- Ogos 30, 2024

- Dihantar oleh: Pasukan Wiki Forex

- kategori: EA Forex Percuma

IcePoint Trader EA: An In-Depth Review of a Forex Trading Tool

Forex trading continues to attract both novice and experienced traders due to its potential for high returns and the ability to trade around the clock. The rise of automated trading systems, known as Expert Advisors (EA), has further simplified the trading process. One such tool is the IcePoint Trader EA—a day scalper designed to execute a high volume of trades daily. This review explores the capabilities, kelebihan, disadvantages, and critical considerations associated with using IcePoint Trader EA.

What is IcePoint Trader EA?

IcePoint Trader EA is an automated trading system that primarily employs a scalping strategy to capture small price movements within the Forex market. The EA is designed to make numerous trades each day, extracting just a few pips per transaction. It leverages the Relative Strength Index (RSI) indicator to determine the trend direction, aligning its trades accordingly.

Spesifikasi Teknikal

Versi: 3.03

Tahun terbitan: 2024

Pasangan kerja: Any

Jangka masa yang disyorkan: H1

Deposit Minimum: $1000

Purata akaun: 1:30 Kepada 1:500

Senarai Broker Terbaik

IcePoint Trader EA works with any broker and any type of account, tetapi kami mengesyorkan pelanggan kami menggunakan salah satu daripada broker forex teratas disenaraikan di bawah:

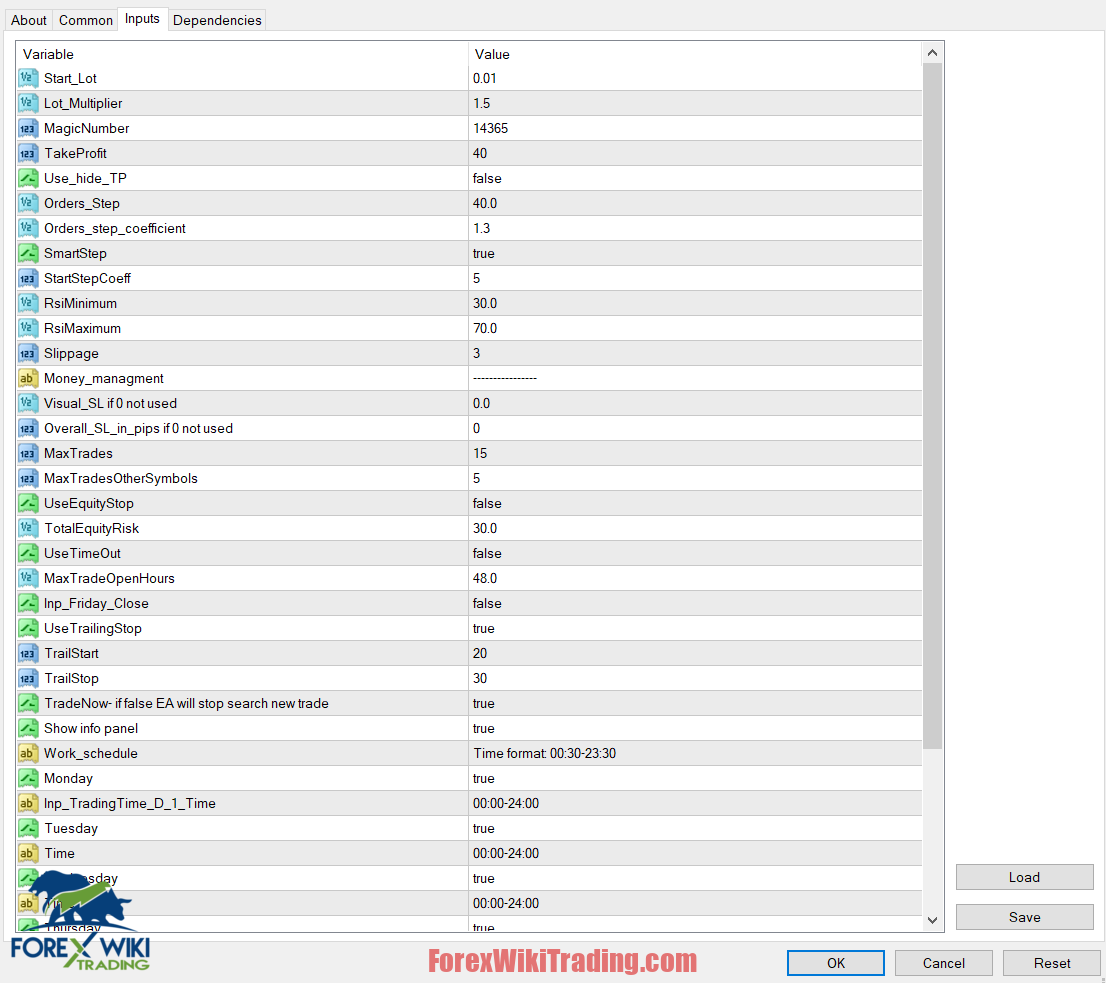

IcePoint Trader EA Settings

Input Parameters

The EA is highly customizable with input parameters that allow traders to fine-tune its operation to suit their risk tolerance and trading strategy. Key parameters include:

- Lot Multiplier: Adjusts the lot size for averaging orders.

