- November 14, 2024

- Posted by: Forex Wiki Team

- Category: Free Forex EA

Elite Pass Trader EA Review

The Elite Pass Trader EA is a high-frequency trading robot tailored to meet the demands of serious forex traders, especially those interested in passing prop trading challenges. Known for its success with prop firms such as First Class Forex Fund and Blue Forex Funds, this EA has gained popularity due to its reliable performance during high-volatility NY sessions. In this review, we’ll analyze its features, pros and cons, and how it operates in different trading environments.

Technical Specifications

Version: 1.0

Year of issue: 2024

Working pairs: US30, NAS100, and DAX

Recommended timeframe: M5

Minimum Deposit: $100

Average of account: 1:30 To 1:1000

Best Brokers List

Elite Pass Trader EA can work with any broker and any type of account, but we recommend our clients use one of the top forex brokers listed below:

Elite Pass Trader EA Settings

EA Settings Overview

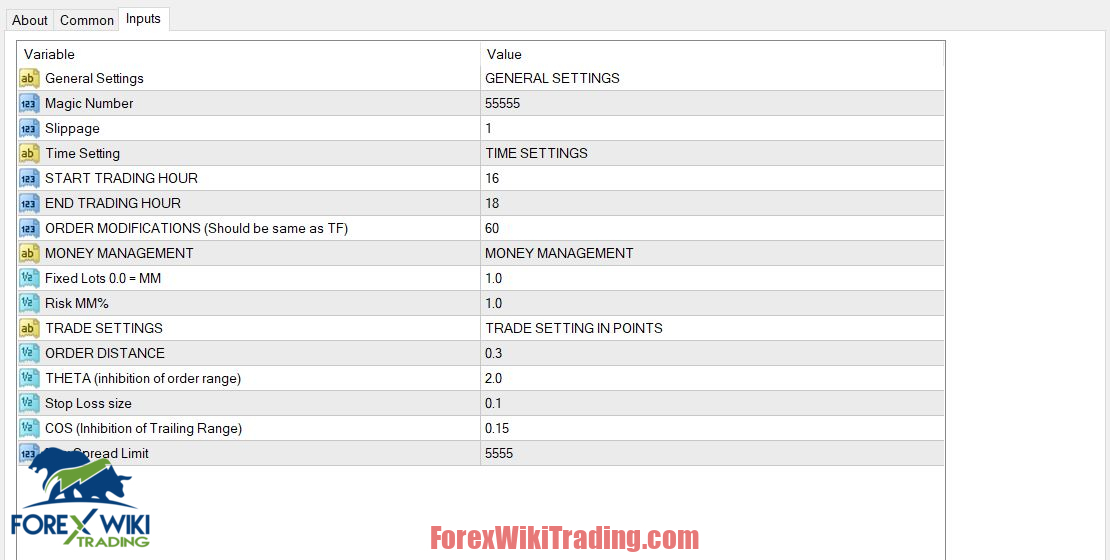

From the provided settings screenshot, some key variables include:

- Trading Hours: Configurable trading window with start and end hours.

- Order Modifications: Defined based on time frame, which adjusts according to the chosen strategy.

- Fixed and Risk-Based Lots: Provides flexibility between fixed lot sizing and risk percentage-based position sizing.

- Order Distance and Inhibition Parameters: Fine-tuning of entry settings to control order distance and prevent entry during unfavorable ranges.

- Trailing Range: COS inhibition setting to limit trailing stop activation.

Key Features of Elite Pass Trader EA

- High-Frequency Trading (HFT)

- The Elite Pass Trader EA is built to capture quick gains during NY session volatility. Its strategy revolves around rapid entries and exits, focusing on small pip movements to accumulate profit.

- Risk Management

- Users can configure the EA with either a fixed lot size or risk percentage-based management, allowing flexibility in position sizing. This feature is essential for traders with different risk appetites and capital sizes.

- Hedging Capabilities

- The EA supports hedging, which allows for risk balancing across trades. Hedging is especially beneficial for managing positions in volatile markets like indices.

- Stop Loss and Trailing Stop

- All trades are protected by a small stop loss to limit potential drawdown. Additionally, a trailing stop feature is available to lock in profits as trades move favorably.

- Compatibility with Specific Prop Firms and Brokers

- The EA has demonstrated consistent success with Eightcap and GOMarket servers, partly due to favorable conditions, such as minimal slippage and zero commissions on indices.

- Security Features

- The EA comes with Name Lock and Passcode Lock options to protect the software and ensure only authorized users can access it.

Advantages of Elite Pass Trader EA

- Short-Term Scalping for Consistent Returns

- By focusing on NY session volatility, the EA can capture quick trades, which is ideal for prop trading challenges that emphasize low drawdowns and consistent returns.

- Risk Management Flexibility

- The ability to toggle between fixed and percentage-based lot sizes is advantageous for traders with varying levels of experience and risk tolerance.

- User-Friendly Interface and Security

- The EA is easy to configure, even for those new to algorithmic trading. Security features ensure that the software remains accessible only to licensed users.

- Compatibility with Multiple Indices

- Optimized for indices such as US30, NAS100, and DAX, the EA is suitable for traders interested in both forex and indices, offering diverse trading opportunities.

- Small Stop Loss and No Martingale

- Unlike many EAs, the Elite Pass Trader EA avoids high-risk strategies like martingale, opting instead for limited-stop-loss protection, which suits conservative traders.

- Community Support and Continuous Updates

- Access to set files, tutorials, and an active community provides continuous learning opportunities, especially beneficial for novice traders.

Disadvantages of Elite Pass Trader EA

- Reliance on Specific Market Conditions

- The EA is optimized for NY session volatility, which may limit its effectiveness during other market hours. Traders need to time their sessions for optimal results.

- High-Frequency Trading Risks

- Due to its scalping nature, the EA is sensitive to slippage, spread, and slow execution, which can affect profitability. Choosing the right broker is critical to minimize these issues.

- Prop Trading Challenge Focus

- The EA's design is specifically oriented towards passing prop trading challenges, which may not align with the goals of long-term investors.

- Requires a Strong Internet Connection

- Due to its high trade frequency, the EA requires a reliable and fast internet connection to ensure trades are executed without delays.

Recommended Setup and Usage Tips

- Minimum Balance and Best Currency Pairs

- For optimal performance, a minimum balance of $100 is recommended. The EA performs best with EURUSD and indices like US30, NAS100, and DAX.

- Time Frame Selection

- The EA is most effective on the M5 time frame, balancing trade frequency and signal reliability.

- Broker Selection

- Selecting a broker with low spreads, minimal slippage, and no commission on indices, like Eightcap or GOMarket, will improve the EA's performance.

- Demo Testing First

- Testing on a demo account is advised to understand the EA’s behavior before transitioning to a live environment. This step helps familiarize traders with its settings and performance.

Conclusion

The Elite Pass Trader EA is a robust trading tool for high-frequency, short-term traders, particularly those targeting prop firm challenges. Its design prioritizes risk management and security while offering substantial customization options. Although its high-frequency trading approach requires specific conditions for peak performance, it offers a valuable resource for traders who prefer frequent, small-profit trades. However, due to its reliance on broker conditions and the NY session, it may not be ideal for all trading styles. Testing and a careful setup are essential for maximizing its potential.

Download Elite Pass Trader EA

Please try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a live account.

Risk Disclaimer

Trading forex carries significant risks and may not be suitable for all investors. Past performance does not guarantee future results. The statistics and performance metrics presented are based on historical data and may not represent future performance. Traders should carefully consider their financial situation and risk tolerance before using any automated trading system