- May 12, 2024

- Posted by: Forex Wiki Team

- Category: Free Forex EA

Introduction TriForceFX EA

In the dynamic realm of forex trading, staying ahead demands strategic diversification and leveraging cutting-edge tools. TriForceFX EA emerges as a game-changer, amalgamating 11 SmartForexExpert EAs into one powerful solution. This article delves into the intricacies of TriForceFX EA, exploring its functionalities, advantages, and potential drawbacks.

Understanding TriForceFX EA

TriForceFX EA stands as a culmination of meticulous development, integrating 11 distinct EAs categorized into three core areas: momentum, reversal, and trend. This amalgamation empowers traders to diversify risk intelligently, capitalizing on various market behaviors. Noteworthy is the incorporation of TriForceFX Crypto Master in version 3.0, catering to the burgeoning crypto market.

Exploring Key Features

TriForceFX EA epitomizes efficiency without compromising system resources. Version 3.0, compatible with MT4, ensures seamless operation while accommodating concurrent usage with other EAs. The 'Portfolio' EA streamlines management, requiring just one M5 chart to oversee multiple EAs effectively.

Technical Specifications

Version: 3.1

Year of issue: 2024

Working pairs: ANY

Recommended timeframe: M15

Minimum Deposit: $500

Average of account: 1:30 To 1:1000

Best Brokers List

TriForceFX EA works with any broker and any type of account, but we recommend our clients use one of the top forex brokers listed below:

TriForceFX EA Settings

Let's break down the parameters:

- param_main: This seems to be a placeholder for general parameters, possibly for overarching settings.

- Broker_Server_GMT_Winter: Specifies the GMT offset for the broker's server during winter.

- Broker_Adapt_GMT_On_DST_Period: Adjusts the GMT offset for the broker's server during daylight saving time.

- _DowJones: Refers to the Dow Jones index, specifically 'US30'.

- _UseCalendar: Likely enables the use of economic calendars for trading decisions.

- _Sfe_stats_server: Points to a server for trade statistics.

- GlobalRiskFactor: A factor affecting risk management, presumably.

- param_backtest: Placeholder for backtesting parameters.

- _Test_use_fixed_balance_10000: Uses a fixed balance of $10,000 for backtesting.

- param_hct: Possibly related to trading with cryptocurrencies (BTC).

- hct_Autolot_Balance_Percentage: Auto lot sizing based on balance percentage for BTC trades.

- hct_Risk_Trade_Percent: Risk percentage for BTC trades.

- _BitcoinName: Name of the Bitcoin trading pair.

- _Symbol_List: List of trading symbols for various cryptocurrencies.

- param_pa, param_alpha, param_goldf, param_kiss, param_atrractor, param_indices, param_ns, param_ste, param_trend, param_other: Placeholder parameters for different trading strategies or asset classes.

- pa_Autolot_Balance_Percentage, alpha_Autolot_Balance_Percentage, GoldF_Autolot_Balance_Percentage, kiss_Autolot_Balance_Percentage, attractor_Autolot_Balance_Percentage, indices_Autolot_Balance_Percentage, ns_Autolot_Balance_Percentage, ste_Autolot_Balance_Percentage, trend_Autolot_Balance_Percentage: Auto lot sizing based on balance percentage for respective trading strategies or assets.

- pa_Risk_Trade_Percent, alpha_Risk_Trade_Percent, fullgold_Risk_Trade_Percent, kiss_Risk_Trade_Percent, at_Risk_Trade_Percent, indices_Risk_Trade_Percent, ns_Risk_Trade_Percent, st_Risk_Trade_Percent, tr_Risk_Trade_Percent: Risk percentages for respective trading strategies or assets.

- Various lists of trading pairs and assets: Specifying which pairs or assets to trade with each strategy.

- _Min_Virtual_Balance, _Max_Virtual_Balance: Minimum and maximum virtual balance for trading.

- _Order_Comment: Default comment for orders placed by the EA.

Unveiling the Included EAs

The repertoire of EAs within TriForceFX EA encompasses a spectrum of trading strategies tailored for different market conditions:

- TriForceFX Crypto Master: Harnessing momentum and trend dynamics in the crypto market.

- TriForceFX Price Action, Attractor, Kiss, and Alpha: Momentum-driven systems optimizing entry and exit points.

- TriForceFX Night Scalper and Stealth: Specialized in capitalizing on reversal patterns.

- TriForceFX Trend, Indices, Gold, and Bitcoin: Targeting trend movements across various asset classes.

