across the account is typically 1.5% - 15% for a group of 3 取引.

注記 4: It is highly recommended that minimal risk be applied on initial entries and as trading progresses favorable then increase trading volume.

The 1st entry is arguably the most important of the sequence of trades in a Quad Setup since it is in a location that the trader expects to be the start of a new super trend either UP or DOWN as the case may be and the addition of trades is expected to add considerably to the growth of the account.

The careful addition of trades to a given Quad Setup is what provides the potential acceleration in growth.

At all times the risk should be monitored and controlled as much as possible from the traders end.

Some risk such as broker negative slippage, flash crashes and black swan events may not be possible to control by the trader.

ストップロス

Generally placed above or below the Quad Candle Cluster (QCC).

Basically above or below the major swings.

しかし, the following may be used at the discretion of the trader

1. Swing Highs or Lows or at QCC locations as mentioned above (allow a minimum gap of 20 ピップス above/below this level);

2. ATR trace indicator;

3. Chart structural highs or lows as the case dictates;

4. Octive SL Logic

(ある) If an Entry (Not Recommended) is to be made from either the Base Octive Price level (Base OPL) または Top Octive Price level (Top OPL)

私) minimum SL of at least 50% of the current Octave Gap should be applied

ii) maximum SL of 100% of the current Octave Gap

b) all other SLs from Octive levels should be a minimum of 1 Octave Gap up to a maximum of 2 Octave Gaps.

c) exceptions may occur based on the chart structure and other factors for a given instrument (通貨, 索引, commodity etc).

利食い

最小 1 に 1 ratio (TP to SL).

Preferably 2:1, 3:1 または 4:1 is applied.

Determine the pips for the SL based on the preferred SL method and then make the TP >= SL pips (always consider chart structure and adjust).

Chart structure, Harmonic completions, Octive zones and Fibonacci ratios (127.2 そして 161.8 or higher ratios) may also be used for potential TP levels.

しかし, the setup must make sense and a TP at least equal to the number of SL pips (SL must be applied in a well thought out location).

The idea should be to start with a larger TP such as a 4 に 1 ratio and as the trade unfolds favorably look to trail your entry from a large distance.

トレーリングストップ

Trades may be trailed as the trader sees fit.

Alternatively a trader can use:

ある) BE + some pips after price has moved favorably X_pips.

b) ATR indicator (or %ADR, %AWR or %AMR)

c) Octive Master indicator

d) Chart structure (eg longer term Support or Resistance zones OR Candlestick Trailing)

e) 2 by D1 opposite colored candles (in series) form anytime after trade entry

f) other methods (eg Fibonacci Trailing, Candlestick trailing, ATR trailing etc)

Note that the trailing method applied is determined by the trader.

Price will not always go in the direction you would like and indeed it may reverse after going a certain number of pips so it is sometimes necessary to simply close out the trade for some profit or a loss and search for the next opportunity.

Often the trader will need to balance between applying too tight of a stop and too generous of a stop.

Too tight of a stop and you might be kicked out of the trade too soon.

Too generous of a stop and you might give back too much floating profit.

Fundamental Analysis

Since this system applies HTF trade setups some fundamental analysis may enter the thread and this is most welcome from all traders.

Some sources include the following:

1. Central Bank speeches

2. News feeds (Bloomberg, Reuters, Ransquawk among others)

3. Economic Calendars (Banks, FF, myfxbook and hundreds of others)

4. Trading Economics website and other academic sources (sites, pdf's, relevant articles)

5. Political commentary (Tweets and speeches among others)

取引期間

This will be dependent upon the movements of the market on the traded instrument and the controls that are put in place.

It is not unlikely that some trades may run for several weeks!

This system is meant to be very simple to apply.

The idea is to get into a long trend and stay in there for hundreds of pips or as long as possible and have your trailing stop take you out.

The trader will need to exercise patience and allow trades to run as much as possible.

If a trader makes a profit on a trade then they really have not done alot wrong however, they may have foregone a greater opportunity.

Swap Rates

On a D1 trade setup, very often the trades run over several days into weeks and perhaps over several months.

At 5pm EST (私たち) rollover occurs on positions left open and either positive swap or negative swap is added to or deducted from the trading account via your broker almost instantaneously.

The swap rates are updated on a weekly basis via Financial Institution passing on rates to brokers.

Wednesday incurs a triple swap rate (markets in FX do not trade over the weekend).

Friday incurs a triple swap rate for CFD's.

Brokers may pass onto customers a financing fee.

So the formula for calculating swap rates below may vary from what the broker actually shows in their platform.

注記: If a broker shows 2 relatively high negative swap rates for the same currency pair, ask questions why and investigate.

