- Haziran 10, 2017

- Yayınlayan: ElmaFlemming

- Kategoriler: Forex Ticaret Sistemi, Ücretsiz Forex EA

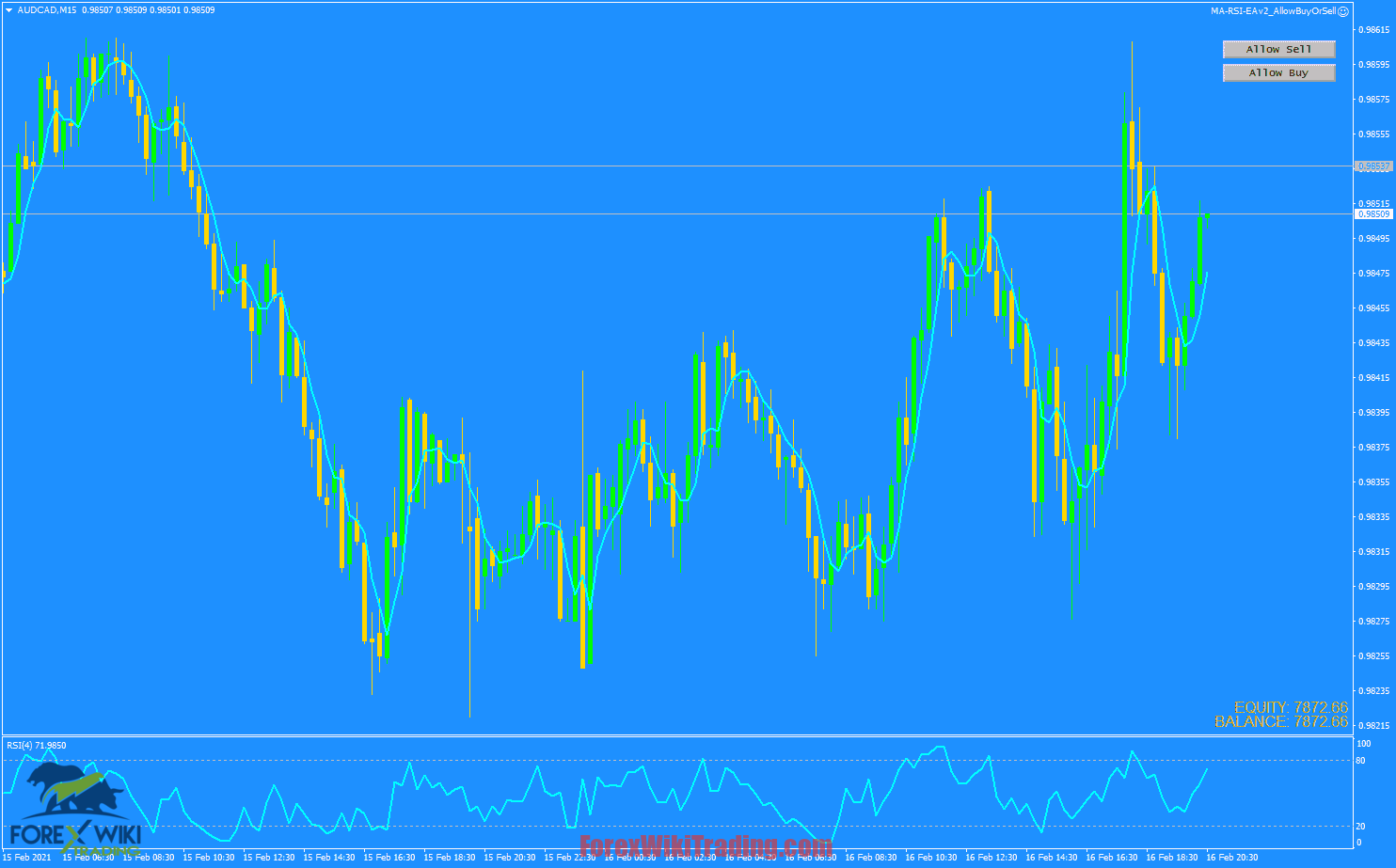

RSI 80-20 Trading Strategy Review

One of the strongest technical for traders is the RSI 80-20 Trading Strategy. We created the 80-20 Trading Strategy, which employs the RSI indicator. It entails price action research, which can assist you in securing excellent trade entrances! This RSI 80-20 Trading approach is just as effective as Larry Connor's RSI 80-20 Trading Strategy. This method, on the other hand, only trades reversals that occur inside the past 50 candles.

For all of the RSI trading rules and trading recommendations, read the complete article. Understanding the laws of these trading techniques will enable you to trade this approach with the most success. We also provide training on the most effective Gann Fan Trading Strategy.

The most crucial things you should know about trading using the Relative Strength Index (RSI) indicator are discussed here.

Basics of RSI 80-20 Trading Strategy

You can determine if a price trend is overbought or oversold using the Relative Strength Index. The RSI 80-20 Trading Strategy may be utilized as an RSI stock, döviz, or options strategy. This essay will cover a variety of topics, including the RSI vs. stochastic indicator and why both are useful trading indicators. We'll also go into stochastic RSI oscillator trading systems, stochastic RSI settings, five-day RSI strategy, Connors RSI strategy, momentum oscillator systems, and binary options trading strategies that use the RSI indicator.

Is the RSI 80-20 Trading Strategy considered a trend indicator?

The RSI is one of the most widely utilized trend indicators on the internet. Many trend trading techniques include the RSI as a crucial component. No one else gives detailed advice on how to trade it. Only thorough instructions will be found here. If forex is your preferred market, this may also be employed with your trading tactics.

The relative strength index is abbreviated as RSI. This indicates an overbought condition. This will also let you know when the price is oversold. This indicator is recommended for RSI overbought positions since it boosts your success rate. We'll go through a few crucial ideas to assist you to enhance your trade before you start trading using our entry signal.

