- May 13, 2024

- Posted by: Forex Wiki Team

- Category: Free Forex EA

Introduction TrendTrekker EA

In the dynamic world of Forex trading, where fortunes are made and lost in the blink of an eye, having a reliable and profitable expert advisor (EA) by your side can make all the difference. One such tool that has been gaining traction among traders is the TrendTrekker EA. In this comprehensive review, we'll delve into the features, advantages, and disadvantages of this powerful trading bot.

Understanding TrendTrekker EA

TrendTrekker EA is not just another run-of-the-mill trading bot; it's a sophisticated tool designed to help traders navigate the complexities of the Forex markets with ease. From adaptive parameters to strategic trading opportunities, this EA empowers traders to customize their strategies and maximize profits intelligently.

Technical Specifications

Version: 1.0

Year of issue: 2024

Working pairs: GBPUSD, XAUUSD, EURUSD, AUDUSD, USDCAD, and US30

Recommended timeframe: M1

Minimum Deposit: $500

Average of account: 1:30 To 1:1000

Best Brokers List

TrendTrekker EA works with any broker and any type of account, but we recommend our clients use one of the top forex brokers listed below:

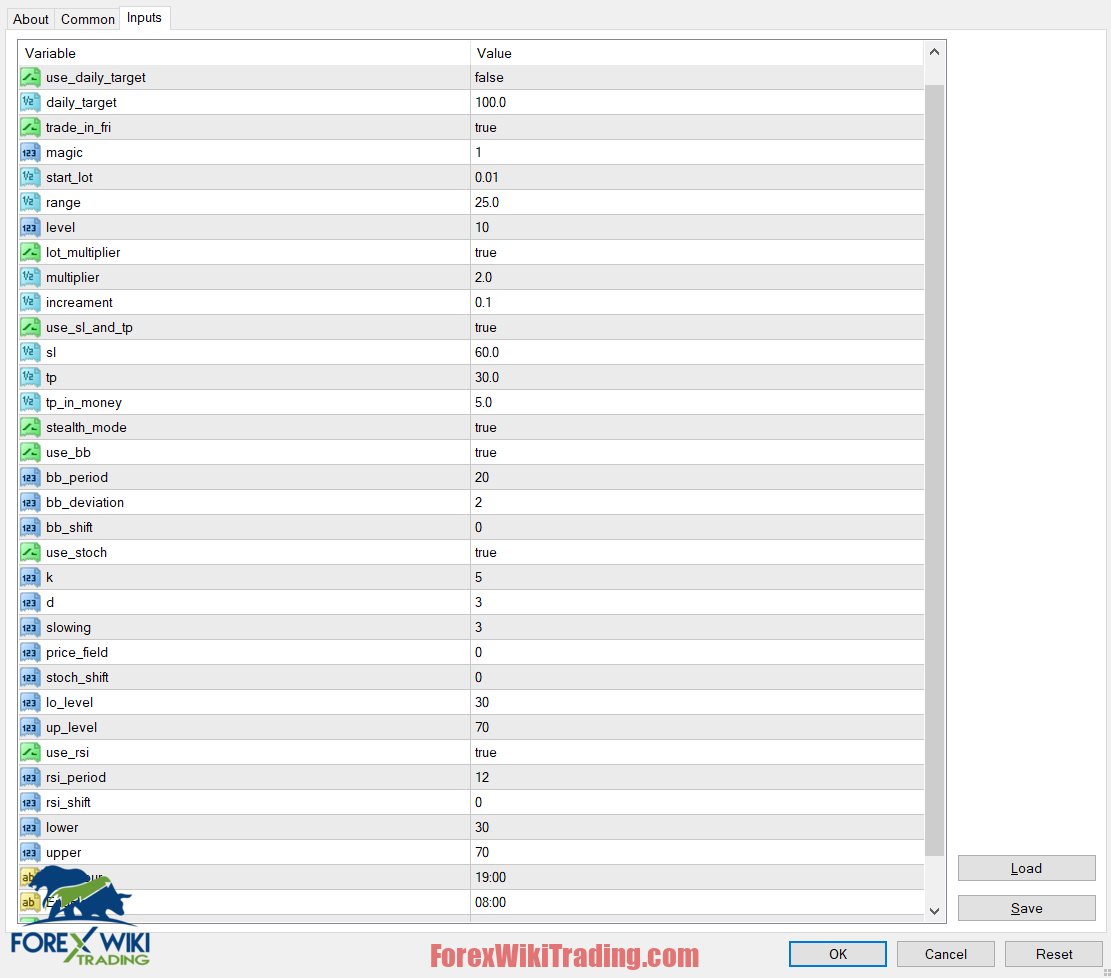

TrendTrekker EA Settings

Let's break down the parameters:

- strcom="grid": Indicates that the strategy being used is a grid trading strategy.

