- Oktober 18, 2024

- Dihantar oleh: Pasukan Wiki Forex

- kategori: EA Forex Percuma

TrendForce EA: A Comprehensive Analysis

TrendForce EA represents an automated forex trading solution designed to capitalize on trend-following strategies across major currency pairs. Based on the provided trading statistics and configuration parameters, this review analyzes its performance, ciri, and potential considerations for traders.

Introduction to Forex Trading and Automated Tools

In the world of Forex trading, mastering the markets can be both rewarding and challenging. Success often requires not only sound trading strategies but also effective tools. Automated trading solutions like Expert Advisors (EA) have revolutionized the way traders participate in the market. One such tool is TrendForce EA, a fully automated Forex robot claiming to deliver up to 5% daily profits. This review will take a deep dive into the capabilities, kelebihan, and potential pitfalls of TrendForce EA, providing a comprehensive analysis for potential users.

What is TrendForce EA?

TrendForce EA is an automated trading robot designed for the Forex market, promising robust daily returns. It's built around a trend-following strategy, leveraging various technical indicators to identify market trends and execute trades accordingly. The goal of this tool is to simplify trading for users, whether they are seasoned traders or beginners, by removing emotional decision-making and manual effort.

Spesifikasi Teknikal

Versi: 13.30

Tahun terbitan: 2024

Pasangan kerja: EURUSD, GBPUSD, USDJPY, GBPJPY

Jangka masa yang disyorkan: M1, M15

Deposit Minimum: $1000

Purata akaun: 1:30 Kepada 1:500

Senarai Broker Terbaik

TrendForce EA works with any broker and any type of account, tetapi kami mengesyorkan pelanggan kami menggunakan salah satu daripada broker forex teratas disenaraikan di bawah:

Key Features of TrendForce EA

1. Trend-Following Strategy

The primary strength of TrendForce EA lies in its trend-following strategy. By focusing on the current strong trends in the market, the robot aims to capitalize on sustained price movements. Many traders struggle with the discipline needed to follow trends, often exiting trades too early. TrendForce EA is programmed to avoid these common pitfalls, allowing the user to ride the market waves for more substantial gains.

2. Fully Automated System

One of the standout features of TrendForce EA is its fully automated nature. Setelah dipasang pada MetaTrader 4 (MT4) platform, the EA handles everything from opening to closing trades, all without human intervention. This is a major advantage for busy traders who cannot constantly monitor the markets.

3. Wide Currency Pair Compatibility

TrendForce EA supports trading across all major currency pairs and commodities. Namun begitu, it is optimized for EUR/USD, GBP/USD, USD/JPY, dan GBP/JPY, where users are likely to see the best results. This flexibility allows traders to diversify their portfolios and take advantage of market opportunities across different assets.

4. Easy Installation and Usage

The robot is designed for ease of use. With a simple installation process on the MT4 platform, even those with minimal technical experience can have it running in minutes. It does not require extensive setup or manual intervention once installed, making it a set-and-forget solution for traders.

