There are many ways to use the momentum 100 cross indicator. But one of the more popular ways to use the momentum indicator is taking a trade as the momentum indicator crosses the 100 level. The 100 level represents the midline. If the momentum indicator is above it and is still heading up, the bias of the market based on momentum is said to be bullish. On the other hand, if the momentum indicator is below the 100 level, then the market is said to be bearish based on momentum.

Göstergeler:

- Momentum

- 100-period EMA (green)

- Timeframe: 1-hour and 4-hour chart

- Currency Pair: any

- Trading Session: any

This concept is very simple, much like other oscillating indicators, a signal is generated as the indicator crosses the midline.

Fakat, the momentum indicator also has its flaws. Due to its simplistic formula, the plotting of the indicator is a little bit jagged. This causes the indicator to chop around at times especially when the price is also chopping up and down on a relatively wide range.

Still, even with these flaws, the momentum indicator is very much useful. We don’t have to throw the baby out with the bathwater. We shouldn’t disregard this indicator just because of this weakness.

Trading Strategy Concept

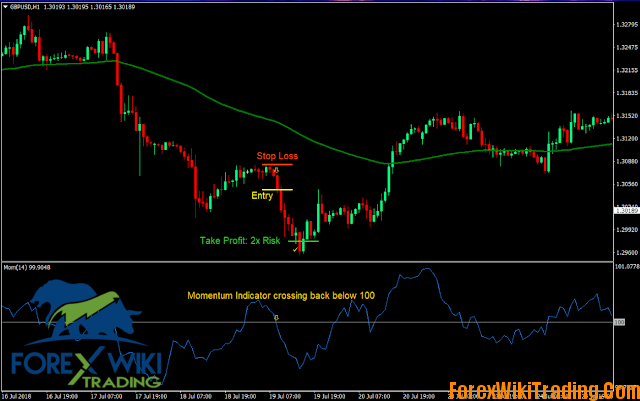

The idea behind this strategy is to use the momentum indicator’s crossing over the 100 level as a signal but filter out trades that are not in agreement with the main trend.

The question is how do we determine the main trend? To do this, we will be using the 100 Exponential Moving Average (EMA). This moving average is leaning towards the longer-term trend. As such, during a trending market, the price would seldom whipsaw the 100 EMA, making it a good filter for the momentum indicator’s crossing of the 100 level.

Still, it is not perfect. There will be times when the momentum indicator would still whipsaw the 100 level. But we will not be going in and out of the market on every cross. Instead, we will allow the market to take us out of the trade by taking a loss only based on the stop loss. The stop loss would be based on the most recent minor swing highs and lows.

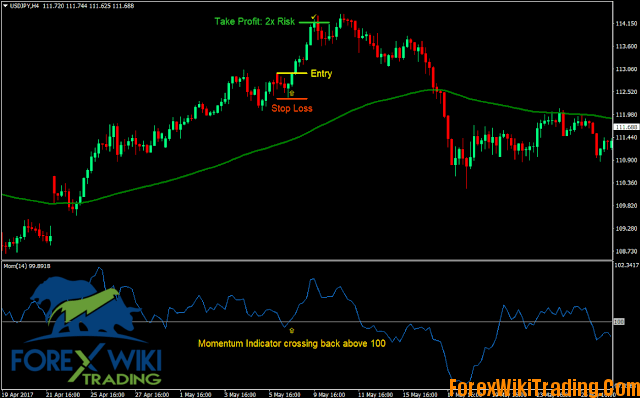

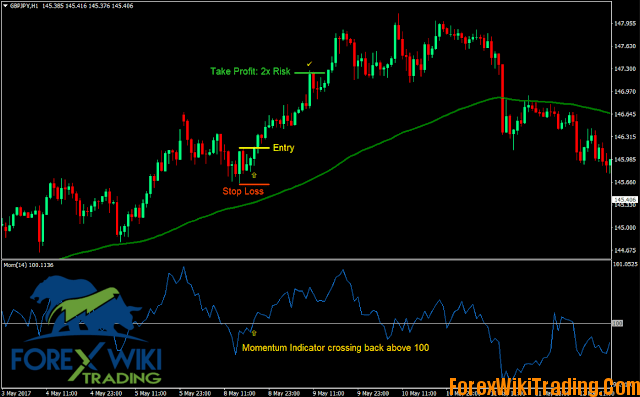

Buy (Long) Trade Setup Rules

Giriş

Price should be above the 100 EMA

The market should be in a bullish trend, making higher swing highs and lows

Allow the momentum indicator to go below the 100 level on the retrace

Wait for the momentum indicator to go back above the 100 level as the trend resumes

