- ਅਗਸਤ 28, 2021

- ਵੱਲੋਂ ਪੋਸਟ ਕੀਤਾ ਗਿਆ: ਫਾਰੇਕਸ ਵਿਕੀ ਟੀਮ

- ਸ਼੍ਰੇਣੀ: ਮੁਫ਼ਤ ਫਾਰੇਕਸ ਸੂਚਕ

![Order Block Breaker Indicator -[ਕੀਮਤੀ $99]- Freeversion Order Block Breaker Indicator -[Worth $99]- FreeVersion](https://forexwikitrading.com/wp-content/uploads/2021/08/g-cash-ic-breaker-order-blocks-screen-7456.png)

ਹੈਲੋ ਫਾਰੇਕਸ ਵਿਕੀ ਦੋਸਤੋ,

Order Block Breaker Indicator Description :

The order block breaker indicator identifies when a trend or price move is approaching exhaustion and ready to reverse. It alerts you to changes in market structure which typically occur when a reversal or major pullback is about to happen.

The indicator uses a proprietary calculation that identifies breakouts and price momentum. Every time a new high is formed near a possible exhaustion point the indicator draws in the last order block responsible for creating that high. It will then trail the order block along with the price as it moves. It then alerts you when price shifts the opposite direction and breaks through that order block, creating a new market structure and start of a possible reversal in trend or major pullback.

Order blocks are the last opposite colored candle before the highs/lows are created and when price breaks back down below these key areas it is a sign of a likely short or long term reversal in trend.

ਵਿਸ਼ੇਸ਼ਤਾਵਾਂ

- Alerts you to changes in market structure at key exhaustion points

- Automatically draws in order blocks as price approaches exhaustion levels

- View order blocks & breakers from higher timeframes (i.e H4 order blocks on M15 chart)

- Trails the order block behind price as moves continue in one direction to alert you the best reversal entries

- Changes colour to a solid block to show when breaks in market structure have occurred.

- Works on all symbols and timeframes

- Integrated pop-up and email alerts built in

Strategy & How To Trade With The Order Block Breaker Indicator

When a breaker block occurs you have two options.

- Look left! Is there a supply/demand or support/resistance level that we’re turning at. Market structure shifts (reversals) usually occur when price is retesting an old level or a stop hunt has just happened above that support or resistance level.

- Consult a higher time frame to see if there is an area of support/resistance we are turning at. As above changes in market structure will often happen on lower time frames when at major levels on a higher time frame.

If the above conditions are met simply place a trade in the direction of the break.

You can add additional indicators as validation or use this indicator to add further validation to your existing indicators or strategy!

Stop Loss and Take Profit

Your stop should always go just above the most recent high or below the most recent low. If the breaker is correctly identifying a shift in market structure price will rarely move back above/below the most recent peak. The size of your stop will be dependent on how aggressive the last move to create the recent high was.

Take profit is up to the individual but using a 1.5:1 ਜਾਂ 2:1 risk to reward is easily achievable. Entering 2 trades and having one trail along with price just above/below new order blocks as they are drawn on the chart can achieve 5:1 and higher risk reward.

ਬ੍ਰੋਕਰ ਦੀ ਲੋੜ :

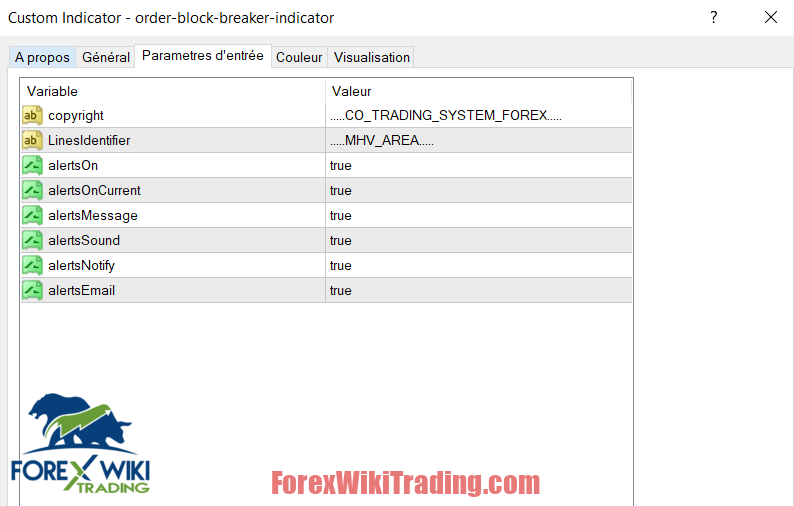

Order Block Breaker Indicator Settings:

Order Block Breaker Indicator Charts :

Download Order Block Breaker Indicator:

We highly recommend trying the Order Block Breaker Indicator for at least a week with ICMarket ਡੈਮੋ ਖਾਤਾ. ਵੀ, ਲਾਈਵ ਖਾਤੇ 'ਤੇ ਇਸਦੀ ਵਰਤੋਂ ਕਰਨ ਤੋਂ ਪਹਿਲਾਂ ਆਪਣੇ ਆਪ ਨੂੰ ਜਾਣੋ ਅਤੇ ਸਮਝੋ ਕਿ ਇਹ ਸਿਸਟਮ ਕਿਵੇਂ ਕੰਮ ਕਰਦਾ ਹੈ.