- 5월 24, 2013

- 게시자:: 외환 위키 팀

- 범주: 외환 트레이딩 시스템

그리고 Day Trading에 적용했습니다. 나는 매우 많은 사람들이 가격 행동을 이해할 수 있다고 믿지 않는다는 것을 발견했습니다., 그리고

strain away from it considering Price Action some complicated method which requires

special skills and experience.

경험, 예, 물론.

That is what Demo and Practise accounts are for.

Never start trading real - live, until you have gained enough experience!

People tend to look for something which, like traffic lights, will tell them

when to Go and when to Stop. They rely on indicators, and lose their money.

Why is it so?

Indicators do not get their data from a different source.

Indicators get the data from the chart.

The data is on the chart first, then it is processed by the written program.

Indicators do not show green and red lights, even though the colors might be such.

Indicators only blink the yellow light, telling us that there is a potential moment.

If we do not know, because we can not see it directly on the chart, no

indicator will ever tell us this!

Learning to read the information from the chart is not really hard, it only requires

repetition. It is repetion that makes us speak our language fluently.

It is repetition that gives us the ability to read this text.

It is repetition of bad habits that makes us lose at Forex.

It is repetition of good habits that makes the winners!

I will try to explain to the best of my abilities how Price Action works.

I will show you some simple step by step practise strategy which you can

excercise on a Demo account and then, after a time, apply your favourite indicator

and see if you will still need it. You must see this for yourself.

After some time you will see for yourself how useless the indicator had been.

I will start with the basics of Price Action and explain the very basic economic principle

of how the Forex Market works, in the first place.

가격 행동 is not about any setups, it is about 가격 행동, that is all, 가격 행동, which means

the ability to read the chart, like reading a text on the internet, like reading this text, 즉.

아빠 does not work better on any Timeframe, it works the same on every Timeframe.

The only difference is in the detailed information in the given Timeframe.

The lower the Timeframe, the more detailed the information.

기간 to work with is only the function of the trading style:

Scalp, DayTrading, ShortTerm, LongTerm, 등., the longer the term, the larger the Timeframe.

In order to truely understand what 가격 행동 거래 is , one must first realize the origins.

Some very inteligent Japanese invented the Candlestick chart - 왜, what for?

Why did this person want to see all levels? OHLC?

Because he wanted to see what the price was doing, and picture 가격 행동 on a chart.

When you study the basic construct of the Candlestick, and think about it, you discover

that the most important elements are the Shadows, not the Body, but the Shadows.

왜? Because the Shadows actually show where the price Consolidated in the given Period.

The even more basic element for understanding PA is understanding the basic economics,

which means - how the Market works.

~ 안에 economics there are two sides: debit & creditors

Which translates in 외환 에게: 구입하다 & 팔다

그만큼 Balance is always = 0.

If you understand that:

When you want to Buy at price X, there must be someone who will Sell to you at price X.

When you want to Sell at price Y, there must be someone who will Buy from you at price Y.

then you begin to understand 가격 행동.

That is where you start to understand, 저것 the Market is always in a Consolidation State.

When the price is going UP, there are Buyers 그리고 Pending Sell Orders waiting at some level,

which others call S/R 레벨, but they actually are Consolidation Levels.

경향 is the journey the price is making from one Consolidation to another Consolidation.

This is what we are aiming to catch and exploit. That is where our Pips are.

지금, when we have understood what Consolidation is,

that it is in fact the End of a Trend 그리고 The Begining of a Trend, of the price journey,

we can start to think how to recognize these moments on the charts.

By definition, Price Consolidation is the Equilibrium of Buy and Sell Volumes in a given period of time.

그만큼 Clue here is "period of time".

On the smallest level Price Consolidation is a Doji Candle on a tick chart.

그 다음에, any other Doji Candle, 물론.

Price Consolidation is also 2 or more Candles of about the same hight.

Price Consolidation is also a series of Candles oscilating between 2 extreme levels, several Pips,에게

even hundreds of Pips apart.

That is clear, but are those the only signals or rather messages about Price Consolidation?

그만큼 Break Candle Pattern, why is it so important?

You should be getting the idea by now, if you understand Price Consolidation!

