- Aprilis 2, 2022

- Missae by: Praenomen to Team

- Categoria: Free congue Indicatores

The Stochastic Histogram Indicator Mt4 True Stochastic Indicator is a highly effective tool for detecting hidden levels of overbought and oversold conditions.

The Stochastic Histogram Indicator Mt4 True Stochastic Indicator is a highly effective tool for detecting hidden levels of overbought and oversold conditions.

It's especially effective for traders who want to use reversal tactics. This is something we employ in our institutional trading techniques.

If you are tired of manually scanning for hidden areas of overbought and oversold zones, Try the MT4 Stochastic Histogram Indicator. It is always being enhanced as a result of a helpful community. Sectorem habeat low feodis, humilis swaps, ac etiam servo ieiunium. Mercator robot operatur cum quovis sectorem et quodlibet genus rationis, sed commendamus clientes nostros ut unum e summo forex praesidium sectorum existimetur infra enumerantur:

Best Brokers List :

The Stochastic Histogram Indicator operatur in sectorem et quamlibet rationem, sed clientibus nostris commendamus ut unum e summo forex praesidium sectorum existimetur infra enumerantur:

Stochastic Histogram TRADING STRATEGY:

In the major hedge funds, do we employ Stochastic Histogram in this way?

There's the right way to trade with Stochastic Histogram and the way the rest of the world teaches you. The overbought and oversold levels are 70 et 30, according to most forums, experts, and websites.

You should expect a rally when the price reaches these levels. Correct? – FALSE!

That is just what the world tells you in order for them to understand where the majority of volume for buys and sells originates. Whoever declared that the mystical number 70 represents an oversold level and 30 represents an overbought level?

WHAT DIFFERENTIATES THIS Stochastic TRADING STRATEGY FROM THE REST?

The key is to discover a True Stochastic Histogram level where the price bounces off. This might be 60 instead of 70.

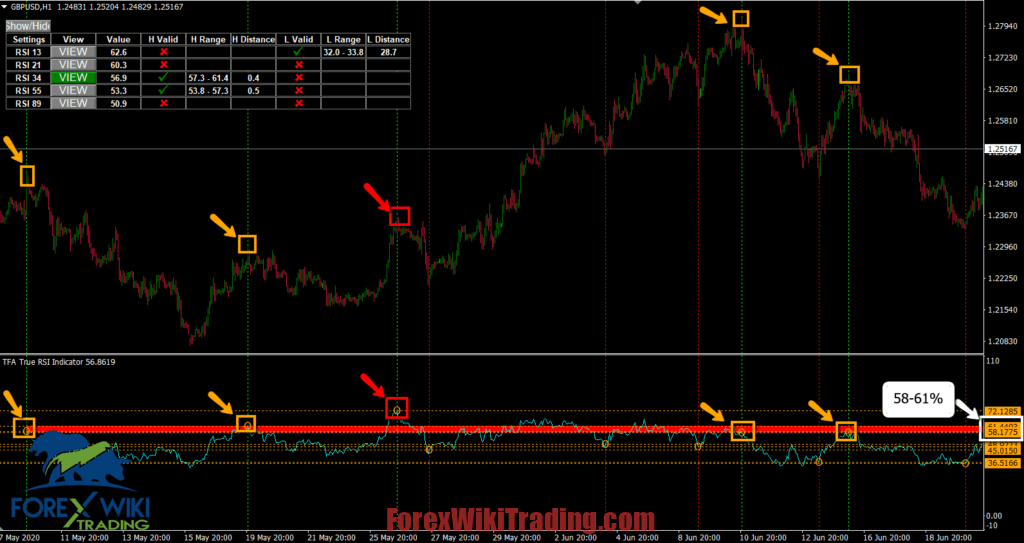

This might be 40 instead of 30. That is the market's True Stochastic Histogram. How does this appear? Here's an example of how our unique True RSI Indicator works to identify important price levels when the price bounces.

