- August 18, 2024

- Posted by: Forex Wiki Team

- Category: Free Forex EA

Introduction to Red Volume EA

The Red Volume EA is a specialized Expert Advisor (EA) designed to enhance forex trading by leveraging a unique approach based on the Volume Profile FR. Unlike traditional volume indicators that display candle volumes, Red Volume EA's strategy focuses on calculating volume at specific price levels. This tool allows traders to identify critical areas where market reversals are likely, offering a strategic advantage in navigating the forex market.

This article delves into the features, advantages, and disadvantages of the Red Volume EA, offering a comprehensive review for traders considering its use.

Key Features of Red Volume EA

Volume Profile FR

The Red Volume EA employs the Volume Profile FR, which calculates volume at price levels rather than just within candles. This advanced method enables traders to pinpoint support and resistance levels with greater precision. Understanding where significant buying and selling volumes occur at different price levels can be crucial in predicting market movements.

Support and Resistance Levels

One of the primary uses of the Volume Profile FR is identifying support and resistance levels. These levels are reactive, based on historical price and volume behavior, making them a reliable indicator of where the market might reverse or stall. The EA uses this data to make informed trading decisions, adding a layer of depth to standard technical analysis methods.

Algorithm and Trading Strategy

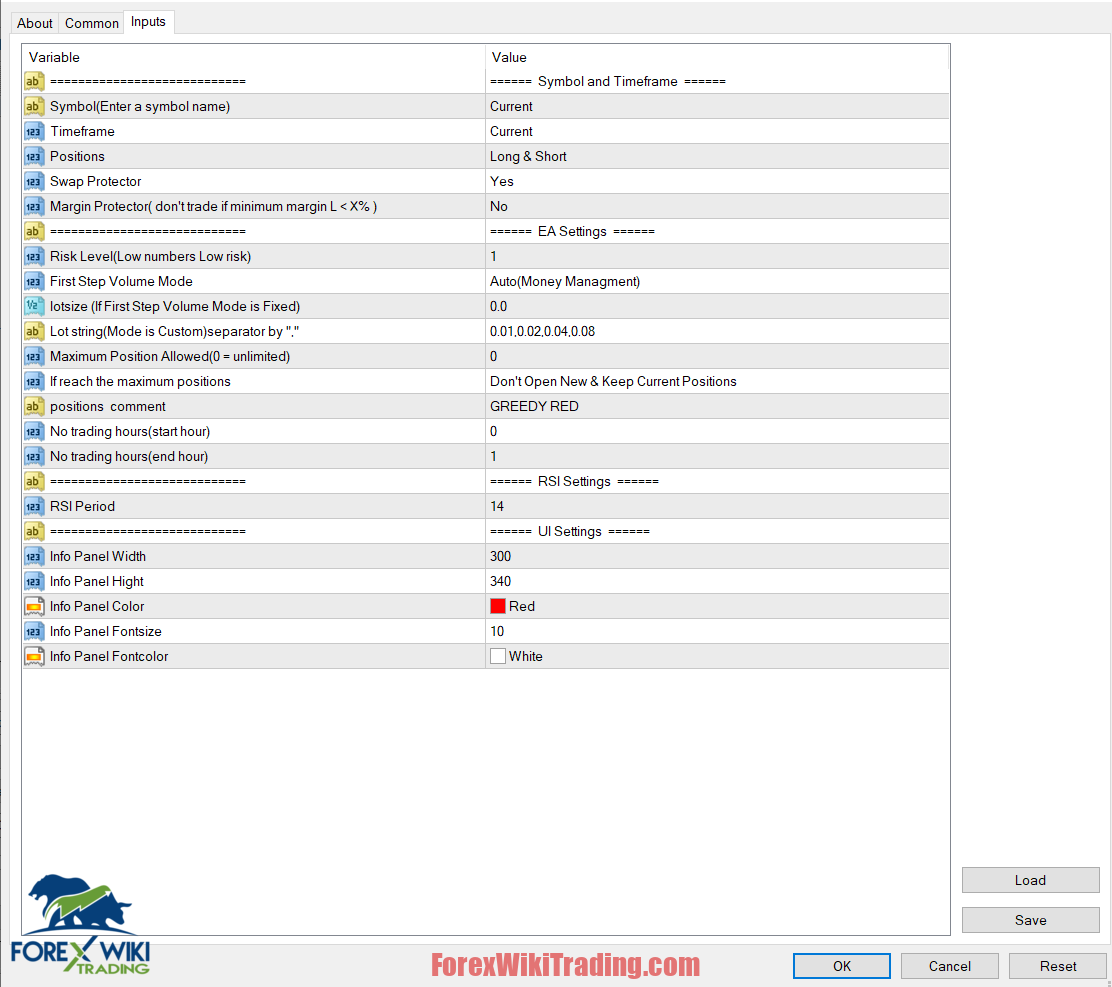

