Introduction GapMaster Pro EA

빠르게 변화하는 외환 거래의 세계에서, 올바른 도구가 큰 변화를 가져올 수 있습니다. One such innovative tool is the GapMaster Pro EA, a professional system designed to trade on live accounts by leveraging patterns of closing gaps in price movements. 이 기사에서는 기능에 대해 자세히 설명합니다., 장점, and disadvantages of GapMaster Pro EA, providing a thorough review without recommending its use.

기술 사양

버전: 1.2

발행 연도: 2024

작동 쌍: GBPJPY

권장 기간: H1

최소 입금액: $1000

계정 평균: 1:30 에게 1:1000

최고의 중개인 목록

GapMaster Pro EA works with any broker and any type of account, 하지만 우리는 고객이 다음 중 하나를 사용하도록 권장합니다. 최고의 외환 중개인 아래에 나열된:

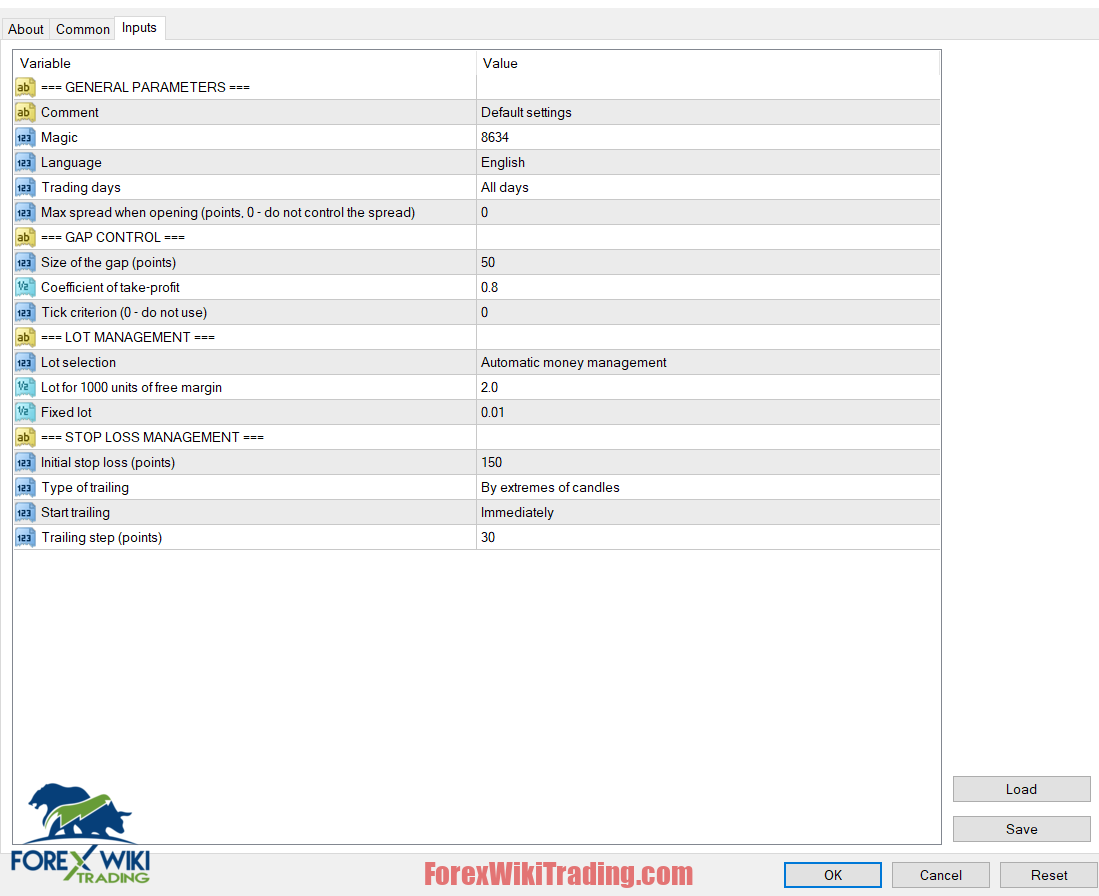

GapMaster Pro EA Settings

Customizable Options

GapMaster Pro EA offers a range of customizable settings to suit individual trading preferences:

- 논평: Add comments to settings.

- 마법: Assign a unique magic number for positions.

- 언어: Choose between English and Russian for messages.

- Trading Days: Specify allowed trading days (예를 들어, only Monday or all days).

- Max Spread When Opening: Set the maximum allowable spread for opening positions.