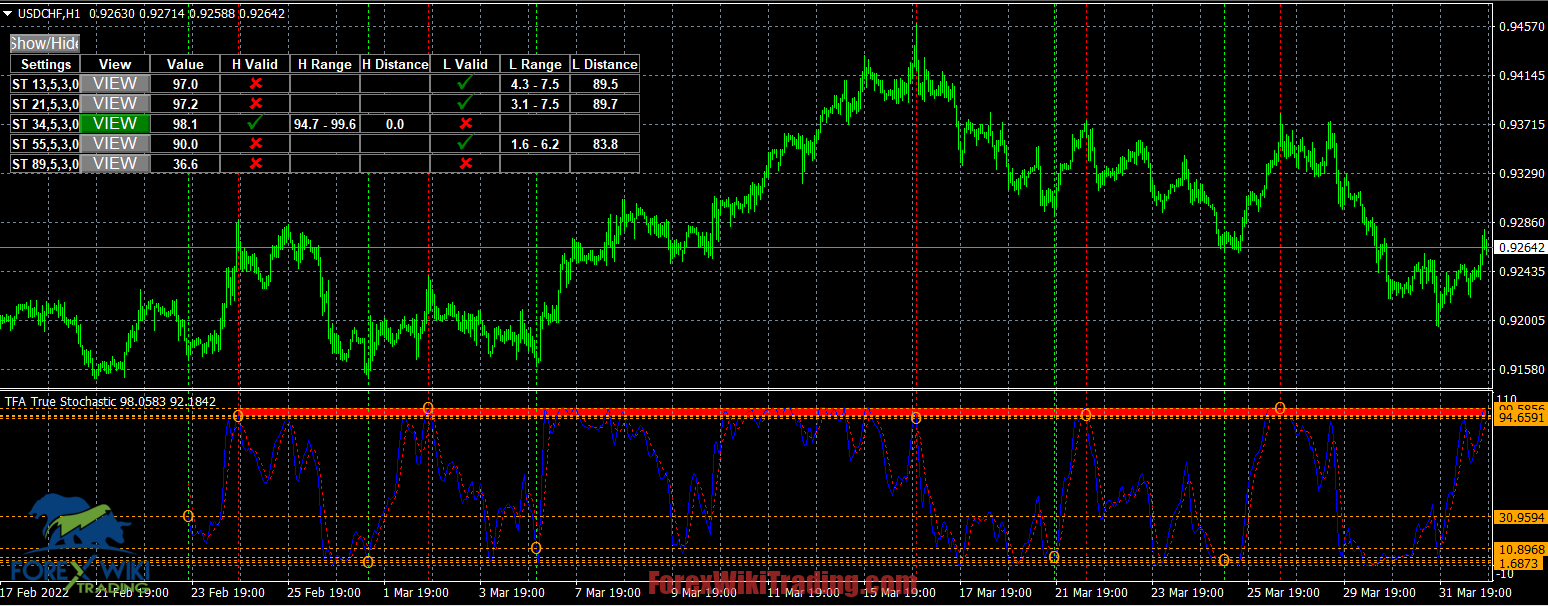

How institutions employ Stochastic uncover areas of concealed support and resistance

