- 십월 4, 2024

- 게시자:: 외환 위키 팀

- 범주: 무료 외환 지표

Review of NeelyWave Pro FX Indicator

외환 거래의 역동적인 세계에서, 올바른 도구를 사용하면 거래 결과에 큰 영향을 미칠 수 있습니다. One such tool gaining attention is the NeelyWave Pro FX Indicator. 이 포괄적인 리뷰에서는 그 기능을 탐구합니다., 운영 전략, and evaluates its advantages and disadvantages to provide a clear understanding of its potential impact on your trading journey.

Introduction to NeelyWave Pro FX Indicator

그만큼 NeelyWave Pro FX Indicator is a sophisticated trading tool designed for the MetaTrader 4 (MT4) 플랫폼. Leveraging the principles of Elliott Wave Theory with Neely’s unique modifications, this indicator aims to provide traders with precise market forecasts and actionable trading signals. Suitable for traders with a minimum deposit of $500, it caters to both intraday and swing trading strategies across major currency pairs.

기술 사양

버전: 1.2

발행 연도: 2024

작동 쌍: EUR/USD, GBP/USD , 미국 달러/엔, AUD/USD

권장 기간: M15 To H4

최소 입금액: $500

계정 평균: 1:30 에게 1:1000

최고의 중개인 목록

NeelyWave Pro FX Indicator works with any broker and any type of account, 하지만 우리는 고객이 다음 중 하나를 사용하도록 권장합니다. 최고의 외환 중개인 아래에 나열된:

