- 구월 29, 2024

- 게시자:: 외환 위키 팀

- 범주: 무료 외환 EA

SafeGrid EA: An In-Depth Review of the Forex Trading Tool

In the fast-paced and highly volatile world of forex trading, traders are constantly seeking innovative tools to enhance their trading strategies, minimize risks, and maximize profits. One such tool that has garnered attention is SafeGrid EA. This comprehensive review delves into the intricacies of EA, exploring its strategies, 기능, 장점, and drawbacks to provide a balanced perspective for traders considering its use.

What is SafeGrid EA?

SafeGrid EA is an automated trading Expert Advisor (EA) MetaTrader를 위해 설계되었습니다. 4 (MT4) 플랫폼. It employs a combination of hedging and grid trading strategies to navigate the unpredictable forex market. Unlike traditional EAs that may rely on aggressive lot size multiplication (마틴게일), EA maintains a fixed lot size for all additional orders, ensuring a more controlled and secure trading environment.

기술 사양

버전: 1.85

발행 연도: 2024

작동 쌍: USDNOK and USDCAD

권장 기간: M1

최소 입금액: $1500

계정 평균: 1:30 에게 1:1000

최고의 중개인 목록

SafeGrid EA works with any broker and any type of account, 하지만 우리는 고객이 다음 중 하나를 사용하도록 권장합니다. 최고의 외환 중개인 아래에 나열된:

