- April 12, 2023

- پاران شايع ٿيل: فاریکس وڪي ٽيم

- زمرو: مفت فاریکس EA

SUPER SIGNAL Trading Strategy Review

In the world of trading, making profitable trades consistently can be challenging. بهرحال, traders have developed different trading strategies to help them identify profitable opportunities in the markets. One of such strategies is the SUPER SIGNAL trading strategy, which employs technical analysis to generate trading signals. هن مضمون ۾, we will take an in-depth look at the SUPER SIGNAL trading strategy and how it works.

Overview of the SUPER SIGNAL Trading Strategy: The SUPER SIGNAL trading strategy is a trend-following strategy that aims to identify the direction of the market and enter trades in that direction. The strategy uses two technical indicators: the Super Signal Channel and the Moving Average. The Super Signal Channel is a custom indicator that displays support and resistance levels on the chart, while the Moving Average calculates the average price of an asset over a specified period.

بهترين بروکرز جي فهرست

The SUPER SIGNAL Trading Strategy works with any broker and any type of account, پر اسان سفارش ڪندا آهيون ته اسان جا گراهڪ انهن مان هڪ استعمال ڪريو مٿين فاریکس بروکرز هيٺ ڏنل فهرست:

SUPER SIGNAL Trading Strategy Setting

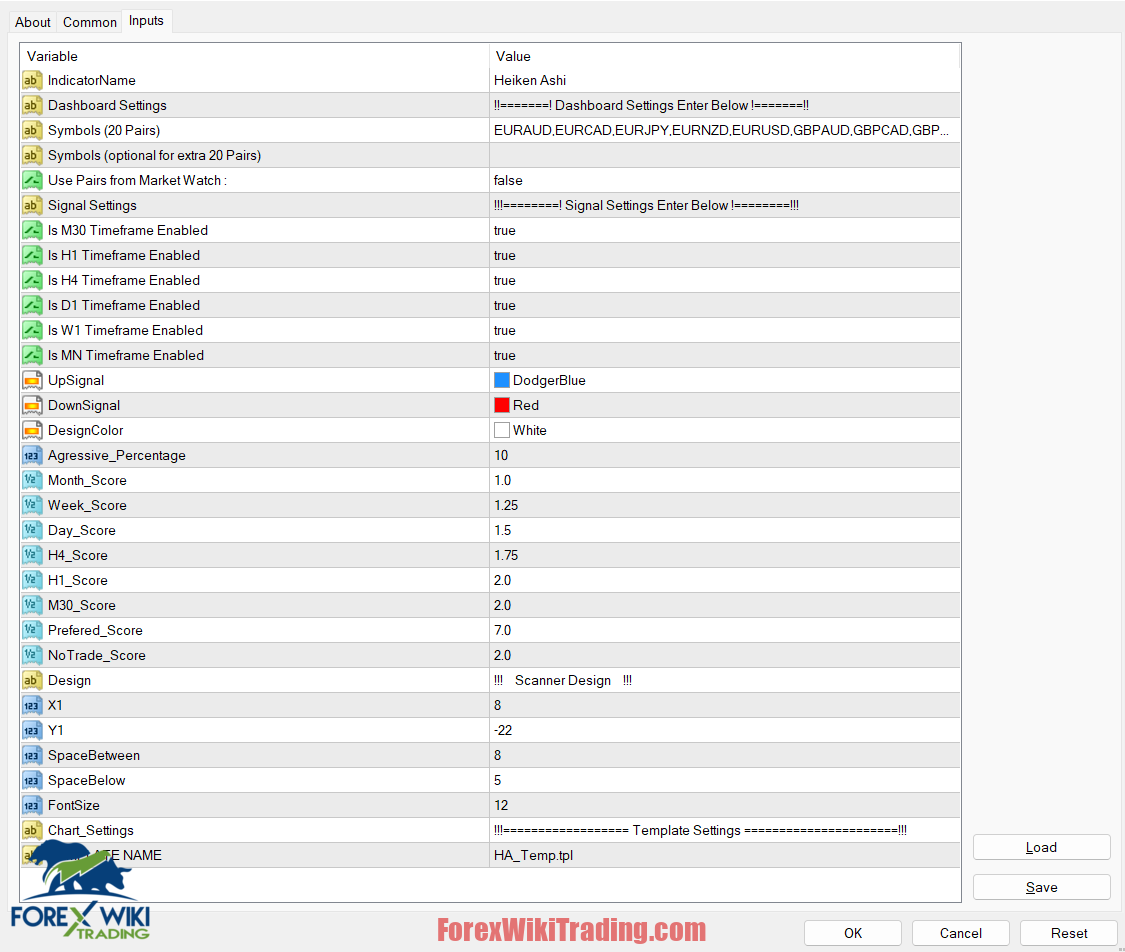

This is the name of the indicator that the EA uses to get its calculations of the Heiken Ashi bars, as long as you have this indicator in your indicators folder the scanner will work. Do not change this indicator name or the scanner may not work, and you may only see all white boxes.