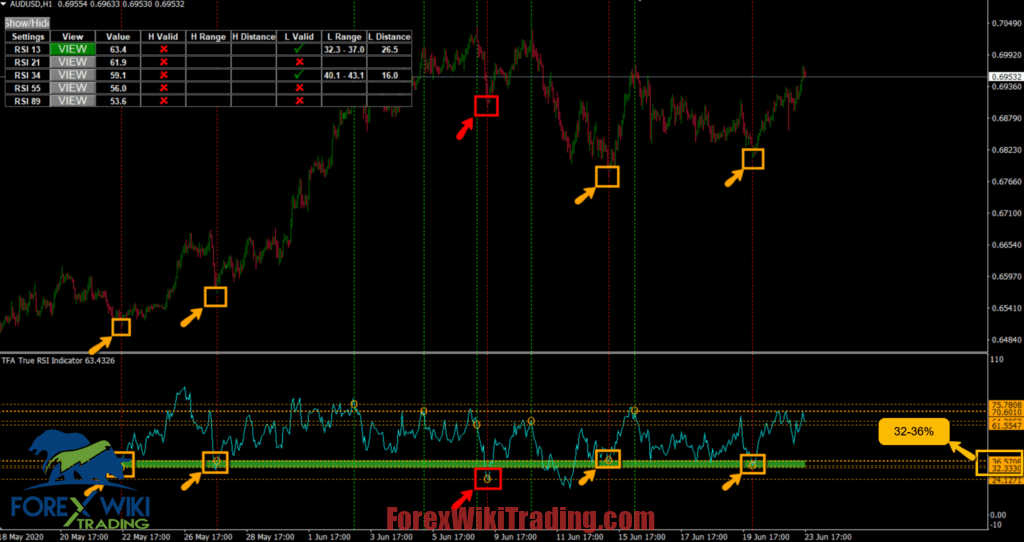

The TFA True Stochastic Histogram indicator has scanned for 5 key swing lows that have rebounded beautifully, as shown in the graphic (we can adjust the sensitivity and how strict these big swing lows are).

Sic, in the last five instances, the price bounced well — it happened to correspond with the Stochastic Histogram being between 32 et 36 percent. 4 out of 5 times (4 orange boxes indicate how well it bounced, 1 red box indicates it did not bounce). Sic, what does all of this mean? It indicates that when the RSI reaches the 32-36 percent level, there is a roughly 80% possibility of a price bounce.

We already have an advantage over the market to trade and generate money with this method alone (really? sure!).

tamen, if you truly want to boost your trading profits, you may use fundamental support and resistance, as well as Fibonacci. In the Stochastic Histogram Indicator settings, this is possible.

We may change the amount of confidence (exempli gratia, 80 percent bounce success) and the minimum numbers necessary (eg. 10 bounces as the sample size instead of 5).

tamen, I believe that 8 out of 10 times is a bit too difficult to achieve.

There will be fewer setups, but when they do arise, they will be better. In statu, my sweet spot is 4 out of 5 times.

DO YOU USE A SPECIFIC INDICATOR VALUE?

IN PARTICULAR, We've narrowed down the most successful periods to these 5 numbers after years of testing: 13, 21, 34, 55, 89 We've made it possible to test up to 5 Stochastic Histogram readings in the indicator at the same time.

Stochastic Histogram Indicator will be able to scan for bounces over several RSI period values, and the table will show you whether any hidden True RSI levels are present on the chart. DO YOU USE THE CATOR VALUE?

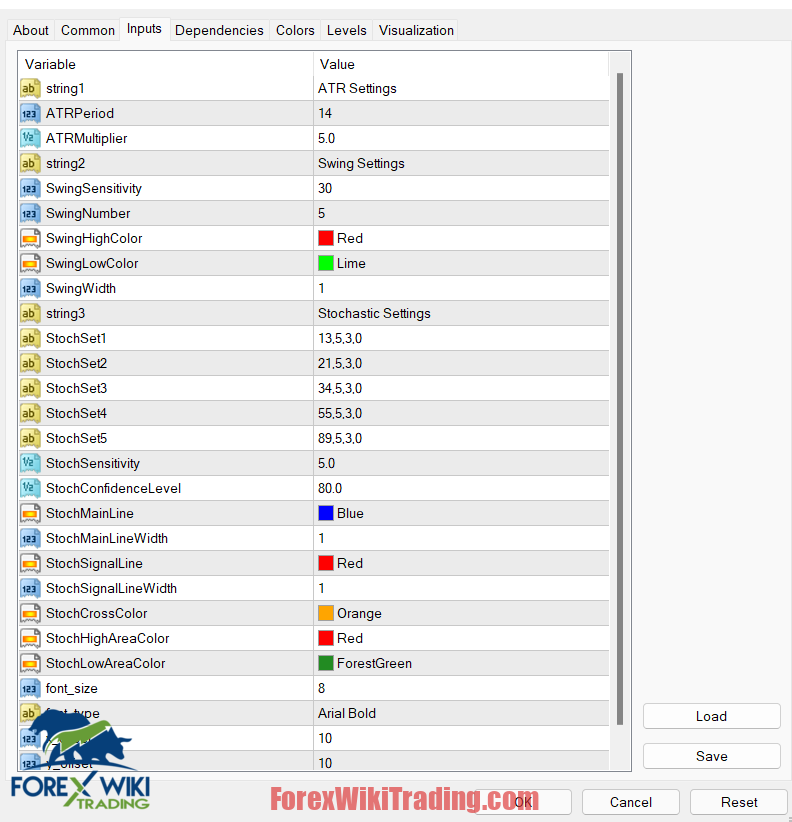

The indicator's settings As you can see in the image above, we're scanning over five settings (13, 21, 34, 55, et 89), and the indicator will tell us whether areas have genuine hidden Stochastic area levels. Here's a rundown of the numerous options: Occasus: These are the many RSI settings that we are experimenting with (up to 5 at a time).