The formula for calculating Swap Rate is as follows:

Daily Rollover Interest = Contract Notional Value x (Base Currency Interest Rate - Quote Currency Interest Rate) / (365 days per year x Current Base Currency Rate)

Contract Notional Value is the volume in quote currency eg EUR/USD: 100,000 (または 1 多く) - swap will be in USD currency.

The interest rate differential is the difference in interest rates between the Base and Quote currencies.

You will need to know the lending and borrowing interest rates of the currencies you trade (many sources online).

The Daily Rollover Interest Formula calculates based on a 1 day rollover, if its more than a day then simply multiply by number of days.

Swap Rate accumulation should certainly be considered in longer term trade setups.

Swap Rate accumulation has a meaningful impact over trades running in the markets over several months.

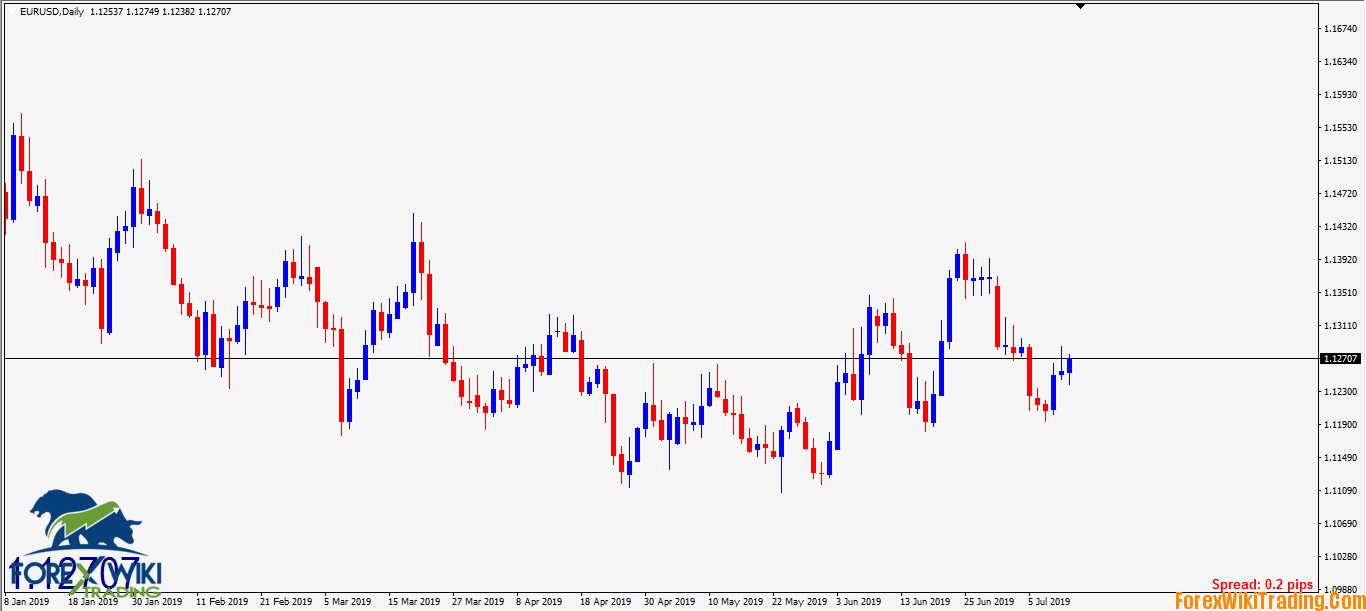

The Chart

D1 (Longer term trading)

ADVANCED TRADING TOOL ACCESS:

================================================= ==============================================

Please be advised that due to a number of reasons access to my trading tools is only currently available to traders who are willing to provide the following information:

1. Trading Account Number;

2. Trading Account Type;

3. Contact Email address (for QCS_password generation);

4. Trader Participation in this thread is also required; そして

5. Final access is at the sole discretion of the Thread Op.

ps. Traders should decide if access to the trading tools suits with their current trading needs before providing such information. Access if granted may be delayed during stages where code is being added, improved or major upgrades are in progress. A series of overlays form part of the system and this may be expanded in the near future.

================================================= ==============================================

BASIC TRADING TOOL ACCESS:

注記:

1. The basic version shows only the Master Octive Grid and the MML (orig) grid levels;

2. It does not show the multi Gann Grids, Gann SQ9 Prices and Dates, Moon Phases, Yearly Reset date, modified calculations or any other advanced overlays.

3. Updates to the basic version indicator will be limited, it also contains an expiry date.

D1 Time Frame

My view on trading is to take what works and bin what doesn't.

Everything else is either a theoretical or research oriented exercise !

