- October 31, 2024

- Posted by: Forex Wiki Team

- Category: Free Forex EA

Comprehensive Review of ProSync EA:

The ProSync EA is an advanced expert advisor (EA) designed for the MetaTrader 4 (MT4) platform. This tool is built to optimize trading performance across multiple currency pairs using a portfolio-based strategy that combines trend-following and countertrend techniques. By dynamically managing risk and conducting correlated market analysis, ProSync EA aims to deliver consistent returns while minimizing exposure. Let’s delve into its features, capabilities, and the insights gathered from its performance metrics.

Technical Specifications

Version: 1.28

Year of issue: 2024

Working pairs: EURUSD, GBPUSD, USDJPY, AUDUSD, NZDUSD, USDCAD, EURGBP

Recommended timeframe: H1

Minimum Deposit: $500

Average of account: 1:30 To 1:1000

Best Brokers List

ProSync EA works with any broker and any type of account, but we recommend our clients use one of the top forex brokers listed below:

Key Features at a Glance

1. Minimum Deposit and Capital Requirement

To operate effectively, ProSync EA requires a minimum deposit of $500. This initial capital allows the EA to manage multiple trades across various currency pairs, mitigating the risk of margin calls. The diversified approach helps spread risk across trades, providing a balanced investment structure even in volatile conditions.

2. Time Frame Suitability

The EA is optimized for the H1 time frame, making it ideal for traders looking to capture broader market trends without getting entangled in the noise of lower time frames. This time frame aligns with the EA’s focus on trend-following and volatility-based strategies, allowing trades ample time to play out and improve profitability.

3. Currency Pairs

ProSync EA is compatible with a variety of currency pairs, including popular ones like EURUSD, GBPUSD, and USDJPY. By working with a diverse set of pairs, it allows traders to benefit from global market movements. Notably, the pie chart from November reveals that XAUUSD (gold) holds a significant share of the trading activity, suggesting a focus on more stable, high-value assets.

Strategy Overview

The ProSync EA employs an intricate trading strategy that leverages trend analysis, price action, and volatility patterns. Here’s a breakdown of its primary techniques:

- Multi-Currency Diversification: By managing trades across various currency pairs, the EA distributes risk, reducing reliance on any single currency’s performance.

- Trend-Following Approach: ProSync EA primarily follows the trend-following strategy, which capitalizes on major market trends to capture extended moves while mitigating reversals.

- Volatility-Based Entries: By analyzing market volatility with indicators like the Average True Range (ATR), it strategically enters the market when volatility favors profitable trades.

- Dynamic Position Sizing: The EA adjusts position sizes based on account equity and market conditions, promoting sustainable growth and safeguarding against potential losses.

- Stop Loss, Take Profit, and Trailing Mechanisms: The EA maintains disciplined risk management by setting strict Stop-Loss and Take-Profit levels, while also using a trailing stop to lock in gains.

- Partial Close Mechanism: To maximize profits, the EA employs partial close tactics that secure portions of profits once certain levels are reached, while a trailing stop ensures further gains if the trend continues.

Performance Analysis

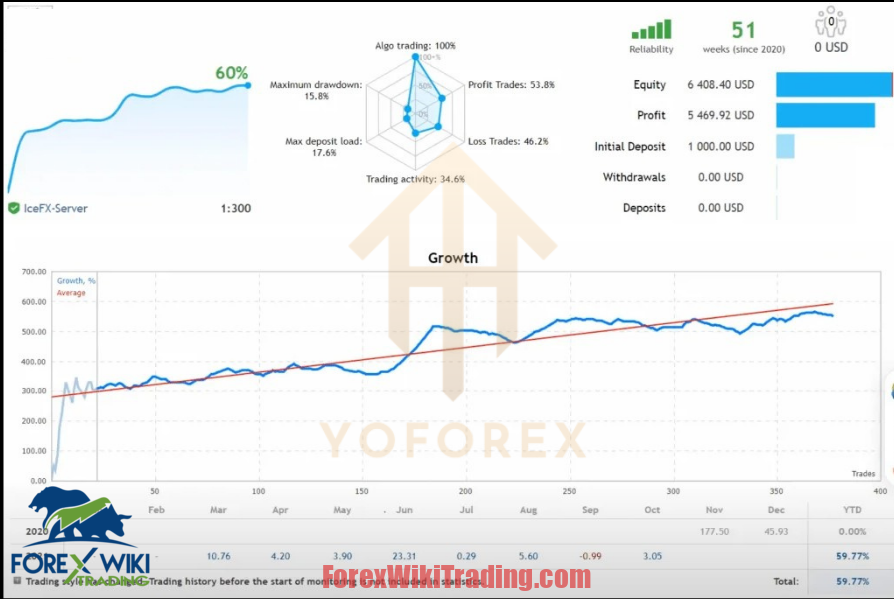

Based on the screenshots, let’s examine ProSync EA’s performance and risk metrics:

