- ਅਕਤੂਬਰ 1, 2024

- ਵੱਲੋਂ ਪੋਸਟ ਕੀਤਾ ਗਿਆ: ਫਾਰੇਕਸ ਵਿਕੀ ਟੀਮ

- ਸ਼੍ਰੇਣੀ: ਮੁਫਤ ਫਾਰੇਕਸ ਈ.ਏ

EuroTrend EA Review

In the dynamic world of forex trading, leveraging advanced tools can significantly enhance trading strategies and outcomes. One such tool gaining attention is the EuroTrend EA. This Expert Advisor (ਈ.ਏ) is designed to exploit trading opportunities within the forex market, particularly focusing on the EURUSD currency pair. In this review, we delve deep into the features, functionalities, ਫਾਇਦੇ, and disadvantages of EuroTrend EA to provide a thorough understanding of its capabilities and limitations.

Introduction to EuroTrend EA

EuroTrend EA is a sophisticated and reliable Expert Advisor tailored for the forex market. Expert Advisors are automated trading systems that execute trades based on predefined algorithms and strategies. EA stands out by offering a comprehensive set of features and indicators aimed at identifying profitable trading signals and managing trades with precision and efficiency. Optimized specifically for the EURUSD currency pair on the H1 timeframe, EA is crafted to deliver high accuracy and performance in a competitive trading environment.

ਤਕਨੀਕੀ ਨਿਰਧਾਰਨ

ਸੰਸਕਰਣ: 1.1

ਜਾਰੀ ਕਰਨ ਦਾ ਸਾਲ: 2024

ਕੰਮ ਕਰਨ ਵਾਲੇ ਜੋੜੇ: EURUSD

ਸਿਫ਼ਾਰਸ਼ੀ ਸਮਾਂ ਸੀਮਾ: H1

ਘੱਟੋ-ਘੱਟ ਡਿਪਾਜ਼ਿਟ: $500

ਖਾਤੇ ਦੀ ਔਸਤ: 1:30 ਨੂੰ 1:1000

ਵਧੀਆ ਦਲਾਲਾਂ ਦੀ ਸੂਚੀ

EuroTrend EA works with any broker and any type of account, ਪਰ ਅਸੀਂ ਆਪਣੇ ਗਾਹਕਾਂ ਨੂੰ ਇਹਨਾਂ ਵਿੱਚੋਂ ਇੱਕ ਦੀ ਵਰਤੋਂ ਕਰਨ ਦੀ ਸਿਫਾਰਸ਼ ਕਰਦੇ ਹਾਂ ਚੋਟੀ ਦੇ ਫਾਰੇਕਸ ਦਲਾਲ ਹੇਠ ਸੂਚੀਬੱਧ:

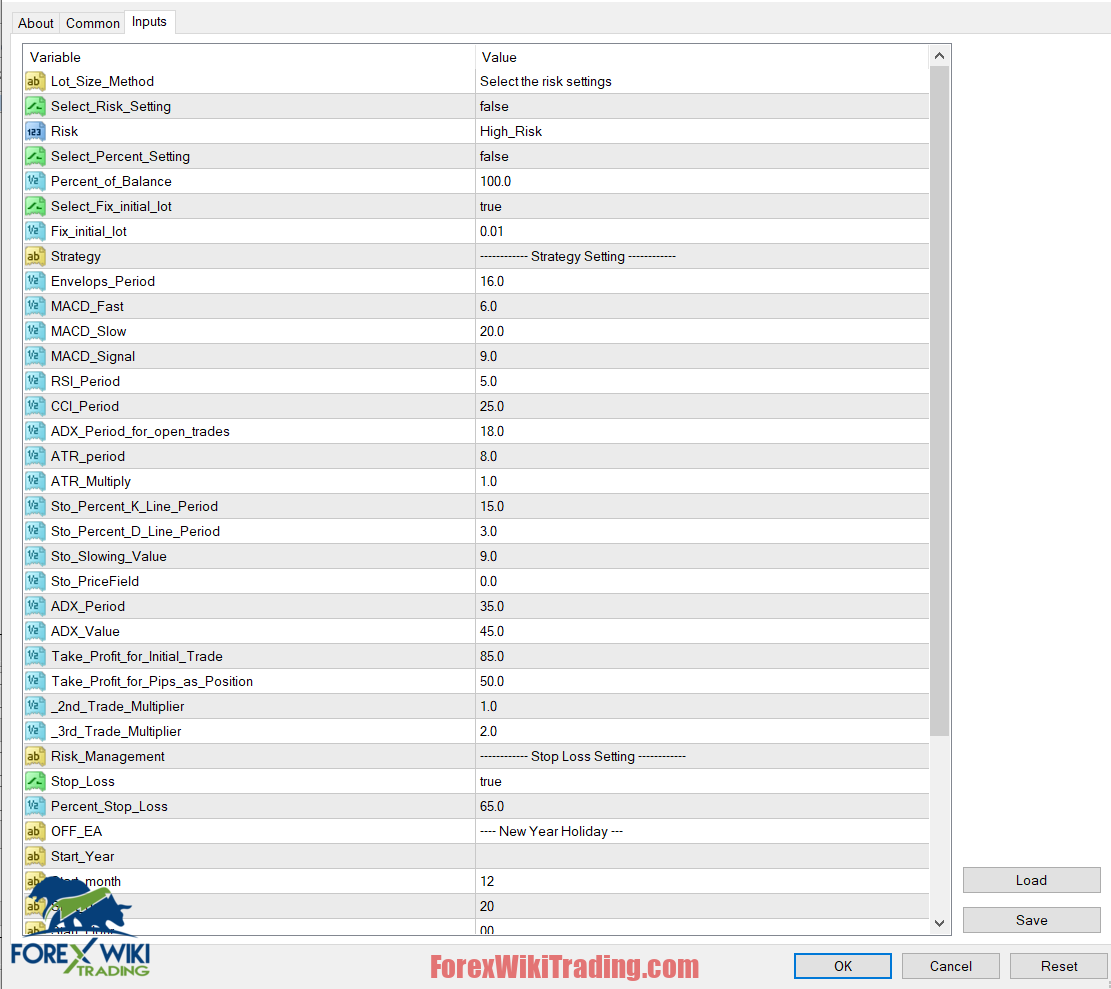

EuroTrend EA Settings

Key Features of EuroTrend EA

1. Optimized for EURUSD and H1 Timeframe

EuroTrend EA is meticulously optimized for trading the EURUSD currency pair on the H1 (one-hour) ਸਮਾ ਸੀਮਾ. This specialization allows the EA to concentrate its analytical capabilities on a single, highly liquid market, enhancing its precision and effectiveness. By focusing on EURUSD, one of the most traded currency pairs globally, EA can capitalize on frequent and reliable trading opportunities.

2. Indicator-Based Strategy

At the core of EA's functionality is its indicator-based strategy. The EA leverages a combination of the Heiken Ashi and Envelopes indicators to identify potential trading signals. These primary indicators are complemented by additional filtering tools such as:

- MACD (Moving Average Convergence Divergence)

- RSI (Relative Strength Index)

- CCI (Commodity Channel Index)

- ADX (Average Directional Index)

- Stochastic Oscillator

This multi-indicator approach ensures that EuroTrend EA can filter out false signals and focus on high-probability trading opportunities, enhancing the reliability of its trades.

3. Robust Risk Management

Risk management is a critical aspect of any trading strategy, and EuroTrend EA incorporates advanced risk management tools to safeguard your trading capital. The EA allows traders to set risk levels based on their preferences, optimizing the risk-reward ratio. Features include:

- ਨੁਕਸਾਨ ਨੂੰ ਰੋਕੋ: Limits potential losses across all positions.

- Percent Stop Loss: Caps the overall risk of the portfolio by setting a percentage-based stop loss.

These tools ensure that traders maintain controlled exposure to market fluctuations, promoting prudent trading practices.

