- July 29, 2024

- Posted by: Forex Wiki Team

- Category: Free Forex Indicators

Introduction Renko Precision Indicator

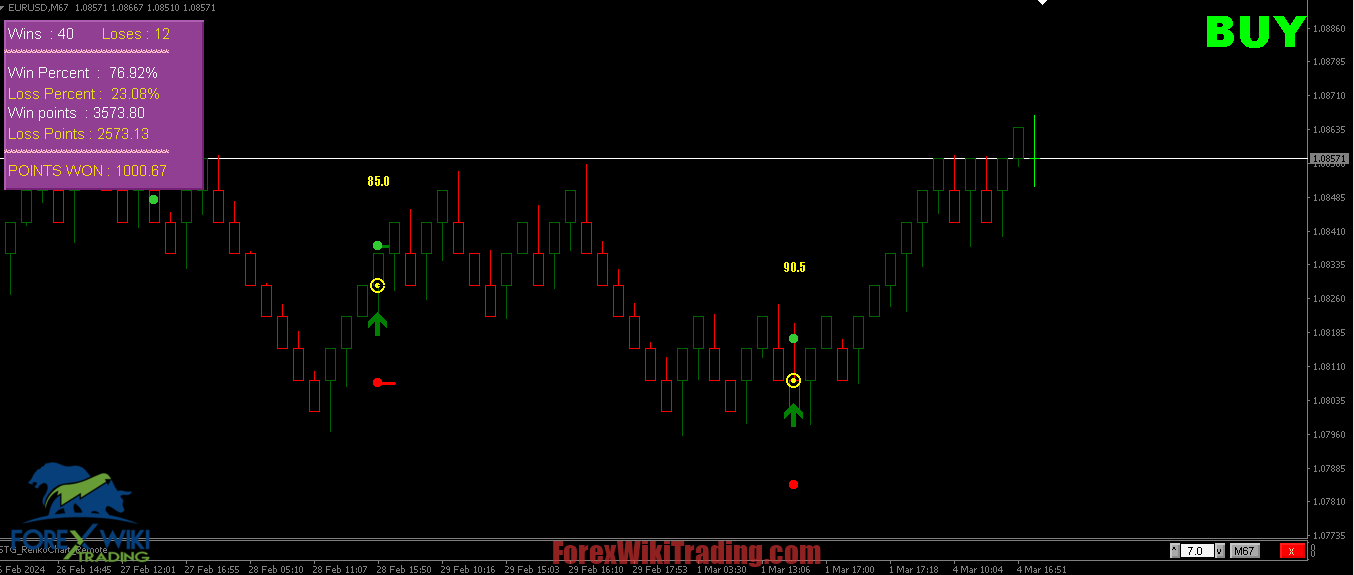

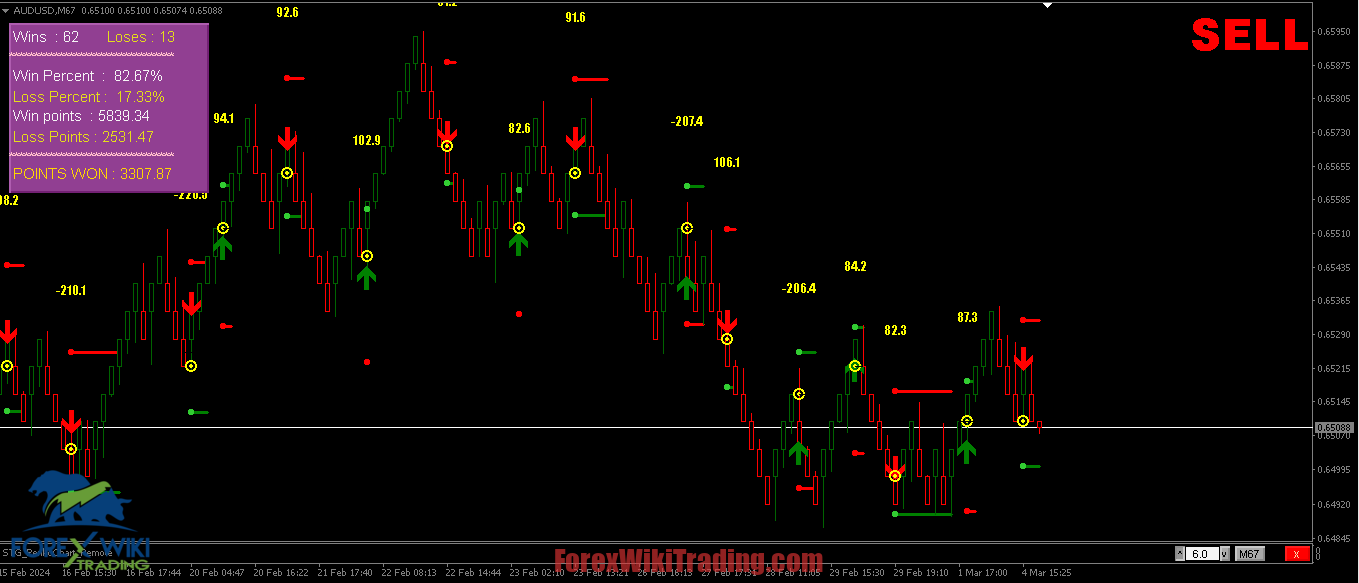

The Renko Precision Indicator is an MT4 arrow-type indicator designed specifically for Renko charts. With a robust backtesting dashboard that provides traders with useful information such as win rates and points won, this tool offers significant insights for making informed trading decisions. This comprehensive review will explore the features, advantages, and disadvantages of the Renko Precision Indicator, providing a balanced perspective for potential users.

Technical Specifications

Version: 4.10

Year of issue: 2024

Working pairs: Any

Recommended timeframe: Any

Minimum Deposit: $300

Average of account: 1:30 To 1:1000

Best Brokers List

Renko Precision Indicator works with any broker and any type of account, but we recommend our clients use one of the top forex brokers listed below:

Renko Precision Indicator Settings

Key Features

1. Renko Chart Integration

The indicator is tailored for Renko charts, a unique chart type that filters out market noise and focuses on price movement.

2. Backtesting Dashboard

The backtesting dashboard is a powerful feature that shows historical performance metrics, including win rates and points won, which are crucial for evaluating the indicator's effectiveness.