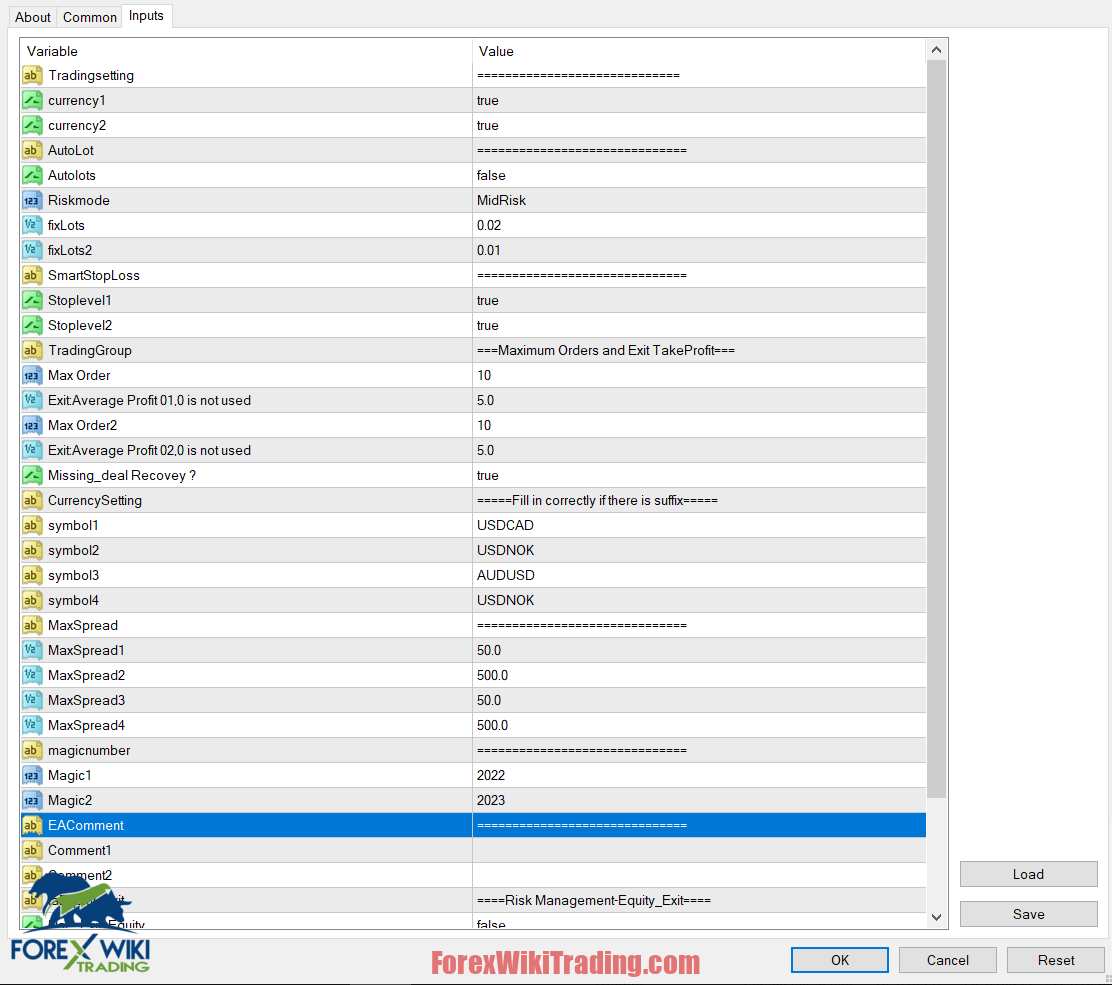

SafeGrid EA Settings

The Strategy Behind SafeGrid EA

Forex markets are notoriously volatile, with currency pairs frequently experiencing significant price fluctuations. To address this volatility, EA integrates hedging—a strategy akin to insurance in trading—to limit potential losses while optimizing profit opportunities. 추가적으로, it utilizes a grid trading algorithm, which systematically places buy and sell orders at predetermined intervals around a set price level.

Hedging as a Core Component

Hedging allows traders to offset potential losses by opening positions that counterbalance their existing trades. In the context of SafeGrid EA, hedging helps protect the trader's deposit from adverse market movements, thereby enhancing the system's resilience against market volatility.

Grid Trading Algorithm

The grid trading component of SafeGrid EA involves placing multiple orders at set intervals, creating a "grid" of orders at various price levels. This approach capitalizes on price movements within a defined range, allowing the EA to accumulate profits as the market oscillates.

How SafeGrid EA Operates

SafeGrid EA is designed to manage trades efficiently by adhering to a predefined algorithm. Here’s a breakdown of its operational mechanics:

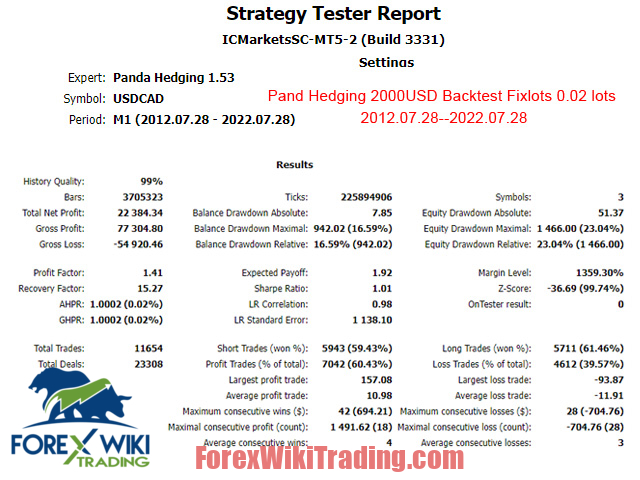

- Fixed Lot Sizes: All additional orders are executed with a consistent lot size, eliminating the risks associated with lot multiplication strategies like Martingale.

- 주문 관리: If the market price moves against an open order, SafeGrid EA initiates additional orders up to a maximum of 10 per currency pair. This controlled approach aims to recover losses and secure profits without overexposing the trader's account.

- Deposit Protection: The EA incorporates robust deposit protection mechanisms to safeguard the trader's capital, ensuring that losses are kept within manageable limits.

Instructions for Using SafeGrid EA

To effectively utilize SafeGrid EA, traders should follow these setup guidelines:

- Currency Pairs and Time Frames:

- USDCAD on the M1 (1분) 기간.

- Initial Investment and Lot Sizes:

- Allocate between $1,000 그리고 $1,500.

- Trade the following pairs with specified lot sizes:

- USDCAD/USDNOK: 0.02 lots

- AUDUSD/USDNOK: 0.01 lots

- Configuration:

- Ensure the correct settings file is used:

- SafeGrid EA SET File:

ea 1.81 MT4 SET File - Backtest File:

ea Backtest

- SafeGrid EA SET File:

- Ensure the correct settings file is used:

- Price Levels:

- Implement a copy left strategy with a base price of $450 and a subsequent price of $500.

- Broker Compatibility:

- Verify that the broker supports the trading currency USDNOK and offers favorable leverage options. 추가적으로, opting for low spread accounts is recommended to optimize trading performance.

