- 십일월 8, 2024

- 게시자:: 외환 위키 팀

- 범주: 무료 외환 EA

Introduction to PropPass EA

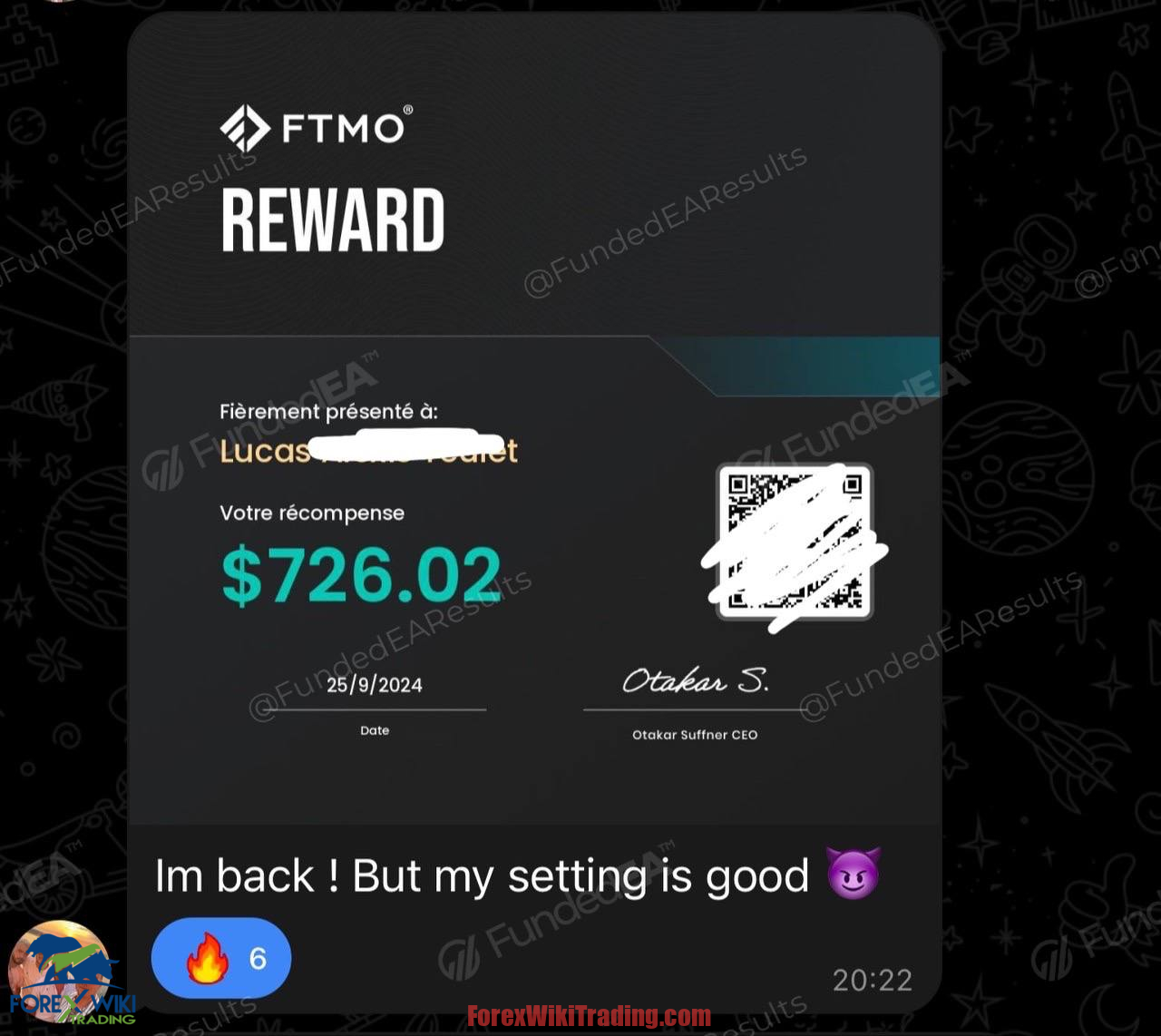

PropPass EA is an advanced forex trading expert advisor (EA) designed with a clear purpose: to help traders pass prop firm challenges and maintain profitable funded accounts. Verified by Myfxbook, it has quickly gained a reputation for reliability, precision, and adaptability across multiple platforms, including MetaTrader 4 (MT4), 메타 트레이더 5 (MT5), cTrader, and DXTrade. This tool is particularly appealing to traders aiming for prop firms such as FTMO, where drawdown limits and risk management are crucial.