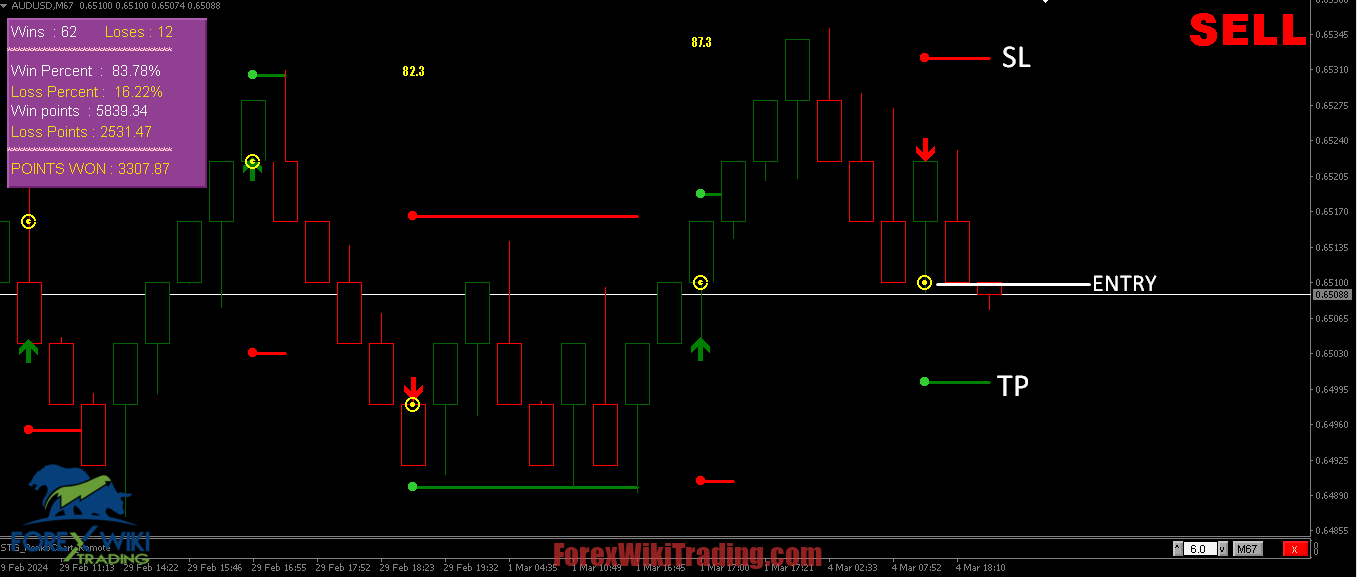

3. TP and SL Based on ATR

The indicator provides Take Profit (TP) and Stop Loss (SL) levels based on the Average True Range (ATR) multiplied by a user-defined factor. This dynamic approach adjusts TP and SL according to market volatility.

4. Signal Precision

Signals are given at bar open or intra-bar with a yellow mark indicating the exact price where the signal was generated. This precise marking aids traders in executing trades accurately.

5. Non-Repainting

The Renko Precision Indicator does not repaint or backpaint, ensuring that signals remain consistent and reliable.