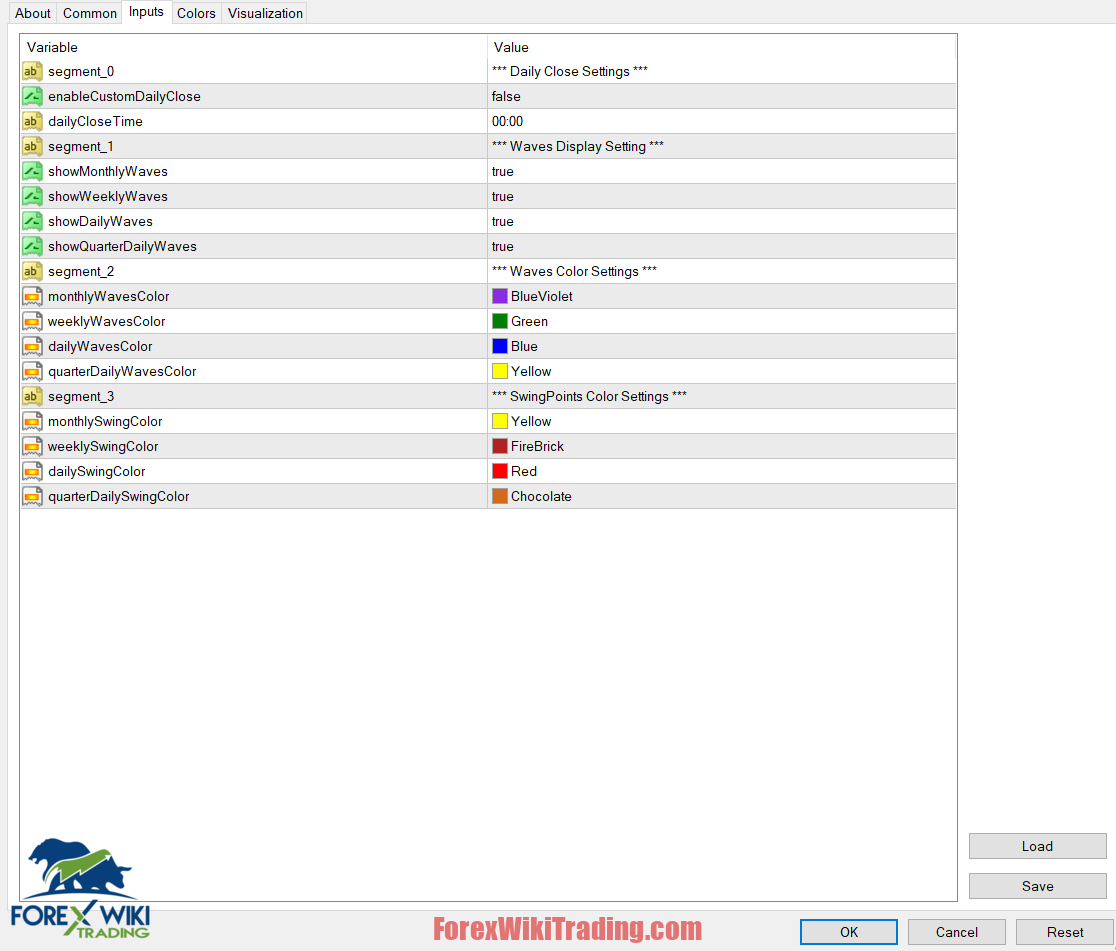

NeelyWave Pro FX Indicator Settings

Key Features of NeelyWave Pro FX Indicator V1.2

최소 입금액: $500

While the NeelyWave Pro FX Indicator does not enforce a strict minimum deposit, it is recommended to operate with at least $500 in your trading account. This balance ensures adequate capital to manage potential drawdowns and effectively utilize the indicator’s strategies without risking excessive funds. Maintaining this amount allows traders to navigate both small and medium-term market fluctuations, especially during volatile periods.

기간: M15 to H4

The indicator is optimized for use on timeframes ranging from 15 분 (M15) 에게 4 시간 (H4). These intervals enable traders to capture short-term price movements while also observing broader market trends.

- M15 (15 Minutes): Ideal for intraday trading, allowing traders to identify smaller wave patterns and capitalize on quick market shifts.

- H4 (4 Hours): Suited for swing trading, providing a broader perspective on market trends for more informed trading decisions over longer periods.

Combining these timeframes offers a comprehensive view of both immediate and extended market behaviors, enhancing decision-making accuracy.

권장 통화 쌍

그만큼 NeelyWave Pro FX Indicator performs optimally with the following major currency pairs:

- EUR/USD

- GBP/USD

- 미국 달러/엔

- AUD/USD

These pairs are favored due to their high liquidity and volatility, essential for effective application of Elliott Wave Theory. Their well-established trading patterns make them prime candidates for identifying wave structures and leveraging market cycles.

거래 전략: Elliott Wave Theory with Neely’s Modifications

At its core, the NeelyWave Pro FX Indicator employs Elliott Wave Theory, enhanced by Neely’s modifications. This combination allows for more adaptable and precise wave counts, aligning with today’s dynamic forex markets. The strategy categorizes market movements into impulse and corrective waves, providing a structured approach to market analysis and trade execution.

Entry and Exit Points

The indicator identifies entry and exit points based on wave terminations and confirmations. It marks wave terminations, particularly after the third and fifth waves, which are considered reliable indicators for trend continuation. This feature aids traders in pinpointing optimal entry points and strategically exiting trades to maximize profits.

Stop Loss Strategy

Risk management is a critical aspect of trading, and the NeelyWave Pro FX Indicator addresses this by placing stop-loss orders at the beginning of the previous wave. This placement offers maximum protection against adverse market movements, ensuring that potential losses are minimized while allowing trades to develop within the identified wave structures.

플랫폼: 메타 트레이더 4 (MT4)

The indicator is designed for the MetaTrader 4 (MT4) 플랫폼, a widely used trading environment known for its user-friendly interface and extensive analytical capabilities. MT4’s compatibility ensures that traders can seamlessly integrate the NeelyWave Pro FX Indicator into their existing trading setups.

How NeelyWave Pro FX Indicator Takes Trades

Wave Identification

The indicator categorizes market movements into five waves during trending markets and three waves during corrective phases. Recognizing these wave structures is fundamental to predicting future market movements and identifying potential trade opportunities.

Entry Points

By marking wave terminations, especially after the third and fifth waves, the indicator highlights the most promising points to enter trades. These terminations are considered highly reliable for indicating trend continuations, providing traders with clear signals to initiate positions.

Trade Confirmation

To ensure high-quality trades, the NeelyWave Pro FX Indicator employs additional filters such as support and resistance zones and momentum oscillators. These filters validate the wave counts, ensuring that only trades with strong confirmation signals are executed, thereby enhancing the overall reliability of the trading signals.

