- 可能 2, 2023

- 發表者: 外匯維基團隊

- 類別: 免費外匯指標

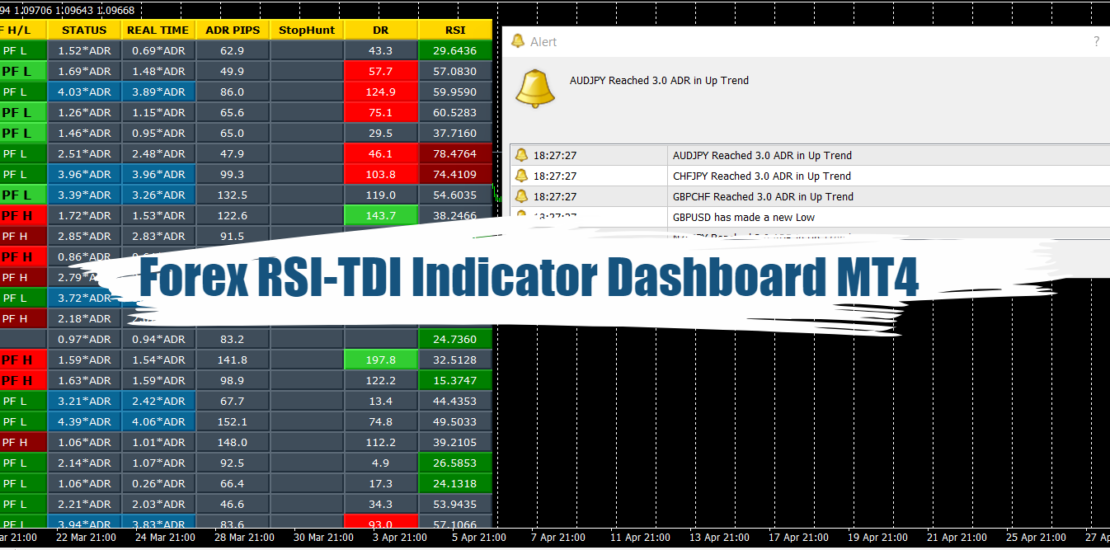

RSI-TDI Indicator Dashboard Review

Forex trading is a complex and dynamic world that requires traders to be equipped with the right tools and strategies to succeed. One such tool that has gained popularity among traders is the RSI-TDI Indicator. This article will provide an in-depth analysis of this indicator, its benefits, and how to use it in forex trading.

What is the RSI-TDI Indicator?

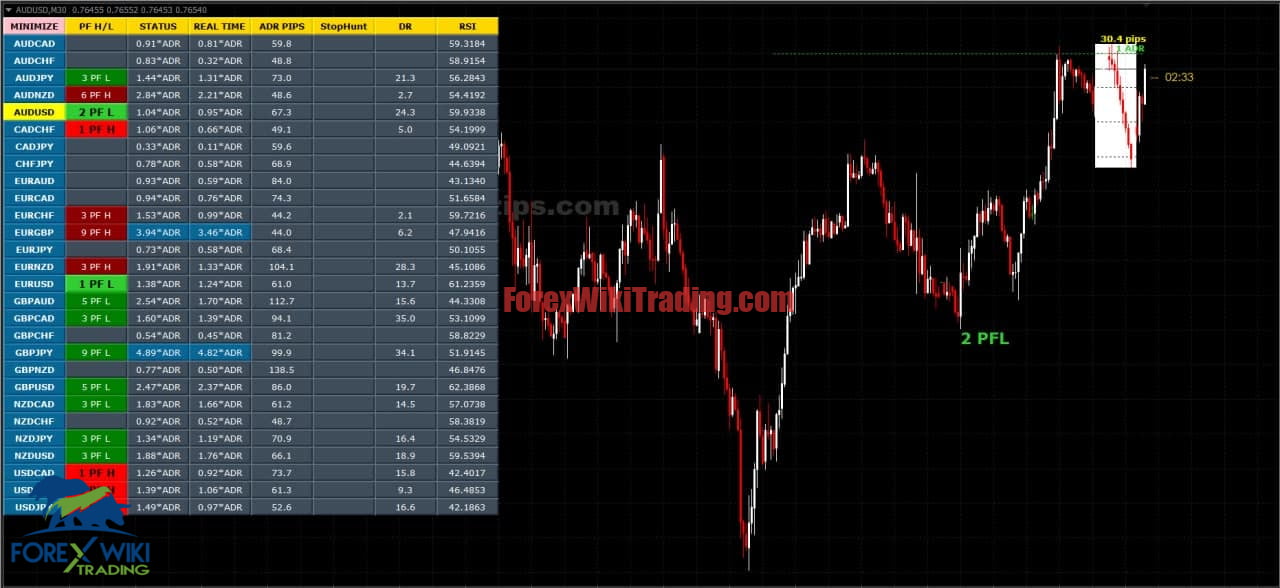

The RSI-TDI Indicator Dashboard is a powerful forex trading tool that allows traders to monitor Relative Strength Index (相對強弱指數) levels on multiple pairs simultaneously. It is a customizable dashboard that displays RSI levels on selected time frames and alerts traders when RSI levels reach overbought or oversold levels.

