- November 11, 2024

- Dihantar oleh: Pasukan Wiki Forex

- kategori: EA Forex Percuma

Introduction to Swift Talon EA

Swift Talon EA is a forex scalping expert advisor (EA) designed for professional traders aiming to capture quick price movements within short timeframes. This EA is equipped with robust risk management features, including predefined stop-loss (SL) and take-profit (TP) levels, ensuring each trade maintains controlled risk. Built for short-term trading, Swift Talon EA focuses on achieving consistent profits by executing trades that generally close within hours.

Technical Specifications

Version: 2.2

Year of issue: 2024

Working pairs: GBPUSD, EURUSD,USDCAD, EURGBP, EURCHF, USDCHF, AUDCAD, AUDUSD, CADCHF

Recommended timeframe: M5

Deposit Minimum: $300

Average of account: 1:30 To 1:1000

Senarai Broker Terbaik

Swift Talon EA can work with any broker and any type of account, tetapi kami mengesyorkan pelanggan kami menggunakan salah satu daripada broker forex teratas disenaraikan di bawah:

Key Features:

- Multi-Symbol Trading: Capable of managing multiple currency pairs in one chart.

- Safe Trading Strategies: Avoids risky techniques such as grid, martingale, averaging, or double lots.

- Automated News Filtering: Adjusts to market news using broker time settings to avoid high-volatility periods.

- Single Trade per Pair: Limits exposure by opening only one trade per currency pair at any given time.

- Broad Compatibility: Supports symbols with prefixes or suffixes, making it versatile for different broker configurations.

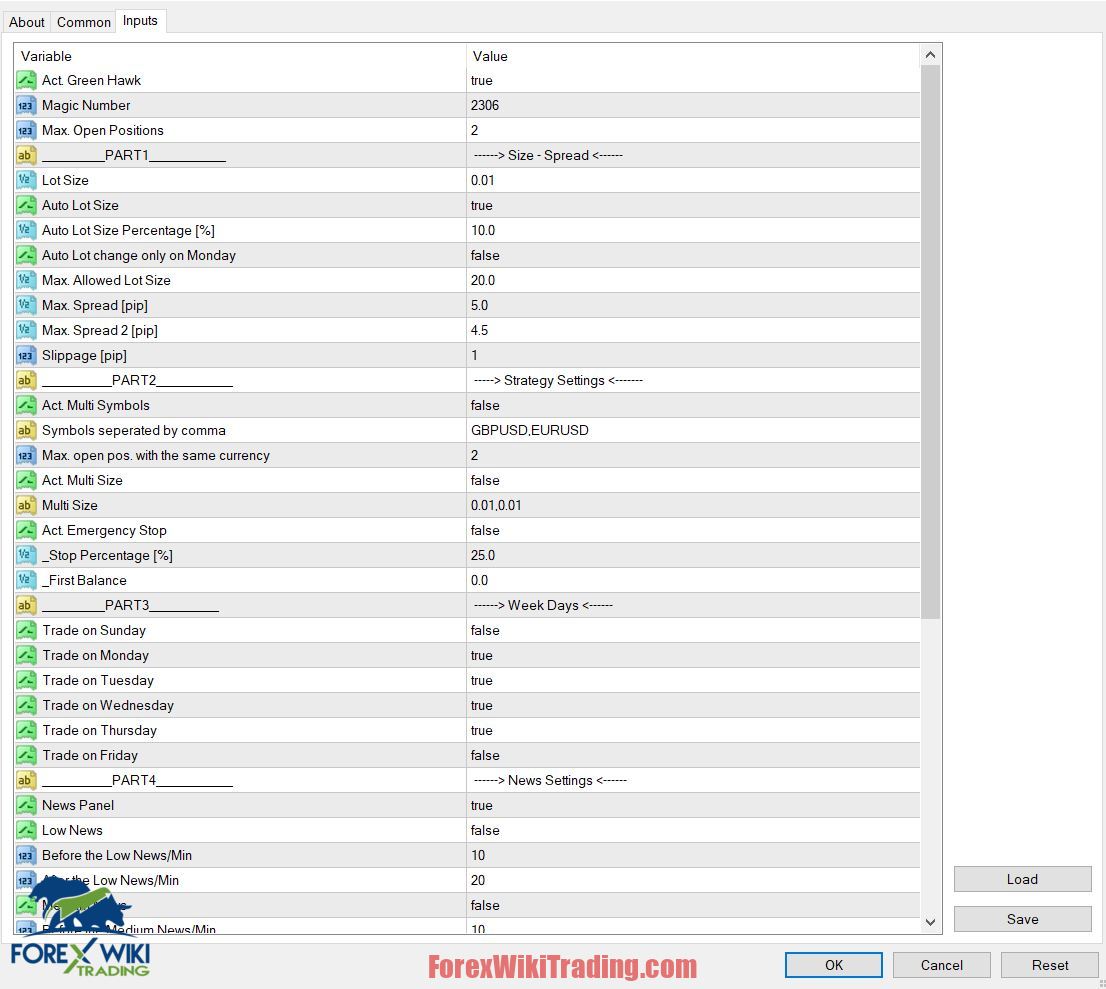

Recommended Setup and Parameters

Currency Pairs: The EA is optimized for pairs such as GBPUSD, EURUSD, USDCAD, EURGBP, and more, with M5 (5-minute) timeframes. For best results, GBPUSD on the M5 timeframe is recommended due to its high liquidity and lower spreads.

Broker Requirements:

- Leverage: Ideal leverage is 1:500, though it can function effectively on 1:30.

- Broker Type: Recommended for ECN brokers with low or zero spread options to avoid slippage and unexpected spread increases.

