- 칠월 30, 2019

- 게시자:: 외환 위키 팀

- 범주: 무료 외환 EA

I present a proprietary robot that was used in a limited circle. But now I have made decisions for its public offering.

The robot uses a series of orders for possible averaging, stops for each order to limit loss, Envelopes and ATR indicators, functions for calculating profit and step using different methods, time filters, and much more. This robot has a similar algorithm with the Zergling robot (my development is 2013). More precisely, Zeratul is a powerful continuation of Zergling, with new additional functions and filters. The idea itself is more than 5 years old, and all this time the robot has shown positive results.

Recommended currency pair: AUDNZD

Timeout: M15

But you can use it on other instruments and timeframes, a large number of settings allows you to do this. For trading, ecn accounts with a small spread are desirable.

The robot is based on the Envelopes indicator, with a period of EnvPeriod and a deviation of EnvDeviation. When the price crosses the lower or upper line, Buy or Sell orders are opened. If the price goes in the opposite direction, a series of orders (grid) is placed with the distance between them. When the price moves in the direction of open orders, the series closes in plus. When the price moves back, the orders will be closed by stop loss, starting with the first open order.

The built-in ATR filter, opening the first order, works when the ATRFilter setting is enabled. If the ATR indicator with the ATRPeriod period shows a value lower than the ATRLowLevel setting in the settings, the signals will be ignored.

When the price moves in the direction opposite to the opening of the order, additional orders are opened. It is possible to increase the distance (pitch) of opening each subsequent order by two methods:

-If the DynamicStep function is deactivated, the distance of the first order will be MinStep, and each subsequent open order will be increased by a factor StepMult, but not more than MaxStep.

-If the DynamicStep function is activated, the distance of the additional order from the previous one will be dynamic. This value will be affected by the difference between the maximum and minimum price values for the number of the last DSBars + candles that are running on the DSTimeframe timeframe. The DSMinPoints value will correspond to a 0% increase (step is equal to MinStep), and DSMaxPoints will correspond to 100% (step is equal to MaxStep). 예: If the difference in price values is 30p, and DSMinPoints = 10 and DSMaxPoints = 50, then the step size is MinStep + (MaxStep-MinStep) * 0.5, that is half between MinStep and MaxStep.

If the OneOrderPerBar setting is enabled, then on each candle of the OOPBTimeframe timeframe no more than one order is opened.

The function of increasing the lot on StepLotMult of each additional order is implemented, but not more than MaxLotMult times from the first order.

The number of orders of one series cannot exceed the value of MaxOpenOrders.

The level of closing a series of orders with a profit is calculated by two different methods:

-If the AccumProfitPoints function is turned off, the level is calculated as the number of points (Takeprofit) from the breakeven level.

-If the AccumProfitPoints feature is enabled, then the actual number of points for each order is considered as breakeven, but excluding the order volume. Ie, if there are 2 orders in the market and Takeprofit is 50, then the distance from the breakeven level to the close level in profit will be equal to 25, but not less than MinTProfit.

Setting ProfitMultiply increases the size of Takeprofit on each subsequent order in the series.

Closing distance (in points) of orders in the profit from the breakeven level can not be less than MinTProfit and more than MaxTProfit. For a single order in the series, your TProfitOne take-profit can be set.

Takeprofit can be set in fact when placing orders, or controlled by a robot, depending on the VirtualTProfit setting.

StopLoss is set for each order.

The robot can open orders in the opposite direction (Reverse), and not reduce the lot while reducing the balance due to losses (NoDecreaseLot).

The trade function (opening a new series) at a specific time UseTradeTime since FromHour hour, ending with ToHour hour is implemented. It is possible to disable trading on Friday FridayStopTrade, after FridayHour hour.

Due to the fact that the robot is often used on non-standard tools or it is necessary to control each pip, two settings are entered: AutoMultPoints - increases points by 10 automatically by 5th sign, and ForceMultPoints - forcibly increases points by 10.