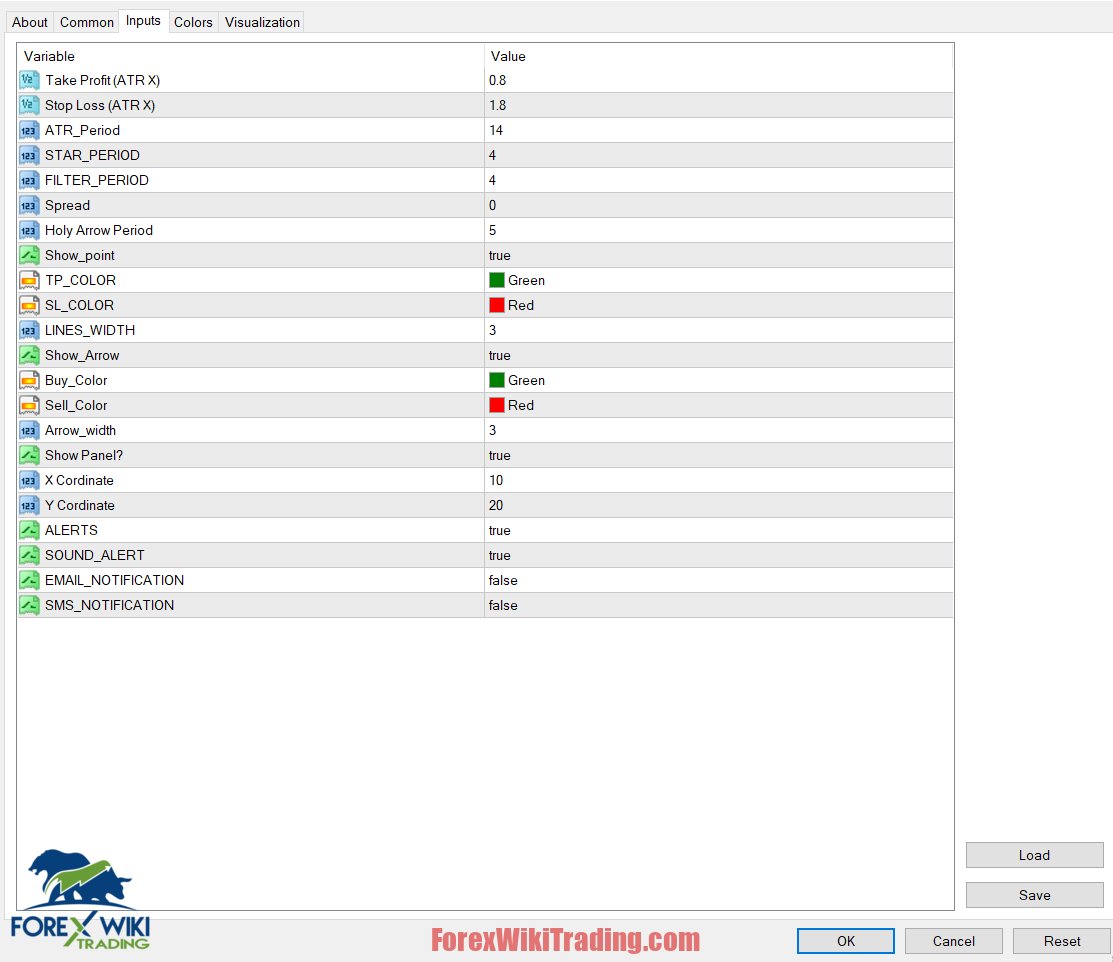

6. Customizable Parameters

Traders can adjust various parameters to optimize the indicator's performance:

- ATR TP: Take Profit value based on ATR.

- ATR SL: Stop Loss value based on ATR.

- ATR Period: The period for ATR calculation.

- Star Period: A custom period setting.

- Star Filter: A filtering mechanism for signals.

- History: Amount of history to backtest.

- Spread: Includes spread in backtesting calculations.

- Show Points: Displays signal results in points.

- Arrows and TP/SL Colors: Customizable signal and TP/SL colors.

- Alerts Settings: Configurable alert options.

- Panel/Dashboard Position: Adjustable dashboard position on the screen.

Renko Precision Indicator In Action

The instruction is here

- Copy both indicator from the zip in his indicators folder.

- Now open any pair chart, and add RenkoChart_Remote Indicator

- Now click on M67 In the Chart, now you can see new offline chart.

- Now add here Renkostar indicator in the Chart.

Now done.

Advantages

1. Enhanced Decision-Making

The backtesting dashboard provides a clear overview of historical performance, aiding traders in making well-informed decisions based on statistical data.

2. Dynamic Risk Management

The ATR-based TP and SL levels adjust according to market conditions, helping traders manage risk more effectively.

3. Clarity and Precision

Signals are marked with precision, reducing the chances of execution errors and ensuring clarity in trading decisions.

4. Customizability

The wide range of adjustable parameters allows traders to tailor the indicator to their specific trading style and preferences.

5. Reliability

The non-repainting nature of the indicator ensures that signals remain stable and reliable, fostering trader confidence.

Disadvantages

1. Complexity

For novice traders, the myriad of customizable parameters may be overwhelming. It requires time and effort to understand and optimize these settings effectively.

2. Dependency on Market Conditions

While the ATR-based TP and SL provide dynamic adjustments, they may not always align with sudden market shifts, potentially leading to suboptimal trade exits.

3. Requires Regular Monitoring

Despite the backtesting dashboard's insights, traders still need to regularly monitor and adjust the indicator settings to maintain optimal performance.

4. Potential Overfitting

Constantly tweaking the settings to achieve perfect backtesting results can lead to overfitting, where the indicator performs well on historical data but fails in live trading conditions.

Conclusion

The Renko Precision Indicator is a robust tool for traders utilizing Renko charts. Its backtesting dashboard, ATR-based TP and SL, and precise signals offer significant advantages in terms of decision-making and risk management. However, the complexity and need for regular monitoring make it more suitable for experienced traders. Overall, while the Renko Precision Indicator provides valuable insights and tools for forex trading, it requires careful handling to fully leverage its potential without falling into the trap of overfitting.

Download Renko Precision Indicator

Please try for at least a week an XM demo account. Also, familiarize yourself with and understand how this free forex ea works before using it on a live account.