- April 11, 2023

- Posted by: Forex Wiki Team

- Category: Free Forex Indicators

MACD Divergence Alert Pro Review

Forex trading can be a challenging and rewarding endeavor, but it requires a lot of skill, knowledge, and patience to succeed. One tool that can help traders identify potential buy and sell signals is the Moving Average Convergence Divergence (MACD) indicator. The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security's price. The MACD is calculated by subtracting the 26-period exponential moving average (EMA) from the 12-period EMA. The result of that calculation is the MACD line, and a nine-day EMA of the MACD called the "signal line" is then plotted on top of the MACD line.

Traders can use the MACD to generate buy and sell signals based on crossovers of the MACD and signal line. For example, when the MACD crosses above its signal line, it can be a signal to buy the security, and when the MACD crosses below its signal line, it can be a signal to sell or short the security. However, the MACD can also be used to identify divergences between the MACD and the price of the security, which can provide valuable information about potential trend changes.

Best Brokers List

The MACD Divergence Alert Pro works with any broker and any type of account, but we recommend our clients use one of the top forex brokers listed below:

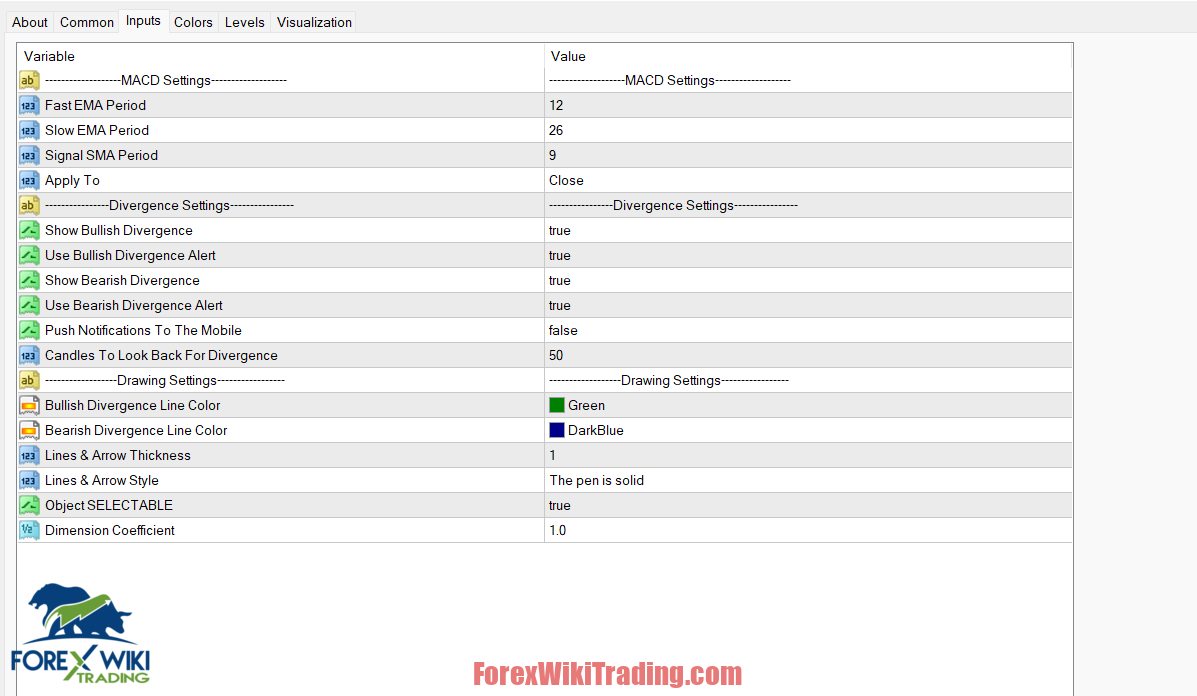

MACD Divergence Alert Pro Setting

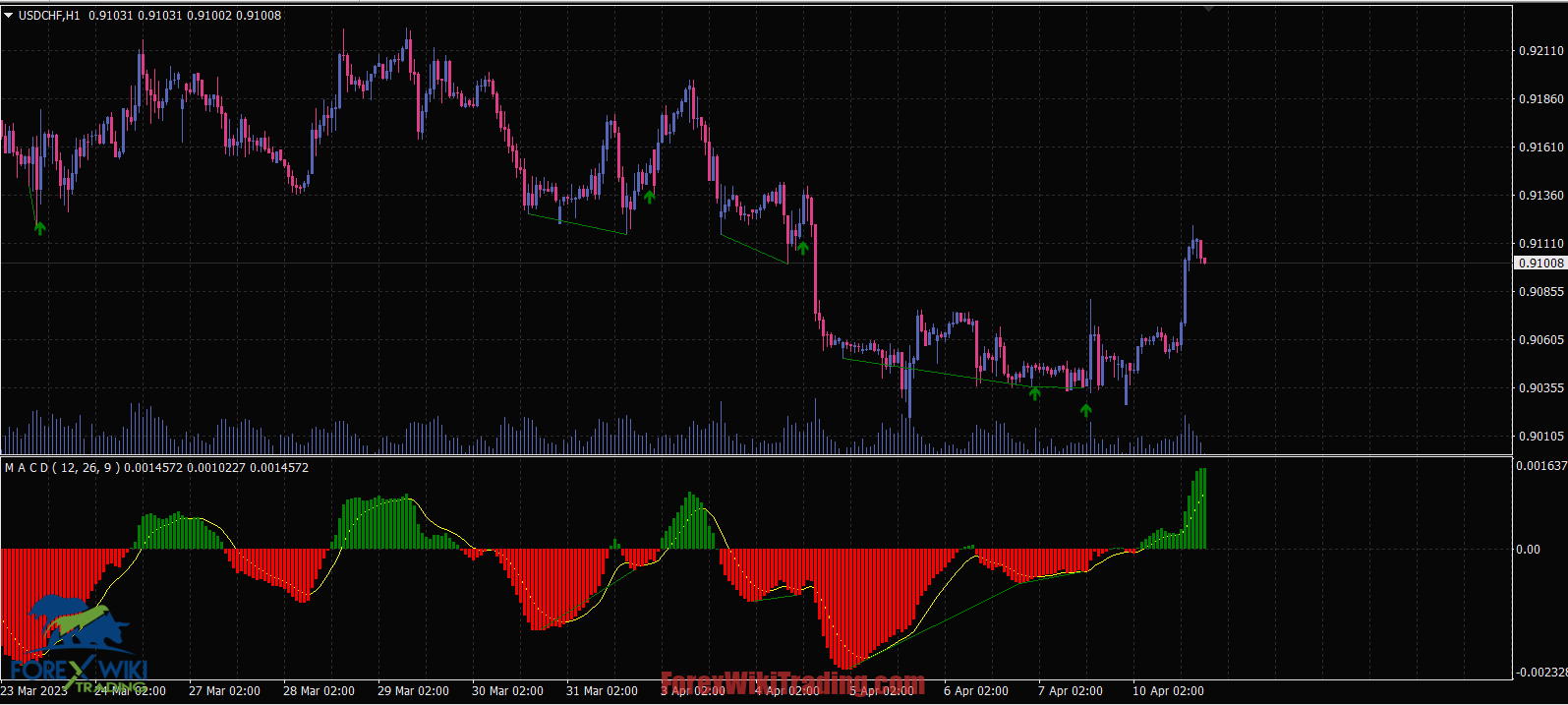

MACD Divergence Indicator

A bullish divergence occurs when the MACD forms two rising lows that correspond with two falling lows on the price. This is a valid bullish signal when the long-term trend is still positive. In contrast, a bearish divergence occurs when the MACD forms a series of two falling highs that correspond with two rising highs on the price. A bearish divergence that appears during a long-term bearish trend is considered confirmation that the trend is likely to continue.

