- August 20, 2024

- Posted by: Forex Wiki Team

- Category: Free Forex EA

TrendMaximizer EA Review: A Comprehensive Look at This Forex Trading Tool

Forex trading, known for its fast-paced environment and high potential for profits, has seen a surge in automated trading tools like the TrendMaximizer EA. Designed to maximize profits by capitalizing on market trends, this tool has garnered attention from traders seeking to enhance their strategies. But is it really as effective as it claims to be? This article will explore the ins and outs of the TrendMaximizer EA, weighing its pros and cons, so you can decide if it’s worth integrating into your trading toolkit.

What is the TrendMaximizer EA?

The TrendMaximizer EA is an automated trading tool, or "robo trader," developed to operate in cycles. Its main strategy is to grow profits by trading along trends, adding positions along the way, transferring those positions to a no-loss state, and cutting losses quickly. The bot aims to capture trend movements as efficiently as possible, using a dynamic trailing stop that’s supposed to be smoother and more reliable than the classic version.

Technical Specifications

Version: 23.072

Year of issue: 2024

Working pairs: Any

Recommended timeframe: Any

Minimum Deposit: $1000

Average of account: 1:30 To 1:1000

Best Brokers List

TrendMaximizer EA works with any broker and any type of account, but we recommend our clients use one of the top forex brokers listed below:

TrendMaximizer EA Settings

How Does It Work?

The TrendMaximizer EA begins each cycle by entering the market with two positions—one for buying and one for selling, both of equal volume. As the market moves, the bot adjusts the positions, moving them to a no-loss state if the trend is favorable. Once a position is secure, the bot opens a new pair of positions. Depending on the settings, the lot size might increase or decrease for trend positions.

The robot’s main feature is its ability to move positions to a no-loss state and then manage them with an upgraded trailing stop. Unlike a standard trailing stop, which might close a position prematurely, the TrendMaximizer EA’s version is smoother, aiming to keep positions open longer to capture more of the trend. Over time, this can result in a large number of profitable positions, all managed with minimal risk.

Key Features of the TrendMaximizer EA

- Cycle-Based Operation: The EA works in cycles, where it either starts fresh or continues with existing no-loss positions.

- Dual-Position Entry: It enters the market with both buy and sell orders, adjusting based on trend movement.

- No-Loss Transfers: Positions are moved to a no-loss state, minimizing the risk of losing money.

- Dynamic Trailing Stop: A modernized trailing stop that works separately for each position, preventing early closures.

- Manual Intervention: While the EA can manage everything, it does allow manual closing of positions, though it’s recommended to let the bot do its thing.