4. Strategic Order Placement

EuroTrend EA employs a strategic approach to order placement, utilizing volume-based orders and a grid technique for secondary orders. This flexibility allows the EA to adapt to various market conditions, providing multiple entry points and enhancing the potential for profitable trades. The strategic order placement includes:

- Volume-Based Orders: Adjusts trade sizes based on market conditions.

- Grid Technique: Adds secondary orders at predetermined intervals to capitalize on market movements.

5. Advanced Trading Techniques

To maximize profitability while mitigating risks, EA incorporates advanced trading techniques such as a doubling strategy for subsequent orders. This method allows the EA to increase trade sizes in favorable market conditions, potentially enhancing gains while controlling losses.

6. Comprehensive Backtesting and Optimization

EuroTrend EA has undergone extensive backtesting using historical market data from 2014 to November 2023. Backtests were conducted with Tick Data Suite GMT+2 with US DST, a standard offset used by most brokers. The EA also offers customizable parameters, allowing traders to optimize settings based on their individual trading preferences and strategies. Key backtesting features include:

- Modelling Quality: Every Tick

- Spread: Variable

- Dynamic Lot Sizing: Adjusts lot sizes based on the current account balance

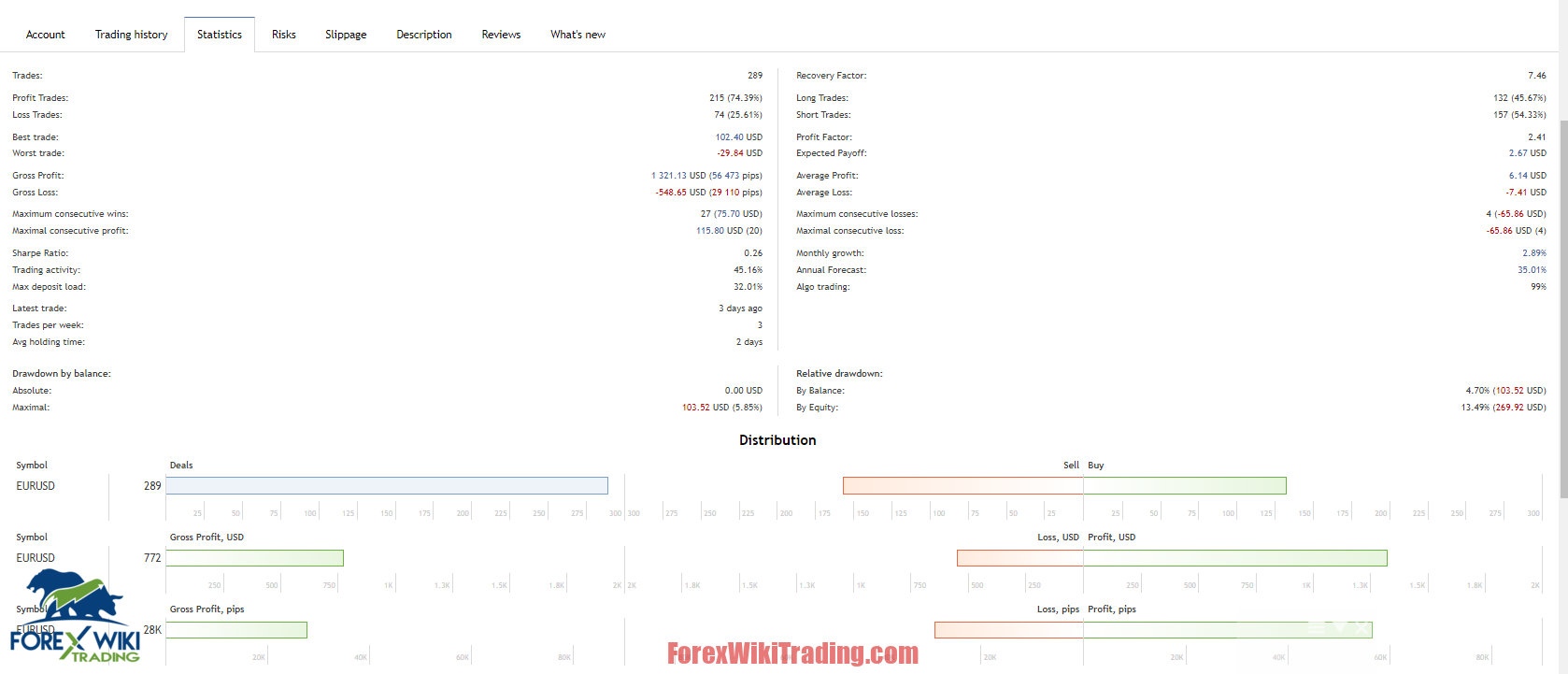

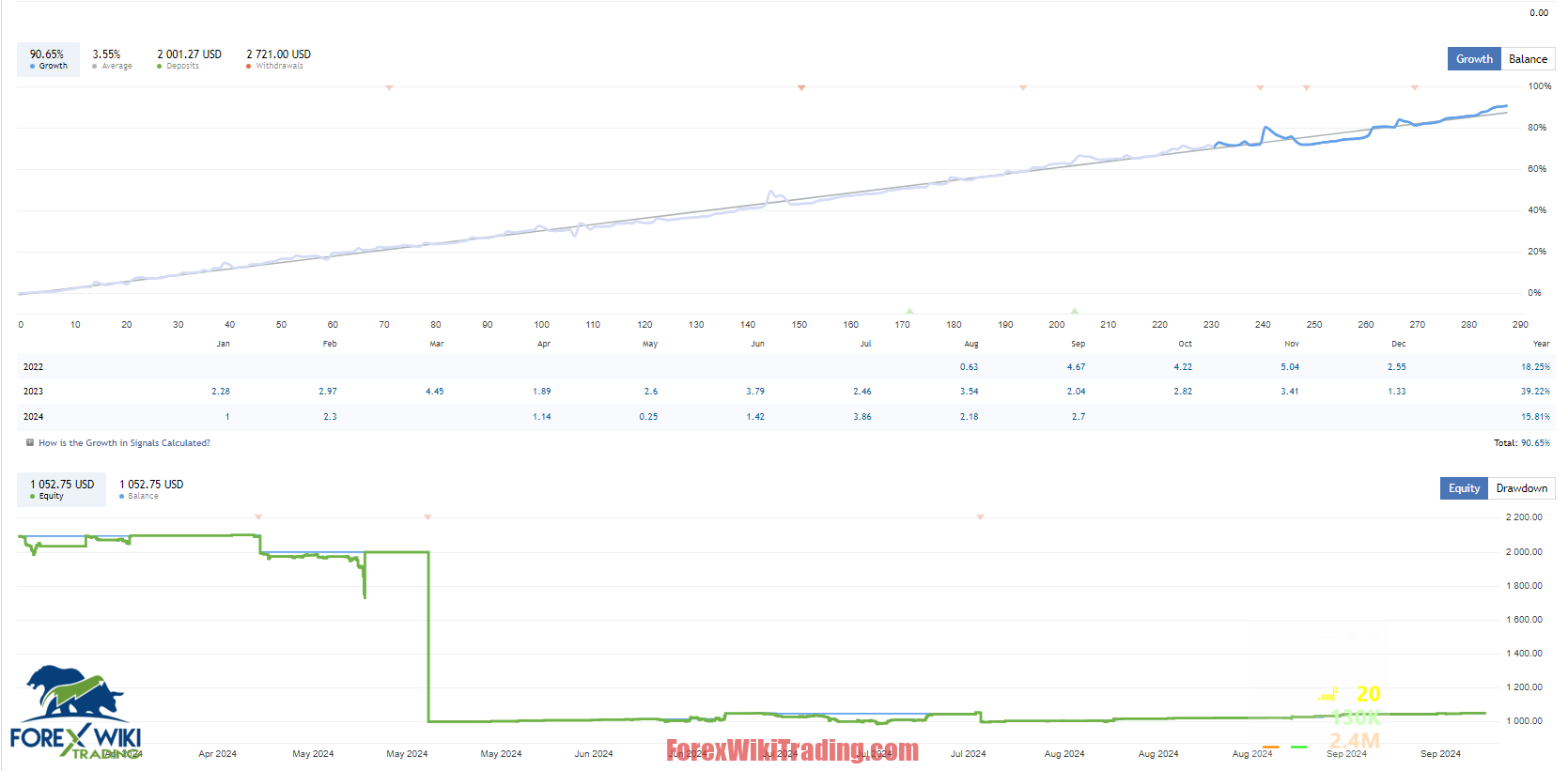

EuroTrend EA Results

Advantages of EuroTrend EA

1. Specialization in EURUSD