Red Volume EA's algorithm integrates the RSI Divergence Indicator to detect market divergences. Upon identifying a divergence, the EA opens a position. If the market moves in favor of the trade, a trailing stop is employed to maximize profits. Conversely, if the market moves against the position, the EA waits for a new divergence to add to the position using the Martingale method, ensuring that all positions are protected by stop-loss orders.

Automated Trading Management

All operations, including position opening, trailing stops, money management, and position protection, are fully automated. This level of automation ensures that trades are executed precisely according to the EA's strategy without the need for manual intervention.

Technical Specifications

Version: 2.6

Year of issue: 2024

Working pairs: AUDNZD- NZDCHF - AUDJPY - EURNZD - CHFJPY - AUDCAD - EURUSD CADJPY - EURAUD - NZDCAD - NZDJPY - EURJPY - USDCAD -XAUUSD

Recommended timeframe: M15,M30,H1,H4(M15 is the best)

Minimum Deposit: $1000

Average of account: 1:30 To 1:1000

Best Brokers List

Red Volume EA works with any broker and any type of account, but we recommend our clients use one of the top forex brokers listed below:

Settings and Performance Tips

For better performance, it is advisable to use accounts with lower spreads and commissions. The EA includes a time filter that can be adjusted to trade during periods of high market volatility or significant news events. Additionally, traders can run the EA on multiple charts simultaneously, using different "Magic Letters" to manage trades on various pairs without interference.