- Size of the Gap: Define the minimum gap size for opening deals.

- Coefficient of the Take Profit: Set the gap share used for profit.

- Tick Criterion: Use the tick criterion to guide trading decisions.

- Lot Selection: Choose between automatic money management or fixed lot.

- 정지 손실: Set the initial stop loss.

- Type of Trailing: Select the trailing type (예를 들어, no trailing, simple trailing, or trailing by candle extremes).

- Start Trailing: Decide when to start trailing (immediately or only when there is no loss).

- Trailing Step: Define the stop loss move step during trailing.

Understanding the Trading Strategy

The Concept of Gaps

In forex trading, gaps refer to the empty spaces on price charts where no trading activity has occurred. These gaps often form after weekends or holidays due to fundamental changes in the market. They can also occur during regular trading days when significant news is released, leading to heightened volatility.

Gap Closure Phenomenon

A notable characteristic of gaps is their tendency to close. This means that after a gap occurs, the price often moves back to its original value, either partially or completely. This behavior presents a lucrative opportunity for traders, as the probability of gap closure is relatively high.

Features of GapMaster Pro EA

Automated Gap Detection and Trading

GapMaster Pro EA is designed to automatically detect gaps, measure their magnitude, and decide on market entry based on the likelihood of the gap closing. Each position is calculated with individual goals tailored to the prevailing market conditions.

Tick Criterion for Precision

One of the standout features is the use of the tick criterion for analyzing price movements. This allows the robot to accurately pinpoint the start of the movement towards gap closure, ensuring nearly inertialess action and maximizing profit potential.

Risk Management and Position Management

The robot includes various types of trailing to manage open positions, significantly reducing trading risks. It also features automatic money management, adjusting transaction lots according to accumulated volumes and allowing for reinvestment of profits.

Infrequent but High-Volume Trades

Due to the rarity of gaps, GapMaster Pro EA does not frequently open positions. 하지만, when it does, the trades are highly accurate and executed with increased volume, leading to high trading efficiency.

Review GapMaster Pro EA Backtest

Summary of Backtest Results

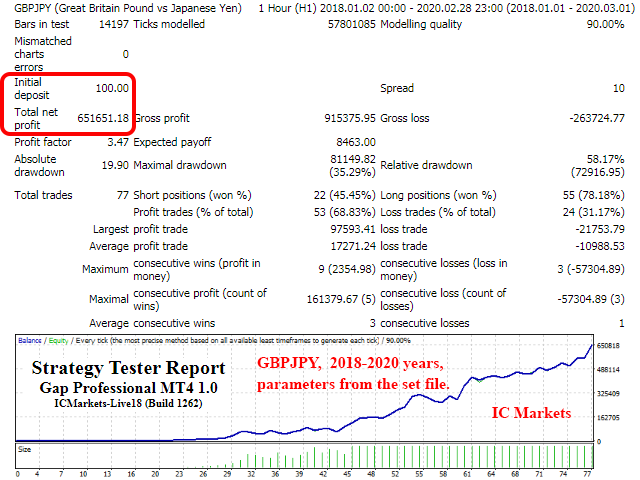

Backtest on IC Markets

- 초기입금: $100.00

- 총 순이익: $651,651.18

- 이익률: 3.47

- 절대 하락폭: 19.90

- 최대 감소: 19.90 (35.29%)

- 총 거래: 77

- Short Positions: 22 (45.45% won)

- Long Positions: 55 (78.18% won)

- Maximal Consecutive Wins: 9

- Maximal Consecutive Losses: 3

- 최대 이익 거래: $97,534.11

- 최대 손실 거래: -$21,753.79

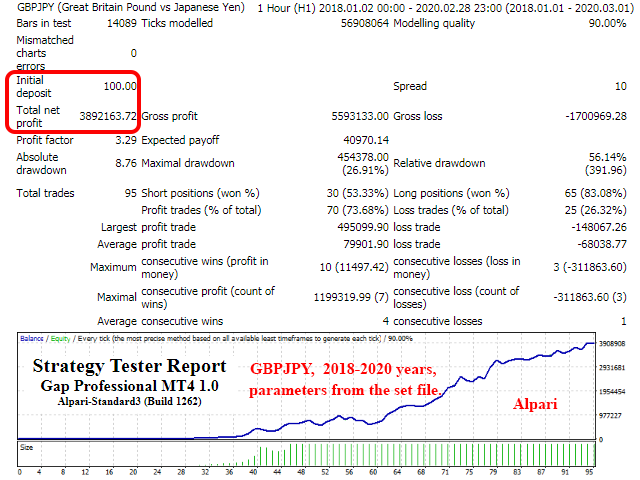

Backtest on Alpari

- 초기입금: $100.00

- 총 순이익: $3,892,163.72

- 이익률: 3.29

- 절대 하락폭: 8.76

- 최대 감소: 8.76 (26.91%)

