- Jun 16, 2019

- Dihantar oleh: Pasukan Wiki Forex

- kategori: Sistem Dagangan Forex

I'm an fairness investor grounded just about on the worth aspect of the market, so I want to see extra elementary logic and parts than purely market sentiment and momentum. Since I'm not some billionaire who can purchase shares and achieve controlling pursuits in an organization, the technical aspect of buying and selling comparable to Fibonacci Pivot Ranges is at all times useful as a software for entries and exits. The mix of fundamentals and techincals has been profitable for me in fairness buying and selling, so I want to transfer on to the foreign money market and see the way it seems.

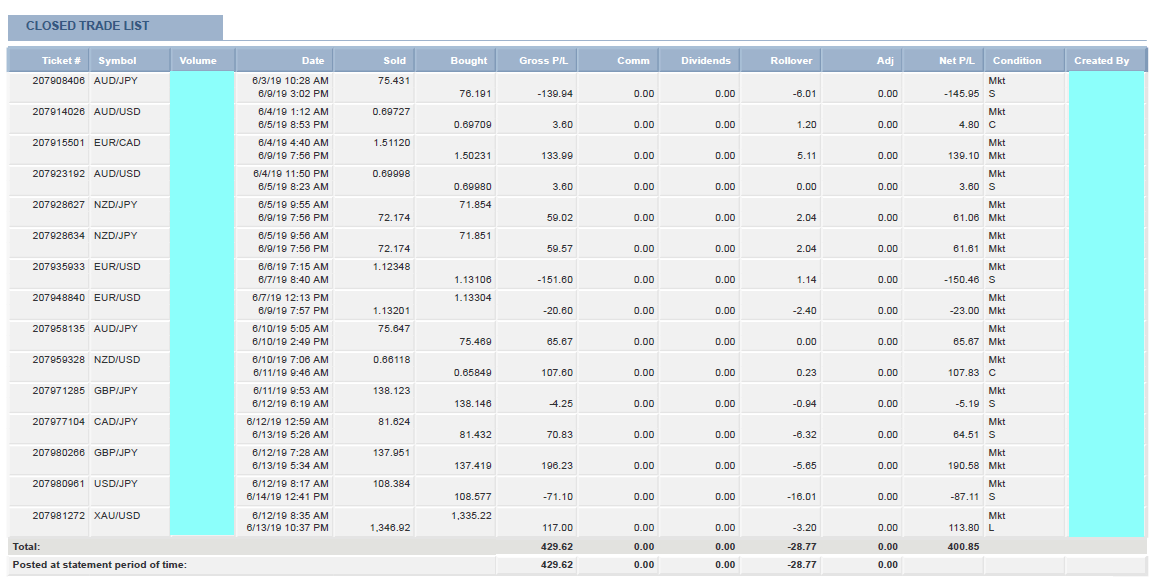

First issues first, the next is my reside buying and selling outcomes for the previous two weeks, and that was after I had spent a number of weeks to check the system now formally known as "Fibonacci Weekly Pivot Integrated with Fundamentals." The preliminary capital deposited into the account was increased than $5,000 and I'd recommend anyone who needs to go reside on their techniques has not less than $5,000 to begin the sport. The platform I'm utilizing is FXCM Buying and selling Station II and I reside in Guangzhou, China, or Hong Kong generally, one way or the other finest becoming the London and New York Open

System Construction

The system per se is discretionary however the implementation shall be logical and disciplinary. There are two underlying pathways to preliminary trades:

A. Elementary standpoint: the foreign money pair is anticipated to be sturdy/weak subsequent week/days by trying going by the financial calendar (will clarify later). Then discover good assist/resistance based mostly on the Fibonacci Pivot ranges to go lengthy/brief a foreign money pair. The elemental standpoint has two sub-approaches:

i. Pre-event: it means buying and selling earlier than the incidence of an financial occasion. For instance, if the USD core CPI is forecast to be decrease than the earlier launch, usually talking, you need to promote USD however not the opposite approach round.

ii. Put up-event: it means buying and selling after the discharge of financial information. For instance, if the launched USD core CPI is definitely higher than each of the forecast and the earlier launch, you need to begin shopping for USD as an alternative of promoting.

Though the truth may be extra sophisticated, however that is the final logic.