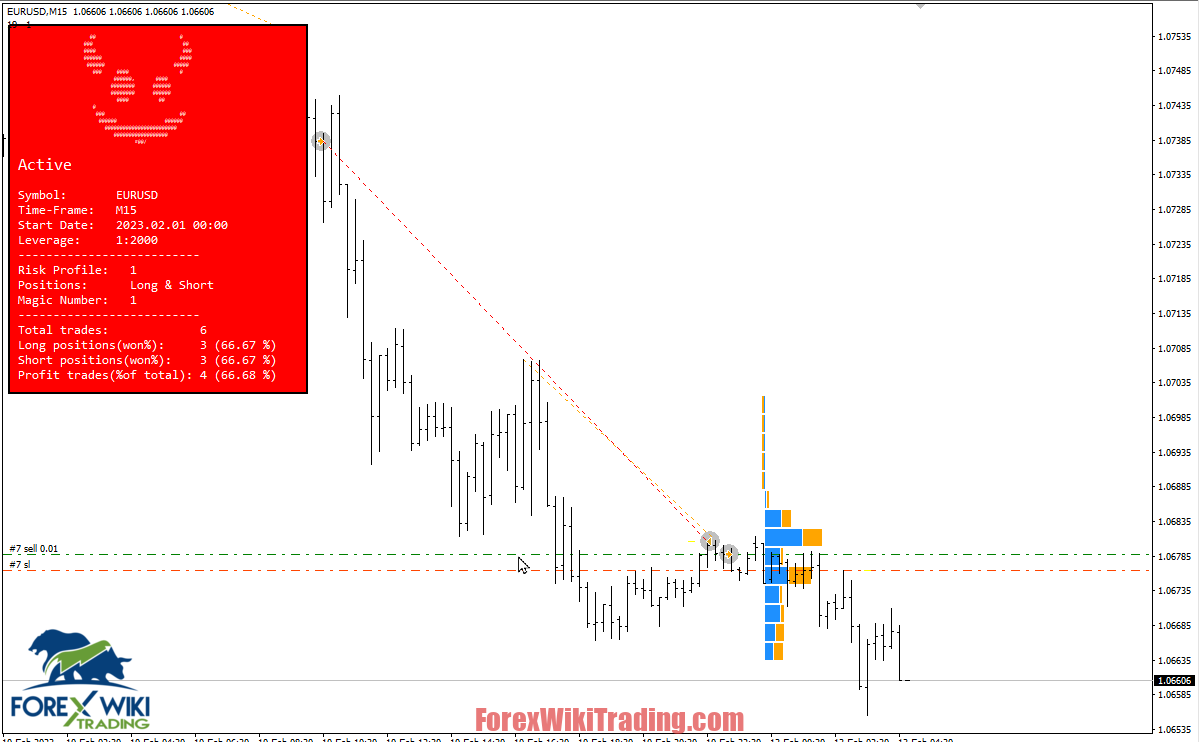

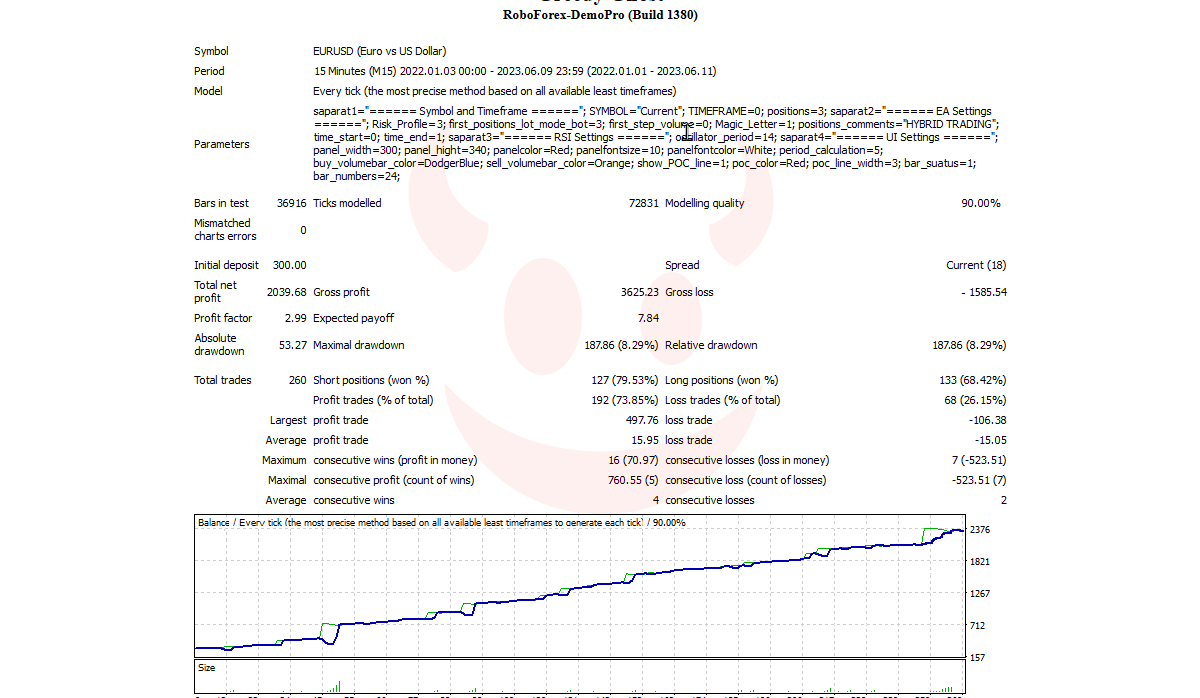

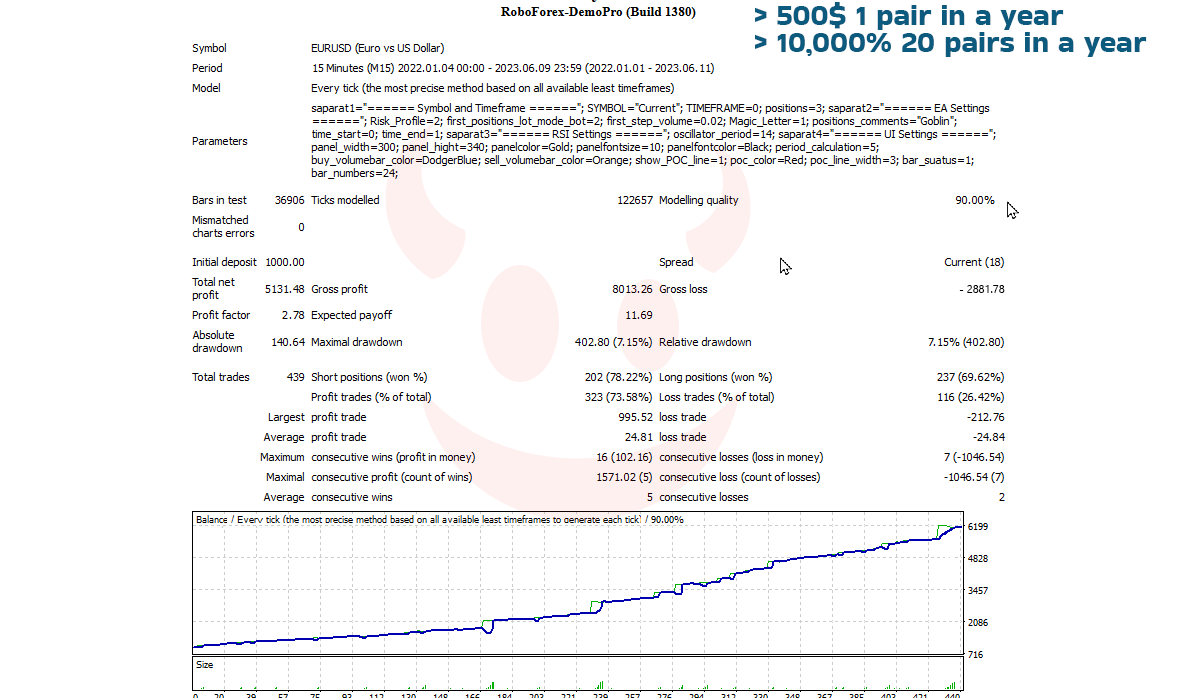

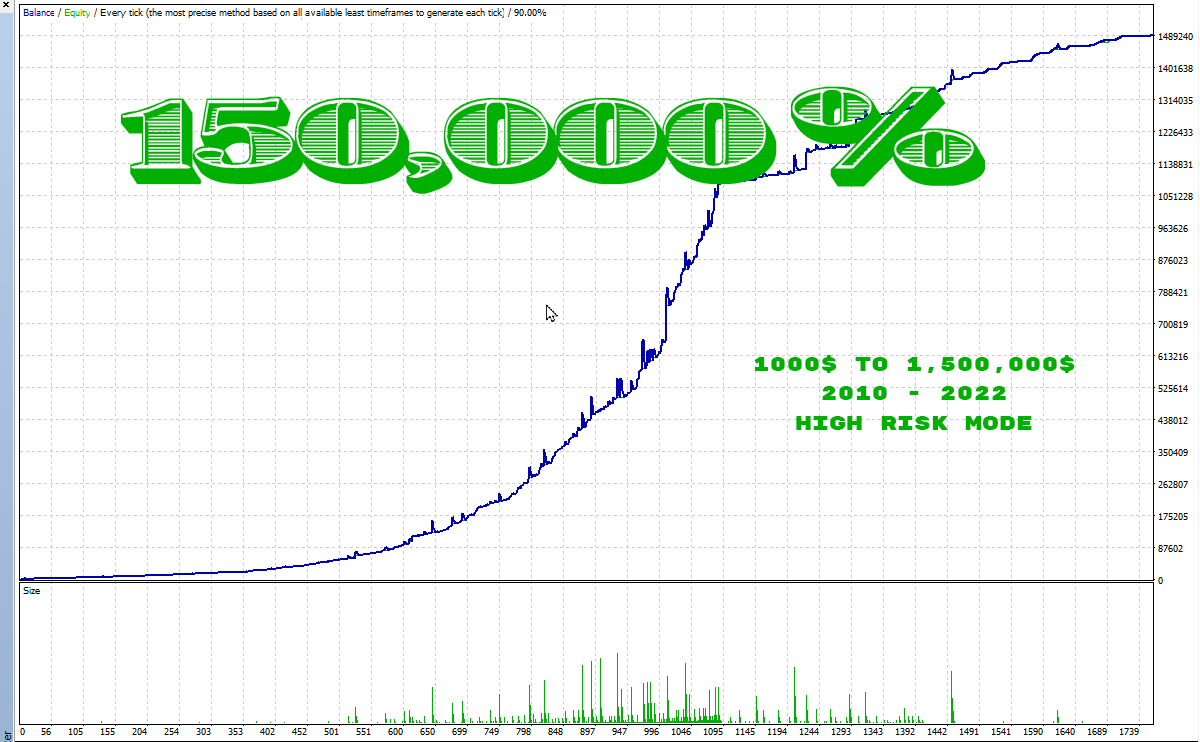

Red Volume EA Results

Advantages of Red Volume EA

Precision in Identifying Market Reversals

The Volume Profile FR's ability to calculate volume at specific price levels offers traders a unique insight into potential market reversals. This precision can lead to more successful trades, especially when combined with other technical analysis tools like Price Action and Elliott Wave analysis.

Automated Trading for Consistency

The fully automated nature of the Red Volume EA ensures that trades are executed consistently according to the predefined strategy. This removes the emotional aspect of trading, which can often lead to poor decision-making.

Adaptability Across Multiple Pairs and Timeframes