MASTERRMIND

================================================= ==============================================

"Being in the brokerage business myself and handling large accounts, I had opportunities seldom afforded the ordinary man for studying the cause of success or failure in the speculations of others. I found that over ninety per cent of the traders that go into the market without knowledge or study usually lose in the end"

W D Gann

================================================= ==============================================

Alleged Trading Performance by WD Gann

1908 – $130 account increased to $12000 で 30 日.

1923 – $973 account increased to $30000 で 60 日.

1933 – 479 trades were made with 422 being profitable. Strike rate of 88% そして 4000% gain.

1946 – 3 month net profit of $13000 from starting capital of $4500 – a 400% 利益.

W D Gann

================================================= ==============================================

Compounding a 1K account (no regular deposits) で 5.93% monthly ==> 1K to 1 Million in ~10 years.

This is basically doubling the account equity every year for 10 年.

年 1: 1000 に 2000

年 2: 2000 に 4000

年 3: 4000 に 8000

年 4: 8000 に 16000

年 5: 16000 に 32000

年 6: 32000 に 64000

年 7: 64000 に 128000

年 8: 128000 に 256000

年 9: 256000 に 512000

年 10: 512000 に 1024000

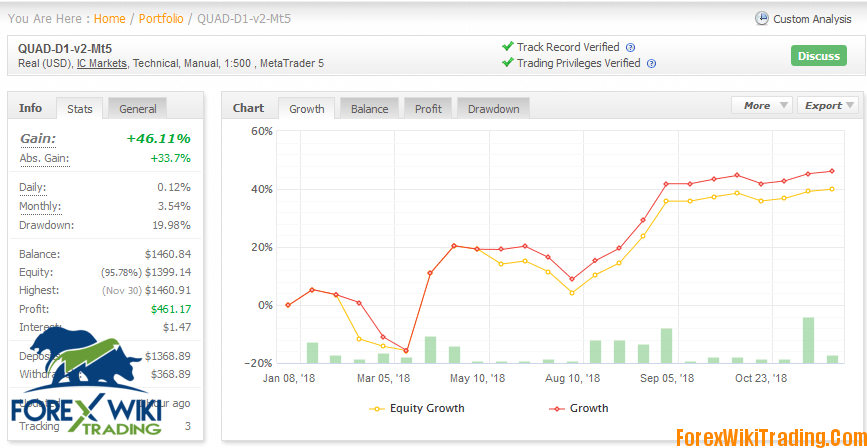

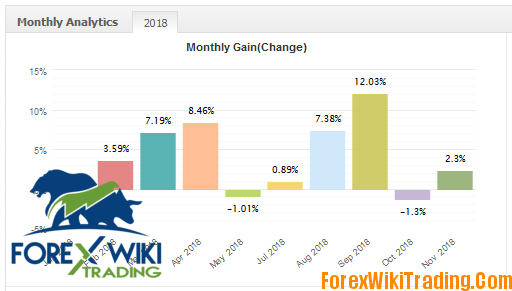

This account now has a 12 month trading history and will continue to be traded in the background so the focus can be solely on Account 2.

The account history is now set to private.

Account Start Date: 8 JANUARY 2018

Account Start Balance: US$1000

Current Account Growth

YEARLY

年 1 (Dec 2018) Net Gain in Equity = 40.50 % @ 19.98 % DD

年 2 (2019) Net Gain in Equity = _____ % @ _____ % DD

Account has been set to private and updates discontinued due to a lack of thread participation.

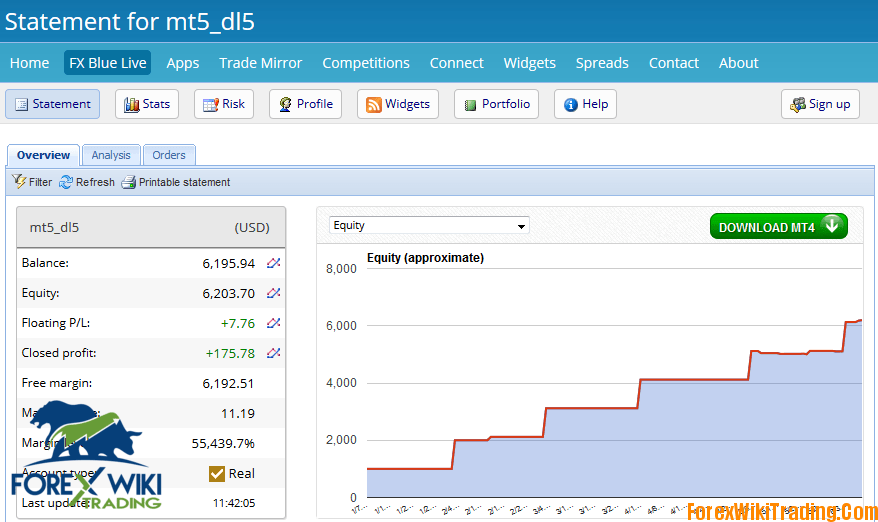

アカウント #2 :: mt5_dl5

Trading Peformance Monitoring

注記: Now discontinued due to a lack of thread participation.