By focusing exclusively on the EURUSD currency pair, EuroTrend EA can hone its strategies to exploit the nuances of this highly liquid market, potentially increasing trade accuracy and profitability.

2. Comprehensive Indicator Suite

The use of multiple indicators for signal generation and trade confirmation enhances the reliability of trading signals, reducing the likelihood of false positives and improving overall trade quality.

3. Robust Risk Management

Advanced risk management features allow traders to control exposure and protect their capital, which is essential for long-term trading success.

4. Strategic Order Placement and Advanced Techniques

The combination of volume-based orders, grid techniques, and doubling strategies provides flexibility and adaptability, enabling the EA to perform well in various market conditions.

5. Thorough Backtesting and Customization

Extensive backtesting ensures that EuroTrend EA has been validated across different market scenarios. ਇਸ ਤੋਂ ਇਲਾਵਾ, customizable parameters allow traders to tailor the EA to their specific trading styles and risk appetites.

Disadvantages of EuroTrend EA

1. Limited Currency Pair Focus

While specialization can be an advantage, EuroTrend EA's exclusive focus on EURUSD limits its applicability for traders interested in diversifying across multiple currency pairs.

2. Complexity in Settings

The EA offers a wide range of customizable settings, which might be overwhelming for novice traders. Proper understanding and adjustment of these settings are crucial for optimal performance, potentially requiring a steep learning curve.

