- December 20, 2024

- Posted by: Forex Wiki Team

- Category: Free Forex EA

Comprehensive Review of FX OscilloPro EA

The FX OscilloPro EA is a sophisticated Forex trading tool designed to capitalize on market trends using advanced algorithmic strategies. Its robust features and functionalities have made it a popular choice among traders seeking automation and efficiency. In this review, we will dive into the tool’s capabilities, analyze its performance, and weigh its advantages and disadvantages based on live results and technical specifications.

Technical Specifications

Version: 23

Year of issue: 2024

Working pairs: AUDCAD, NZDCAD, CADCHF, GBPCAD, AUDNZD

Recommended timeframe: M5

Minimum Deposit: $1200

Average of account: 1:30 To 1:1000

Best Brokers List

CycleMaster EA works with any broker and any type of account, but we recommend our clients use one of the top forex brokers listed below:

Trading Algorithm and Strategy

FX OscilloPro EA employs a dynamic approach to Forex trading, leveraging the William Percentage Range (W%R) indicator. This indicator identifies oversold or overbought conditions, creating potential entry points for trades. Here are the primary highlights of its strategy:

- Flexible Grid System:

- The EA incorporates a grid trading mechanism designed to recover from losing positions effectively.

- It places trades exclusively at pre-defined oversold or overbought levels, ensuring calculated risks.

- Safety Mechanisms:

- Features such as hedging and drawdown reduction are implemented to minimize potential losses.

- Adjustable timeframes provide users with the flexibility to respond to volatile market conditions.

- No Curve Fitting:

- The algorithm avoids optimization practices that fit historical data but fail in live trading environments.