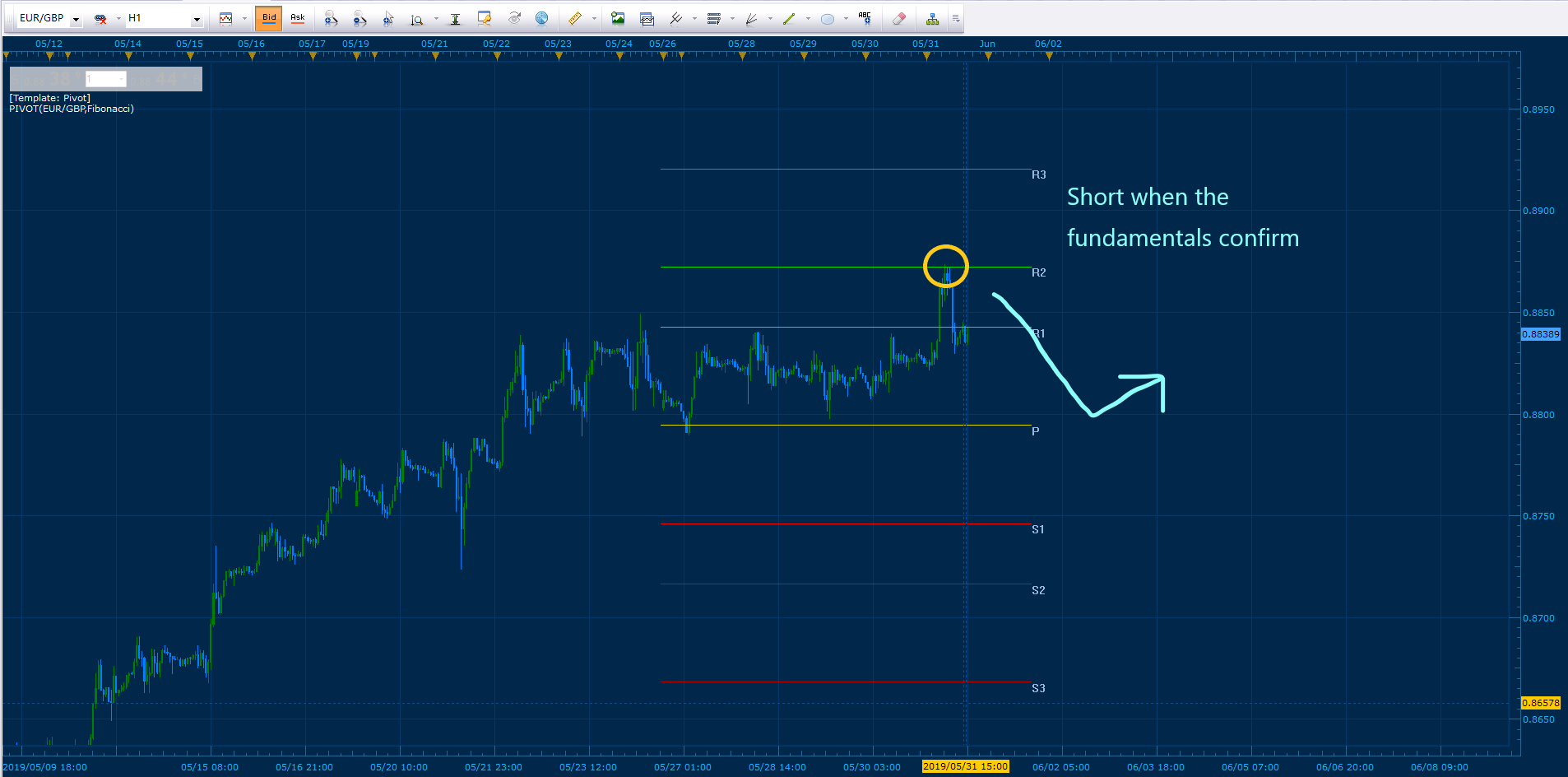

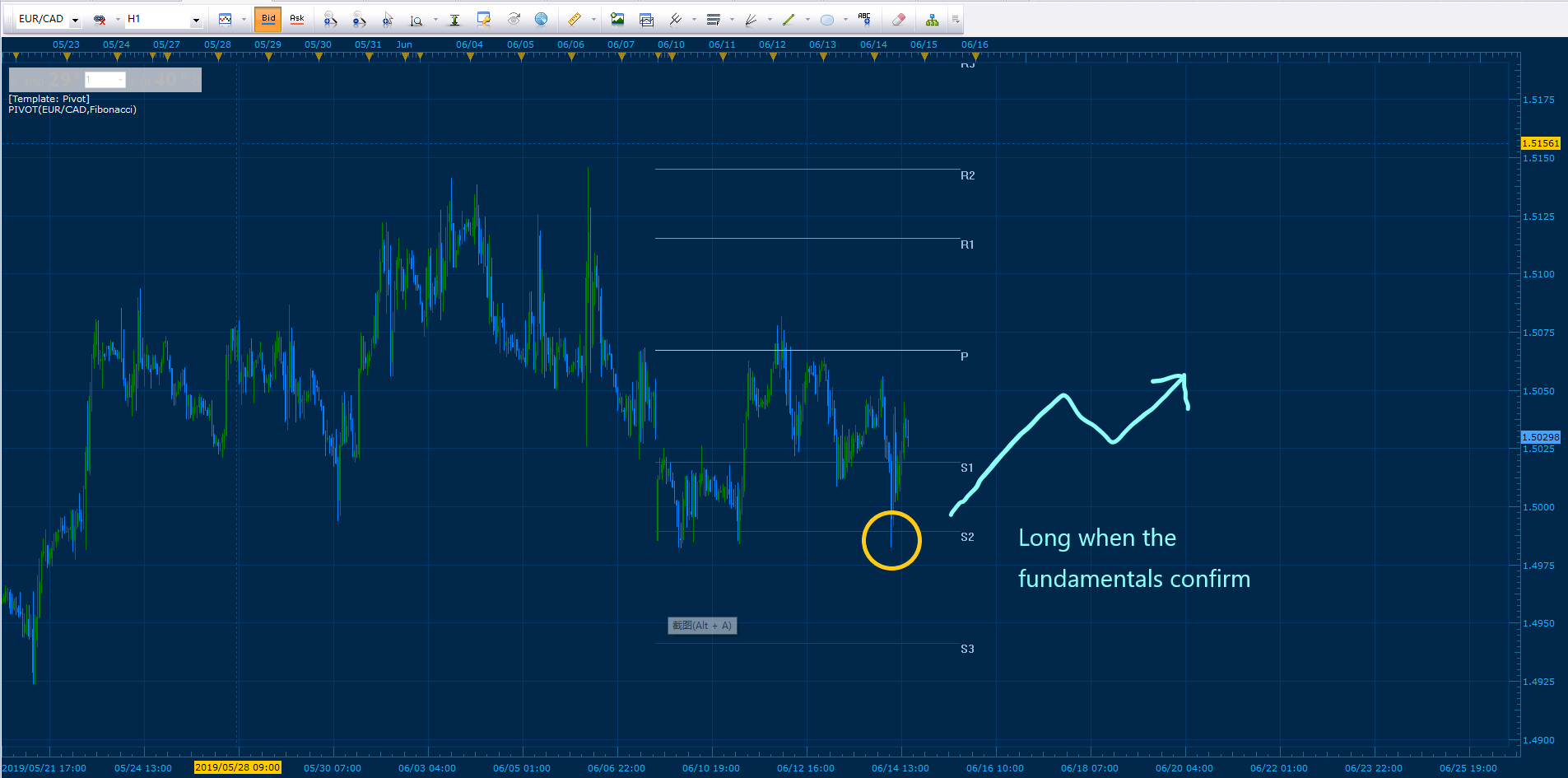

B. Techinical standpoint: the value of the foreign money pair reaches the Fibonacci Pivot ranges, then undergo the financial calendar and see if the pair is anticipated to be sturdy/weak subsequent week/days. Whether it is sturdy, then be able to go lengthy, and vice versa.

Fibonacci Weekly Pivot Ranges

Typically, there are 9 horizontal strains: R1 ~ R4, S1 ~ S4, & the Pivot degree. R means resistance and when value goes up and hits the R ranges, value is anticipated to reverse and fall; S means assist and when value goes down and hits the S ranges, value is anticipated to reverse and rise; Pivot is just the mid line and may function a assist or resistance degree. Nonetheless, based mostly on what I've examined, shopping for at S1 or promoting at R1 is just not really helpful.

Pentadbiran Perdagangan

Expeceted returm

My anticipated month-to-month return is ready round 2% for now since it isn't perfected but. Nonetheless, anybody who expects a month-to-month return of 8% ought to go away this thread as a result of this thread is about investing/buying and selling however not playing. I do not suppose a substainable month-to-month ROI > 5% is scientific and real looking until that could be a Ponzi Scheme.

Place dimension

At any cut-off date, the utmost lack of my present ongoing trades won't exceed 5% of my whole fairness.

