- September 24, 2024

- Dihantar oleh: Pasukan Wiki Forex

- kategori: EA Forex Percuma

Introduction US30 Turbo Scalper EA

The forex market offers numerous tools and strategies for traders to maximize their profits. Among these tools, automated trading systems, atau Penasihat Pakar (EA), have gained immense popularity. One such tool is the US30 Turbo Scalper, a next-generation scalping robot designed by a team of experienced traders and coders. This article provides a comprehensive review of US30 Swift EA, covering its features, kelebihan, disadvantages, and tips for optimal use.

Overview of US30 Turbo Scalper EA

US30 Swift EA is specifically designed for scalping on the US30 index, one of the most prominent Wall Street indices. It operates on the M15 timeframe and is optimized for raw accounts with low spreads. The EA does not utilize risky trading strategies such as grid, martingale, or funding. Sebaliknya, it ensures each trade is protected by a Stop Loss and Take Profit level.

Ciri-ciri Utama

- Pengurusan Risiko: No grid, hedge, or multiple open trades; every trade has a Stop Loss.

- Automatic Lot Bidding: Built-in function for automatic lot sizing.

- Easy Installation: Default settings are optimized for most brokers, requiring minimal setup.

- 24/7 Operation: Recommended to use a VPS for continuous operation.

- Account Type: Raw accounts for the lowest spreads

- Broker: Use brokers with low spread differentials (100-150 points)

Spesifikasi Teknikal

Versi: 1.4

Tahun terbitan: 2024

Pasangan kerja: US30

Jangka masa yang disyorkan: M15

Deposit Minimum: $1000

Purata akaun: 1:30 Kepada 1:1000

Senarai Broker Terbaik

US30 Swift EA works with any broker and any type of account, tetapi kami mengesyorkan pelanggan kami menggunakan salah satu daripada broker forex teratas disenaraikan di bawah:

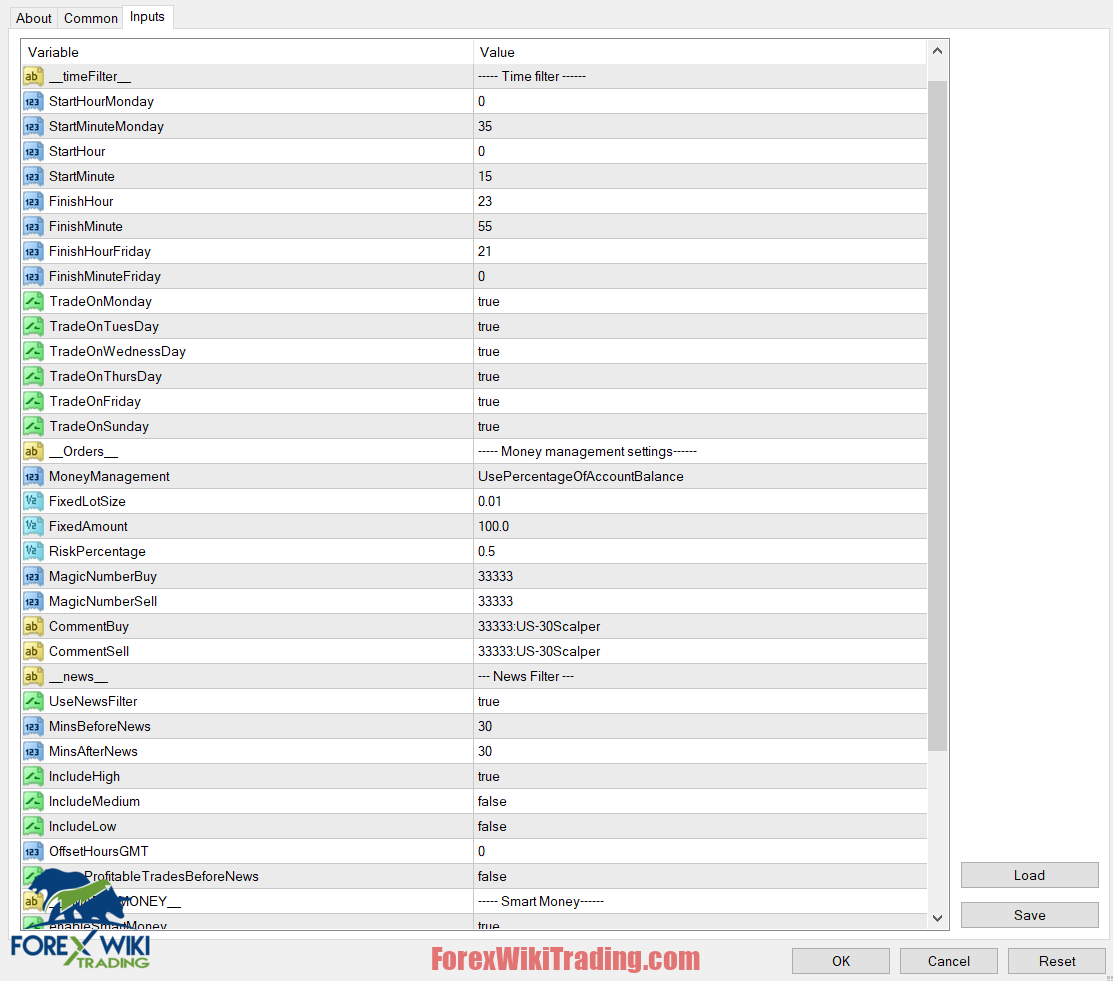

US30 Turbo Scalper EA Settings

Review US30 Swift EA Results

Performance Overview:

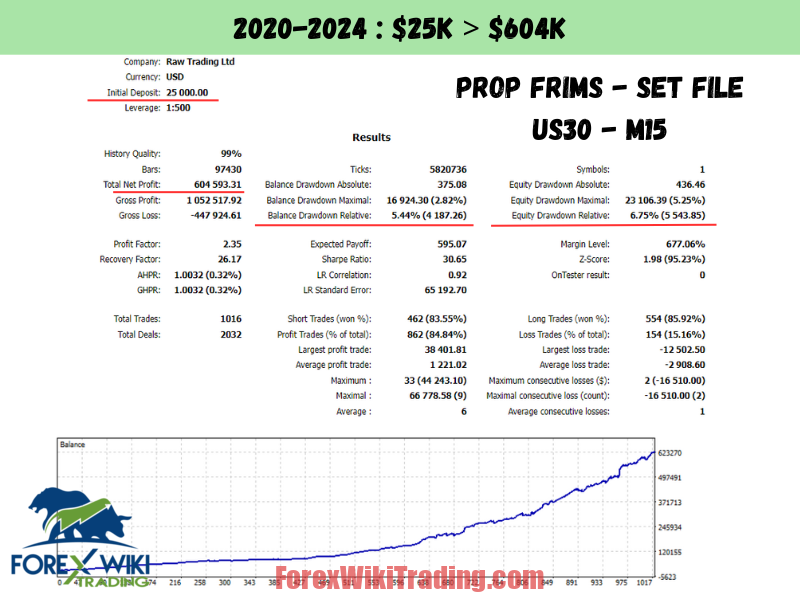

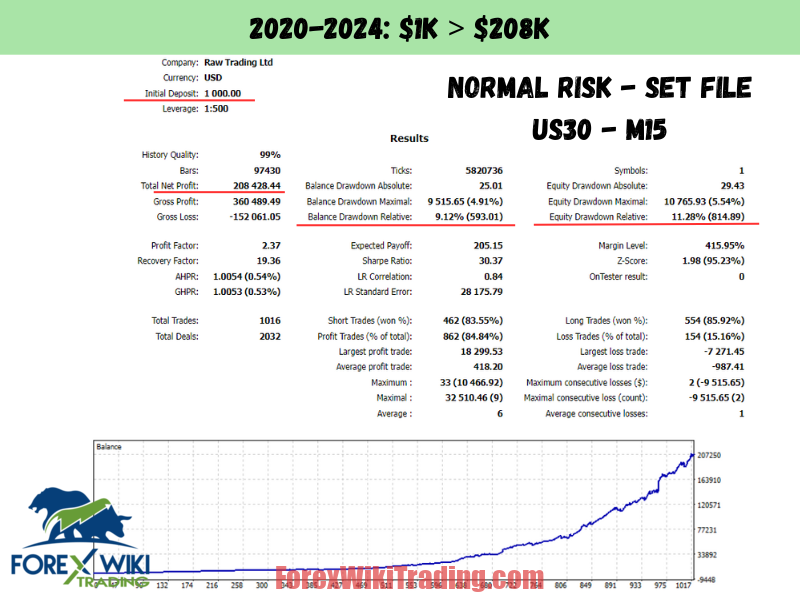

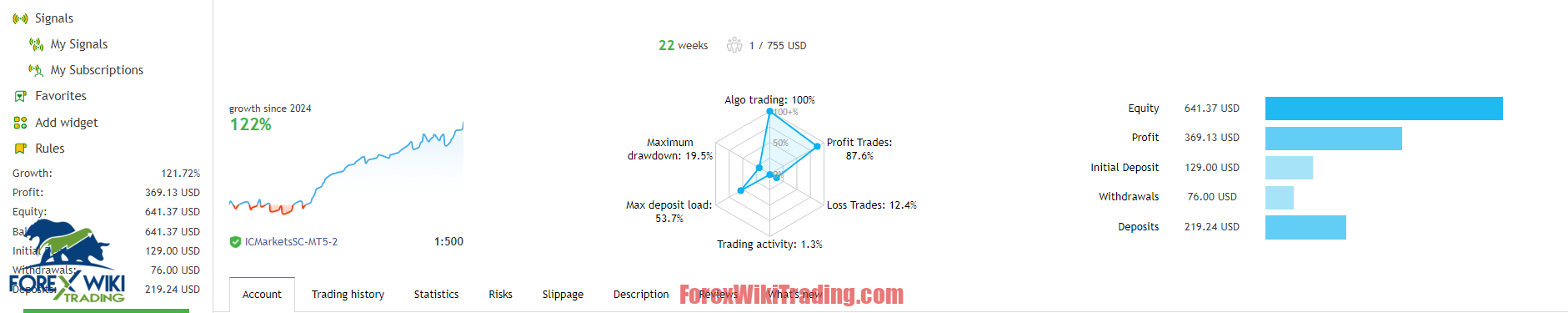

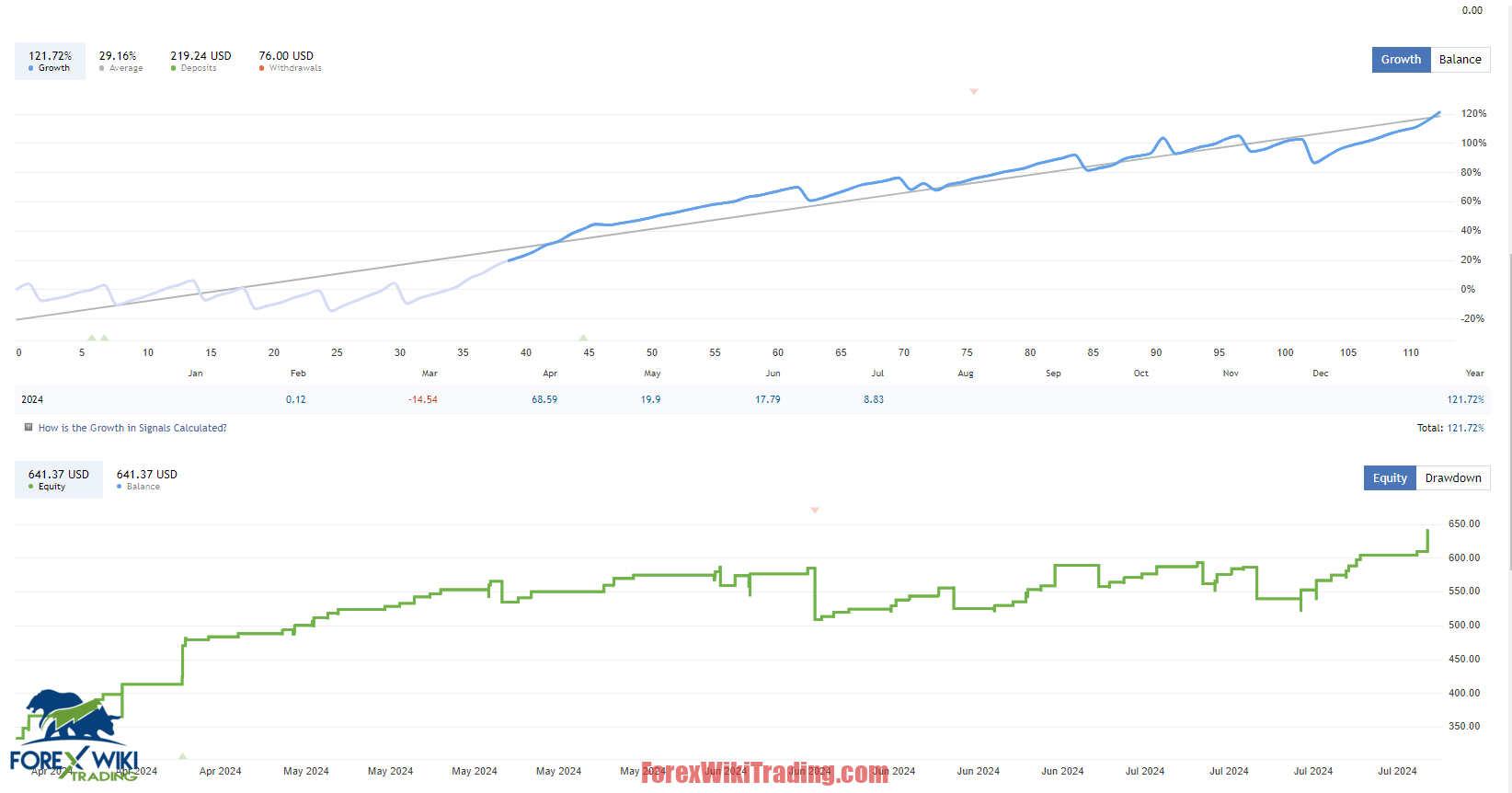

- Growth since 2024: 121.72% (Image 1) / 122% (Image 2)

- Current Equity: $641.37 USD

- Initial Deposit: $129.00 USD

- Total Profit: $369.13 USD

- Deposits: $219.24 USD

- Withdrawals: $76.00 USD

Key Performance Metrics:

- Profit Trades: 87.6%

- Loss Trades: 12.4%

- Maximum Drawdown: 19.5%

- Algo Trading: 100%

- Trading Activity: 1.3%

- Max Deposit Load: 53.7%

Analisis:

- Profitability: The EA has shown impressive growth of over 120% since the beginning of 2024, which is excellent performance in a relatively short time frame (about 7 months).

- Win Rate: With 87.6% profitable trades, the system demonstrates a very high success rate, which is exceptional for an automated trading system.

- Pengurusan Risiko: The maximum drawdown of 19.5% is reasonable, suggesting the EA has decent risk management protocols in place.

- Consistency: The equity curve in Image 1 shows a generally upward trend, with some fluctuations but overall consistent growth.

- Trading Frequency: The trading activity of 1.3% indicates a relatively low-frequency trading approach, which can be beneficial for reducing transaction costs and avoiding overtrading.

- Capitalization: The initial deposit was modest at $129, and additional deposits have been made, showing the trader is reinvesting and scaling up carefully.

