- December 11, 2024

- Posted by: Forex Wiki Team

- Category: Free Forex EA

Unveiling AI Pips EA

In the vast landscape of Forex trading, expert advisors (EAs) often promise remarkable returns based on backtest performances. However, the reality often falls short of these lofty expectations, leaving traders wondering why their EA fails to deliver in live trading scenarios. The culprit? Over-fitting – a menace that undermines the efficacy of many trading systems.

Understanding Over-fitting in Forex Trading

Over-fitting occurs when an EA is meticulously tuned to historical data, yielding impressive results in backtests but failing to adapt to live market conditions. Developers, whether out of ignorance or intent, often fall into the trap of over-optimizing their EAs, rendering them ineffective in real-world trading environments.

Technical Specifications

Version: 4.3

Year of issue: 2024

Working pairs: AUDNZD, NZDCAD, AUDCAD

Recommended timeframe: M5

Minimum Deposit: $500

Average of account: 1:30 To 1:1000

Best Brokers List

AI Pips EA works with any broker and any type of account, but we recommend our clients use one of the top forex brokers listed below:

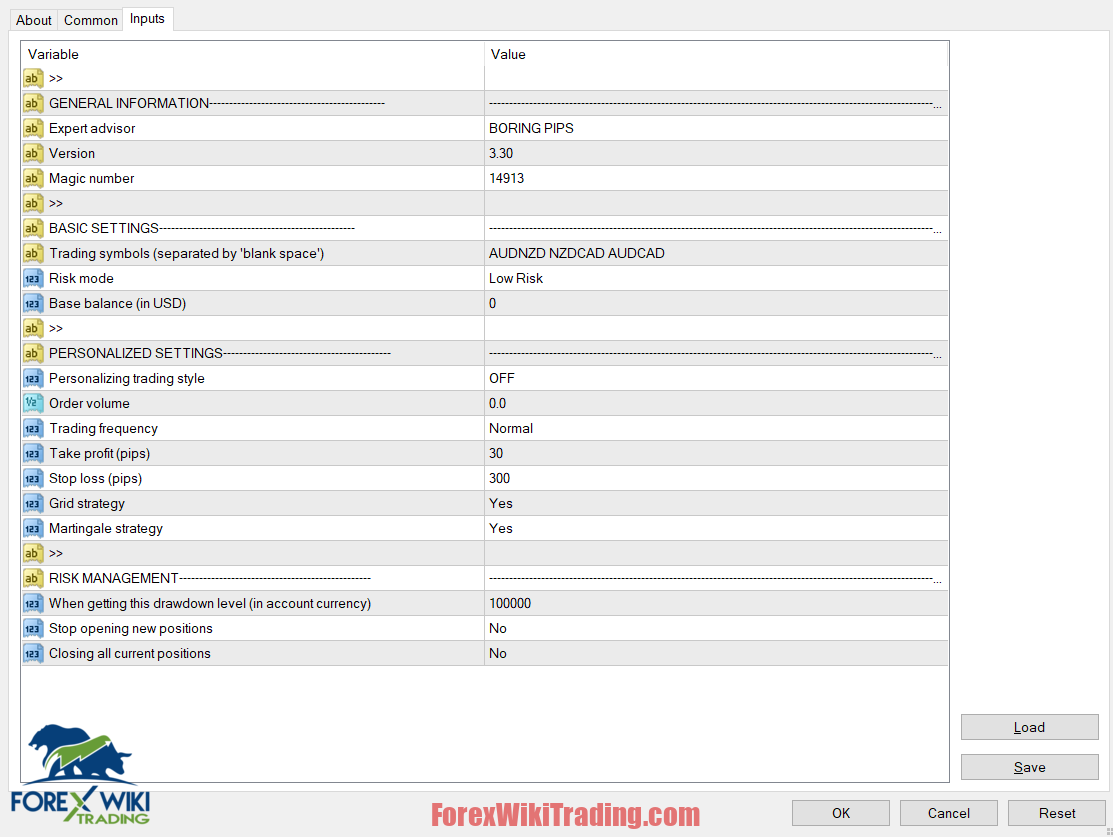

AI Pips EA Settings

Features and Specifications

- Trading Strategies: Momentum, Supply and Demand Zones, Fibonacci Retracement, Artificial Intelligence

- MultiCurrency EA: Yes, with one chart for all symbols

- Take Profit: Yes, with trailing feature

- Stop Loss: Yes, with fixed values

- Grid: Optional

- Martingale: Optional

- Manual Risk Management: Yes, with stop entry and close all positions functionalities

Installation and Personalization

To harness the full potential of AI Pips EA, follow these recommended installation steps:

- Install the EA on an AUDCAD/AUDNZD/NZDCAD chart with a timeframe of M5.

- Select the trading currency pair from the recommended options.

