- 六月 21, 2019

- 發表者: 外匯維基團隊

- 類別: 外匯交易系統

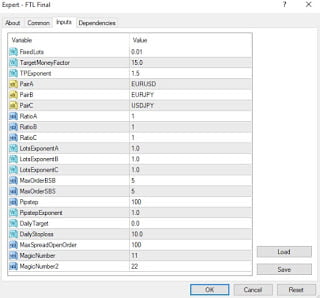

This time I'll share the newest model of the EA FTL with a slight change within the set off sign for the entry level. 如果較早的模型利用了利基市場, FPI, 同樣鍵入第三個蠟燭對, however on this model it's even easier utilizing solely a less complicated sign calculation.

基本上, this triangular correlation is all the identical as hedging however utilizing completely different tons. for instance the correlation between eur / 美元, 歐元, 日元和美元 / 日元.

PairsA = eur / 美元

PairsB = eur /

jpy pairsC = usd / 日元

for instance we open BSB (purchase promote purchase) means we open purchase eur / usd promote eur / jpy purchase usd / 日元, then we will group our open into 2 elements that's

group A, particularly purchase eur / usd eurjpy VS group B, which is purchase usd / 日元 (Observe: the grouping is predicated on the equation of the bottom forex, 特別是歐元)

In a forex pair, there are at all times 2 currencies in it. within the point out of the pair, the one positioned in entrance is named the bottom forex and the one positioned behind is named the quote forex. So in pairs of eur / 美元, eur acts as the bottom forex and usd acts because the quote forex.

as a result of this triangular correlation is a hedging then really by opening 3 positions we get /;

purchase eur / usd promote eur / jpy purchase usd / 日元

as a result of

purchase eur / usd promote eur / jpy = promote usd / 日元

then we really open usd / jpy and purchase usd / 日元.

Is the consequence the identical if we open usd / jpy promote and purchase usd / jpy in comparison with if we open with triangular correlation? DIFFERENT. as a result of the worth per level of those pairs is completely different. 看 Foreign exchange Pip Calculator. for instance if we open with tons 0.01 promote usd / jpy and purchase usd / jpy concurrently then our commerce will be unable to generate income at any time as a result of the worth per level is identical and the open place we do is the alternative, the opposite revenue is definite will probably be minus.

However by utilizing triangular correlation hedging we will get revenue

If we open with 1 purchase tons eur / usd promote eur / jpy purchase usd / jpy by trying on the pip worth, we get it

(歐元 / usd = 10 + 歐元 / jpy = 9,32) / 2 vs usd / jpy = 9, 32

outcomes are 9,66 vs 9,32

和 1 點= 10 factors so

group A per level is 0,00966

group B per level is 0,00932

so with tons 0.01 then the mix is identical as we open promote usd / jpy with worth level 0.00966 and purchase usd / jpy with a price per level 0.00932 ..

Then the conclusion of the triangular correlation is, the three pairs will probably be in a revenue if group B (pairs C) loses. pairs C losses should be capable of cowl spreads and commissions from all three pairs so the outcomes will be revenue.

instance

現在, from the instance above we will conclude the better the minus skilled by pairs C within the triangular correlation, the full whole will really be revenue.