예, 그만큼 Break Candle is showing us 브레이크아웃 또는 Breakdown of the Price ~에서

에이 Price Consolidation Zone. And 브레이크아웃 또는 Breakdown of the Price ~에서

에이 Price Consolidation Zone is showing us the building of a new Trend.

따라서, where is the Price Consolidation Zone?

It is the Candlestick preceeding the Break Candle.

And it is the End of the Price Consolidation.

Where is the Begining of the Price Consolidation, 그 다음에?

All we have to do, is turn the pattern around.

When we see a shorter opposite Candle after a longer Trend direction Candle,

이것은 the Begining of the Price Consolidation.

Now comes the tricky part!

We know how the Price moves, we understand Price Action.

We understand, that Price Consolidation is where Trend Ends and Begins.

We see, that Breakout and Breakdown are indications of the new Trend direction.

그만큼 MOST IMPORTANT thing to realize at this moment is that:

그만큼 Price can always do 3 things, when in the Price Consolidation Zone:

1. Continue Consolidating,

2. 브레이크아웃 and form a Bullish Trend,

3. Breakdown and form a BearishTrend.

It can be a new reversal trend or the continuation of the former trend.

We must free ourselves of judgment or speculation.

It is 가격 행동 which tells us which direction the Price is Trending inside

그만큼 Price Consolidation Zone.

And this applies to every Timeframe and every Trading Style.

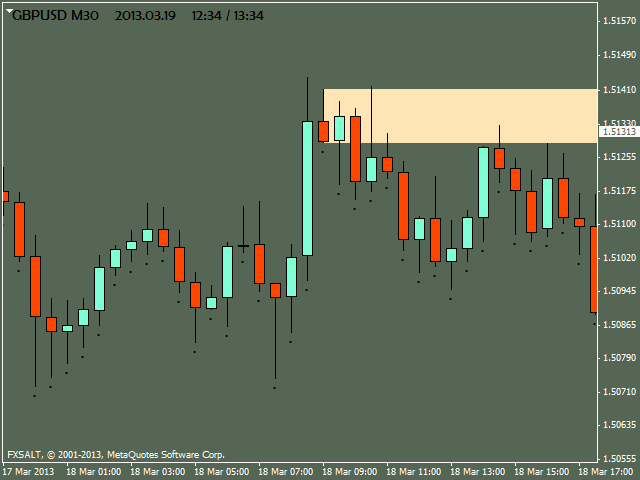

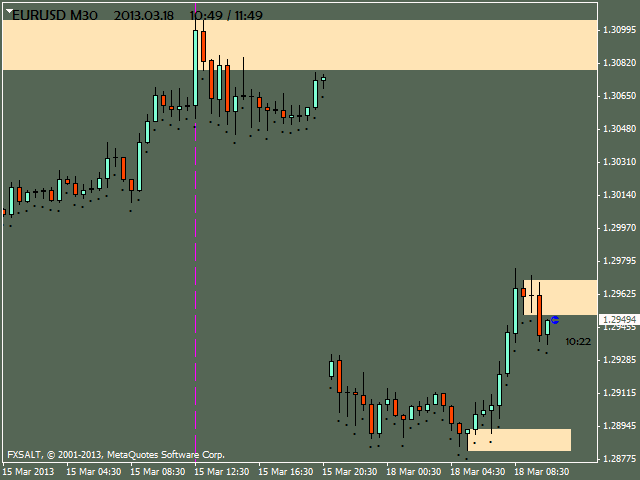

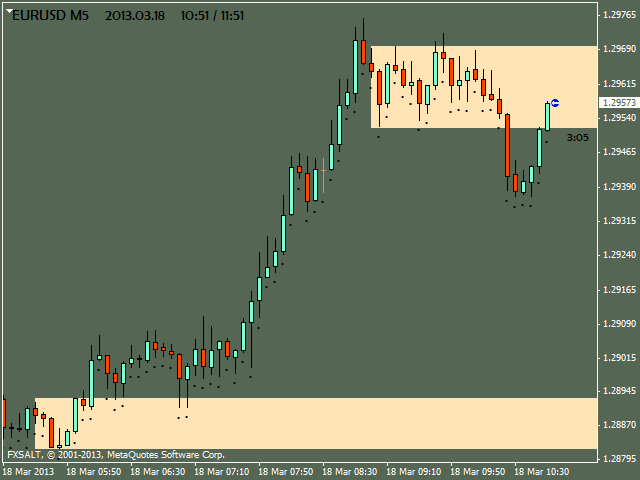

1. Find 2 Timeframes most suitable to Your trading style (즉. M30 and M5 for DT EURUSD).

2. Watch for begining Price Consolidation Zones - the potential End of Trend.

3. Use the Rectangle tool and draw the Zone as follows:

4. Switch the Timeframe to the lower one.

5. Watch for entry moments on the retrace to the zone.

6. Simultanuesly watch another larger Timeframe, H1, H4, D1, to estimate the general Trend.

Go along the General Trend, not against.

