- Novembris 2, 2024

- Missae by: Praenomen to Team

- Categoria: Free Forex EA

Introduction to XAU Strike EA

XAU Strike EA is a forex trading tool developed with insights gained from extensive research of the gold (HAUUSD) nundinae. Its primary focus is on generating rapid profits while maintaining risk management strategies. Designed for the 1-minute (M1) time frame, hoc perito Consiliario (EA) is tailored for traders with a minimum balance of $1,500 and aims to strike the market with precision.

Technical Specifications

Version: 9.5.9

Annus proventus: 2024

opus pairs: HAUUSD

Suspendisse timeframe: M1

Minimum Deposit: $1500

Mediocris rationis: 1:30 Ad 1:1000

Best Brokers List

XAU Strike EA works with any broker and any type of account, sed commendamus clientes nostros ut unum e summo forex praesidium sectorum existimetur infra enumerantur:

XAU Strike EA Settings

Detailed Breakdown of Settings

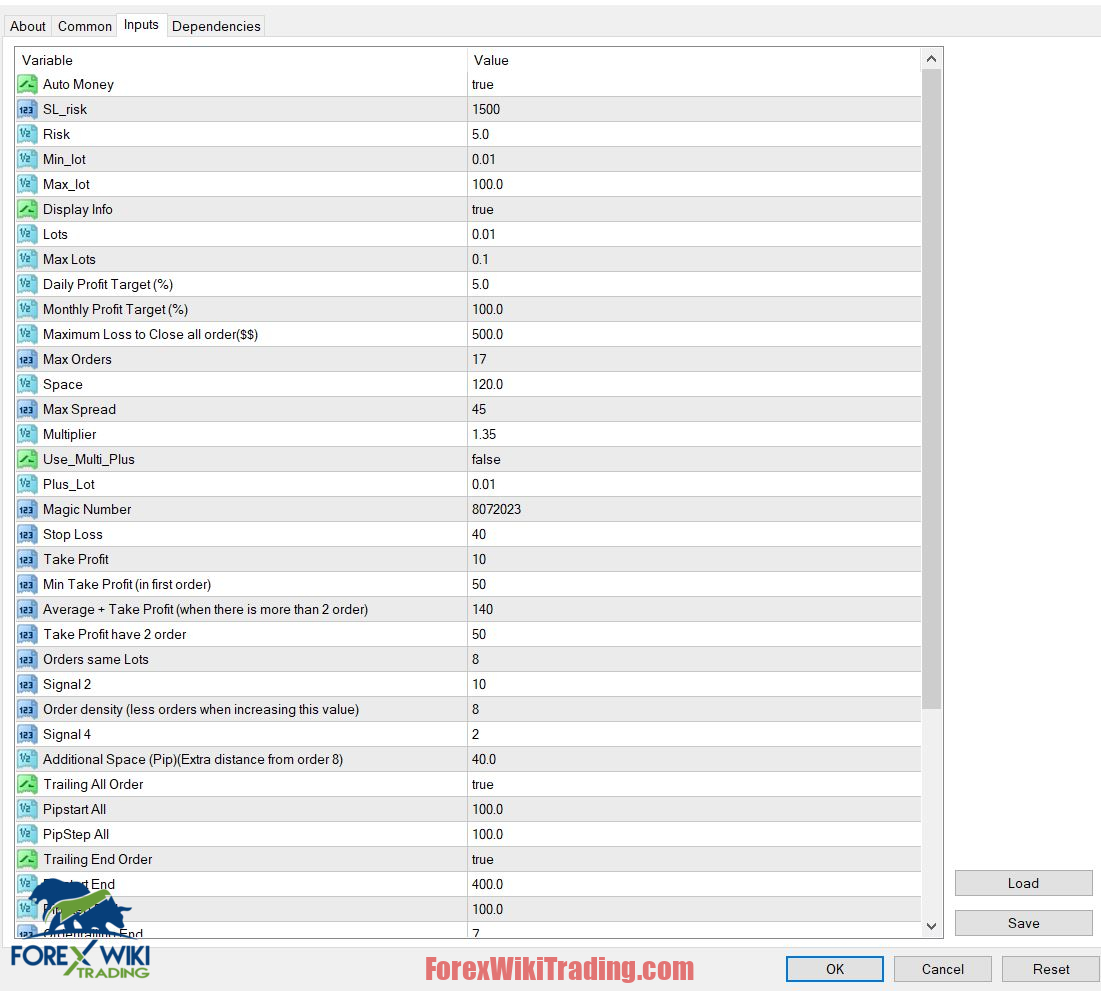

From the provided images, the XAU Strike EA offers an array of adjustable settings, each contributing to its strategy:

- Periculum et Pecunia Management:

- Auto Money: Automates lot sizing based on account balance.

- SL Risk: Determines the risk level for stop loss calculation.

- Min and Max Lots: Sets the boundaries for the size of trades.

- Profit Targets and Drawdown Limits:

- Daily and Monthly Profit Targets: These parameters help cap profits and protect gains.