- Withdrawal History: There have been some withdrawals ($76), which is a positive sign as it shows the system is generating real, withdrawable profits.

Potential Concerns:

- Short Track Record: The performance data only covers about 7 months. A longer track record would provide more confidence in the EA's long-term viability.

- Market Conditions: It's important to consider how this EA might perform in different market conditions, as we don't have data from various market cycles.

- Dependency on Deposits: The growth seems partially supported by additional deposits. It would be useful to see performance metrics excluding these deposits.

Overall Assessment: This EA shows promising results with high profitability, good risk management, and consistent growth. Namun begitu, the relatively short track record and the impact of additional deposits should be considered. It would be advisable to continue monitoring its performance over a longer period and across different market conditions before fully relying on this system for significant capital allocation.

Advantages of US30 Turbo Scalper

1. Optimized Performance

US30 Swift EA has undergone extensive testing on both real and demo accounts. This thorough vetting process ensures that the EA is optimized for the best performance, increasing the likelihood of profitable trades.

2. User-Friendly Setup

The EA is designed for ease of use. Traders do not need to tweak any settings as the default configurations are suitable for most brokers. This simplicity makes it accessible even to those with limited technical knowledge.

3. Robust Risk Management

By avoiding risky strategies like grid and martingale, US30 EA focuses on capital preservation. The inclusion of Stop Loss and Take Profit levels for each trade further enhances its risk management capabilities.

4. Automated Trading

The built-in automatic lot bidding function and the recommendation to use a VPS allow for continuous, hands-free trading. This automation saves time and effort, enabling traders to focus on other aspects of their trading strategy.

Disadvantages of US30 Turbo Scalper EA

1. Dependence on Broker Spreads

The performance of US30 EA heavily relies on the broker's spread differentials. High spreads can significantly reduce profitability, making it crucial to choose a broker with low spreads.

2. Market Volatility

Scalping strategies can be particularly sensitive to market volatility. Sudden price movements can trigger Stop Losses, resulting in losses. This volatility risk needs to be carefully managed.

3. Initial Testing Period

To ensure compatibility and effectiveness, the EA should be tested on a demo account for 12 weeks before live trading. This requirement might delay the start of live trading and necessitate additional patience from traders.

4. No Guaranteed Profits

As with any trading tool, there are no guarantees of profitability. Backtests, while optimized, may not accurately predict live trading outcomes. Traders must be prepared for potential losses.

Tips for Optimal Use

1. Choose the Right Broker

Select a broker offering low spread differentials to maximize the EA's performance. Raw accounts are typically preferred for this purpose.

2. Use a VPS

To ensure uninterrupted operation, especially during peak trading hours, using a Virtual Private Server (VPS) is highly recommended. This setup keeps the EA running 24/7 without downtime.

3. Conduct Thorough Testing

Before committing to a live account, test the EA on a demo account for at least 12 weeks. This period allows for assessing the EA's compatibility with your broker and understanding its behavior under various market conditions.

4. Monitor Market Conditions

While the EA automates trading, staying informed about market conditions is crucial. Significant economic events or announcements can impact market volatility and affect the EA's performance.

Kesimpulan

US30 Turbo Scalper is a promising tool for traders interested in scalping the US30 index. Its user-friendly setup, robust risk management, and automated trading capabilities make it an attractive option. Namun begitu, traders must be mindful of the broker spreads, market volatility, and the necessity of a thorough testing period. By carefully considering these factors, traders can effectively utilize US30 EA to enhance their trading strategies.

Amaran Risiko

Potential users should be aware of the risks involved in forex trading. Historical performance does not guarantee future results, and the EA can incur losses. It is advisable to test the EA on a demo account for at least 12 weeks to ensure compatibility and effectiveness.

Download US30 Turbo Scalper EA

Sila cuba sekurang-kurangnya seminggu an Akaun demo XM. Juga, biasakan diri anda dan fahami bagaimana ini free forex ea works sebelum menggunakannya pada akaun langsung.