The EA's compatibility with various currency pairs and timeframes makes it a versatile tool for traders. Whether trading short-term or long-term, Red Volume EA adapts to the chosen strategy and market conditions.

Protection Against Market Fluctuations

With built-in stop-loss mechanisms and the use of the Martingale method, the EA protects against significant market fluctuations. This risk management feature is crucial in the volatile forex market.

Disadvantages of Red Volume EA

Dependency on Historical Data

Since the EA's strategy is based on reactive methods, it relies heavily on historical data. While this can be effective, it may not always account for sudden market changes or news events that could drastically alter price movements.

Martingale Method Risks

The use of the Martingale method, which involves doubling down on losing positions, can be risky. If the market continues to move against the trade, it can lead to significant losses, especially in highly volatile conditions.

Requires Trust in Automation

Traders need to fully trust the EA to execute trades without manual intervention. This can be challenging for those who prefer a more hands-on approach or who are skeptical of automated systems.

Potential for Overlapping Trades

When running the EA on multiple charts, there is a risk of overlapping trades if not managed carefully. This requires careful attention to the "Magic Letter" settings to ensure trades are isolated to their respective charts.

Conclusion: Is Red Volume EA Right for You?

Red Volume EA offers a robust trading tool for those looking to enhance their forex strategy with volume-based analysis. Its unique approach to identifying support and resistance levels, combined with automated trading and risk management features, makes it a compelling option for traders. However, its reliance on historical data and the risks associated with the Martingale method mean it may not be suitable for everyone.

Download Red Volume EA

Please try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a live account.