기술 사양

버전: 1.0

발행 연도: 2024

작동 쌍: 어느

권장 기간: H1

최소 입금액: !!

계정 평균: 저것

최고의 중개인 목록

PropPass EA can work with any broker and any type of account, 하지만 우리는 고객이 다음 중 하나를 사용하도록 권장합니다. 최고의 외환 중개인 아래에 나열된:

Key Features of PropPass EA

- Optimized for Prop Firm Challenges

- The PropPass EA is specifically tailored for prop firm accounts, making it suitable for traders who must adhere to strict risk management guidelines.

- It includes built-in parameters like a maximum drawdown of just 1.72%, which aligns well with typical prop firm requirements.

- Versatile Trading Pair and Timeframe Compatibility

- It can operate on any currency pair, allowing for broader market exposure.

- Recommended timeframe is H1 (매시간), providing balance between responsiveness and trend analysis without falling prey to short-term market noise.

- Non-Aggressive Trading Strategies

- 많은 EA와는 달리, PropPass does not use martingale, grid trading, or high-frequency trading (HFT). This conservative approach minimizes potential losses and aligns with prop firms’ rules.

- Lifetime Access and Multi-Platform Support

- Users pay a one-time fee for lifetime access, with no recurring charges. This single purchase grants unlimited usage on multiple accounts, offering excellent long-term value.

- Compatible with MT4, MT5, cTrader, and DXTrade, the EA is accessible for a variety of trading platforms, which adds flexibility.

- Verified Track Record

- The Myfxbook-verified performance shows a max drawdown under 5% with monthly returns exceeding 10%, giving users a high level of transparency and confidence.

PropPass EA’s Trading Performance Metrics

Based on the monthly analytics and trading metrics provided:

- Monthly Gain: Achieved a 13.05% growth in September, showcasing its profit potential.

- Risk-Reward Ratio: PropPass EA maintains balanced risk management, with a conservative reward-to-risk ratio, critical for funded accounts.

- 평균 보유 시간: For XAUUSD trades, the EA demonstrated well-timed entries and exits, managing trades over durations from a few hours to over 11 시간. This controlled approach helps in achieving steady returns while minimizing risk.