For additional details, see our profitable news trading method.

To begin, keep in mind that the daily charts should be used to discover the finest possibilities. To dial in your entries and make them more precise, apply our Strategy with several time periods. Second, the RSI 80-20 Trading Strategy signal must be utilized. The price-breaking critical levels for the best possible entries will be found.

When Trading, How to Use RSI 80-20 Trading Strategy?

You will consistently strike trading home runs if you combine this indicator with pivot points and a nice candlestick pattern.

This post has several photos that will teach you how to sell and buy signals. To make this trading approach more effective, you'll employ the RSI line, also known as the RSI level. This article also serves as a comprehensive introduction to the relative strength index (RSI 80-20 Trading Strategy ). We spent a lot of time creating this detailed information with examples to help you become better traders.

We created an indicator that employs this method and offers straightforward entry and exit points.

This method detects a trend break and capitalizes on the following movement in the opposite direction. (This is similar to our Trend Breaker Strategy.)

We'll look at a simple trading technique that uses the RSI indicator in this post. Learning to trade divergence will help you gain from this technique. Find a low-risk technique to sell around the top of a trend or to purchase towards the bottom.

En İyi Broker Listesi

The RSI 80-20 Trading Strategy works with any broker and any type of account, but we recommend our clients to use one of the en iyi forex brokerleri aşağıda listelenmiştir:

Forex Trading Indicator Settings

This indicator's smoothing period is set to 14 by default. That setting is going to be changed to 8. Before you begin, double-check that this setting is turned on. Because the RSI will be much more sensitive, I favor eight over fourteen. When looking for overbought or oversold circumstances and readings, this is crucial. Ayrıca, go into the RSI settings and adjust the indicator's lines to 80, Ve 20. More about this will be revealed later.