- Choose an appropriate risk mode based on your risk tolerance.

- Allocate a suitable balance for trading.

- Personalize settings as per detailed instructions provided.

The Pitfalls of Over-fitting

- Lack of Generalizability: EAs optimized solely on historical data lack the adaptability required to navigate dynamic market conditions.

- False Sense of Security: Impressive backtest results may deceive traders into believing that an EA is foolproof, leading to substantial losses in live trading.

AI Pips EA: A Beacon of Reliability

Enter AI Pips EA – a game-changer in the realm of Forex trading. Developed with a steadfast commitment to combat over-fitting, AI Pips EA undergoes a rigorous optimization process known as Anti-overfitting. This meticulous approach ensures that the EA's performance transcends the confines of historical data, offering traders a genuine edge in live trading environments.

The Anti-overfitting Process Unveiled

AI Pips EA's Anti-overfitting process comprises three pivotal stages:

- Initial Optimization: Historical data from 2010 to 2019 is utilized to fine-tune the EA, extracting robust parameter values and laying the foundation for a resilient trading strategy.

- Walk-forward Analysis: Parameters validated in the initial optimization phase undergo scrutiny using fresh data spanning from 2019 to 2022. This step ensures the stability and predictive power of the trading model under real-world conditions.

- Stress Testing: Parameters that withstand the rigors of walk-forward analysis are subjected to stress testing, where simulated market variables like noise and lag are introduced. This final examination evaluates the EA's resilience to unforeseen challenges, bolstering confidence in its efficacy.

The Power of AI Pips EA Algorithm

At the heart of AI Pips EA lies a potent algorithm that amalgamates cutting-edge artificial intelligence with time-tested trading strategies. Key components of this algorithm include:

- Momentum Analysis: Leveraging deep learning algorithms, AI Pips EA discerns changes in price momentum across multiple time frames, enabling it to identify lucrative trading opportunities.

- Supply and Demand Zones: The EA's sophisticated algorithm scans the market for potential supply and demand zones, where price reactions are likely to occur, facilitating strategic entry and exit points.

