- July 4, 2023

- Posted by: Forex Wiki Team

- Category: Free Forex EA

Algo Smart Entry EA Review

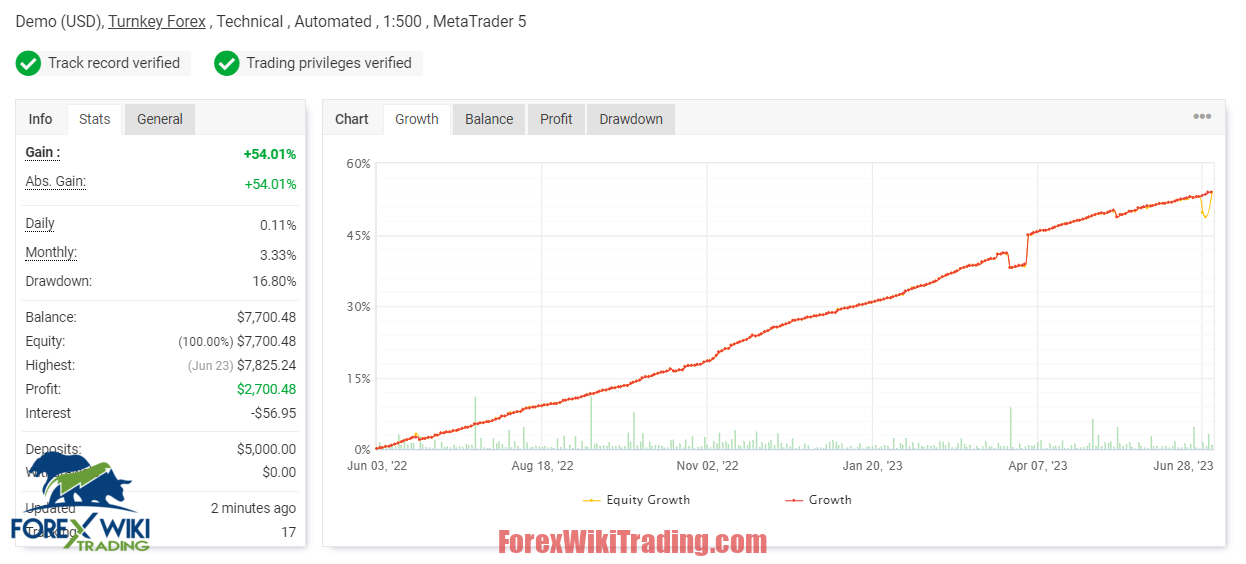

In the dynamic world of Forex trading, staying ahead of the game requires innovative strategies and tools. One such tool that has gained significant attention is the Algo Smart Entry EA. Designed to enhance scalping techniques, this expert advisor (EA) offers a unique approach to trading the EURUSD and GBPUSD pairs. With its robust money management system, trend-based trading approach, and reliable backtesting results, the Algo Smart Entry EA has emerged as a promising solution for traders seeking consistent profits in the Forex market. .

Recommended timeframe: M5, M15

Best Brokers List

Algo Smart Entry EA works with any broker and any type of account, but we recommend our clients use one of the top forex brokers listed below:

Scalping with Precision

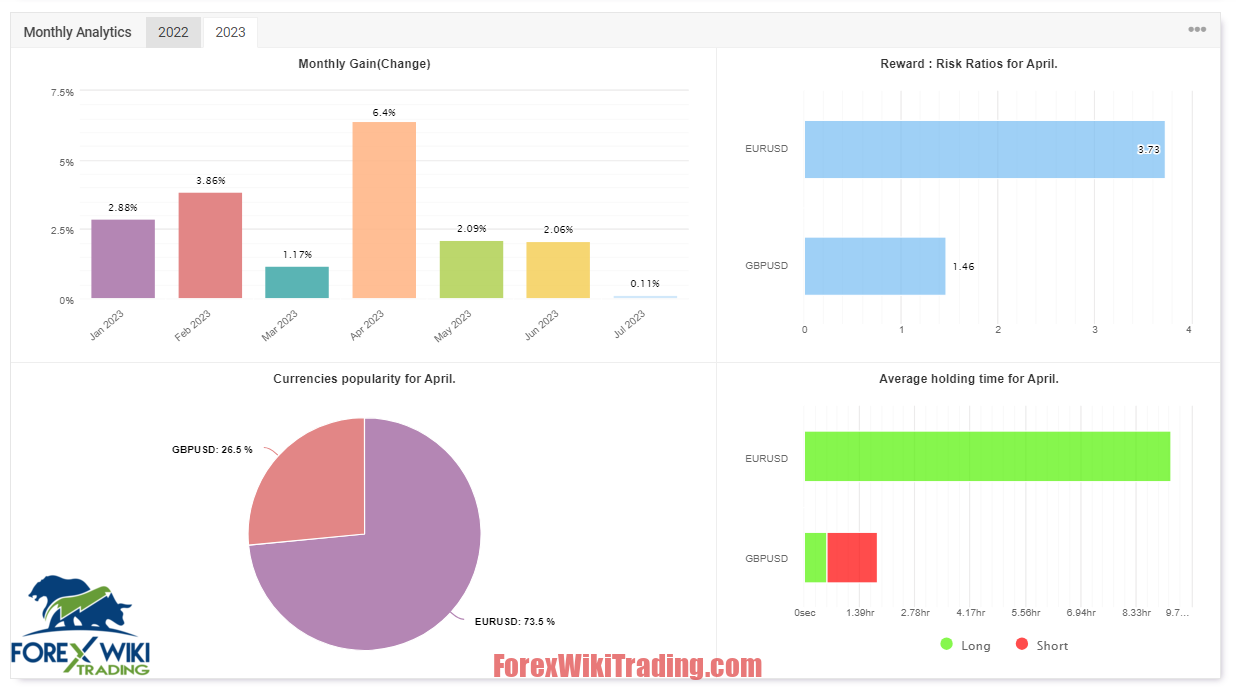

The Algo Smart Entry EA employs a scalping strategy, targeting small profits of 5-15 pips per trade. By taking advantage of short-term market fluctuations, it maximizes the potential for quick gains. With an average trade length of just 1.5 hours, this EA ensures swift execution and minimizes exposure to market volatility. By focusing on the larger time-frame trend, it identifies opportune moments within the dips to enter trades. This strategy allows traders to make precise entries and capitalize on potential profits.

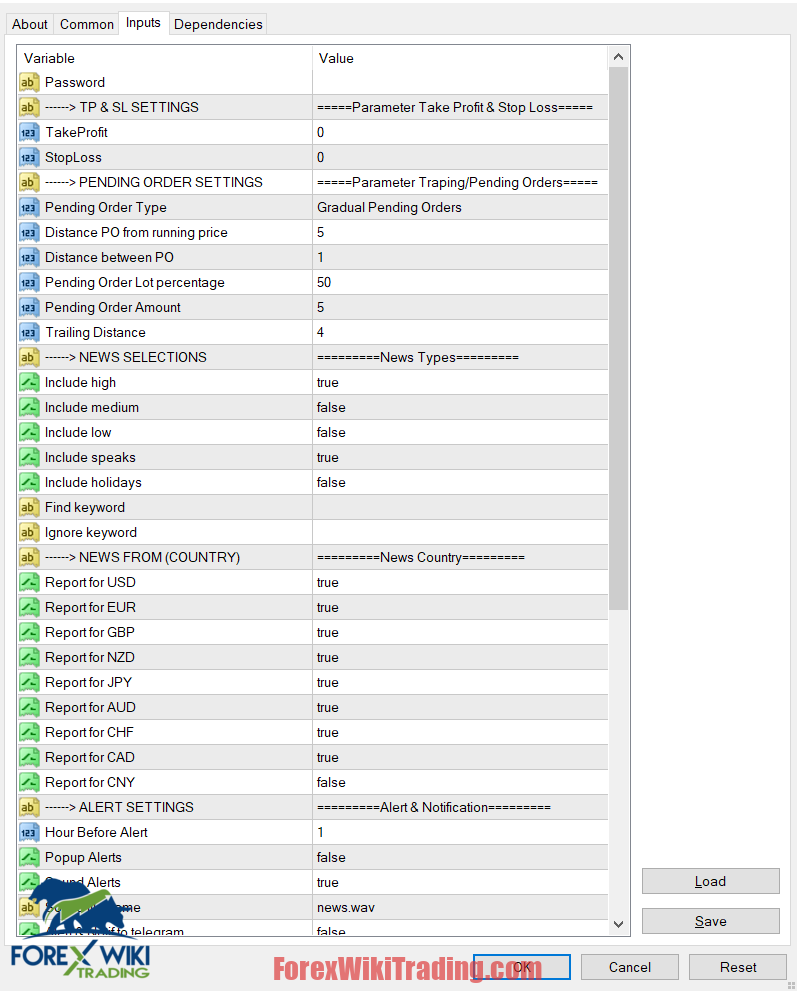

Adaptive Money Management

Effective money management is crucial for long-term success in Forex trading. The Algo Smart Entry EA incorporates a flex-grid money management system, which is active only when the trend is present. This adaptability enables the EA to navigate various market conditions and adjust position sizes accordingly. Traders can divide their starting balance into 20 or 10 equal parts, allowing for controlled risk exposure. Additionally, traders are advised to trade in accordance with their risk tolerance, ensuring that they are comfortable with the potential losses.