Dream Levels (DL) through the Power of Compounding

Compounding Monthly Projections(No Additional Deposits) to create the Dream Level (DL):

US$1000 to US$1Million

DL1. Compounding a 1K account at ~5.93% MoM ==> 1K to 1 Million in ~10 years.

DL2. Compounding a 1K account at ~7.47% MoM ==> 1K to 1 Million in ~8 years.

DL3. Compounding a 1K account at ~10.08% MoM ==> 1K to 1 Million in ~6 years.

DL4. Compounding a 1K account at ~15.49% MoM ==> 1K to 1 Million in ~4 years.

DL5. Compounding a 1K account at ~33.36% MoM ==> 1K to 1 Million in ~2 years.

US$10,000 to US$1Million

DL1. Compounding a 10K account at ~3.92% MoM ==> 10K to 1 Million in ~10 years.

DL2. Compounding a 10K account at ~4.93% MoM ==> 10K to 1 Million in ~8 years.

DL3. Compounding a 10K account at ~6.62% MoM ==> 10K to 1 Million in ~6 years.

DL4. Compounding a 10K account at ~10.1% MoM ==> 10K to 1 Million in ~4 years.

DL5. Compounding a 10K account at ~21.2% MoM ==> 10K to 1 Million in ~2 years.

Compounding Monthly Projections (Deposits Added regularly) to create the Dream Level (DL):

DL1. Compounding a 1K account (with regular deposits of 1000, Tot Inv Cap. = $120K) で 2.84% MoM ==> 1K to 1 Million in ~10 years.

DL2. Compounding a 1K account (with regular deposits of 1000, Tot Inv Cap. = $116K) で 3.00% MoM ==> 1K to 1 Million in ~9 years 8 月.

DL3. Compounding a 1K account (with regular deposits of 1000, Tot Inv Cap. = $94K) で 4.00% MoM ==> 1K to 1 Million in ~7 years 10 月.

DL4. Compounding a 1K account (with regular deposits of 1000, Tot Inv Cap. = $80K) で 5.00% MoM ==> 1K to 1 Million in ~6 years 8 月.

DL5. Compounding a 1K account (with regular deposits of 1000, Tot Inv Cap. = $48K) で 10.00% MoM ==> 1K to 1 Million in ~4 years.

Compounding Monthly Projections to create the Dream Level (DL):

DL1. Compounding a 1K account (with regular deposits of 1000, Tot Inv Cap. = $120K) で 2.84% MoM ==> 1K to 1 Million in ~10 years.

DL2. Compounding a 1K account (with regular deposits of 1000, Tot Inv Cap. = $116K) で 3.00% MoM ==> 1K to 1 Million in ~9 years 8 月.

DL3. Compounding a 1K account (with regular deposits of 1000, Tot Inv Cap. = $94K) で 4.00% MoM ==> 1K to 1 Million in ~7 years 10 月.

DL4. Compounding a 1K account (with regular deposits of 1000, Tot Inv Cap. = $80K) で 5.00% MoM ==> 1K to 1 Million in ~6 years 8 月.

DL5. Compounding a 1K account (with regular deposits of 1000, Tot Inv Cap. = $48K) で 10.00% MoM ==> 1K to 1 Million in ~4 years.

注記 1: Tot Inv Cap. means Total Invested Capital made up of Start Balance plus the sum of all regular deposits until 1M (資本) is achieved.

注記 2: Based on continual deposits over the course of the preferred DL period it will not be possible to state later that 1K went on to make 1M.

注記 3: It is the traders choice whether a regular deposit strategy is applied to the trading account or not.

例えば,

DL1 suggests that about $120K would be applied to make 1M;

DL2 suggests that about $116K would be applied to make 1M;

DL3 suggests that about $94K would be applied to make 1M;

DL4 suggests that about $80K would be applied to make 1M; そして

DL5 suggests that about $48K would be applied to make 1M.

注記:

Any of these outcomes entails successful trading over the longer term such that milestones and goals are achieved.

Can YOU successfully trade at the required MoM compounding rate to achieve the target ... odds are stacked heavily against YOU !

Master Octive Indicator (MT4)

MT4 (Basic version 1)