The MACD Divergence Alert Pro is an indicator that can help traders identify divergences between the MACD and the price of the security. The indicator has several parameters, including MACD settings, divergence settings, and drawing settings. The MACD settings include fast EMA period, slow EMA period, signal SMA period, apply to, positive MACD color, negative MACD color, and signal color. The divergence settings include show bullish divergence, use bullish divergence alert, show bearish divergence, use bearish divergence alert, and candles to look back for divergence. The drawing settings include bullish divergence line color, bearish divergence line color, lines & arrow thickness, lines & arrow style, object selectable, and dimension coefficient for the arrow.

The MACD Divergence Alert Pro can be a useful tool for traders who want to identify potential trend changes based on divergences between the MACD and the price of the security. By setting the alert parameters, traders can receive notifications when a new bullish or bearish divergence is detected, which can help them take action quickly. However, traders should remember that the MACD is just one tool among many, and it should be used in conjunction with other indicators and analysis methods to make informed trading decisions.

Conclusion

The MACD Divergence Alert Pro is a powerful tool for forex traders who want to identify potential trend changes based on divergences between the MACD and the price of the security. With its customizable parameters and alert features, traders can stay on top of the market and make informed trading decisions. However, traders should remember that the MACD is just one tool, and they should use it in conjunction with other analysis methods to make informed trading decisions.

MACD Divergence Alert Pro Download

We highly recommend trying the MACD Divergence Alert Pro with ICMarket demo account. Also, familiarize yourself with and understand how this system works before using it on a live account.

Get MACD Divergence Alert Pro