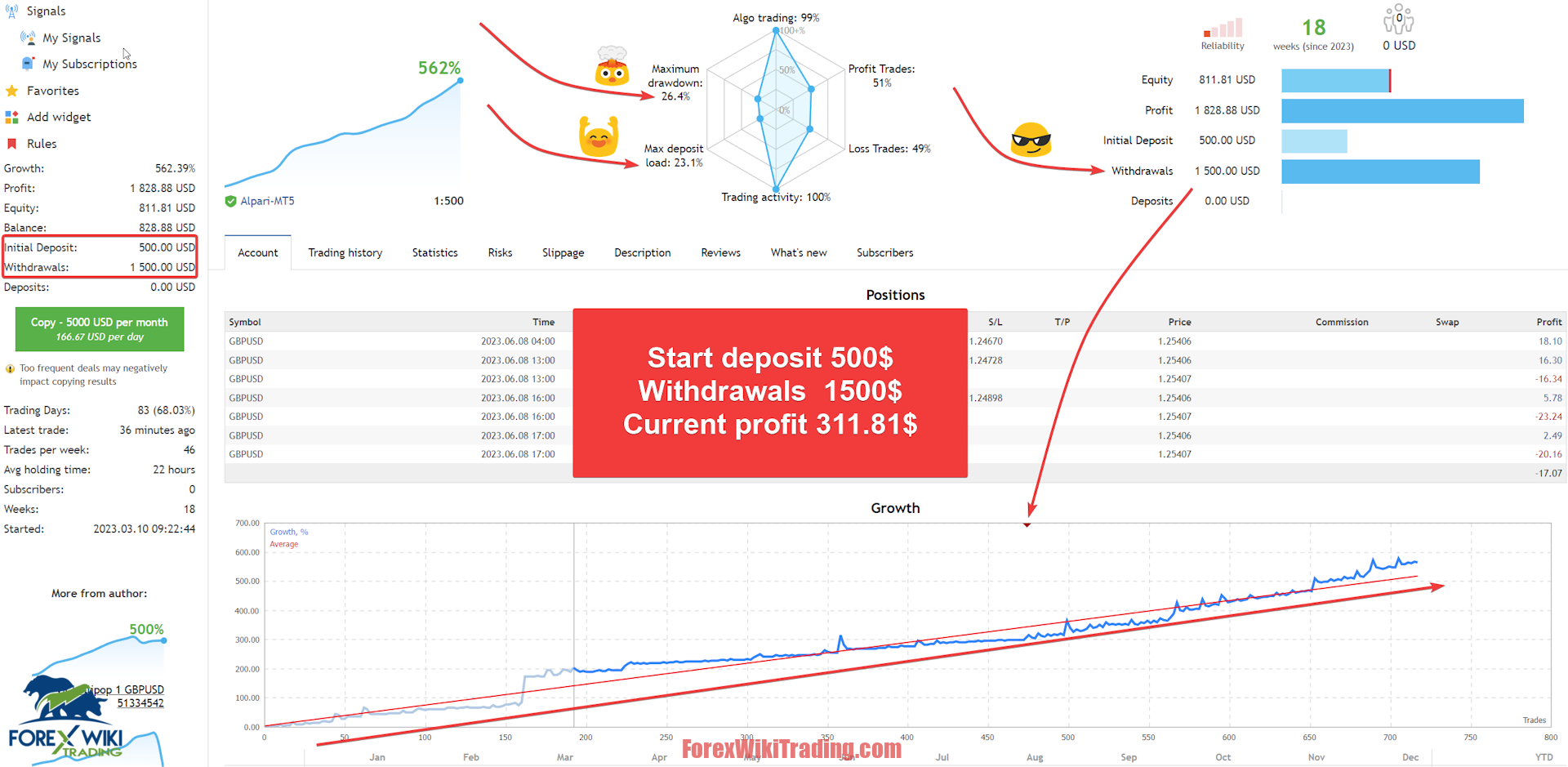

TrendMaximizer EA Reults

Advantages of Using TrendMaximizer EA

- Risk Management: The tool is designed to minimize risks by moving positions to a no-loss state and using a more reliable trailing stop.

- Automation: It handles everything from entry to exit, reducing the need for constant monitoring.

- Profit Maximization: By following trends and allowing profits to accumulate, it aims to maximize gains over time.

- User-Friendly Settings: With adjustable settings, even less experienced traders can customize the bot to their liking.

- Demo Testing: The ability to test on demo accounts helps traders understand the EA’s behavior without risking real money.

Disadvantages of Using TrendMaximizer EA

- Complexity for Beginners: Despite its user-friendly settings, the overall strategy might be confusing for those new to forex trading.

- Not Foolproof: Like any trading bot, it’s not immune to market volatility, and there’s no guarantee of profits.

- Initial Setup: It requires careful setup and understanding of the settings, which could be daunting for some.

- Over-Reliance on Automation: While automation is a plus, it might lead to a hands-off approach, which isn’t always ideal in fast-moving markets.

- Potential for Overtrading: The dual-position strategy could lead to overtrading in certain market conditions, increasing transaction costs.

How to Optimize Use of TrendMaximizer EA

To get the most out of TrendMaximizer EA, it’s crucial to first test it on a demo account that mimics real trading conditions. This helps you understand how the bot operates without putting real money at risk. Additionally, it’s wise to only trade with funds you can afford to lose and to regularly withdraw any profits to minimize risk.

Final Thoughts

The TrendMaximizer EA presents an intriguing option for forex traders looking to automate their strategies and maximize profits. Its focus on trend-following and no-loss management, coupled with a dynamic trailing stop, makes it a powerful tool in the right hands. However, it’s not without its challenges, especially for beginners or those who prefer a more hands-on approach. As with any trading tool, it’s important to approach it with caution, thoroughly test it, and understand its limitations.

Download TrendMaximizer EA

Please try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a live account.