- October 29, 2024

- Posted by: Forex Wiki Team

- Category: Free Forex EA

Scalptimus BTC EA Review

Scalptimus BTC EA is an automated trading tool explicitly designed to capitalize on Bitcoin’s volatile market by employing a breakout strategy. With a unique approach that focuses on safe trading through adaptive parameters, Scalptimus BTC EA offers Bitcoin traders a distinct blend of risk management and automated precision. This review covers the EA’s key features, advantages, limitations, and performance metrics to help traders make an informed decision.

Technical Specifications

Version: 1.8

Year of issue: 2024

Working pairs: BTCUSD ETHUSD

Recommended timeframe: H1

Minimum Deposit: $500

Average of account: 1:30 To 1:1000

Best Brokers List

Scalptimus BTC EA works with any broker and any type of account, but we recommend our clients use one of the top forex brokers listed below:

Key Features of Scalptimus BTC EA

- Smart Adaptive Parameter System

- The EA adjusts its parameters—such as stop loss (SL), take profit (TP), trailing stop loss (TrailingSL), and lot sizes—based on Bitcoin’s price. This adaptive approach ensures that risk and reward levels scale dynamically, whether Bitcoin is priced at $6,000 or $30,000.

- This adaptability minimizes the need for manual recalibration, allowing Scalptimus BTC EA to remain effective in fluctuating market conditions.

- Low Drawdown and Risk Control

- Scalptimus BTC EA has been backtested with a high modeling quality of 99.9%, providing a strong indication of its reliability. During testing from 2020 to 2022, the EA maintained a relative drawdown of 12.25%, even with medium risk settings.

- With a profit factor of 2.04, Scalptimus BTC EA prioritizes a balanced risk-to-reward ratio of approximately 2:1, safeguarding capital through controlled risk management strategies.

- Automatic Lot Size Calculation Based on Risk

- The EA automatically adjusts the lot size based on the selected risk setting and Bitcoin’s current price, enabling tailored risk management that suits different account sizes.

- Predefined risk settings range from 0.5% (low risk) to 10% (high risk) per trade, making it flexible for both conservative and aggressive traders.

- Trade Management Focused on Safety

- Scalptimus BTC EA does not use risky trade management strategies like Martingale or grid trading, which can lead to large drawdowns. Instead, it focuses on single entries with protective stop losses and trailing stop losses, reducing the risk of account erosion.

- The EA also includes an automatic breakeven function, moving the stop loss to breakeven once a trade reaches a certain profit level, locking in gains and reducing risk.

- Compatibility with Low-Spread Brokers

- Given that Bitcoin spreads can vary significantly across brokers, Scalptimus BTC EA is best used with a broker offering low BTC spreads. This will ensure that its performance is optimized, as higher spreads can impact profitability.