- use_daily_target=false; daily_target=100: Sets whether there's a daily profit target. Here, it's set to false, but if enabled, the target profit would be $100.

- trade_in_fri=true: Determines whether trading occurs on Fridays. If set to true, trading is allowed on Fridays.

- magic=1: A unique identifier for the trades executed by this EA. Helps differentiate its trades from others if multiple EAs are running simultaneously.

- start_lot=0.01: Specifies the initial lot size used for trading.

- range=25: Sets the grid range in pips.

- level=10: Determines the number of grid levels.

- lot_multiplier=true; multiplier=2; increment=0.1: If enabled, the lot size increases with each grid level. Here, the initial lot size is multiplied by 2 for each additional level, and the increment is set to 0.1.

- use_sl_and_tp=true; sl=60; tp=30; tp_in_money=5: Configures stop loss (SL) and take profit (TP) levels. SL is set to 60 pips, TP to 30 pips, and TP in money (presumably a feature to convert TP to a monetary value) is set to $5.

- stealth_mode=true: Likely conceals the SL and TP levels from the broker.

- use_bb=true; bb_period=20; bb_deviation=2; bb_shift=0: Utilizes Bollinger Bands (BB) indicator. BB period is set to 20, deviation to 2, and shift to 0.

- use_stoch=true; k=5; d=3; slowing=3; price_field=0; stoch_shift=0; lo_level=30; up_level=70: Implements Stochastic Oscillator. Parameters such as %K period, %D period, slowing, and levels are configured.

- use_rsi=true; rsi_period=12; rsi_shift=0; lower=30; upper=70: Includes Relative Strength Index (RSI) indicator. RSI period is set to 12, and the overbought and oversold levels are set to 70 and 30, respectively.

- StartHour="19:00"; EndHour="08:00": Specifies the start and end hours for trading. Here, trading starts at 19:00 (7:00 PM) and ends at 08:00 (8:00 AM).

- use_daily_maxloss=true; max_daily_loss=4000: Sets a maximum allowable daily loss. If enabled, the maximum daily loss allowed is $4000.

Key Features

Adaptive Parameters: One of the standout features of TrendTrekker EA is its adaptability. Traders can tailor the bot to their preferences by adjusting a range of parameters, allowing for greater flexibility and control over trading operations.

Strategic Trading: TrendTrekker EA provides traders with up to three daily trading opportunities across a variety of currency pairs, including GBPUSD, XAUUSD, EURUSD, AUDUSD, USDCAD, and US30. With built-in stop-loss and take-profit levels, traders can ensure optimal profits while minimizing risk.

Comprehensive Support: Getting started with TrendTrekker EA is a breeze, thanks to its comprehensive support system. Traders have access to detailed installation videos and setup guides, enabling them to hit the ground running with confidence.

Transparency and Ethics: Unlike some EAs that rely on risky strategies such as netting, martingale, or hedging, TrendTrekker EA prioritizes transparency and ethical trading practices. Traders can rest assured knowing that their assets are protected, with no hidden risks lurking in the shadows.

Smart Risk Management: With advanced risk management features, TrendTrekker EA helps traders protect their capital and ensure successful trading within the MT4 M1 timeframe. By implementing intelligent risk management strategies, traders can mitigate losses and maximize returns.