Detailed Settings and Customization Options

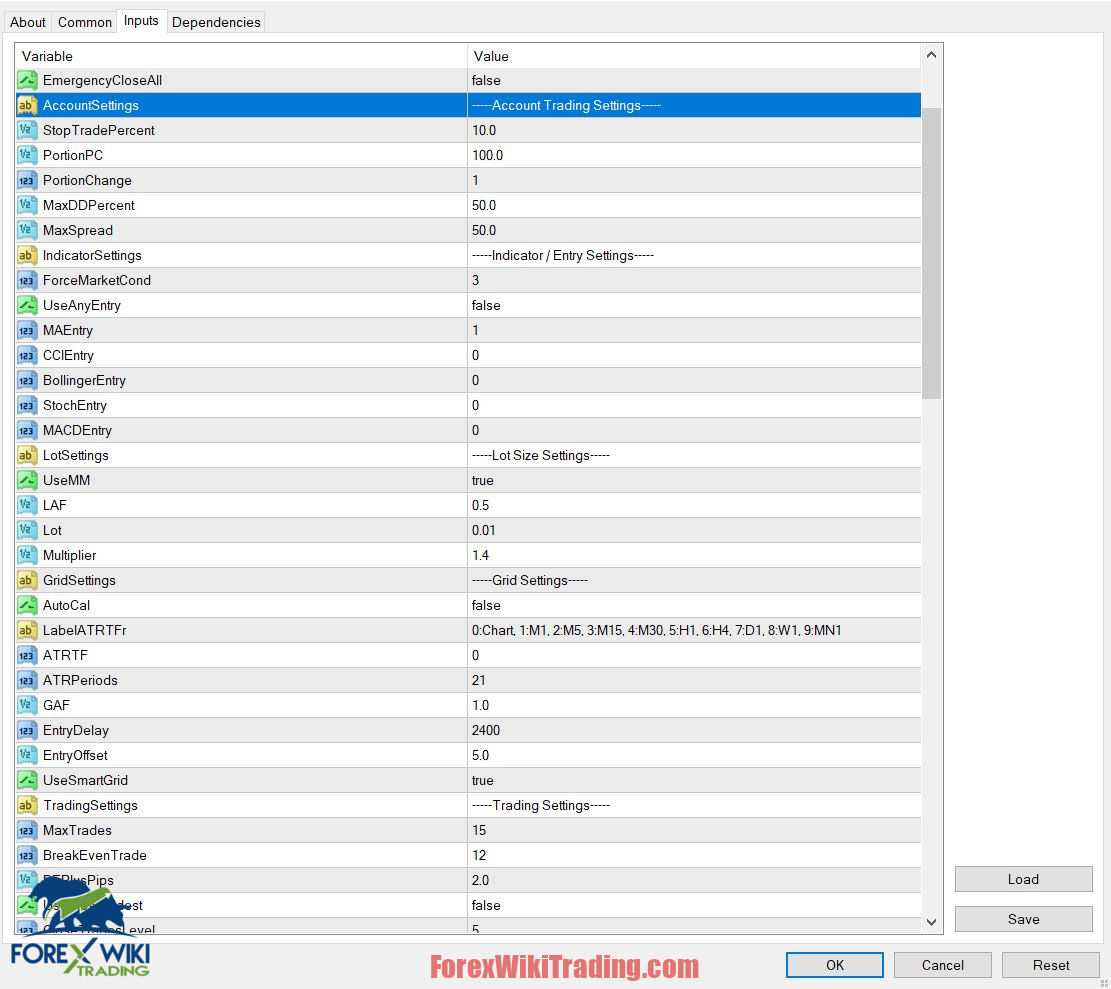

PropPass EA offers a wide range of settings for users to customize their trading experience, 포함:

- Account Trading Settings: Users can set parameters such as stop trade percentage, portion size, maximum drawdown percentage, 그리고 더, allowing for precise risk management.

- Indicator/Entry Settings: The EA integrates multiple indicators (예를 들어, Moving Average, CCI, 볼린저 밴드, 확률론적) for refined trade entries, catering to different trading strategies.

- Lot Size Management: The EA supports money management settings with options for automatic lot adjustment, a multiplier feature, and risk-based lot sizes.

- Grid and Trading Settings: For those interested, grid trading is an option, although it’s not mandatory. Users can also configure maximum trades, break-even trades, and trading delays.

Advantages of PropPass EA

- Risk Management Compliance

- With a low maximum drawdown and no risky strategies like martingale or grid trading, PropPass EA aligns well with prop firm requirements.

- Multi-Platform Accessibility

- Traders can use the EA across several popular trading platforms, giving them the flexibility to operate on their preferred system.

- Verified Results and Transparency

- The Myfxbook verification adds a layer of trust, showing users actual performance metrics, which are essential for assessing EA reliability.

- Lifetime Access with No Hidden Fees

- One-time payment grants users unlimited usage without monthly or additional fees, making it a cost-effective solution.

- Broad Customization Options

- The EA is customizable to meet the specific needs and risk tolerance of different traders, from entry conditions to position sizing.

Disadvantages of PropPass EA

- Limited Timeframe and Pair Recommendations

- Although it can be used on any currency pair, the EA is optimized for the H1 timeframe, which may not suit traders who prefer shorter timeframes.

- Lacks High-Risk, High-Reward Strategies

- Some traders may find the conservative approach limiting, especially those seeking higher gains through aggressive strategies.

- Reliance on Market Conditions

- Like all trading EAs, the effectiveness of PropPass EA can vary with changing market conditions, which may impact performance during highly volatile periods.

- Complexity for Beginners

- The wide array of customization options, though advantageous for experienced traders, might be overwhelming for beginners.

최종 평결: Is PropPass EA Worth It?

PropPass EA is an excellent choice for traders focused on passing prop firm challenges or maintaining profitable funded accounts. Its conservative, risk-averse strategies, combined with rigorous risk management, make it ideal for these purposes. While the customization options and broad platform support offer flexibility, the EA may feel restrictive to traders who favor high-risk, high-reward approaches. Nonetheless, for traders committed to consistent, verified performance and those who need to meet strict drawdown limits, PropPass EA is a strong, reliable tool worth considering.

Download PropPass EA

적어도 일주일에 한 번씩 시도해 보세요. ICMarket 데모 계정. 또한, 이 방법을 숙지하고 이해하십시오. 무료 외환 도구 작동 실제 계정에서 사용하기 전에.

위험 면책 조항

외환 거래는 상당한 위험을 수반하며 모든 투자자에게 적합하지 않을 수 있습니다.. 과거의 성과가 미래의 결과를 보장하지 않습니다. 제시된 통계 및 성능 측정항목은 과거 데이터를 기반으로 하며 향후 성능을 나타내지 않을 수도 있습니다.. 거래자는 자동 거래 시스템을 사용하기 전에 재무 상황과 위험 허용 범위를 신중하게 고려해야 합니다.