7. Set Your SL Close, a couple of Pips above or below the High or Low values as seen on pics.

8. With TP you can either set Your own target, or follow until the next Price Consolidation Zone,

and then decide upon the same rule - the Break Candlesticks and simple Trend recognition.

중요한:

The signals from the larger Timeframe always come first!

그래서, if there is no Break Candlestick in the opposite direction on the larger Timeframe,

do not count on trend reversal.

Rather see this as potential retrace in Trend continuation and look out for the next Price Consolidation Zone in accord with the larger Timeframe Trend.

그 다음에, watch for Break signals and Trend signals inside the Consolidation Zone.

The final decision and risk is on Your side.

Sometimes the market is completely unpredictable!

General rules for thread:

1. No predictions about future price movement.

2. No private opinions about future price movement.

3. Fundamental hints allowed, as long as in: "Watch PA on ..., because ..." style.

4. Critisism of my method and/or myself, and attempts to prove me wrong will be treated as

violation of Forum #1Rule: Respect the Fellow Trader.

5. People who take no interest in my method for whatever reasons are

welcome to post on my thread as long as they show proper respect to the

thread starter, other readers, respect the Forum rules, and respect the thread rules.

Anybody who fails to follow the above rules shall be added to my ignore list and cleanedup.

Rules for charts:

1. Only plain charts with the helpers and indicators supplied by me!

2. No Moving Averages, no Fibonacci, no Elliot, no other Moving Average

based indicators are allowed in this thread!

No indicators other than stated in point 1.

3. Trend lines and Andrew's Pitchfork are allowed.

4. There might be singular exclusions upon my decision for educative reasons

as negative examples or examples necessary for the context of the post.

5. No future price movement predictions or private opinions on charts.

6. Descriptions and indications of Price Action, Consolidation Zones,

CSCZ, TBCZ, PTECZ and Zone Candle are allowed on charts!

Rule for following posts which I can not edit:

1. The term "삼켜버리다" should be substituted with the term "Break"

as in the text above. 따라서 "Engulfing Candle" should be understood as "Break Candle".

I am willing to help anybody who is willing to follow my rules.

Anybody who will post charts that do not apply to the above rules

will be reported and cleaned up, added to my ignore list, and I will not be able to help them.

All of my indicator-tools have been designed in order to assist the Forex Trader in the process of learning Price Action and

the Supply/Demand Trading concept on demo accounts.

Any other usage of these indicator-tools is solely at the risk and responsibility of the individual Trader.

As with any tool, the proper usage depends on proper training and experience.

Any tool can be used in the occasional amateur style, the proffesional skilled craftsmen style, or the artists style!

And, as with any other tool, it can be missused, as well.

It is the investor/trader who makes the final decisions and judges or diagnoses the potential,

and it is the investor who is the amateur, the proffesional skilled craftsman, or the artist!

Just like the manufacturers of the simple hammer can not take responsibility for the effects or damages

arrising from using their simple tool, the creator of the tools presented herein can not take any responsibility,

whatsoever, for the effects or damages arrising directly or indirectly from using theForex Trade Supporting tools.

Loss or Profit in Forex Trading is the sole responsibility and sole risk of the investor/trader, and has nothing to do,

whatsoever, with any available tool, indicator or other computer programme.

There are a number of different factors, other than the tools themselves, which lead to success or failure in any trade,

including Forex Trading. It is extremely important to understand, that it is the investor’s ability to make the right decisions

at the right moments which lead to success, and the tools, no matter how fantastic, are only the Supportive Aid,

and not the decisive factor.

It is strongly advisable to thoroughly learn Price Action in Day Trading by Dadas as explained in this thread,

before applying the tools to your charts and trying to use the concept.

Attached, some helping tools.