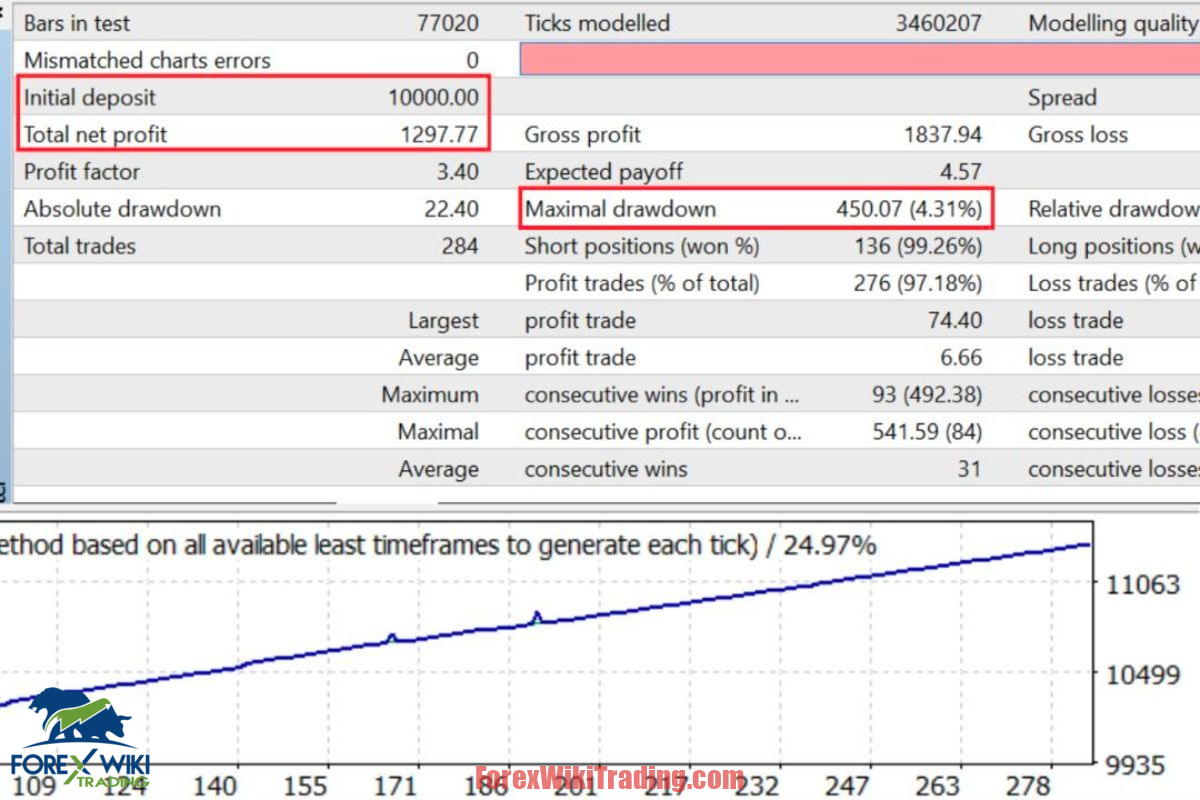

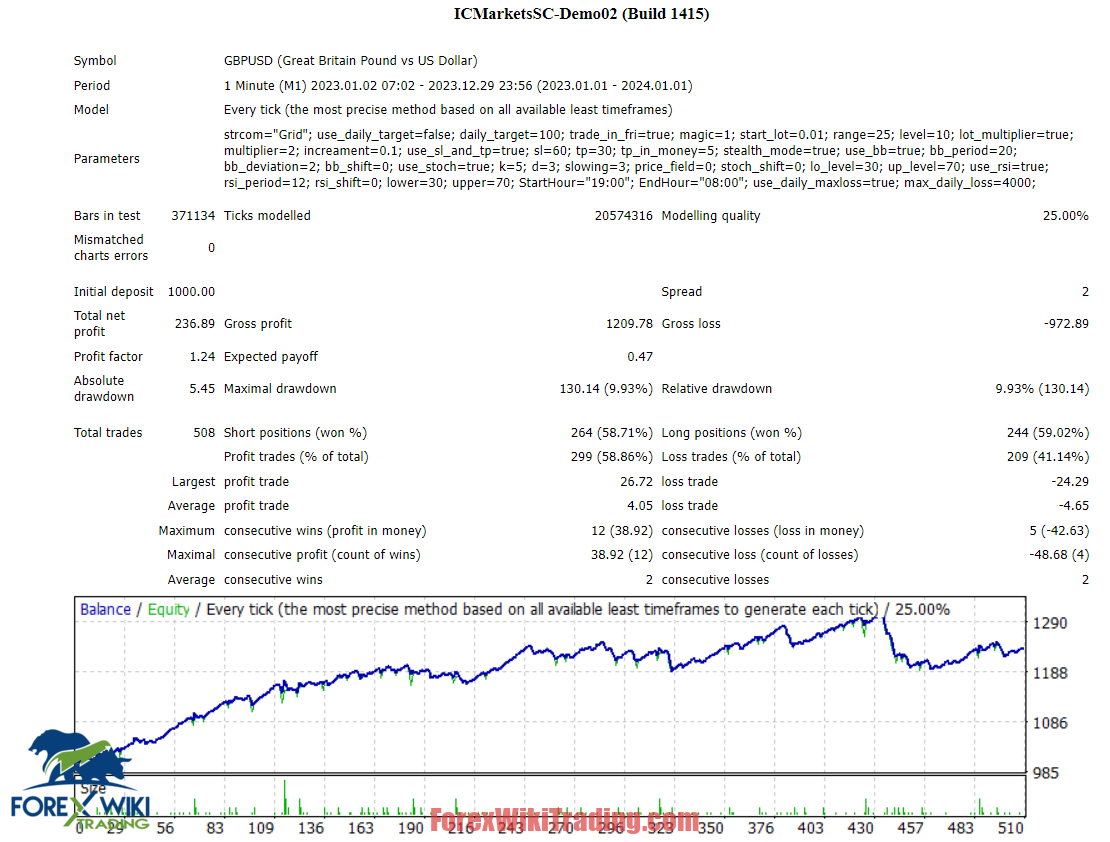

Review TrendTrekker EA Backtest

This backtest of the EA (Expert Advisor) for GBPUSD on a 1-minute timeframe spanning from January 2nd, 2023, to December 29th, 2023, provides valuable insights into its performance and efficacy. Let's delve into the analysis:

- Total Net Profit: The EA managed to yield a total net profit of $236.89 over the given period, which indicates its ability to generate positive returns.

- Profit Factor: With a profit factor of 1.24, the EA demonstrates a reasonably favorable ratio of gross profit to gross loss, suggesting its effectiveness in capitalizing on profitable trades relative to losing ones.

- Drawdowns: The absolute drawdown of 5.45 and maximal drawdown of 9.93% reflect the potential risks associated with using this EA. While the drawdowns are relatively modest, they highlight the importance of risk management strategies to mitigate losses during adverse market conditions.

- Trade Statistics: Out of a total of 508 trades, the EA secured profitable outcomes in 58.86% of cases, indicating a consistent performance. Additionally, the distribution between short and long positions showcases a balanced approach in trade execution.

- Average Trade Performance: The average profit trade of $4.05 and average loss trade of -$4.65 provide insights into the typical gains and losses incurred by the EA per trade. While the profit per trade slightly outweighs the loss, further optimization may enhance overall profitability.

- Consecutive Wins and Losses: The EA exhibits a maximum consecutive win streak of 12 trades with a cumulative profit of $38.92, underscoring its ability to capitalize on favorable market conditions. Conversely, the maximum consecutive loss streak of 5 trades, with a cumulative loss of -$42.63, emphasizes the importance of implementing risk control measures to avoid prolonged downturns.