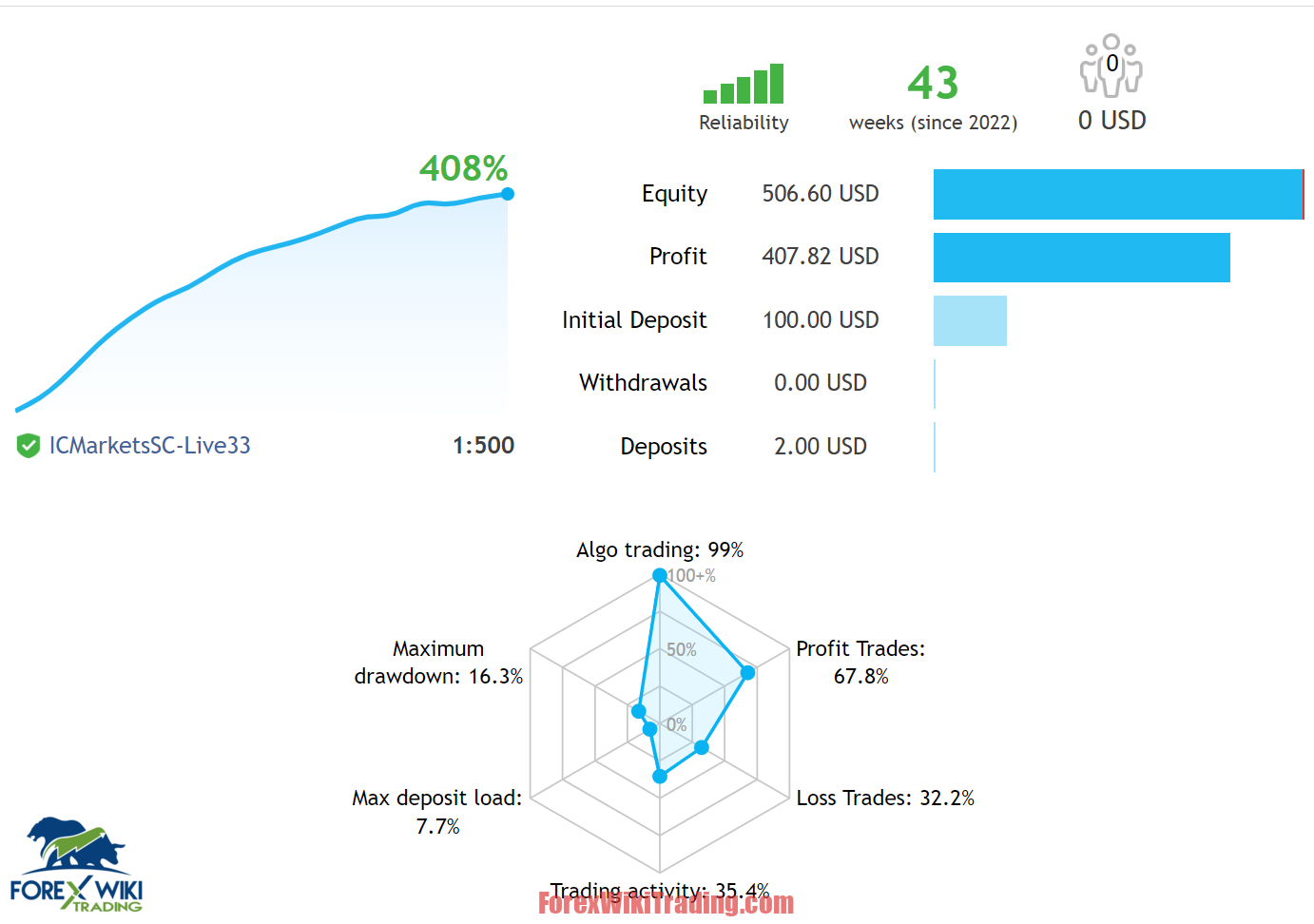

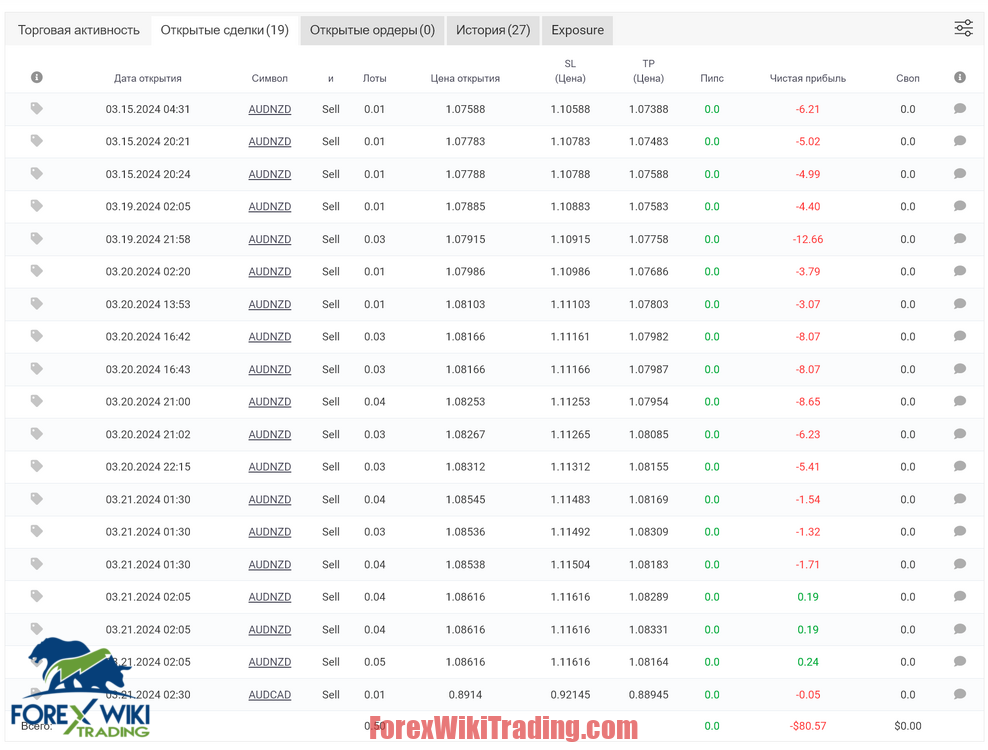

AI Pips EA Results

Advantages:

- Robust optimization process mitigates the risks of over-fitting.

- Incorporates advanced artificial intelligence for enhanced decision-making.

- Diverse trading strategies cater to varying market conditions.

- Comprehensive feature set allows for personalized trading experiences.

Disadvantages:

- Complexity may intimidate novice traders.

- Requires careful monitoring and adjustment to optimize performance.

- Reliance on past performance, albeit rigorously validated, does not guarantee future results.

Embrace the future of Forex trading with AI Pips EA – where innovation meets reliability, and profitability knows no bounds.

Conclusion: Embrace the Future of Forex Trading

In a landscape fraught with uncertainty, AI Pips EA stands as a beacon of reliability, offering traders a formidable ally in their quest for consistent profits. Through its innovative Anti-overfitting optimization process and cutting-edge algorithm, AI Pips EA transcends the limitations of traditional EAs, paving the way for a new era of Forex trading excellence.

Download AI Pips EA

Please try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a live account.

Disclaimer: Trading forex involves inherent risks, and past performance is not indicative of future results. Users are advised to conduct thorough research and seek professional advice before engaging in forex trading activities.