Begin a commerce from constructing small positions. Contohnya, if you're brief AUD/JPY as a result of JPY now obtain safe-heaven bids whereas AUD financial system is weakening and the value hits the pivot degree R2 now, you could begin from promoting 0.1 numerous AUD/JPY as an alternative of 0.3 tan, assuming your whole place is 0.3 tan. Of the value continues as much as R3, you'll be able to go brief for the 0.2 tan (0.2 = 0.3 - 0.1).

Stoploss and trailing stoploss

Stoploss at 20 pips above the R4 degree or stoploss at 20 pips beneath the S4 degree is really helpful if you're brief or lengthy a pair. The vary of your entry to stoploss is extensive, however your place dimension is small, the accuracy fee is excessive, and you need to at all times path stoploss to, contohnya, R3 when the value strikes to R1. Or, you'll be able to merely shut the place. Whereas that is the best way I implement a stoploss, you'll be able to experiment what works finest for you personal threat urge for food.

Kemasukan

Though I don't suggest making entries on the pivot, S1 and R1 ranges, if the basic may be very sturdy and apparent, it's undoubtedly okay to begin constructing positions at these ranges. That is versatile, it's backed again strong logic nonetheless.

Exit

Should you attain 0.5% - 1% achieve of your fairness, you'll be able to shut the commerce and look forward to subsequent one. Or, should you purchase at S2, you'll be able to exit half positions at S1 and the opposite half on the pivot. There are lots of variations right here so one ought to be taught to handle it by precise trades.

For extra data, I'll put it right here later or share it in later posts.