In conclusion, while this EA demonstrates promising results with its ability to generate consistent profits and manage risk effectively, traders should exercise caution and conduct thorough analysis before deploying it in live trading environments. Additionally, continuous monitoring and optimization are essential to adapt to evolving market dynamics and maximize returns while minimizing risks.

Advantages

- Profitability: TrendTrekker EA has proven to be highly profitable for traders, with its strategic trading approach and adaptive parameters yielding consistent results.

- Customizability: Traders have the freedom to tailor the bot to their preferences, allowing for greater control over trading operations.

- Comprehensive Support: TrendTrekker EA offers extensive support resources, including installation videos and setup guides, making it accessible to traders of all skill levels.

- Ethical Trading Practices: Unlike some EAs that rely on risky strategies, TrendTrekker EA prioritizes transparency and ethical trading practices, ensuring a safer trading environment for users.

Disadvantages

- Learning Curve: While TrendTrekker EA is user-friendly, it still requires a certain level of knowledge and understanding of the Forex markets to use effectively.

- Market Dependency: Like any trading tool, TrendTrekker EA's performance is dependent on market conditions, and there are no guarantees of success in the Forex markets.

Conclusion

Download TrendTrekker EA

Please try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a live account.

Disclaimer: Trading Forex carries a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. Always conduct thorough research and consult with a financial advisor before making any investment decisions.