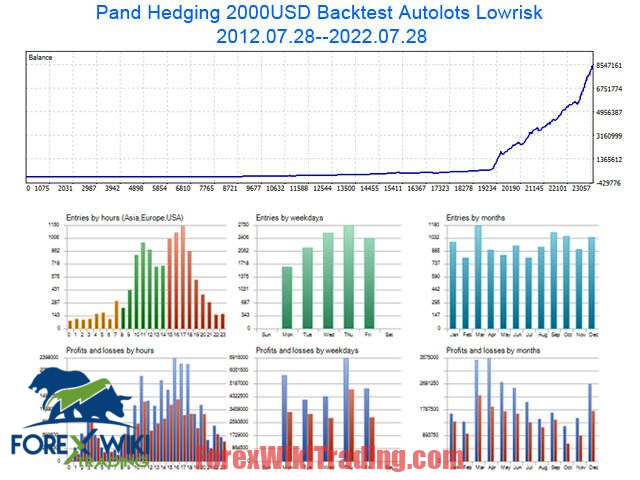

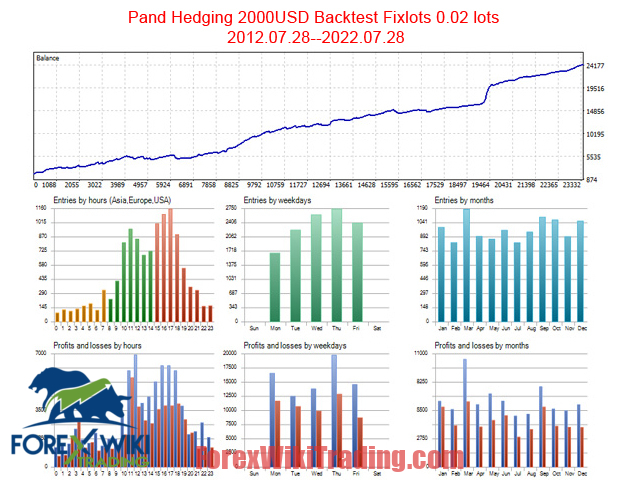

Real-World Testing and Performance

SafeGrid EA has been tested on a live account, providing insights into its real-world efficacy. Traders can access live signals through the MQL5 platform, offering transparency and real-time performance data.

Advantages of SafeGrid EA

- Controlled Risk Management:

- By avoiding lot multiplication, EA reduces the risk of substantial losses associated with aggressive trading strategies.

- Hedging Integration:

- The inclusion of hedging acts as a safety net, protecting the trader's capital during unfavorable market conditions.

- Fixed Lot Sizes:

- Consistent lot sizes simplify trade management and enhance predictability in trading outcomes.

- Deposit Protection:

- Advanced protection mechanisms ensure that the trader's deposit remains secure, fostering a more stable trading environment.

- Real-Time Performance Tracking:

- Live signals available on the MQL5 platform allow traders to monitor the EA’s performance in real time.

Disadvantages of SafeGrid EA

- Limited Backtesting on MT4:

- EA cannot be backtested on the MT4 platform, which may hinder traders from evaluating its historical performance comprehensively before deployment.

- Restricted Currency Pairs:

- Currently, SafeGrid EA only supports trading pairs involving USDCAD, USDNOK, 그리고 AUDUSD. This limitation restricts diversification opportunities for traders looking to explore other currency pairs.

- Dependence on Broker Support:

- The effectiveness of SafeGrid EA is contingent upon the broker’s support for specific trading currencies and leverage options, potentially limiting its usability across different brokerage platforms.

- No Lot Multiplication:

- While avoiding lot multiplication reduces risk, it may also limit the potential for higher profits in trending markets where aggressive strategies could be more beneficial.

Important Considerations Before Using SafeGrid EA

- 브로커 선택:

- Ensure that your broker supports the trading currencies USDNOK 그리고 USDCAD. 추가적으로, opt for brokers offering low spread accounts to enhance trading performance.

- Platform Compatibility:

- SafeGrid EA is compatible with both MT4 and MT5 platforms, providing flexibility for traders who prefer either interface.

- Future Enhancements:

- The developers plan to include additional currency pairs in future releases, which could expand the tool’s applicability and trading opportunities.

- Initial Investment:

- The recommended initial investment ranges between $1,000 그리고 $1,500, making it accessible to a broad range of traders.

결론

SafeGrid EA presents a structured approach to forex trading by combining hedging and grid trading strategies within a secure framework. Its emphasis on risk management and deposit protection makes it an attractive option for traders seeking a balanced trading tool. 하지만, limitations such as the inability to backtest on MT4 and restricted currency pair options may pose challenges for some users. 다른 거래 도구와 마찬가지로, prospective users should conduct thorough research and consider their individual trading needs and risk tolerance before integrating SafeGrid EA into their trading strategies.

Download SafeGrid EA

적어도 일주일에 한 번씩 시도해 보세요. XM 데모 계좌. 또한, 이 방법을 숙지하고 이해하십시오. 무료 외환 ea works 실제 계정에서 사용하기 전에.