最佳經紀商名單 :

The RSI-TDI Indicator Dashboard with any broker and any type of account, 但我們建議我們的客戶使用其中之一 頂級外匯經紀商 下面列出:

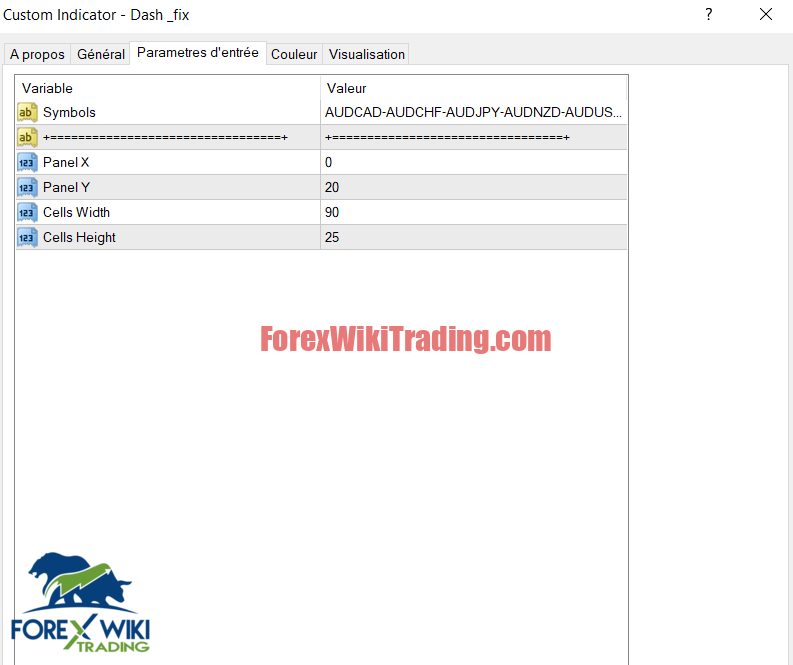

RSI-TDI Indicator Settings

How Does the RSI-TDI Indicator Work?

The RSI-TDI Indicator is designed to be used in two ways. The first is by selecting multiple time frames and monitoring when RSI levels are extended beyond normal trading conditions. This is an indicator that the price has pushed hard and achieved an overbought or oversold level across multiple time frames. A pullback or reversal is, 所以, due soon.

The second way to use the RSI-TDI Indicator is by selecting one time frame (your favorite to trade) and monitoring multiple RSI levels to show the strength of the extension of RSI on that time frame. This is a great strategy for taking mean reversion trades when the price has pushed very hard in one direction for too long, and the market is due a profit take move.

The RSI-TDI Indicator dashboard alerts traders to extended conditions (overbought and oversold) at levels of their choice when a candle closes on the chosen time frame. Traders can monitor up to 6 separate RSIs at once, selecting the time frame, 類型, and overbought and oversold levels independently.

Benefits of the RSI-TDI Indicator

The RSI/TDI Indicator provides traders with several benefits. Firstly, it allows traders to monitor multiple RSI levels simultaneously, saving time and increasing efficiency. Secondly, it alerts traders to extended conditions, making it easier to identify pullback or reversal opportunities. 最後, the RSI/TDI Indicator is customizable, allowing traders to select the time frames, RSI levels, and overbought/oversold levels that best suit their 交易策略.

Using the RSI/TDI Indicator in Forex Trading

The RSI/TDI Indicator can be used in conjunction with other indicators or as a standalone system. It is a great confirmation indicator and can be used in any strategy to help confirm price action reversal patterns. Traders can use the dashboard as a standalone system and take entries on pairs as they get overextended across multiple time frames.

When using the RSI/TDI Indicator, traders should be aware of the limitations of the indicator. Like all indicators, it is not foolproof and should be used in conjunction with other indicators and analysis to make informed trading decisions. It is also important to note that past performance does not guarantee future results, and traders should always practice good risk management.

結論

The RSI/TDI Indicator is a powerful forex trading tool that allows traders to monitor RSI levels on multiple pairs simultaneously. It is a customizable dashboard that displays RSI levels on selected time frames and alerts traders when RSI levels reach overbought or oversold levels. Traders can use the RSI/TDI Indicator in conjunction with other indicators or as a standalone system, making it a versatile tool in any trading strategy. As with any indicator, traders should use it in conjunction with other analyses and practice good risk management.

Download RSI/TDI Indicator :

We highly recommend trying The RSI/TDI Indicator with ICMarket 模擬帳戶. 也, 在真實帳戶上使用系統之前,請熟悉並了解系統的工作原理.