Symbols(20 Pairs):

This is where you enter the symbols you want to trade. Make sure each one is separated by a common with no space as shown above. The names must match 100% which your broker offers. For example, if you want to trade gold, don't enter "gold" in this field if your broker uses the symbol XAUUSD for gold, if this is the case use "XAUUSD". Even spelling mistakes will be why it is not working correctly. It will not recognize, so check carefully if you are seeing a pair with all white boxes as this will be the reason.

Symbols(optionals for extra 20 Pairs):

If you want to add lots of pairs you can add more here as well but it is no needed, you can still add more than 20 pairs in the first input (Symbols (20 Pairs) this is handy if you want to say add Forex in the first symbols input and Futures in the second symbols input as this line can get very long if you want to add or remove pairs in the future from your selection. I also add everything in alphabetical order so I can see them faster.

Use Pairs from market watch:

It will automatically pull all of the pairs from your market watch into the scanner, be careful though if your market watch has all symbols it could show over 60 symbols at once on your scanner and can slow your PC down but more importantly you won't be able to see all of them one on screen, the scanner will not allow you to scroll down (MT4 restriction) so you can resize the boxes possibly but keep this in mind. Handy if you have presets set up for market watch then you can just pull these up when needed and scanner will find them.

Signal Settings :

To enable or disable any timeframes showing in the scanner, remember if you remove some, it will also affect how the overall scoring works that drives the recommendation engine for overall direction (more on that below)

UP/Down Signal Color :