Features and Functionalities

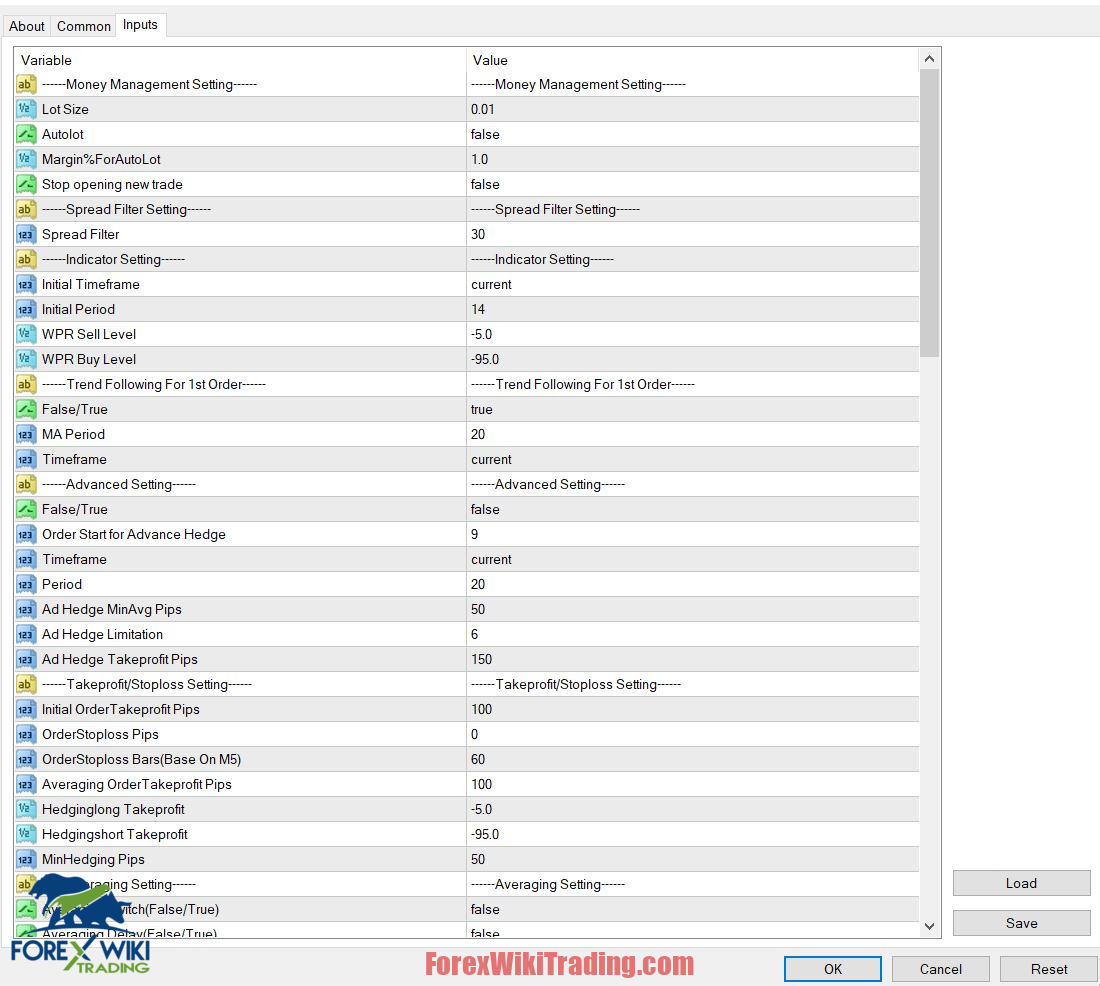

FX OscilloPro EA boasts several key features designed to optimize trading efficiency:

- Spread Filter: Ensures trades are executed only when market conditions are favorable.

- Hedge System: Protects against significant losses by balancing open positions.

- Advanced Drawdown Reduction System: Mitigates risks during unfavorable market movements.

- Customizable Lot Size: Allows users to define averaging lot sizes for flexibility.

- Backtesting: Validated with 15 years of tick data at 99.9% modeling quality to ensure reliability.

Recommended Settings

- Trading Pairs:

- AUDCAD

- NZDCAD

- CADCHF

- GBPCAD

- AUDNZD

- Timeframe:

- Operates optimally on the 5-minute (5M) timeframe.

- Account Type:

- Requires an ECN account with leverage of 1:100 or higher.

- Initial Deposit:

- Recommended USD 1,200 per 0.01 lot per pair for optimal performance. Traders can start with lower deposits but should maintain sufficient reserves to handle potential drawdowns.

Performance Analysis

Growth and Profitability

Based on the provided live results:

- Growth: Achieved an impressive 924.6% growth since its inception in 2022.

- Profit: Generated a total profit of USD 8,261.45 with an initial deposit of USD 1,000.

- Withdrawals: Recorded withdrawals of USD 4,500, demonstrating liquidity.

Risk Metrics

- Maximum Drawdown: 47.3%, indicating a moderate level of risk.

- Win Rate: 71.3% of trades were profitable, showing consistent performance.

- Trading Activity: Maintains 100% activity, ensuring continuous engagement with the market.

Equity and Balance Trends

The equity curve exhibits steady growth with occasional drawdowns, reflecting the tool’s reliance on grid and hedging strategies. The balance curve shows robust upward movement, aligning with the reported growth percentage.

Advantages

- Automated Trading:

- Eliminates emotional decision-making by relying on algorithmic strategies.

- High Growth Potential:

- Demonstrates significant growth and profitability over an extended period.

- Robust Safety Features:

- Incorporates multiple mechanisms to reduce drawdowns and protect capital.

- Versatility:

- Supports multiple currency pairs and allows customizable settings for diverse trading needs.

- Comprehensive Testing:

- Backtested with high-quality data to validate its performance across market conditions.

Disadvantages

- High Drawdown:

- The maximum drawdown of 47.3% may deter risk-averse traders.

- Capital Requirements:

- Requires substantial initial deposits for optimal operation, especially when trading multiple pairs.

- Complexity:

- May require advanced knowledge to configure settings like lot sizes and grid parameters effectively.

- Dependency on Market Conditions:

- Performance may vary significantly during unexpected market movements.

Conclusion

FX OscilloPro EA is a powerful tool for automated Forex trading, offering high growth potential and innovative safety mechanisms. While it presents notable advantages like significant profitability and robust features, it also comes with risks such as high drawdown and the need for adequate capital. Traders should evaluate their risk tolerance and financial capacity before adopting this EA.