- 一月 2, 2023

- 發表者: 外匯維基團隊

- 類別: 免費外匯 EA

Forex Correlation Calculator Review

Forex Correlation Calculator, As a Forex trader, it's important to stay on top of the relationships between different currency pairs. This is where the Forex Correlation Calculator can be invaluable. This powerful tool measures the degree to which two currency pairs move in relation to each other, providing traders with insight into the potential for one pair to influence the other.

Using the Forex Correlation Calculator to Identify Trading Opportunities

One of the primary ways traders can utilize the Forex Correlation Calculator is to identify potential trading opportunities. By analyzing the strength and direction of the correlation between different currency pairs, traders can make informed decisions about whether to buy or sell.

例如, if two currency pairs have a strong positive correlation, a trader may consider buying one pair and selling the other, expecting that they will move in the same direction. 另一方面, if two currency pairs have a strong negative correlation, a trader may consider buying one pair and selling the other, expecting that they will move in opposite directions.

Choosing TP and SL with the Correlation Strategy

Once a trader has identified a potential trade using the Forex Correlation Calculator, they will need to decide on their take profit (TP) and stop loss (SL) 等級. TP is the target price at which the trader will close their position and realize a profit, while SL is the price at which the trader will close their position to minimize their loss.

There are several approaches that traders can take when choosing TP and SL with the correlation strategy. One approach is to set the TP at a level that is a multiple of the average daily range (ADR) of the correlated pair. 例如, if the ADR of the correlated pair is 100 pips and the trader wants to aim for a TP of 300 點, they could set their TP at three times the ADR.

Another approach is to use technical analysis to identify key levels of 支撐和阻力 on the correlated pair and set the TP and SL accordingly. 例如, if the correlated pair is approaching a key level of resistance, the trader may set their TP just above that level and their SL just below it.

最佳經紀商名單

The No Loss Forex Robot works with any broker and any type of account, 但我們建議我們的客戶使用其中之一 頂級外匯經紀商 下面列出:

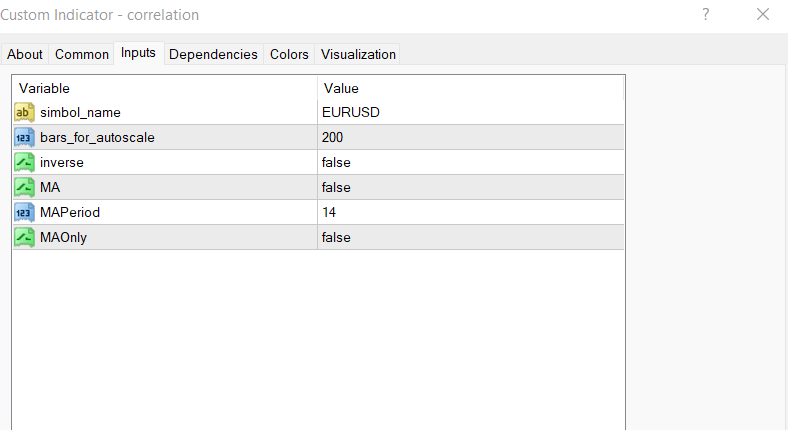

Adjusting the Parameters of the Forex Correlation Calculator

The Forex Correlation Calculator has several adjustable parameters that can be tailored to meet the needs of the trader:

- Symbol_Name: The currency pair to which you want to calculate the correlation.

- Bars_of_autoscale: The number of bars to autoscale.

- Inverse: If set to true, it will flip the chart horizontally.

- 碩士: If set to true, it will display the moving averages for the overlaying pair.

- 時期: The period of the moving average that you want to use.

- MA_Only: If set to true, it will only display the moving average.

Take Your Forex Trading to the Next Level with the Forex Correlation Calculator

綜上所述, the Forex Correlation Calculator is a valuable tool for Forex traders looking to identify new opportunities and diversify their portfolios. By analyzing the relationships between different currency pairs with the Forex Correlation Calculator and using this information to make informed buy or sell decisions, traders can potentially increase their chances of success in the volatile world of Forex trading. When choosing TP and SL levels, traders can consider using a multiple of the ADR of the correlated pair or identifying key levels of support and resistance. 然而, it's important to remember that the Forex Correlation Calculator is not a guarantee of future performance and should be used as just one tool in an overall trading strategy.

Read More: Forex Correlation EA

Forex Correlation Calculator Free Download

We highly recommend trying the Forex Correlation Calculator with ICMarket 模擬帳戶. 也, 在真實帳戶上使用系統之前,請熟悉並了解系統的工作原理.