3. Dependence on Specific Timeframe

EuroTrend EA is optimized for the H1 timeframe, which may not align with all traders' strategies. Those preferring different timeframes might find the EA less effective or incompatible with their trading styles.

4. Potential Overfitting from Backtesting

While extensive backtesting is a strength, there's a risk of overfitting the EA to historical data, which might not fully capture future market conditions. Real-time performance can sometimes deviate from backtested results.

5. Market Condition Sensitivity

Like all EAs, EuroTrend EA's performance is influenced by prevailing market conditions. Sudden market shifts or unprecedented events can impact its effectiveness, leading to unexpected losses.

ਸਿੱਟਾ

EuroTrend EA presents a robust and feature-rich solution for traders focusing on the EURUSD currency pair. Its comprehensive indicator-based strategy, advanced risk management tools, and strategic order placement make it a compelling tool for those seeking automated trading solutions. ਹਾਲਾਂਕਿ, its specialization, complexity, and sensitivity to market conditions may pose challenges for some traders. As with any trading tool, it's essential to thoroughly understand its functionalities, conduct personal evaluations, and consider individual trading preferences before integrating EuroTrend EA into your trading strategy.

Download EuroTrend EA

ਕਿਰਪਾ ਕਰਕੇ ਘੱਟੋ-ਘੱਟ ਇੱਕ ਹਫ਼ਤੇ ਲਈ ਕੋਸ਼ਿਸ਼ ਕਰੋ XM ਡੈਮੋ ਖਾਤਾ. ਵੀ, ਆਪਣੇ ਆਪ ਨੂੰ ਜਾਣੋ ਅਤੇ ਸਮਝੋ ਕਿ ਇਹ ਕਿਵੇਂ ਹੈ ਮੁਫਤ ਫਾਰੇਕਸ ਈ ਏ ਕੰਮ ਕਰਦਾ ਹੈ ਇਸ ਨੂੰ ਲਾਈਵ ਖਾਤੇ 'ਤੇ ਵਰਤਣ ਤੋਂ ਪਹਿਲਾਂ.