- April 11, 2024

- Posted by: Forex Wiki Team

- Category: Free Forex EA

Revolutionizing Index Scalping for the Major Exchanges

Welcome to the world of Machine Scalping EA, a cutting-edge trading system designed to conquer the major indices (NASDAQ, DOW, and S&P 500). Developed by a team of quants with over 20 years of experience, this system is an aggressive and powerful trading machine poised to transform your approach to index scalping.

Harness the Power of Major Indices

Machine Scalping EA is an index scalper that capitalizes on the high liquidity and low spreads of the major indices. These markets run consistently throughout the day, providing ample trading opportunities. The system is a frequent trader, executing an average of over 5 trades per day, with the potential for more on volatile days and fewer on slower trading days. This ensures an exciting and dynamic trading experience focused on the European and US sessions.

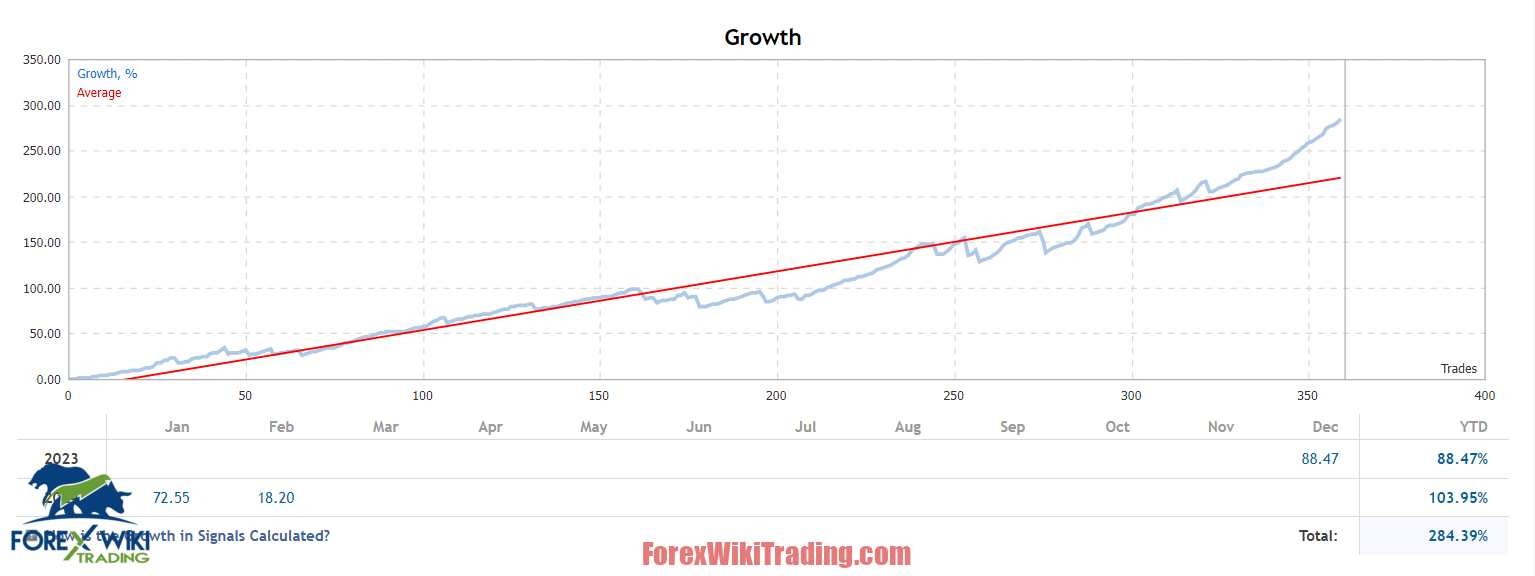

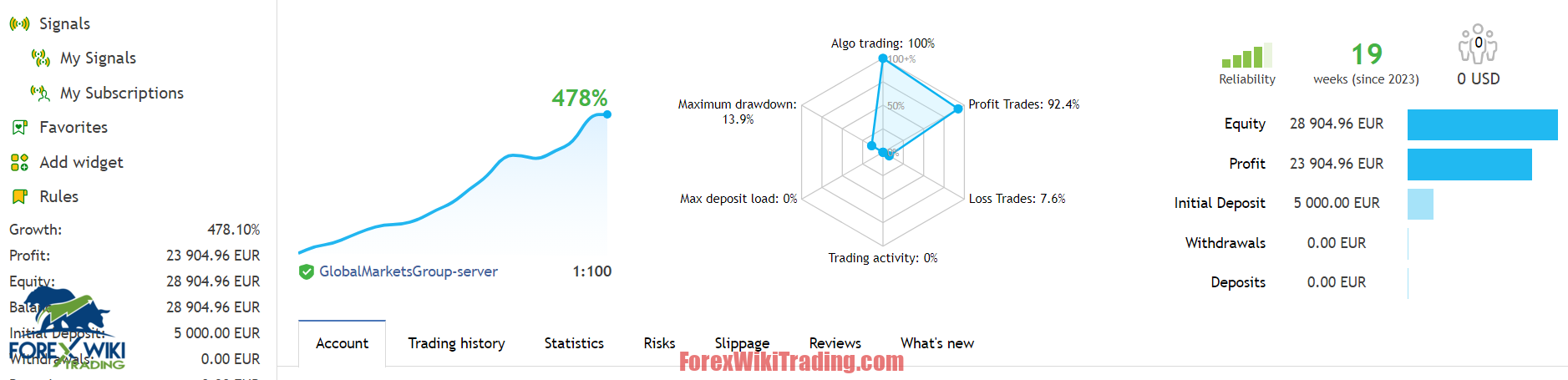

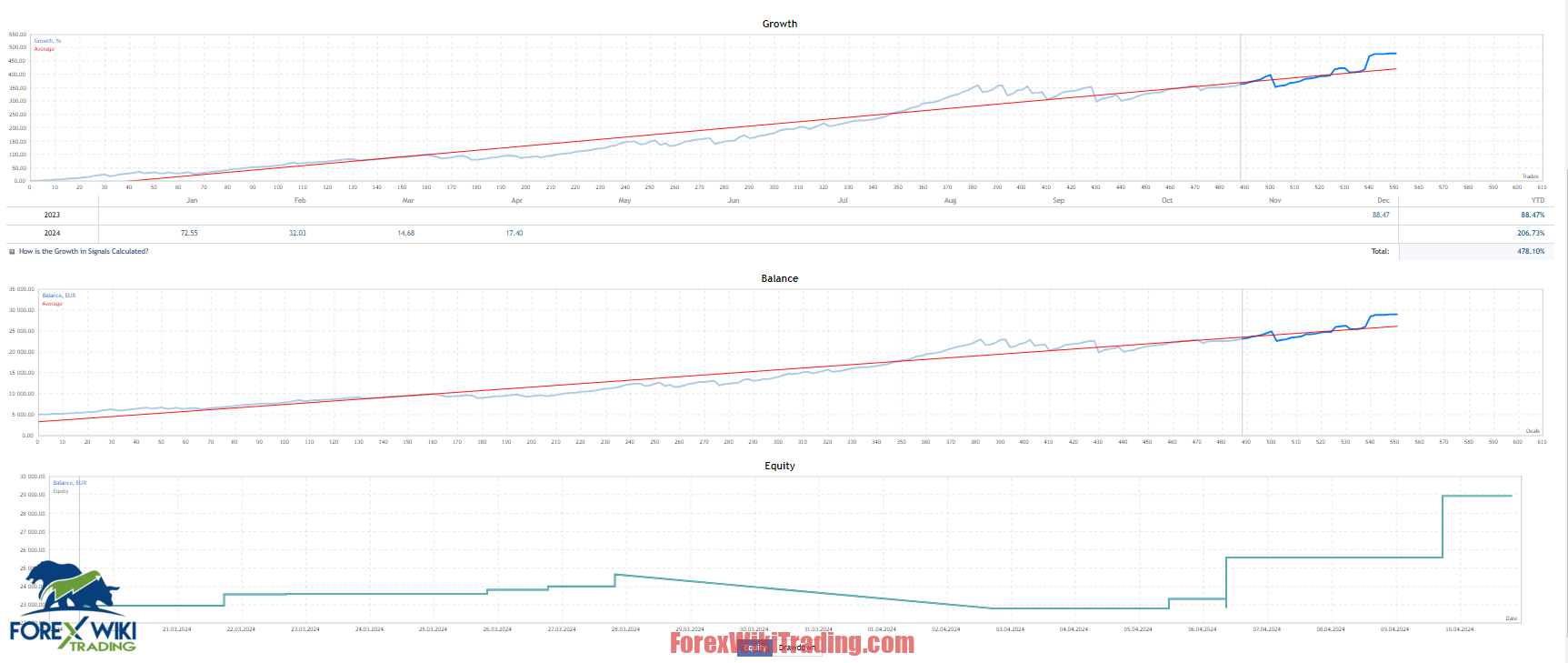

Proven Backtesting and Forward Live Performance

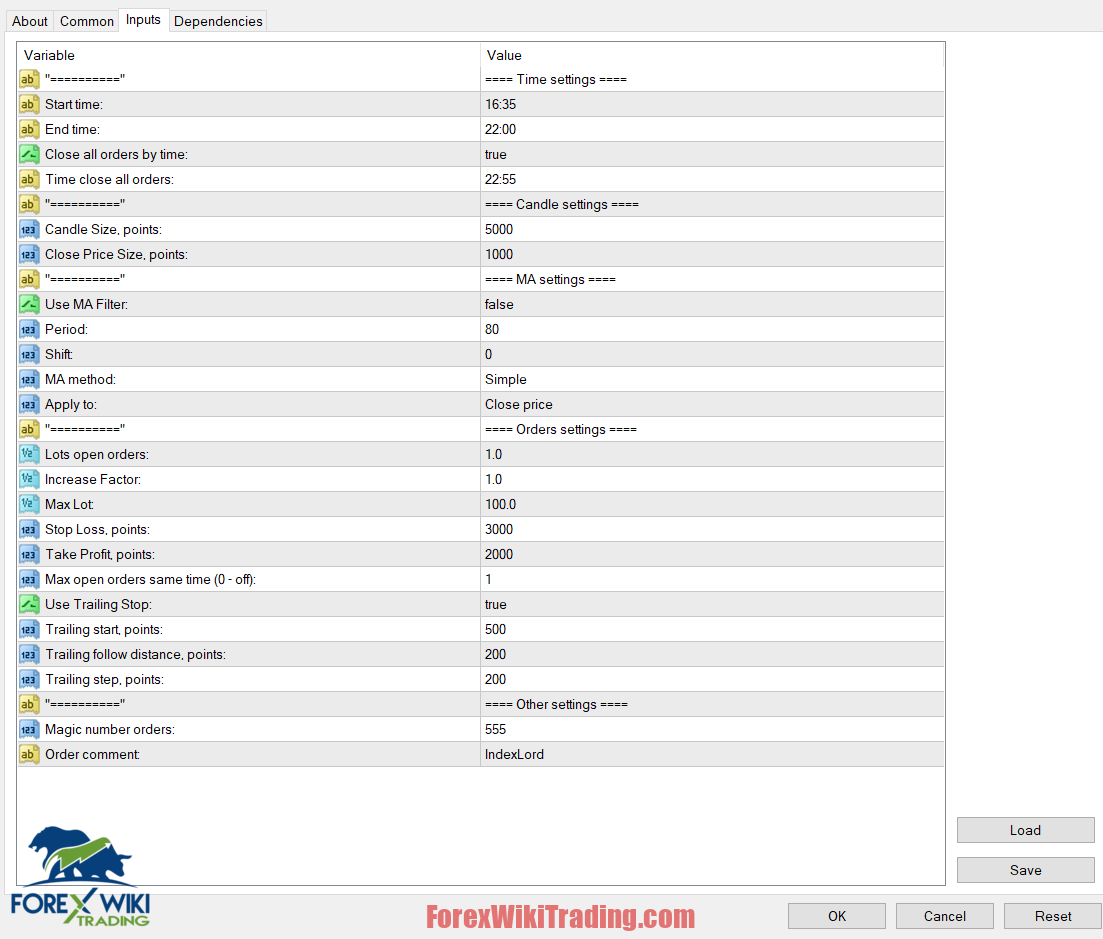