- Start Lot: Defines the initial lot size.

- Orders Step: Determines the distance between averaging orders.

- Max Trades: Sets the maximum number of open orders.

- Use Timeout: Enables or disables the trade timeout feature.

- Friday Trading Time: Customizes trading hours on Fridays to manage weekend risks.

Key Features of IcePoint Trader EA

1. Trend Trading with RSI Indicator

- The EA uses the RSI indicator to assess market trends and execute trades that align with the prevailing trend. This method aims to increase the likelihood of successful trades by following the market's momentum.

2. Averaging with Multiplier Lot

- One of the more sophisticated features of IcePoint Trader EA is its use of averaging with a lot multiplier. When a trade goes against the EA, it opens additional trades at increasing lot sizes to average the position. While this can potentially recover losses, it also introduces higher risk.

3. Customizable Risk Management

- Users have the ability to limit the maximum number of orders for averaging, as well as control equity risk. This customization is crucial for managing potential drawdowns and safeguarding trading capital.

4. Smart Mode for Order Management

- The EA includes a smart mode option, which dynamically adjusts the step between averaging orders based on market conditions. This feature is designed to optimize trade entries and exits, enhancing overall performance.

5. Timeout and Friday Trading Management

- IcePoint Trader EA provides an option to close trades after a specified timeout period, which can prevent trades from being stuck in unfavorable positions. Additionally, there are specific settings for Friday trading, allowing users to force close orders before the market closes for the weekend.

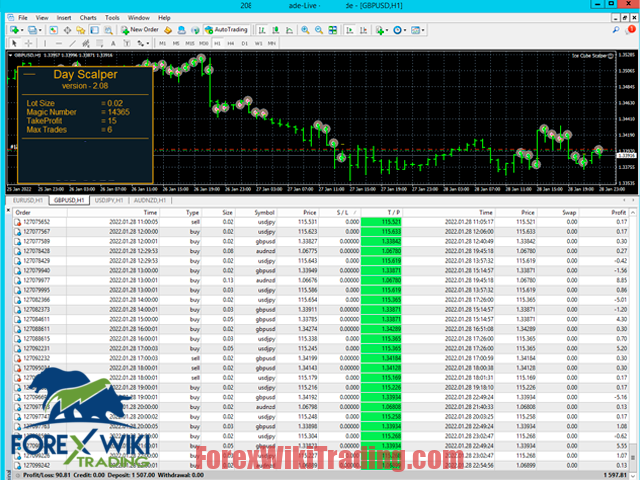

Result IcePoint Trader EA

Recommendations for Optimal Use

To maximize the potential of IcePoint Trader EA, users are advised to:

- Start with a lot size of 0.01 for every $1,000 in their trading account. For accounts with less than $1,000, a cent account type is recommended.

- Regularly withdraw profits to recover the initial investment.

- Use a trading leverage of 1:500.

- Operate on the H1 time frame for best results.

Advantages of IcePoint Trader EA

1. High Trade Frequency

- The EA’s scalping strategy ensures a high volume of trades, which can be beneficial in volatile markets where small price movements are frequent.

2. Customizability

- IcePoint Trader EA offers extensive customization options, allowing traders to adjust the system according to their risk appetite and market outlook.

3. Risk Management Tools

- The ability to limit the number of open trades and control equity risk helps mitigate the potential for significant losses, making it suitable for traders with varying risk profiles.

4. Compatibility with Other EAs

- This EA can be used in conjunction with other trading systems, provided sufficient capital is allocated. This flexibility allows traders to diversify their strategies..

Disadvantages of IcePoint Trader EA

1. High-Risk Averaging Strategy

- The use of a lot multiplier for averaging can lead to significant drawdowns if the market moves strongly against the EA’s position. This strategy requires a deep understanding and careful monitoring.

2. Market Dependency

- Like all trend-following strategies, IcePoint Trader EA performs best in trending markets. During sideways or choppy markets, its effectiveness can diminish, leading to potential losses.

3. Requires Adequate Capital

- To effectively use the EA, especially with the averaging strategy, a substantial account balance is required. Under-capitalization can quickly lead to margin calls or account depletion.

4. Complexity

- The EA’s extensive customization options, while beneficial, may be overwhelming for novice traders. It requires a good understanding of forex trading principles and the specific mechanics of the EA.

Kesimpulan

IcePoint Trader EA is a powerful tool for traders who prefer a high-frequency, trend-following approach. Its sophisticated averaging strategy and extensive customization options make it suitable for traders with a deep understanding of the forex market and a tolerance for risk. Namun begitu, the potential for significant drawdowns and the need for substantial capital are critical considerations. Prospective users should thoroughly test the EA in a demo environment and consider the free signal service before deploying it in live trading.

Download IcePoint Trader EA

Sila cuba sekurang-kurangnya seminggu an Akaun demo ICMarket. Juga, biasakan diri anda dan fahami bagaimana ini Alat forex percuma berfungsi sebelum menggunakannya pada akaun langsung.