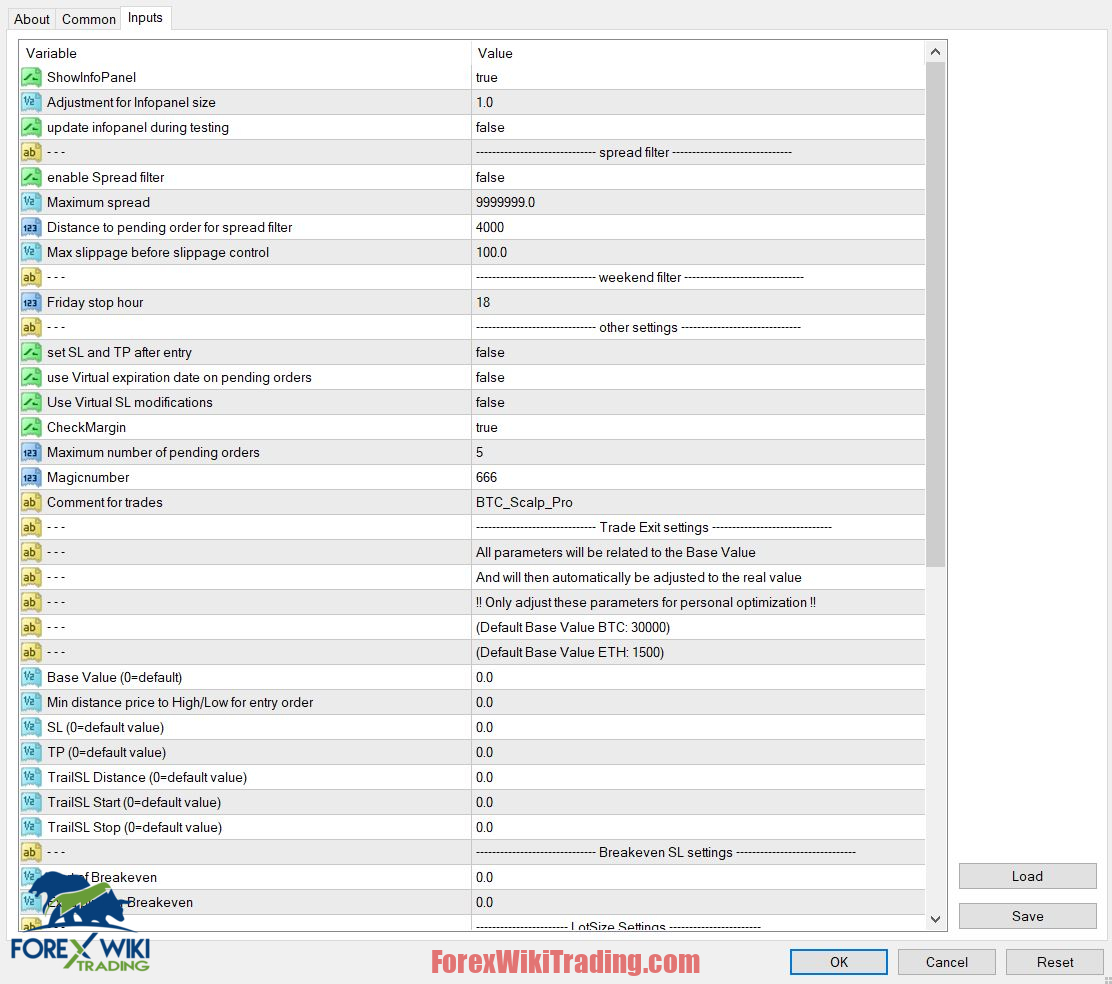

Setup and Configuration

Setting up Scalptimus BTC EA is straightforward:

- Chart and Timeframe: The EA should be applied to a BTC H1 chart.

- Parameter Settings: Users can fine-tune the risk percentage using the "Lotsize Calculation Method" parameter and select settings based on their risk tolerance.

- Spread and Slippage Control: The EA has features to control the maximum spread and slippage, allowing traders to set their desired thresholds.

Scalptimus BTC EA : Backtesting Performance

Backtesting is a critical component to understanding an EA’s potential:

- High Modeling Quality: With 99.9% tick quality, Scalptimus BTC EA’s backtest from 2020 to 2022 shows promising results with a total net profit of $134,880.10, starting from an initial deposit of $1,000.

- Low Drawdown: Despite being set to a medium risk level, the EA maintained an absolute drawdown of $53.17 and a relative drawdown of 12.25%—both indicating strong capital preservation.

- Consistency: Scalptimus BTC EA executed over 1,000 trades, with a near 60% win rate on long positions and a profit factor above 2.0, showing consistent profitability.

Advantages of Scalptimus BTC EA

- Adaptive System for Enhanced Market Responsiveness: The EA’s dynamic parameter adjustments help it stay effective across different Bitcoin price levels, a rare feature in cryptocurrency trading EAs.

- Risk Management and Safety Measures: Scalptimus BTC EA’s strict use of stop losses, trailing stops, and breakeven points prioritizes capital safety, making it an attractive choice for cautious traders.

- Verified Backtest Performance: Verified backtests and live trading records show reliable growth, reinforcing the EA’s potential for consistent profits.

- No High-Risk Trade Management Systems: By avoiding strategies like Martingale or grid trading, Scalptimus BTC EA limits exposure to large losses, reducing risk for account depletion.

- Easy Setup for New and Experienced Traders: With straightforward setup and customization options, Scalptimus BTC EA is accessible to all trading levels, especially those familiar with basic EA settings.

Disadvantages of Scalptimus BTC EA

- Broker-Dependent Performance: The EA’s reliance on low spreads for Bitcoin means that traders may need to carefully select a compatible broker to achieve optimal results.

- Single-Asset Focus: EA is exclusively designed for Bitcoin trading and may not be suitable for traders looking to diversify across multiple cryptocurrencies or forex pairs.

- Medium to High-Cost EA: High-performance EAs like EA generally come at a premium cost, which may require traders to evaluate ROI potential before purchase.

- Limited in Range-Bound Markets: EA may experience reduced effectiveness in low-volatility, range-bound markets where breakout opportunities are limited.

Recommended Usage for Scalptimus BTC EA

EA is best suited for traders who:

- Prefer Bitcoin trading and are comfortable with scalping or breakout strategies.

- Require an EA that manages risk meticulously with adaptive settings based on the market’s price.

- Have access to a broker with low BTC spreads to avoid unnecessary trading costs.

- Appreciate the simplicity of setting up an EA but need advanced features that adapt to market volatility.

Final Verdict

In conclusion, Scalptimus BTC EA is a well-rounded Bitcoin trading EA that combines safety and adaptability to tackle the cryptocurrency market's volatility. Its smart parameter adjustment system and emphasis on low drawdown make it suitable for traders prioritizing capital preservation over high-risk, high-reward strategies. Despite its limitations, such as broker dependency and single-asset focus,EA shows strong potential for generating consistent returns in the Bitcoin market. However, as with any trading tool, thorough backtesting and a demo period are advised before live trading.

Download Scalptimus BTC EA

Please try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a live account.

Risk Disclaimer

Trading forex carries significant risks and may not be suitable for all investors. Past performance does not guarantee future results. The statistics and performance metrics presented are based on historical data and may not represent future performance. Traders should carefully consider their financial situation and risk tolerance before using any automated trading system