Review TriForceFX EA Backtesting

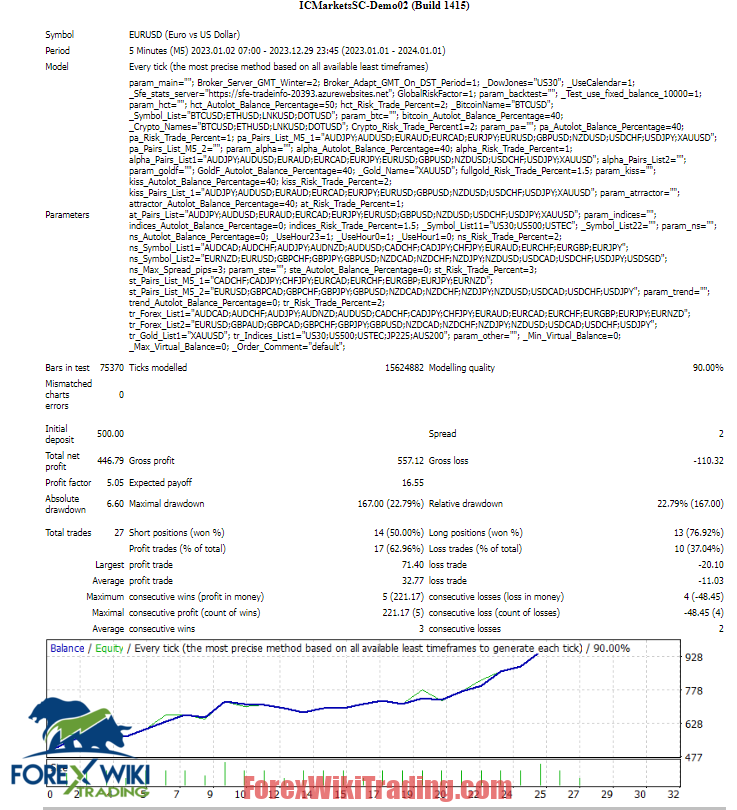

The EA demonstrates promising performance but with room for improvement:

- Total Net Profit: $446.79 is a positive outcome, indicating that the EA was able to generate profits over the tested period.

- Profit Factor: The profit factor of 5.05 suggests that for every dollar lost, the EA made approximately $5.05 in profit, which is considered favorable.

- Drawdown: The absolute drawdown of $6.60 and the maximal drawdown of $167.00 (22.79%) indicate that the EA experienced some periods of losses, with the maximal drawdown representing the largest drop from peak to trough during the testing period.

- Win Percentage: The EA won 62.96% of its trades, which is relatively high and contributes to the overall positive net profit.

- Trade Analysis: The average profit trade ($32.77) is significantly higher than the average loss trade (-$11.03), indicating that the EA tends to capture larger gains compared to losses, which is a positive sign for its profitability.

- Consecutive Trades: The EA demonstrated the ability to string together multiple winning trades, with a maximum consecutive win streak of 5 trades.

- Modeling Quality: The modeling quality of 90.00% suggests that the backtest was conducted using high-quality historical data, enhancing the reliability of the results.

- Spread: The spread of 2 pips is reasonable for a forex trading environment and is factored into the profitability of the EA.

Overall, while the backtest results show promising performance with profitable trades and a favorable profit factor, there are areas for improvement, such as reducing drawdowns and optimizing trade entry and exit strategies. Further analysis and refinement of the EA's parameters and trading logic may lead to enhanced performance and risk management.

Advantages of TriForceFX EA

- Diversification: Seamlessly blend multiple trading strategies to mitigate risk and optimize returns.

- Efficiency: Streamlined operation and minimal resource demands ensure smooth execution.

- Adaptability: Versatility to trade across different asset classes and market conditions.

- Risk Management: Customizable parameters empower traders to fine-tune risk exposure according to their risk appetite.

Disadvantages of TriForceFX EA

- Complexity: Novice traders may find the multitude of parameters and strategies overwhelming.

- Dependency on Configuration: Inaccurate parameter settings can lead to suboptimal performance and losses.

- Market Dependence: Performance may vary based on market conditions, necessitating ongoing monitoring and adjustment.

Conclusion

TriForceFX EA emerges as a formidable ally for forex traders seeking to navigate the intricacies of the financial markets. By amalgamating diverse strategies into a singular, efficient solution, it unlocks unparalleled potential for diversification and profitability. However, prudent utilization, backed by thorough testing and parameter optimization, remains imperative to harness its full capabilities and mitigate inherent risks.

Download TriForceFX EA

Please try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a live account.