- November 4, 2024

- Posted by: Forex Wiki Team

- Category: Free Forex EA

Aggro Trader EA: A Comprehensive Review

The Aggro Trader EA is an advanced forex expert advisor designed for traders who prefer aggressive strategies. It incorporates cutting-edge methodologies to identify and leverage market trends effectively, emphasizing precision, risk management, and steady profit accumulation.

Technical Specifications

Version: 1.0

Year of issue: 2024

Working pairs: EURUSD / GBPUSD / XAUUSD / USDCAD / NZDUSD / AUDUSD / EURJPY /

Recommended timeframe: M30 - H1

Minimum Deposit: $1000

Average of account: 1:30 To 1:1000

Best Brokers List

Aggro Trader EA works with any broker and any type of account, but we recommend our clients use one of the top forex brokers listed below:

Aggro Trader EA Settings

Input Parameters Analysis

- InfoPanel: Enables a user-friendly display of essential trading statistics.

- Lotfix: Set at 0.01, reflecting a fixed, low-risk lot size for accounts with a minimum balance of $1000.

- TakeProfit and UseTrailing: Offers flexibility in closing trades with a set profit target or using a trailing mechanism for maximum gains.

- MaxCountOrders: Restricts the number of open trades to 15, maintaining a balance between trading activity and risk exposure.

- MagicNumber: Ensures the EA tracks and manages its trades independently, avoiding conflicts with other trading strategies.

- PanelPosition: Configures the position of the visual panel for personalized trading setups.

Key Features and Parameters

- Trend Detection: The EA employs innovative trend analysis to pinpoint directional movements, making the most out of short-term market fluctuations.

- Profit Management System: It operates on a minimal profit, no-loss mechanism, ensuring all trades are closely monitored and controlled to mitigate risk.

- Lot Calculation: The recommended lot size is 0.01 per $1000 of the deposit, promoting a conservative approach to leverage.

- Trailing Options: Key parameters like

TrailStartandTrailStopallow trades to lock in profits efficiently, dynamically adjusting as the market moves. - Risk Control: Features such as

SafeEquityandSafeEquityRiskprovide built-in mechanisms to safeguard the account from extreme drawdowns. - Compatibility: Best suited for pairs like EURUSD, GBPUSD, XAUUSD, USDCAD, NZDUSD, AUDUSD, and EURJPY, with an optimal timeframe of M30 to H1.

Backtesting Results: Performance Insights

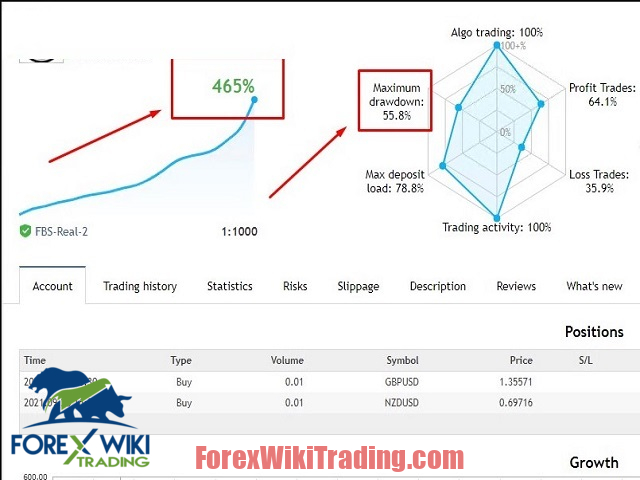

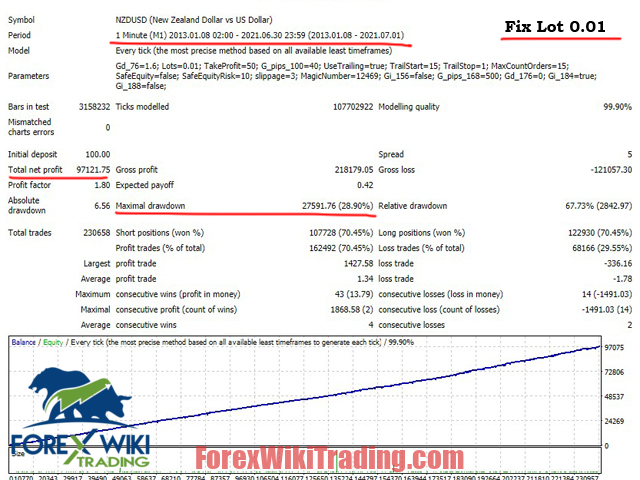

From the attached backtesting data for NZDUSD on the M1 timeframe (spanning 2013-2021), the EA demonstrates:

- Total Net Profit: $97,121.75 from an initial deposit of $100, signaling substantial profitability.

- Profit Factor: 6.56, indicating a strong profit to loss ratio.

- Maximal Drawdown: 27,591.76 (67.39%), a significant drawdown that underscores the high-risk nature of aggressive trading.

- Trades Analysis: 230,658 trades were executed, with a win rate exceeding 70% for both short and long positions.

These metrics reveal that the EA can generate substantial returns but requires careful risk management and capital allocation.

Recommended Usage and Setup

- Account Setup: Use on a minimum balance of $1000 per pair to avoid over-leveraging.

- VPS Requirement: For optimal performance and 24/7 trading, install the EA on a VPS with low latency.

- Demo Testing: Initial testing on a demo or cent account is crucial for two weeks to familiarize yourself with the EA's behavior and to optimize settings.

- Weekly Profit Collection: It is advisable to withdraw or secure profits weekly, especially on Fridays, as the EA accumulates earnings over the trading week.

Advantages of Aggro Trader EA

- High Profit Potential: The EA's aggressive approach can yield significant profits, as reflected in the backtest.

- Advanced Trend Analysis: The proprietary methods improve the EA’s ability to adapt to market changes.

- Risk Management: Built-in safety mechanisms like

SafeEquityhelp prevent catastrophic losses. - Customizable Settings: With parameters like

TrailStop,MaxCountOrders, andTakeProfit, traders can tailor the EA to their strategies.

Disadvantages of Aggro Trader EA

- High Drawdown Risk: The relative drawdown of 67.39% indicates the EA can suffer substantial losses before recovering, which may not suit risk-averse traders.

- Aggressive Strategy: The EA's trading style may not be appropriate for all market conditions, and performance could suffer during low-volatility periods.

- Dependence on Optimal Settings: Misconfiguring settings could lead to poor performance, emphasizing the need for proper setup and testing.

- VPS Dependency: Continuous operation on a VPS can add to the cost of running the EA.

Conclusion

The Aggro Trader EA is a robust tool for traders looking to capitalize on aggressive strategies. It combines powerful trend detection with sophisticated risk management, though the high drawdown levels and aggressive trading approach require careful capital management. Proper setup and regular monitoring are essential to maximize its potential while minimizing risks.

Download Aggro Trader EA

Please try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a live account.

Risk Disclaimer

Trading forex carries significant risks and may not be suitable for all investors. Past performance does not guarantee future results. The statistics and performance metrics presented are based on historical data and may not represent future performance. Traders should carefully consider their financial situation and risk tolerance before using any automated trading system