Machine Scalping EA has demonstrated remarkable backtesting agility and impressive forward live trading results, showcasing its long-term potential. The system operates on 5 different charts – 2 for NASDAQ, 2 for DOW, and 1 for S&P 500 – utilizing timeframes ranging from 1-minute to 5-minute charts. Each trade is protected by a 30-60 point stop loss, and the system employs a trailing stop function activated from a 5-point gain onwards.

Versatile Trading Capabilities

The system can have multiple trades open simultaneously, particularly around market open when price movements are most volatile. It can trigger trades on both the 1-minute and 5-minute charts at the same time, with the potential to have up to 5 trades open at once (one from each chart).

Price Action-Driven Approach

Machine Scalping EA relies on candlestick patterns and price action mechanisms to identify trading opportunities, offering a unique perspective compared to standard indicator-based trading. This approach ensures the system only takes trades when there is strong market momentum, resulting in a high win rate and avoiding poor trading entries.

Technical Specifications

Version: 1.0

Year of issue: 2024

Working pairs: NASDAQ100, US30 (DOW), SP500

Recommended timeframe: M1 and M5

Minimum Deposit: $100 (with 0.1 trading index lots)

Average of account: 1:30 to 1:1000

Best Brokers List

Machine Scalping EA works with any broker and any type of account, but we recommend our clients use one of the top forex brokers listed below:

Strategy Summary

- Broker Offering: Any decent broker with good index trading conditions

- Account Type: Low-spread with commission (RAW/RAZOR/ECN)

- Entry: Open of a new bar on the 1-minute or 5-minute chart

- Exit: Stop loss or trailing stop loss

- Trading Frequency: Average of over 5 trades per day

- Session: European and US trading sessions only

Unlock your trading potential with Machine Scalping EA, a powerful and versatile system designed to conquer the major indices. Explore the backtests and setup files provided in the comments to start your journey towards consistent and profitable index scalping.

Machine Scalping EA Results

Advantages and Disadvantages of Machine Scalping EA

Advantages:

- Proven Performance: The system has demonstrated impressive backtesting results and forward live trading success, showcasing its long-term potential.

- Versatile Trading Approach: The ability to trade multiple instruments (NASDAQ, DOW, S&P 500) and open multiple trades simultaneously provides flexibility and diversification.

- Automated Trading: The system's automated nature reduces the cognitive load on the trader, allowing for a more efficient and consistent trading experience.

- Price Action-Driven Methodology: The focus on candlestick patterns and price action rather than standard indicators offers a unique and potentially more effective trading perspective.

- Adaptability: The system can be optimized for different broker conditions and account types, allowing for adaptability to various trading environments.

Disadvantages:

- Broker Dependency: The system's performance is heavily dependent on the broker's execution quality, spreads, and slippage. Finding the right broker with optimal trading conditions is crucial.

- Frequent Trading: The system's high trading frequency may require increased monitoring and discipline, which may not suit all traders.

- Potential Drawdowns: As with any trading system, there may be periods of drawdown or losses, which traders must be prepared to manage emotionally and financially.

- Limited Geographical Reach: The system only operates during the European and US trading sessions, excluding the Asian session.

- Complexity: The system's technical aspects, such as the multiple chart setups and trading logic, may require a steeper learning curve for some traders.

By carefully considering both the advantages and disadvantages of Machine Scalping EA, traders can make an informed decision on whether this system aligns with their trading style, risk tolerance, and overall investment goals.