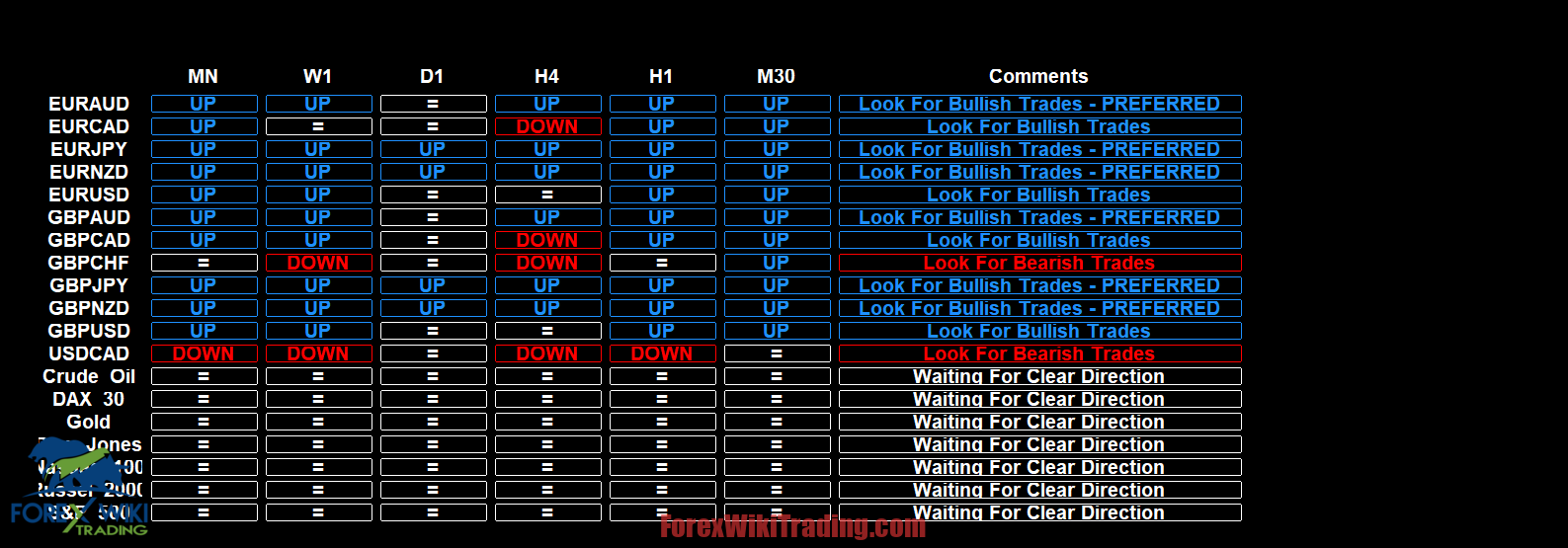

Option to change the colour of the UP/DOWN and overall comments. All bearish comments would be red in the above example and bullish would be blue in the above example. The design colour is the colour of the boxes and pair names/timeframe headings etc. You cannot change the background; it will also be black due to how the internal template design has been created.

Aggressive percentage:

This adjusts the tolerance of the size of the wick on top of the Heiken Ashi candle for a SELL and below the candle for a BUY. The strict rule for a buy is to have no wick on the bottom of the blue Heiken Ashi candle. Setting this to 0 would do this but sometimes the tiniest of wicks may form below the wick (even where it doesn’t look like a wick to the eye but still could be. Setting this to 10 allows slightly more signals but still to the eye there would be no visible wicks on the bottom of the Heiken Ashi candle for buy or top of the candle for sell as per the rules. The higher you set this number the more it will allow tiny wicks that go against this rule. the highest you can set this it 100 (يا 100%) just play around with this to see what you like but 10 is the best optimal setting to follow the rules, it will still give enough UPs/DOWNs but will ensure you are only getting the best signals. Technically it’s a percent of the size of the wick relative to the size of the body but just change this and look at the candles to see what it’s doing and find a setting you like.

Time Score :

These settings do not in any way affect whether is a UP/DOWN or FLAT for that timeframes signal. These scores affect the decision engine and makes its recommendation for the overall bias in the comments field - EG Look for bullish trades. If every timeframe had the same score so for this example lets set all six timeframes to 1 then they all have equal value, and no timeframes would have more importance over the other when giving a direction

So, using this example the EA counts all the UPs and all the DOWNs using this score and the direction with the highest score is what it will print in the comments section. So again, using this example where all timeframes had a score of 1 then see below how this would work

How works SUPER SIGNAL Trading Strategy

The strategy works by identifying trends in the market and waiting for pullbacks before entering a trade. The Super Signal Channel is used to identify support and resistance levels, while the Moving Average is used to confirm the direction of the trend. When the price of an asset pulls back to a support or resistance level, and the Moving Average confirms the direction of the trend, a trading signal is generated.

How the SUPER SIGNAL Trading Strategy Works: To use the SUPER SIGNAL trading strategy, a trader needs to follow these steps:

- Identify the trend: The first step is to identify the direction of the trend using the Moving Average. If the Moving Average is sloping upwards, the trend is considered bullish, while a downward sloping Moving Average indicates a bearish trend.

- Identify Support and Resistance Levels: The next step is to identify the support and resistance levels using the Super Signal Channel. These levels are where the price of an asset is expected to encounter resistance or support.

- Wait for a Pullback: Once the support and resistance levels have been identified, the trader waits for a pullback towards these levels.

- Confirm the Trend: The Moving Average is then used to confirm the direction of the trend. If the Moving Average is in line with the trend identified in step 1, then the trader has a confirmation of the trend direction.

- Enter a Trade: Finally, when the price pulls back to a support or resistance level, and the Moving Average confirms the trend, a trading signal is generated, and the trader can enter a trade in the direction of the trend.

نتيجو

The SUPER SIGNAL trading strategy is a trend-following strategy that uses technical analysis to identify profitable trading opportunities. The strategy is simple to use and can be applied to different markets and timeframes. بهرحال, like any trading strategy, it is essential to manage risks by setting stop-losses and taking profits at reasonable levels. With the SUPER SIGNAL trading strategy, traders can increase their chances of making profitable trades consistently.

SUPER SIGNAL Trading Strategy Free Download

We highly recommend trying the MACD Divergence Alert Pro with ICMarket ڊيمو اڪائونٽ. پڻ, پاڻ کي واقف ڪريو ۽ سمجھو ته ھي سسٽم ڪيئن ڪم ڪندو آھي ان کي لائيو اڪائونٽ تي استعمال ڪرڻ کان اڳ.