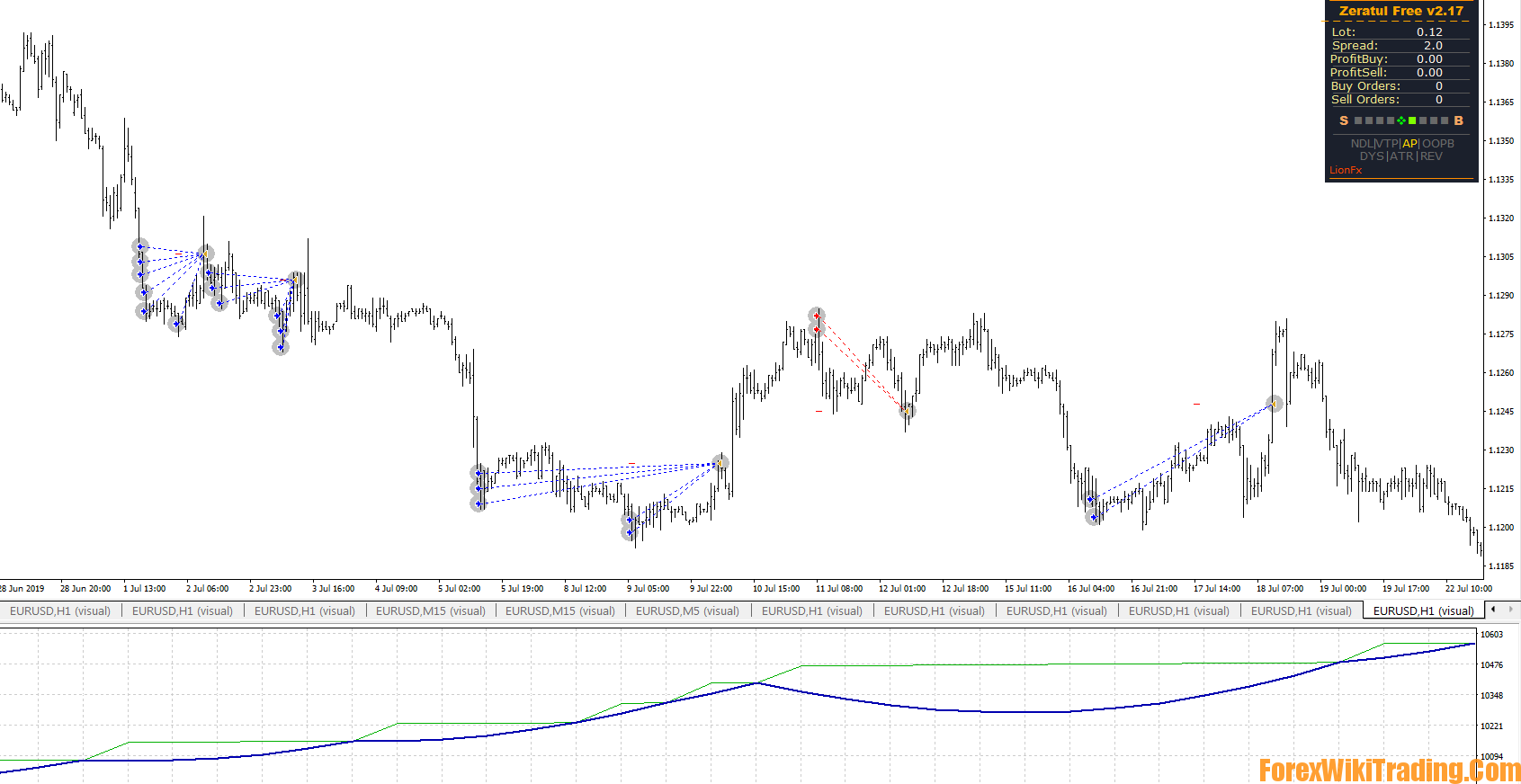

To display information, a small Info Panel is used , which is located on the right of the graph, so it is more convenient to click the button “Shift of the chart” in the terminal and adjust the shift of the chart relative to the right edge.

On the Info Panel at the top is information about the lot of the first order in the series, spread and current open series. Below is the signal strength indication. Even lower indication of active functions.

This Free version of the robot has a restriction for use on real accounts with a balance above 500 of the deposit currency. For the initial acquaintance with the robot and testing this is quite enough. There is no limit on balance in the tester and on the demo account. 또한, Free differs from other versions, in that there is no progressive work with orders and there is no output of additional information in the journal. In all other respects, the Free version has full functionality. Information on the version with the withdrawn deposit limit, the Pro version and my contacts is available in my profile. If you plan to trade on a real account, then I am sure that you will find the means to buy the Pro version. Unlimited version will be available for free.

Results for 12 연령 (2007.01-2019.05):

AUDNZD, M15, settings are standard, lot is fixed.

For the convenience of receiving new versions, information and news, see my profile (click on the avatar).