Take a buy market order on the confluence of the above rules

Stop Loss

Set the stop loss on the most recent minor swing low

Take Profit

Set the take profit target price at 2x the risk on the stop loss

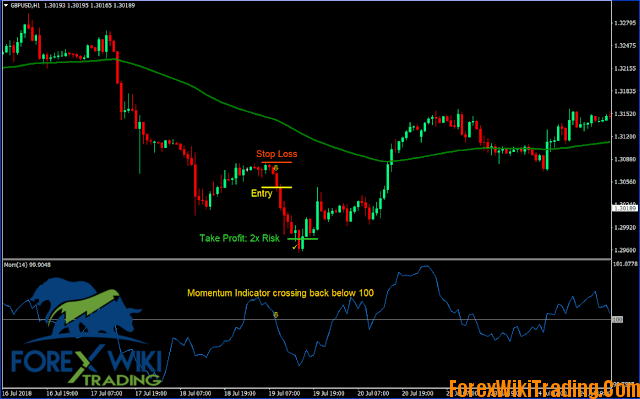

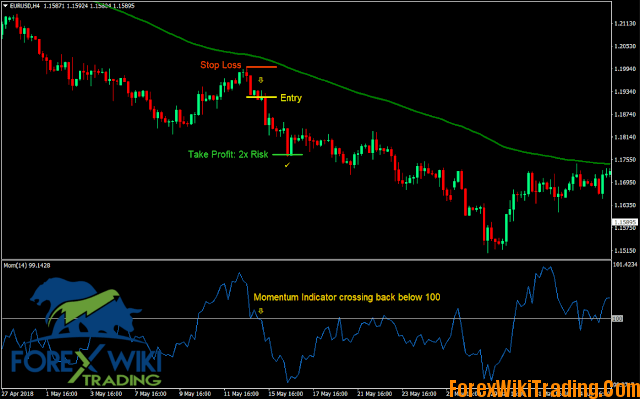

Sell (Short) Trade Setup Rules

Giriş

Price should be below the 100 EMA

The market should be in a bearish trend, making lower swing lows and highs

Allow the momentum indicator to go above the 100 level on the retrace

Wait for the momentum indicator to go back below the 100 level as the trend resumes

Take a sell market order on the confluence of the above rules

Stop Loss

Set the stop loss on the most recent minor swing high

Take Profit

Set the take profit target price at 2x the risk on the stop loss

This is a basic strategy using the momentum indicator’s crossing of the 100 level. What makes it different though is that it filters out trades that aren’t on a longer-term trend by using the 100 EMA.

On the right market condition, this strategy should allow you to get into trades that would trend quite longer. Fakat, because of the fixed take profit ratio, we could be capping our profits, as you could notice on some of the charts.

If you feel a bit aggressive, you could modify the exit strategy. You could opt to use a trailing stop as an exit strategy. It could be by moving the stop loss as price makes new swing highs or lows. It could also be by using a fixed ATR. It is up to you. Setting up a fixed take profit target though leans toward the more conservative side.

It would also be good to complement this strategy with a price action-based thesis. It could be a break of smaller trendline, a candlestick pattern, or a price pattern. This could increase the probability of a successful trade as other traders might be taking the same trade but based on a different price action-based strategy.

How to install Momo 100 Forex Trading Strategy?

-

Download Momo 100 Forex Trading Strategy.zip

-

Copy mq4 and ex4 files to your Metatrader Directory/experts/indicators/

-

Copy tpl file (Template) to your Metatrader Directory/templates/

-

Start or restart your Metatrader Client

-

Select Chart and Timeframe where you want to test your forex system

-

Right-click on your trading chart and hover on “Template”

-

Move right to select Momo 100 Forex Trading Strategy

-

You will see Momo 100 Forex Trading Strategy is available on your Chart