- 총 거래: 95

- Short Positions: 30 (33.33% won)

- Long Positions: 65 (73.68% won)

- Maximal Consecutive Wins: 10

- Maximal Consecutive Losses: 4

- 최대 이익 거래: $495,099.89

- 최대 손실 거래: -$148,067.26

Detailed Analysis

- Initial Deposit and Total Net Profit:

- Both backtests start with an initial deposit of $100.00.

- The IC Markets backtest resulted in a total net profit of $651,651.18, while the Alpari backtest achieved a significantly higher net profit of $3,892,163.72. This discrepancy suggests the EA performed substantially better on the Alpari platform during the tested period.

- 이익률:

- IC Markets: 3.47

- Alpari: 3.29

- The profit factor is slightly higher for IC Markets, indicating marginally better efficiency in generating profit relative to the risk taken.

- 드로다운:

- IC Markets:

- 절대 하락폭: 19.90

- 최대 감소: 19.90 (35.29%)

- Alpari:

- 절대 하락폭: 8.76

- 최대 감소: 8.76 (26.91%)

- The drawdown figures for Alpari are significantly lower, indicating less risk and volatility compared to IC Markets. This is a crucial aspect for risk-averse traders.

- Trade Statistics:

- 총 거래: More trades were executed in the Alpari backtest (95) compared to IC Markets (77).

- Win Rates:

- Short Positions:

- IC Markets: 45.45%

- Alpari: 33.33%

- Long Positions:

- IC Markets: 78.18%

- Alpari: 73.68%

- The win rates for long positions are high in both tests, with IC Markets performing slightly better.

- Profit and Loss Distribution:

- The largest profit and loss trades show significant variance, with the Alpari test having both higher profit and loss extremes. This indicates that while Alpari had some very high-winning trades, it also had larger losing trades, which could contribute to the higher overall profit but also suggests higher risk per trade.

결론

The Gap Professional MT4 1.0 EA shows strong profitability and robustness across both IC Markets and Alpari platforms. 하지만, there are notable differences:

- 수익성: The EA was much more profitable on Alpari.

- 드로다운: The risk (감소) was lower on Alpari, suggesting more stability.

- Trade Performance: The EA had a higher win rate for long positions on both platforms, with IC Markets showing slightly better performance in terms of win rate.

전반적인, while both backtests indicate a profitable strategy, the choice of broker/platform can significantly impact the EA's performance. Traders should consider these differences and possibly conduct further testing under live market conditions before making a decision.

Advantages of GapMaster Pro EA

- 자동화된 거래: Reduces the need for constant monitoring, allowing traders to focus on other tasks.

- 높은 정확도: Trades based on a well-researched phenomenon (gap closure) with a high probability of success.

- 맞춤화 가능성: Offers numerous settings to tailor the trading experience to individual needs.

- 리스크 관리: Incorporates various protective measures to ensure stable operation even in adverse conditions.

- Efficient Use of Resources: Trades infrequently but with high accuracy and volume, maximizing trading efficiency.

Disadvantages of GapMaster Pro EA

- 시장 의존성: Performance may vary significantly depending on market conditions and broker specifics.

- Infrequent Trading: May not be suitable for traders looking for constant trading activity.

- Initial Setup Complexity: The numerous customizable options might be overwhelming for beginners.

- Optimization Requirement: Although not frequent, optimization may be necessary when switching brokers or in response to changing market conditions.

- Dependency on Leverage: The tool performs best with high leverage accounts, which may not be suitable for all traders.

결론

GapMaster Pro EA offers a sophisticated approach to forex trading by exploiting the gap closure phenomenon. With its robust features, 위험 관리 도구, and high trading efficiency, it presents a valuable tool for traders. 하지만, potential users should consider its market dependency, infrequent trading nature, and the need for occasional optimization. 다른 거래 도구와 마찬가지로, thorough research and careful consideration are essential before integrating GapMaster Pro EA into your trading strateg

Download GapMaster Pro EA

적어도 일주일에 한 번씩 시도해 보세요. XM 데모 계좌. 또한, 이 방법을 숙지하고 이해하십시오. 무료 외환 ea works 실제 계정에서 사용하기 전에.