- Июнь 28, 2024

- Опубликовано: Команда Форекс Вики

- Категория: Бесплатный советник Форекс

Обзор продукта: CryptoVolatility Master EA

CryptoVolatility Master EA, also known as Bitcoin Scalp Pro, is a unique trading system engineered to exploit the volatility of Bitcoin by trading breakouts of support and resistance levels. It prioritizes safety, resulting in extremely low drawdowns and a commendable risk/reward ratio.

Технические характеристики

Версия: 1.8

Год выпуска: 2024

Рабочие пары: Bitcoin

Рекомендуемый период времени: H1

Минимальный депозит: $200

Среднее по счету: 1:30 К 1:1000

Список лучших брокеров

CryptoVolatility Master EA works with any broker and any type of account, но мы рекомендуем нашим клиентам использовать один из лучшие форекс брокеры перечислено ниже:

Ключевые особенности

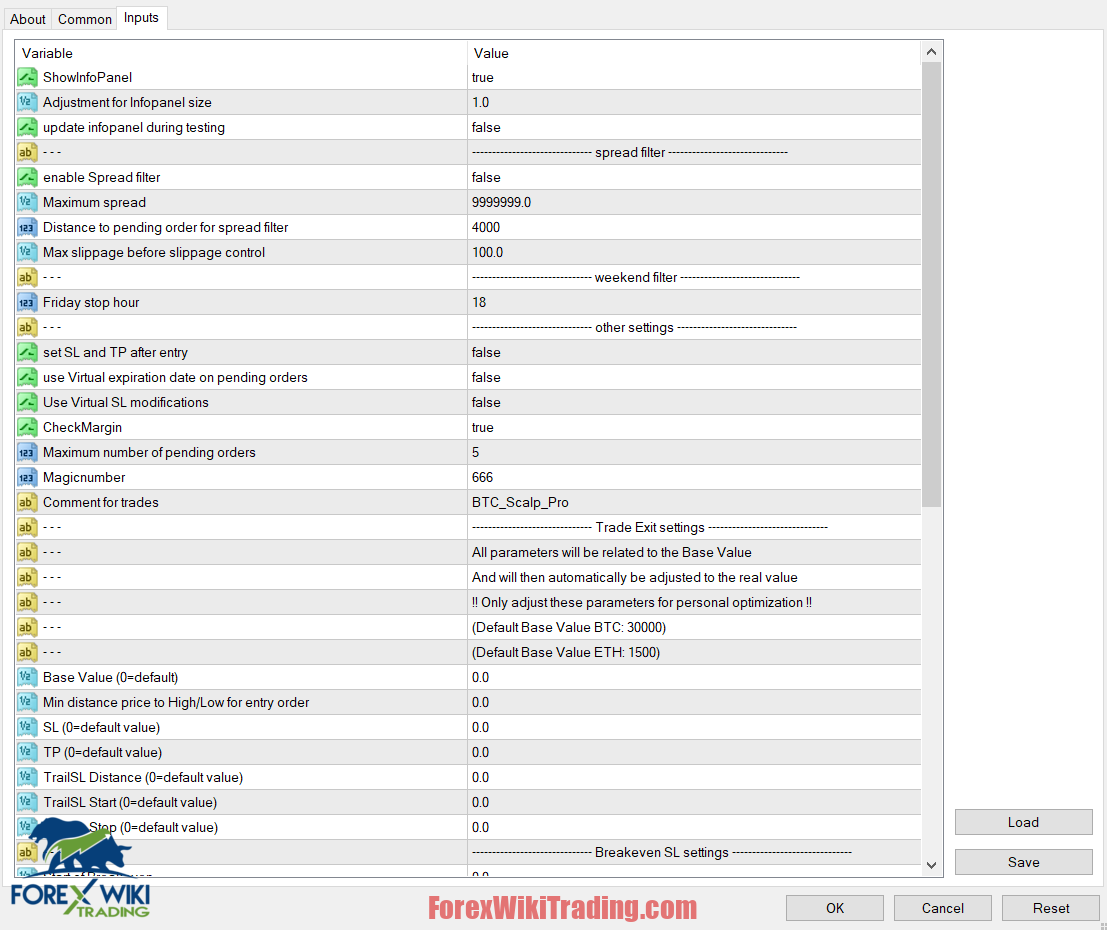

Adaptive Parameter System

One of the standout features of the CryptoVolatility Master EA is its smart adaptive parameter system. This system dynamically adjusts stop-loss (СЛ), тейк-профит (ТП), скользящий стоп-лосс (ТрейлингSL), точки входа, and lot size based on the current price of Bitcoin. Whether Bitcoin is trading at $6,000 или $30,000, the EA adapts all parameters accordingly.

Risk/Reward Ratio

The EA boasts a very favorable risk/reward ratio of 2:1, ensuring that potential profits are always significantly higher than potential losses. This is a critical feature for traders who prioritize risk management.

