- 팔월 13, 2024

- 게시자:: 외환 위키 팀

- 범주: 무료 외환 EA

Introduction to BreakoutGuard EA

BreakoutGuard EA is an advanced Expert Advisor (EA) designed for Forex traders who seek to capitalize on breakout trading strategies. Breakout trading is one of the most popular and frequently used strategies in the Forex market, offering significant opportunities for profit by identifying and trading breakouts from key levels of support, 저항, or trend lines. BreakoutGuard EA is engineered to automatically execute trades based on these breakouts, leveraging a sophisticated algorithm to maximize profitability while minimizing risk.

Understanding Breakout Trading Strategy

Before diving into the specifics of BreakoutGuard EA, it's essential to understand the underlying strategy it employs. Breakout trading involves identifying key levels where the price of a currency pair has historically struggled to move beyond. These levels can be points of support or resistance or trend lines in a downtrend or uptrend. When the price breaks through these levels, it often signals a strong move in the direction of the breakout, providing traders with an opportunity to enter the market.

BreakoutGuard EA enhances this strategy by automating the process, identifying three types of breakouts:

- Support and Resistance Breakout: This occurs when the price breaks through established levels of support (a price level where a currency pair tends to stop falling) or resistance (a price level where it tends to stop rising).

- Downtrend Breakout: This is identified when the price breaks out above a descending trend line, indicating a potential reversal or strong upward move.

- Uptrend Breakout: This occurs when the price breaks out below an ascending trend line, signaling a potential downward movement.

기술 사양

버전: 10.79

발행 연도: 2024

작동 쌍: EUR/USD H1 and USD/JPY H1 or EUR/USD M30 and USD/JPY M30

권장 기간: !!

최소 입금액: $1000

계정 평균: 1:30 에게 1:1000

최고의 중개인 목록

BreakoutGuard EA works with any broker and any type of account, 하지만 우리는 고객이 다음 중 하나를 사용하도록 권장합니다. 최고의 외환 중개인 아래에 나열된:

Key Features of BreakoutGuard EA

BreakoutGuard EA is equipped with various features designed to enhance the effectiveness of breakout trading. Here are some of the key features:

1. 작은 정지 손실 (SL) for Risk Management

One of the standout features of BreakoutGuard EA is its emphasis on risk management. The EA employs a very small stop loss to ensure that the account is always protected from significant equity drawdowns. This conservative approach minimizes the risk per trade, making it an attractive option for traders who prioritize capital preservation.

2. Adaptive Trailing Stop Algorithm

The EA utilizes an adaptive trailing stop algorithm, which adjusts the trailing stop level dynamically as the trade progresses. This feature allows traders to lock in profits while still allowing room for the trade to grow, optimizing the trade's potential without exposing it to unnecessary risks.

3. Slippage Management and Position Closure

BreakoutGuard EA includes a system that monitors slippage and closes positions during high slippage conditions. Slippage occurs when an order is executed at a price different from the expected price, often due to high market volatility. By closing positions during slippages, the EA protects the account from unexpected losses.

4. Backtesting and Stress Testing

BreakoutGuard EA has undergone rigorous backtesting and optimization using real ticks with 99.9% quality. 추가적으로, it has successfully completed stress testing, ensuring that it performs reliably under various market conditions. This level of testing instills confidence in the EA's robustness and its ability to deliver consistent results over time.

5. Information Panel for Real-Time Monitoring

The EA includes an information panel that provides real-time statistics and data, allowing traders to monitor the performance of the EA and make informed decisions. This feature is particularly useful for traders who want to stay informed about the EA's operations without constantly monitoring the market.

Recommended Pairs and Timeframes

BreakoutGuard EA is optimized for specific currency pairs and timeframes to maximize its effectiveness. The recommended pairs and timeframes are:

- EUR/USD (M30, H1)

- 미국 달러/엔 (M30, H1)

- GBP/USD (M30, H1)

최적의 성능을 위해, it is advised to use EUR/USD H1 and USD/JPY H1 or EUR/USD M30 and USD/JPY M30. These combinations have been tested to provide the best balance between risk and reward.

Requirements and Recommendations for Optimal Use

To achieve the best results with BreakoutGuard EA, certain requirements and recommendations should be followed:

- 브로커 선택: Choose a broker that offers low spreads, low commissions, and high-quality execution. This is crucial for minimizing costs and ensuring that trades are executed accurately and efficiently.

- VPS Server: Use a Virtual Private Server (VPS) with minimal network latency to the broker's server. This reduces the chances of delays in order execution, which can be critical in a fast-moving market.

- 영향력: A leverage of 1:100 or more is recommended to maximize the potential of the EA. 하지만, higher leverage also increases risk, so it should be used with caution.

- 매직넘버: If you use multiple EAs on the same account, ensure that each EA has a different Magic number to prevent conflicts in trade management.

BreakoutGuard EA Results

Advantages of BreakoutGuard EA

BreakoutGuard EA offers several advantages that make it a valuable tool for Forex traders:

- 자동화된 거래: The EA automates the entire trading process, from identifying breakouts to executing trades and managing risk, saving time and effort for traders.

- 효과적인 위험 관리: With its small SL and adaptive trailing stop, the EA ensures that risk is kept to a minimum, protecting the trader's capital.