Risk and Reward Ratio

Managing risk and reward is a fundamental aspect of any trading strategy. The Algo Smart Entry EA emphasizes a disciplined approach to risk management. In the event of a loss, the EA limits the capital loss to only 5-10% of the total account balance or as per the trader's predetermined risk tolerance. However, when successful, the profit potential can reach several hundred percent. Historical records show impressive gains, such as a 2100% profit within two minutes in October 2017, showcasing the EA's potential to deliver substantial returns. It is important to note that achieving high-profit percentages is subject to market conditions and individual trading practices.

Optimized Time Management

Trading news events can present lucrative opportunities, but they require swift execution. The Algo Smart Entry EA focuses on high-impact news releases, selecting trades that have the potential for significant rewards. This selective approach ensures that traders maintain a manageable trade frequency, with approximately 7-10 trades per month. By referring to reliable sources such as fasteconomicnews.com, the EA streamlines the trade selection process, making time management highly efficient.

Overcoming Psychological Challenges

Emotions can often cloud judgment and hinder trading decisions. To counteract this, the Algo Smart Entry EA operates as an expert advisor, eliminating the impact of emotions such as fear, greed, and hope. By relying on a systematic and automated trading approach, traders can mitigate the psychological challenges associated with manual trading. The EA's rigorous testing since 2016 establishes its reliability and effectiveness in executing timely trades.

Alternative Risk and Money Management

While the Algo Smart Entry EA provides flexible money management options, it is essential for traders to exercise caution and prudence. Instead of employing excessive leverage, the EA encourages the use of leverage as minimally as possible. By avoiding overplotting, averaging down, or martingale strategies, traders can protect their capital and maintain a disciplined approach to trading.

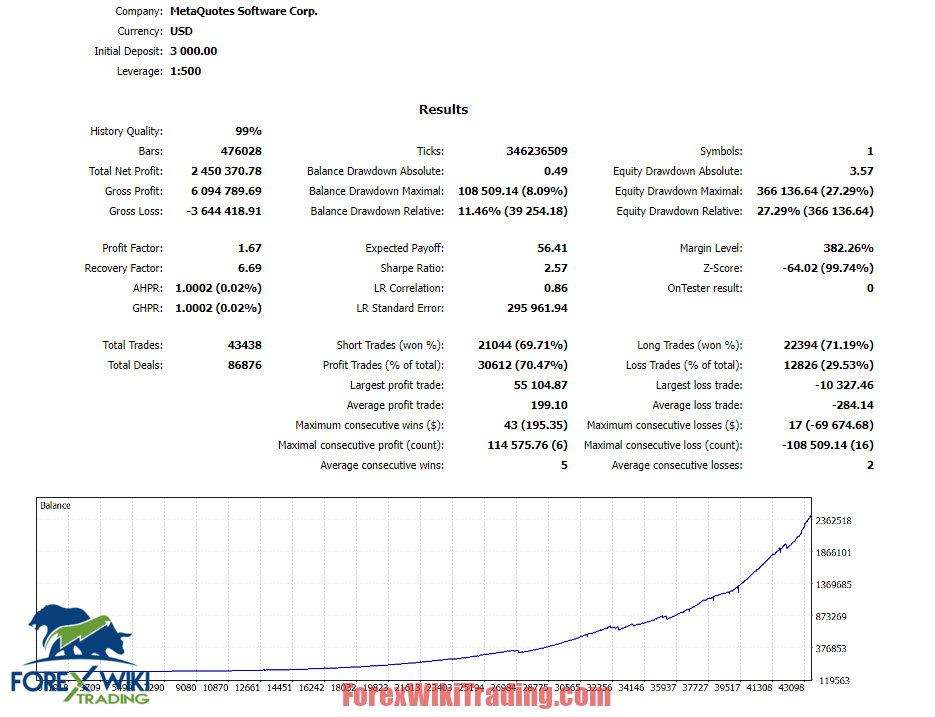

Reliable Backtesting Results

The Algo Smart Entry EA has undergone rigorous backtesting to ensure its reliability and adaptability. Using reliable and accurate Dukascopy data, the EA was tested with a variable spread, reflecting real market conditions. With an impressive modeling quality of 99.90%, the EA demonstrates its robustness and potential for consistent performance.