Performance Analysis TrendForce EA

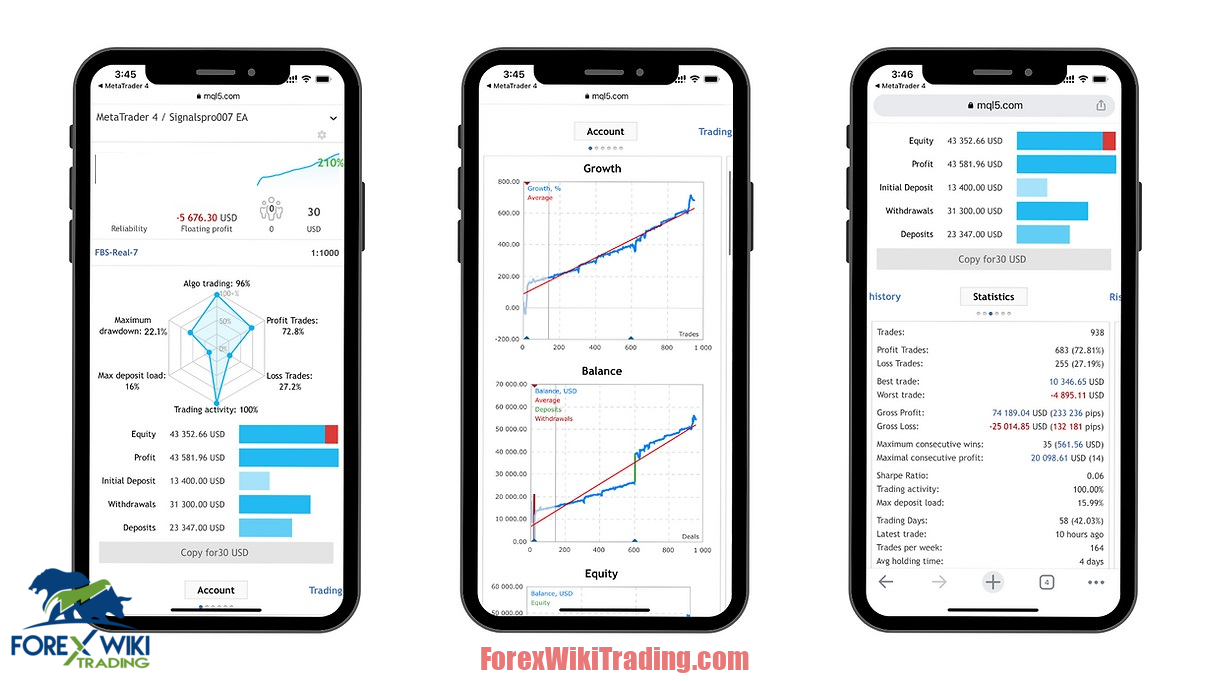

Key Statistics

- Initial Deposit: $13,400 USD

- Current Equity: $43,352.66 USD

- Total Profit: $41,581.96 USD

- Trading Activity: 100%

- Profit Trades: 72.81%

- Loss Trades: 27.19%

- Maximum Drawdown: 22.1%

Trading Metrics

- Total Trades: 938

- Profit/Loss Ratio: 683 winning trades vs. 255 losing trades

- Best Trade: $10,346.65 USD

- Worst Trade: -$895.11 USD

- Average Holding Time: 4 days

- Trading Activity: 144 trades per week

Core Features

1. Trend-Following Strategy

- Utilizes multiple trending indicators for signal generation

- Focuses on major currency pairs (EURUSD, GBPUSD, USDJPY, GBPJPY)

- Implements position sizing based on account balance

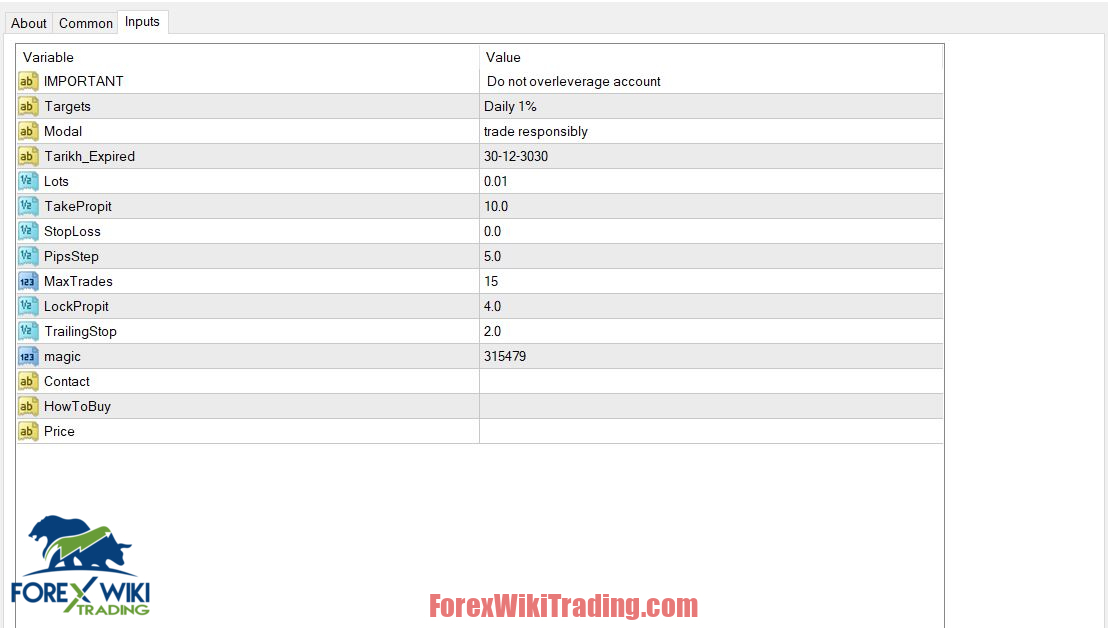

2. Risk Management Parameters

- Ambil Untung: 10.0 pips

- Stop Loss: Dynamic trailing stop of 2.0 pips

- Maximum Trades: 15 concurrent positions

- Lot Size: 0.01 standard lots

- Daily Target: 1% account growth

3. Automation Features

- Fully automated execution

- 24/5 market monitoring

- No manual intervention required

- Compatible with MetaTrader 4 platform

Advantages

- Systematic Approach

- Removes emotional trading decisions

- Consistent strategy execution

- Clear risk management parameters

- Time Efficiency

- Fully automated operation

- No need for constant monitoring

- Suitable for passive trading

- Performance Metrics

- Positive risk-reward ratio

- High win rate (72.81%)

- Demonstrated account growth

Disadvantages

- Risk Considerations

- Significant maximum drawdown (22.1%)

- Dependency on trend conditions

- Potential for consecutive losses

- Technical Requirements

- Requires stable internet connection

- VPS recommended for optimal performance

- Limited to MetaTrader 4 platform

- Strategy Limitations

- May underperform in ranging markets

- Fixed lot size might limit scaling

- Potential over-optimization risks

Kesimpulan

TrendForce EA demonstrates a systematic approach to forex trading with promising performance metrics. Namun begitu, potential users should carefully consider the significant drawdown risks and technical requirements before implementation. The system appears best suited for traders seeking a hands-off approach to trend-following strategies in major currency pairs.

Download TrendForce EA

Sila cuba sekurang-kurangnya seminggu an Akaun demo ICMarket. Juga, biasakan diri anda dan fahami bagaimana ini Alat forex percuma berfungsi sebelum menggunakannya pada akaun langsung.

Penafian Risiko

Berdagang forex membawa risiko yang ketara dan mungkin tidak sesuai untuk semua pelabur. Prestasi masa lalu tidak menjamin hasil masa hadapan. Statistik dan metrik prestasi yang dibentangkan adalah berdasarkan data sejarah dan mungkin tidak mewakili prestasi masa hadapan. Pedagang harus mempertimbangkan dengan teliti keadaan kewangan dan toleransi risiko mereka sebelum menggunakan mana-mana sistem perdagangan automatik