- Maximum Loss: Sets a hard stop on losses, adding a layer of protection.

- Order Management:

- Martingale Multiplier: Defines the lot size increment when using the martingale method.

- Order Density: Controls how closely subsequent orders are placed.

- Trading Indicators:

- Siste agmen trahentem: Protects gains by moving the stop loss as the trade becomes profitable.

- PipStart and PipStep: Configures trailing stop parameters to optimize exits.

Key Features of XAU Strike EA

- Optimized for Gold Trading: The EA is specifically calibrated for XAUUSD, ensuring high compatibility with the volatility and movements unique to the gold market.

- Rapid Profit Strategy: It adopts a “quick entry, quick exit” approach, emphasizing profit-taking and risk mitigation. The idea is to recover the initial capital swiftly and then consider higher-risk strategies for potential gains.

- Martingale Recovery System: If the EA's initial prediction of a market reversal is incorrect, it deploys a martingale strategy to average the entry price. This can help recover losses if the market eventually turns in the desired direction.

- Pre-Virtual Order Analysis: The EA anticipates and positions itself ahead of virtual orders, aiming to predict reversal points with higher accuracy.

- Customizable Parameters: The EA allows traders to fine-tune settings, including stop loss, take profit, and order density, to match their trading style and risk tolerance

XAU Strike EA : euismod Analysis

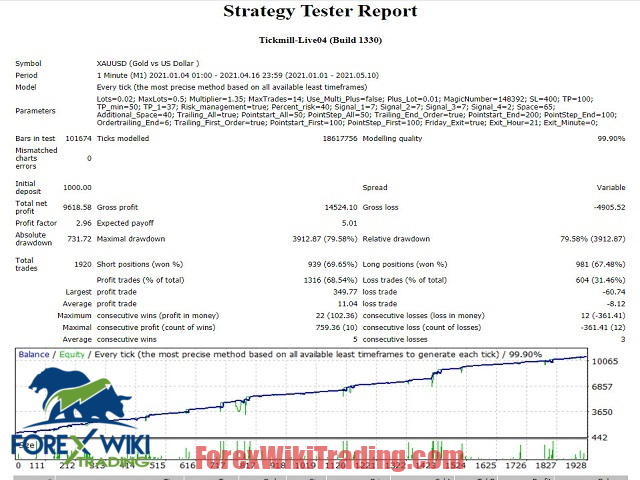

The backtest report, based on Tickmill Live04 with a modeling quality of 99.90%, shows promising results:

- Coepi Depositum: $1,000

- Gross Profit: $9,618.58

- Lucrum Factor: 2.96, significans omni pupa periclitatur, approximately $2.96 was earned.

- Maximal Drawdown: 79.58% ($3,912.87), highlighting the significant risk associated with the martingale strategy.

Advantages of XAU Strike EA

- Maximum lucrum Potential: The EA's strategy can yield substantial gains, especially in a volatile market like gold.

- Fusce Occasus: Flexibility in adjusting parameters allows traders to optimize the EA for different market conditions.

- Effective Use of Martingale: While risky, the martingale strategy can effectively recover from unfavorable trades if market conditions align.

- Pre-Emptive Market Analysis: Entering trades before virtual orders provides an edge in identifying reversal points early.

- Automated Risk Management: Features like daily profit caps and drawdown limits help protect against large losses.

Disadvantages of XAU Strike EA

- High Drawdown Risk: The martingale strategy inherently carries the risk of significant drawdown, which can lead to substantial losses if not managed properly.

- Requires High Capital: The EA's effectiveness is best realized with a sufficient account balance to withstand periods of loss, making it less accessible to traders with limited capital.

- Forum Dependency: The EA's performance is heavily influenced by market conditions. Extreme volatility or unforeseen events can adversely impact its strategy.

- Potential Overfitting: While the EA is optimized for gold, its performance may not generalize well to other instruments, bella diversificationis.

- Complex Setup: Traders may find the numerous adjustable parameters overwhelming, especially if they lack experience in EA optimization.

conclusio

XAU Strike EA offers an exciting approach to gold trading, blending rapid profit-taking strategies with risk management features. tamen, it is essential to recognize the inherent risks, particularly the potential for large drawdowns associated with martingale systems. For traders willing to invest time in fine-tuning settings and monitoring performance, this EA can be a valuable tool. tamen, novice traders should approach with caution and consider using demo accounts to understand its behavior fully.

Download XAU Strike EA

Quaeso experiri saltem hebdomadam an ICMarket demo propter. Also, adsuescere te et intelligere quomodo hoc liberum forex Mors operatur ante usus est in ratione vivere.

Periculum Disclaimer

Forex negotiatio pericula significantia portat et omnibus investors apta non potest. Praeteritum perficientur non praestat futuros eventus. Statistics et metrica opera exhibita in notitia historica nituntur et futuram observantiam non repraesentant. Negotiatores diligenter considerant eorum condicionem oeconomicam et periculum tolerantiae antequam aliqua automated systema negotiatione utatur