View: Selecting this brings up the Stochastic as well as the concealed area. Only if there is a legitimate concealed RSI area do we click "View."

H valid: A high valid value indicates that there is a concealed Stochastic swing. When we're playing drops instead of bounces, there's a lot of resistance in this region.

H Range: This secret Stochastic swing high resistance has a hidden RSI area range. H Distance: The current RSI's distance from the concealed region is displayed. The lower the number, the closer the situation is. L valid: Low valid indicates that an RSI swing is present. Low-support zone (where we play bounces from).

L Distance: The current Stochastic distance from the concealed region is displayed. The lower the number, the closer the situation is.

L Range: The secret Stochastic region range where the hidden Stochastic swing low support is located is displayed.

"Does this also work for locating overbought areas?" >

Yes, it is correct. Let me demonstrate what it looks like:

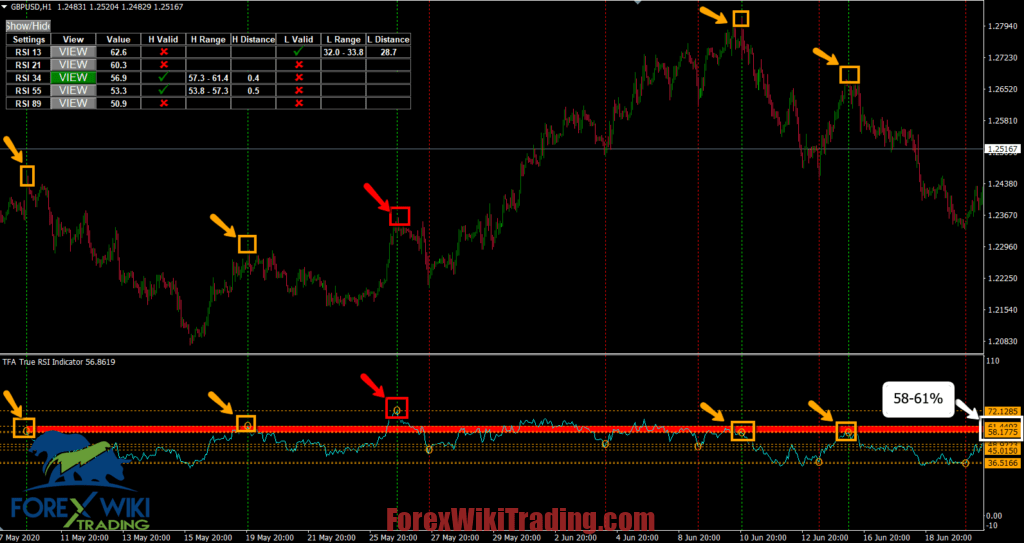

The Stochastic Histogram indicator may also be used to find hidden resistance levels. As you can see in the image below.

We applied the same 80 percent confidence threshold and a sample size of 5 to discover that there is a secret Stochastic Histogram resistance area ranging from 58 to 61 percent (rather than the 70 percent most people claim!). The legal reversals are shown by the orange arrows + boxes.

The 1/5 time it didn't reverse properly is shown by the red arrow + box. Since there are four orange (valid) and one red (invalid) box, we still have an 80 percent confidence level.

By finding high-probability reversal levels using this method, you may dramatically improve any trading strategy.

Sic, what more should I know about this metric? Just download it and discover other hidden options 😉 it's a free forex indicator.

Stochastic Histogram Indicator Mt4 Download

We highly recommend trying the Stochastic Histogram Indicator for at least a week with ICMarket demo propter. Also, te persuade et intellege quomodo haec ratio operatur antequam ea utatur in ratione viva.