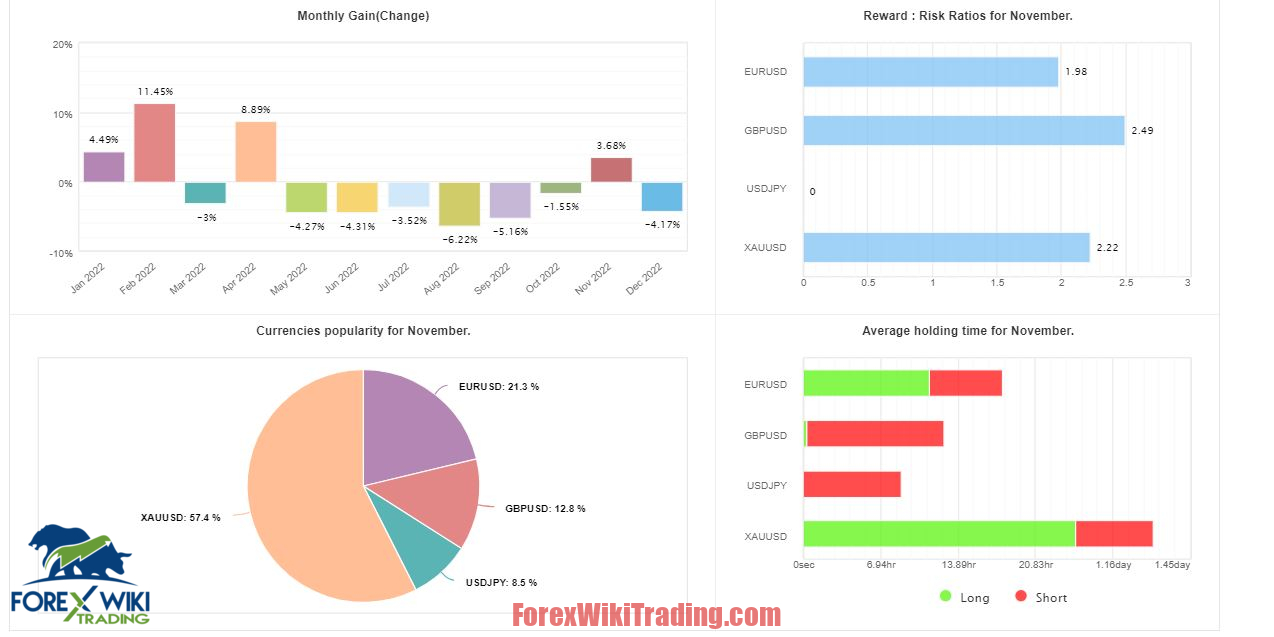

- Monthly Gain and Drawdown Analysis

- Performance Consistency: The monthly gain chart reflects significant fluctuations, with peaks in February (11.45%) and March (8.89%). However, it also shows notable losses, such as -6.22% in September, indicating periods of high volatility.

- Risk Factor: A drawdown of 35.22% suggests that, while the EA is capable of generating profits, it involves considerable risk exposure, requiring users to employ cautious risk management.

- Reward-to-Risk Ratios

- The EA has a respectable reward-to-risk ratio, particularly for pairs like GBPUSD (2.49) and XAUUSD (2.22). A higher ratio signifies that winning trades generally yield larger profits relative to losses, reflecting the EA’s effective risk management strategy.

- Currency Popularity for November

- According to the currency popularity chart, XAUUSD holds 57.4% of trading activity, suggesting a heavier focus on commodities during this period. EURUSD follows at 21.3%, while USDJPY and GBPUSD have relatively lower shares, potentially indicating ProSync EA’s adaptive strategy based on market conditions.

- Average Holding Time for Trades

- The holding time chart illustrates that most positions in XAUUSD are held for over a day, indicating a trend-following strategy designed to capture prolonged moves. On the other hand, EURUSD and GBPUSD trades are shorter, likely due to high liquidity and volatility that facilitate quicker trade closures.

Advantages of ProSync EA

- Diversified Currency Pair Coverage: ProSync EA covers multiple currency pairs, reducing dependency on any single currency's performance.

- Comprehensive Risk Management: The use of stop-loss, take-profit, trailing stops, and dynamic position sizing helps limit potential losses, making it suitable for risk-averse traders.

- Trend and Volatility-Based Strategy: By combining trend-following with volatility filters, ProSync EA optimizes entry and exit points, maximizing profit potential during favorable conditions.

- Automatic Adjustments: ProSync EA's ability to dynamically adjust lot sizes based on account balance and market volatility helps manage trades in a sustainable manner.

- Detailed Performance Insights: The EA provides comprehensive performance statistics, helping traders monitor and adjust settings based on monthly performance, reward-to-risk ratios, and currency pair popularity.

Disadvantages of ProSync EA

- High Drawdown Levels: The drawdown of 35.22% suggests potential risk, which may deter traders with low-risk tolerance.

- Variable Monthly Gains: The monthly gain chart indicates inconsistency in returns, which may not appeal to traders looking for steady income.

- Limited to MT4: ProSync EA is designed specifically for MT4, limiting its compatibility for traders who use other trading platforms.

- Higher Capital Requirement: With a recommended minimum deposit of $500, ProSync EA might not be suitable for traders with limited capital.

- Complex Strategy: Beginners might find it challenging to understand and utilize all the EA’s features, especially with multi-currency and dynamic position sizing strategies.

Conclusion

ProSync EA stands out as a robust forex trading tool, offering advanced capabilities for both trend-following and volatility-based strategies across multiple currency pairs. While it provides a diversified approach to minimize risk, users should be prepared for potential drawdowns and varying monthly returns. The EA’s complex setup and minimum capital requirement may make it better suited for experienced traders or those with a moderate risk appetite. Its MT4 compatibility, comprehensive risk management, and multi-currency support give it an edge in the forex trading landscape, but cautious monitoring and a sound understanding of market trends are essential for success.

Download ProSync EA

Please try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a live account.

Risk Disclaimer

Trading forex carries significant risks and may not be suitable for all investors. Past performance does not guarantee future results. The statistics and performance metrics presented are based on historical data and may not represent future performance. Traders should carefully consider their financial situation and risk tolerance before using any automated trading system