Step-by-Step Trading Process

- 추세 분석: The indicator begins by scanning for long-term trends and labeling wave structures (1 through 5 for impulsive waves and A, 비, C for corrective waves).

- Wave Pattern Detection: As clear wave patterns form, the tool marks entry and exit points, with the third wave often serving as the most potent signal for initiating trades.

- Stop-Loss Placement: The stop-loss is strategically placed at the beginning of the identified wave to manage risk effectively.

- 출구 전략: Traders are advised to exit trades at the conclusion of the fifth wave or during the corrective wave (wave C), ensuring they capitalize on the trend before potential reversals.

- 실시간 업데이트: The indicator continuously updates wave counts in real-time, allowing traders to adjust their strategies in alignment with the latest market patterns.

How the Strategy Works

The NeelyWave Pro FX Indicator enhances Elliott Wave Theory with Neely’s refinements, making wave counts more adaptable to contemporary market conditions.

Impulse Waves

Impulse waves consist of five distinct waves and occur when the market is trending in a single direction.

- Wave 1: Initial price movement in the direction of the main trend.

- Wave 2: A pullback or correction following Wave 1.

- Wave 3: The strongest wave, offering the best trading opportunity.

- Wave 4: A smaller correction, weaker than Wave 2.

- Wave 5: The final push in the direction of the main trend, often weaker than Wave 3.

Corrective Waves

Corrective waves consist of three waves (에이, 비, 기음) and occur when the market reverses after a trend.

- Wave A: The first corrective movement.

- Wave B: A smaller counter-trend move.

- Wave C: The final corrective move, typically offering a good exit point.

By accurately identifying these wave structures, the indicator provides a clear framework for predicting market movements and executing trades accordingly.

Advantages of NeelyWave Pro FX Indicator

Precision in Wave Identification

The integration of Elliott Wave Theory with Neely’s modifications allows for more accurate wave counts, enhancing the reliability of trade signals.

종합적인 위험 관리

The strategic placement of stop-loss orders at the beginning of waves ensures effective risk management, protecting traders from significant losses during adverse market movements.

실시간 업데이트

Continuous real-time updates enable traders to stay aligned with the latest market trends and adjust their strategies promptly, ensuring they remain competitive in fast-moving markets.

User-Friendly Integration with MT4

Designed for the MetaTrader 4 플랫폼, the indicator is easy to install and integrate into existing trading setups, making it accessible to a wide range of traders.

Suitable for Multiple Trading Styles

Whether you are an intraday trader or a swing trader, the NeelyWave Pro FX Indicator accommodates various trading styles by operating effectively across multiple timeframes.

Disadvantages of NeelyWave Pro FX Indicator

학습 곡선

For traders unfamiliar with Elliott Wave Theory or Neely’s modifications, there may be a steep learning curve to fully utilize the indicator’s capabilities.

Dependence on Correct Wave Interpretation

The effectiveness of the indicator relies heavily on accurate wave identification. Misinterpretation of wave structures can lead to incorrect trading signals and potential losses.

Limited to Major Currency Pairs

While the indicator is optimized for major currency pairs, its performance may be less effective with minor or exotic pairs, limiting its versatility across all forex markets.

Minimum Deposit Requirement

The recommended minimum deposit of $500 may be a barrier for novice traders or those with limited capital, restricting access to the indicator’s full potential.

플랫폼 제한

Being exclusive to the MetaTrader 4 플랫폼, traders who prefer other trading platforms may find it inconvenient or incompatible with their preferred systems.

결론: Weighing the NeelyWave Pro FX Indicator

그만큼 NeelyWave Pro FX Indicator presents a robust tool for forex traders, especially those who are well-versed in Elliott Wave Theory and seek precise market forecasts. Its ability to integrate seamlessly with MT4, coupled with comprehensive risk management features, makes it a valuable asset for both intraday and swing traders.

Download NeelyWave Pro FX Indicator

적어도 일주일에 한 번씩 시도해 보세요. XM 데모 계좌. 또한, 이 방법을 숙지하고 이해하십시오. 무료 외환 ea works 실제 계정에서 사용하기 전에.