How to Use the RSI Trading Indicator in Your Trading

This is the sole indication we will utilize for this technique. This is because we must follow a series of tight standards before engaging in a deal. And these regulations will undoubtedly certify a reversal so that we may initiate a trade. Another method for using technical analysis is outlined below. Make the following tweaks to the RSI 80-20 Trading indicator before using this strategy:

Adjustments:

- 14 period, ile 8.

- 70 Ve 30 lines, ile 80 Ve 20.

- This indicator comes standard on most trading platforms. You'll just need to make the adjustments above.

Trading Strategy using RSI 80-20

-

Look for a currency pair with a recent high in the latest 50 candlesticks. (Depending on the deal) (OR low)

The 80-20 Trading strategy is applicable to any time frame. This is due to the fact that trends change throughout time. Swing trading, day trading, or scalping are all options. It is a lawful deal as long as the regulations are followed. We also provide Forex Basket Trading Strategy instruction. We simply need to make sure it's low or high of the last 50 candles in this phase. As an example, consider the following: This technique will be explained using the same example. This is a BUY trade on the USDCHF currency pair.

We can go to the following stage after determining whether this is low or high. I placed vertical lines on the price chart to show you the identified 50 candle low. You may use horizontal lines on your chart to confirm that the candle has closed at the lowest point in the last 50. This is not required, although it may be useful in determining the strength of the trend. -

When a 50 candle low is found, it must be combined with an RSI value of 20 or below.

(If it's high, it should be paired with an RSI of 80 or greater.) Below is a reading that struck the RSI's 20 line and was the lowest of the previous 50 candles.

We may go to the following phase after we observe that we have a low, the last 50 candles, and the RSI is BELOW 20. Keep in mind that this is a reversal tactic. It will buck the present trend and travel in the other direction. -

After the first price (high candle) has closed, wait for a second price (low candle) to close.

The second price low has to be lower than the first. The RSI 80-20 Trading indicator, on the other hand, must produce a stronger indication than the first. Remember that price action and indicator movement can be compared to see divergence. The oscillator should be making greater highs if the price is making higher highs. The oscillator should be generating lower lows if the price is making lower lows. If they aren't, it signifies that the price and the oscillator are diverging.

This is why the term "divergence" was coined. Just because you see a bullish or bearish divergence does not mean you should immediately enter a trade. We have policies in place that will take advantage of this discrepancy and allow us to benefit significantly. Remember that this step may take some time to complete. Waiting for this second low is crucial because it puts you in a stronger trading position. This may be complicated, but consider this:

The price falls while the RSI rises. The Divergence is that. Remember, we're looking at a current downtrend that's about to break to the upside. We'd be looking at the exact reverse of this stage if this was a 50 candle high. With that in mind, let's look at our graph.

We can begin looking for admittance after this requirement has been satisfied. This is because the charts indicate that a reversal is on the way. -

How to Use the RSI 80-20 Trading Strategy to Enter a Trade

The process of entering a trade is extremely straightforward. You wait for a candle to close above the first candle you identified that was previously 50 candle low, and then you wait for the price to move in the direction of the trade.

Save the image for reference if you're having trouble with this step. This will assist you in your search for a trade.

-

Place a stop-loss order once you've made your entry.

To put your halt, go back one to three time periods and choose a suitable, logical level. You're seeking resistance and support from the past.

We came to a halt just below this area of support. If the trend is maintained without breaking, it may reach this level and rebound back up in our direction.

I advocate sticking to a profit-to-risk ratio of 1 ile 3. This will guarantee that you are getting the most out of the plan by maximizing your potential. You can make whatever changes you want. Keep in mind that most successful trend-breaking tactics have a profit-to-risk ratio of 1 ile 3. You may discover how to make money from trading here.

We highly recommend trying RSI 80-20 Trading Strategy for at least a week with ICMarket demo hesabı. Ayrıca, Canlı bir hesapta kullanmadan önce bu sistemin nasıl çalıştığını öğrenin ve anlayın.