Important Settings:

- Act. Multi Symbol: To activate multi-symbol trading, set this parameter to true and specify the pairs in the EA settings.

- Auto Lot Sizing: Apabila didayakan, the lot size automatically adjusts based on the account equity and specified percentage, allowing scalability with different account sizes.

- Spread Sensitivity: Due to the nature of scalping, low spreads are essential, emphasizing the need for a high-quality ECN broker.

Strategy Overview

Swift Talon EA capitalizes on price reversals within short timeframes. By focusing on brief market fluctuations, it aims to minimize exposure and quickly capture profits. The system trades only during favorable conditions and filters out high-risk trades by avoiding grid, martingale, and other compounding strategies. This conservative approach is ideal for traders seeking controlled, low-risk growth in their accounts.

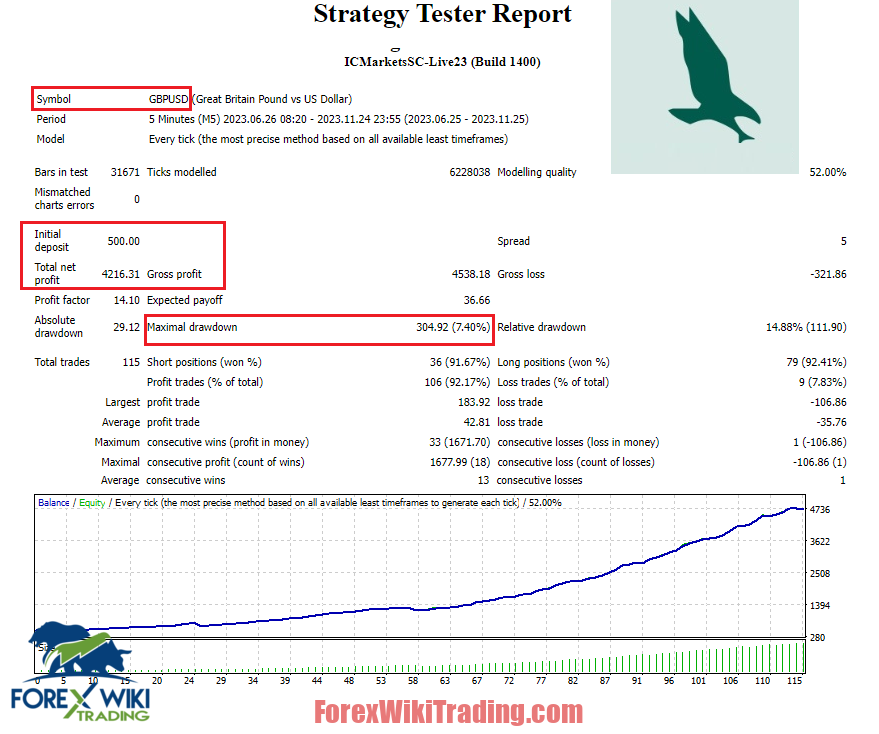

Swift Talon EA : Backtesting Results

Based on the attached test report, here are some key performance metrics for Swift Talon EA:

- Initial Deposit: $500

- Net Profit: $4,216.31, showcasing significant growth over the testing period.

- Profit Factor: 14.10, indicating high profitability relative to risk.

- Drawdown: Maximal drawdown of 7.4% demonstrates the EA's efficiency in managing risk.

- Win Rate: Maintains a high win rate of over 92%, reflecting the EA’s effectiveness in capturing profitable trades within short timeframes.

This test on GBPUSD (M5) shows steady equity growth with controlled drawdowns, affirming the EA's promise for low-risk, consistent gains.

Advantages of Swift Talon EA

- Risk Management: Every trade is equipped with a predefined stop loss and take profit, reducing exposure to potential market shocks.

- Automated News Filtering: Prevents trades during high-impact news events, which could lead to erratic market behavior.

- Controlled Scalping: Scalping strategies are usually high-risk, but Swift Talon EA mitigates this by focusing on individual trades without leveraging risky tactics.

- Broad Pair Compatibility: Flexibility with multiple currency pairs offers users opportunities to diversify within a single EA.

Potential Drawbacks of Swift Talon EA

- Sensitivity to Spread: Since Swift Talon EA relies on tight spreads, it may underperform with brokers that have high spreads or frequent spread widening.

- Market Limitations: Although it supports multiple pairs, the EA is best suited to high-liquidity, low-spread pairs like GBPUSD or EURUSD. It may struggle with exotic or volatile pairs.

- Broker Dependency: Requires an ECN broker with fast execution and minimal slippage for optimal results, which may not be accessible for all traders.

- Requires Monitoring: While Swift Talon EA automates trades, regular monitoring is recommended, especially around news events, to ensure performance stability.

Kesimpulan: Is Swift Talon EA Suitable for You?

Swift Talon EA is a robust tool for traders looking to implement a professional-grade scalping strategy without taking unnecessary risks. Its strong risk management, spread sensitivity, and ability to manage multiple pairs make it a suitable option for both beginner and experienced traders. Namun begitu, it requires a favorable broker environment, such as low spreads and high-speed execution, to achieve optimal results. With disciplined settings and careful broker selection, Swift Talon EA can be a valuable addition to a forex trading portfolio.

Download Swift Talon EA

Please try for at least a week an Akaun demo ICMarket. Juga, familiarize yourself with and understand how this free forex Tool works before using it on a live account.

Risk Disclaimer

Trading forex carries significant risks and may not be suitable for all investors. Past performance does not guarantee future results. The statistics and performance metrics presented are based on historical data and may not represent future performance. Traders should carefully consider their financial situation and risk tolerance before using any automated trading system