- Proven Strategy: The breakout strategy has been tested extensively, both historically and in stress tests, demonstrating its reliability and effectiveness.

- 실시간 모니터링: The information panel provides valuable insights and statistics, allowing traders to stay informed and make data-driven decisions.

- Versatile Performance: The EA is optimized for multiple currency pairs and timeframes, offering flexibility in trading strategies.

Disadvantages of BreakoutGuard EA

Despite its many advantages, BreakoutGuard EA also has some limitations:

- 시장 상황에 대한 의존성: The EA's performance is highly dependent on market conditions. In ranging or choppy markets, breakouts may be less effective, leading to potential losses.

- 기술 요구 사항: Successful implementation of the EA requires a reliable VPS and a broker with specific execution conditions. Traders without access to these resources may face challenges.

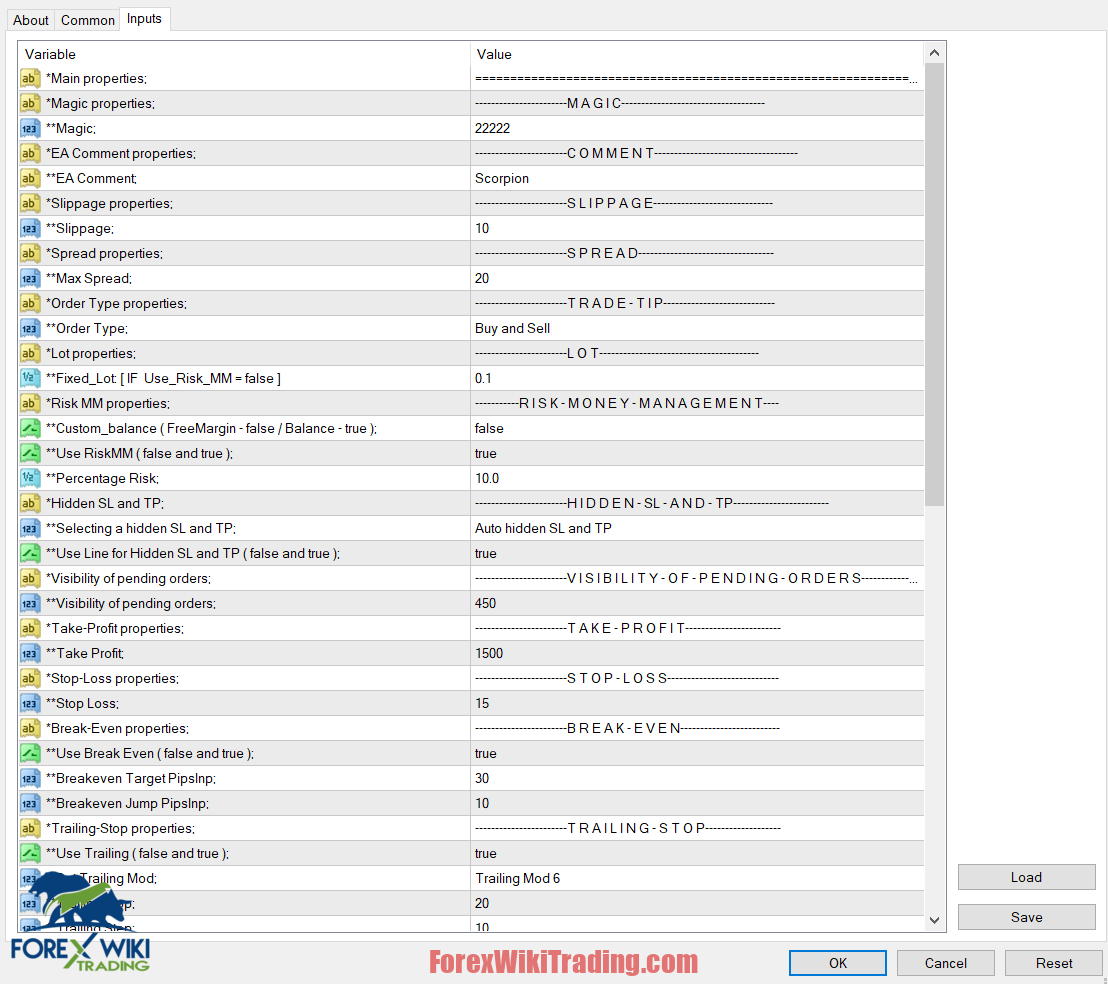

- 복잡성: The EA comes with various settings and parameters that may be overwhelming for beginners. Proper understanding and configuration are necessary for optimal performance.

- No Guarantee of Profit: 다른 거래 도구와 마찬가지로, there is no guarantee of profit. 시장 상황은 바뀔 수 있습니다, and even the best strategies can result in losses.

결론

BreakoutGuard EA is a powerful tool for Forex traders who want to capitalize on breakout strategies. With its robust risk management features, adaptive algorithms, and proven strategy, it offers significant potential for profit. 하지만, it is not without its challenges, and traders must be aware of its dependencies on market conditions and technical requirements.

Download BreakoutGuard EA

적어도 일주일에 한 번씩 시도해 보세요. ICMarket 데모 계정. 또한, 이 방법을 숙지하고 이해하십시오. 무료 외환 도구 작동 실제 계정에서 사용하기 전에.