Verified Live Trading Results

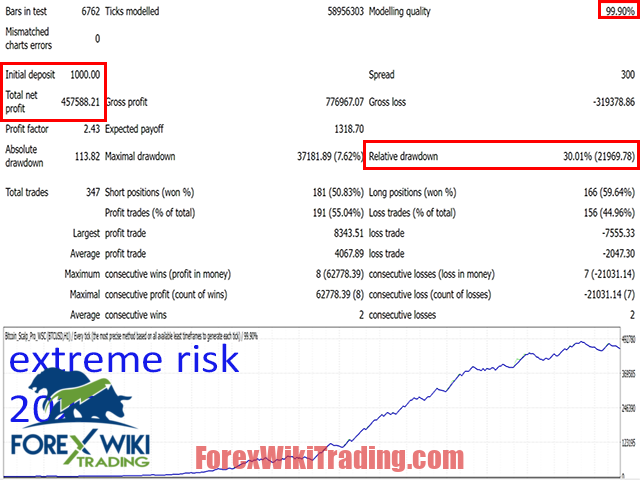

Since June 2022, the EA has been forward tested on real live accounts, demonstrating promising results. Кроме того, backtests with 99.90% tick quality have shown stable growth over recent years, providing further confidence in its performance.

Automatic Lot Size Calculation

CryptoVolatility Master EA automatically calculates the lot size based on the trader's specified risk and the current price of Bitcoin. Эта функция упрощает торговый процесс, making it more accessible to both novice and experienced traders.

Safe Trading Practices

Safety is a cornerstone of this EA. It uses stop-loss and trailing stop-loss on all trades to protect against significant losses. Importantly, it avoids risky trade management systems like grid trading and Martingale.

Easy Setup and Customization

Setting up the EA is straightforward. Traders simply need to open an H1 chart and run the EA. The risk can be adjusted using the "Метод расчета размера лота" параметр, with predefined risk settings ranging from 0.5% к 10% за сделку.

Review CryptoVolatility Master EA Results

Обзор производительности:

- Рост с 2023: 70%

- Current equity: 1,699.13 евро

- Initial deposit: 1,000.00 евро

- Выгода: 699.13 евро

- Overall growth: 69.91%

Key Metrics:

- Надежность: The EA has been running for 36 недели, which is a decent timeframe for evaluation.

- Algo trading: 100% - This is a fully automated system.

- Profit vs Loss Trades:

- Profit trades: 44.6%

- Loss trades: 55.4% Despite more losing trades, the EA is profitable, indicating good risk management.

- Maximum drawdown: 33.8% - This is relatively high and could be concerning for risk-averse investors.

- Max deposit load: 8.9% - Suggests conservative position sizing.

- Trading activity: 2% - Low frequency trading strategy.

Анализ:

- Последовательность: The growth chart shows an overall upward trend, with some volatility. The EA has managed to maintain growth despite market fluctuations.

- Monthly Performance: Mixed results, with both positive and negative months. Notably strong performances in January 2024 (32.14%) and May 2024 (30.99%).

- Управление рисками: The high maximum drawdown (33.8%) suggests aggressive trading at times. Однако, the overall profitability indicates the EA recovers well from drawdowns.

- Фактор прибыли: While not explicitly stated, the EA is profitable despite having more losing trades than winning ones, implying a good risk-reward ratio.

- Longevity: С 36 weeks of trading history, the EA has demonstrated its ability to perform in various market conditions.

Заключение: This EA shows promising results with significant overall growth and consistent profitability. Однако, the high maximum drawdown and higher percentage of losing trades suggest it may be suitable for investors with a higher risk tolerance. The low trading activity and conservative deposit load indicate a cautious approach to position sizing, which helps balance the risk.

Преимущества

Low Drawdowns

The EA’s focus on safety translates to low drawdowns, minimizing the risk of substantial losses and providing peace of mind to traders.

Excellent Risk/Reward Ratio

С 2:1 risk/reward ratio, traders can expect significant returns on their investments relative to the risks taken.

Adaptive to Market Conditions

The smart adaptive parameter system ensures that the EA remains effective regardless of Bitcoin’s price, making it versatile and robust in various market conditions.

Verified Performance

The verified live trading results and comprehensive backtesting provide evidence of the EA's reliability and effectiveness.

Удобный

The easy setup and automatic lot size calculation make the EA accessible, even for those new to trading.

Недостатки

Зависимость от брокера

The EA requires a broker that offers low spreads on Bitcoin, which may limit the choice of brokers available to traders.

Initial Setup and Testing

While the setup is generally straightforward, ensuring optimal performance may require some initial testing and fine-tuning, especially for those unfamiliar with backtesting or parameter adjustments.

Market-Specific

The EA is specifically designed for the Bitcoin market, which means its application is limited to this particular asset. Traders looking to diversify across multiple cryptocurrencies or forex pairs may need additional tools.

Backtesting the EA

When backtesting the EA:

- Choose a historical price feed with low spreads, or manually set the spread to below 1000 points on average.

- If your backtesting results do not match the provided data, contact the developer for assistance with the setup.

Заключение

The CryptoVolatility Master EA is a promising tool for traders looking to exploit Bitcoin's volatility while maintaining a strong focus on risk management. Its adaptive parameter system, verified live results, and excellent risk/reward ratio make it a compelling choice for both novice and experienced traders. Однако, its dependence on specific brokers and the need for initial setup and testing are factors to consider. Как и любой торговый инструмент, it is essential to conduct thorough research and testing to ensure it aligns with your trading strategy and risk tolerance.

Download CryptoVolatility Master EA

Пожалуйста, попробуйте хотя бы неделю демо-счет ICMarket. Также, ознакомиться и понять, как это бесплатный инструмент форекс работает прежде чем использовать его на реальном счете.

Отказ от ответственности: Торговля на Форексе сопряжена с неизбежными рисками, и прошлые результаты не отражают будущих результатов. Пользователям рекомендуется провести тщательное исследование и обратиться за профессиональной консультацией, прежде чем заниматься торговлей на Форекс..