- June 26, 2023

- Posted by: Forex Wiki Team

- Category: Forex Trading System

Time and Price Forecasting Trading System Review

In the dynamic world of forex trading, success is often attributed to the ability to accurately predict future market moves. While traditional indicators provide valuable insights, they are inherently lagging in nature. To transcend the limitations of lagging indicators and enhance trading precision, the Time and Price Forecasting Trading System introduces a comprehensive set of geometric tools. By leveraging mathematical principles and probability analysis, this system empowers traders to project future market movements with increased accuracy and confidence. In this article, we will explore the key geometric tools that comprise this trading system and shed light on their effectiveness in the realm of forex trading.

Version: V 1.7

Terminal: MT4

Year of issue: 2022

Working pairs: Any Pair

Recommended timeframe: H30, H1, H4

Best Brokers List

Time and Price Forecasting Trading System works with any broker and any type of account, but we recommend our clients use one of the top forex brokers listed below:

Time and Price Forecasting Trading System Settings:

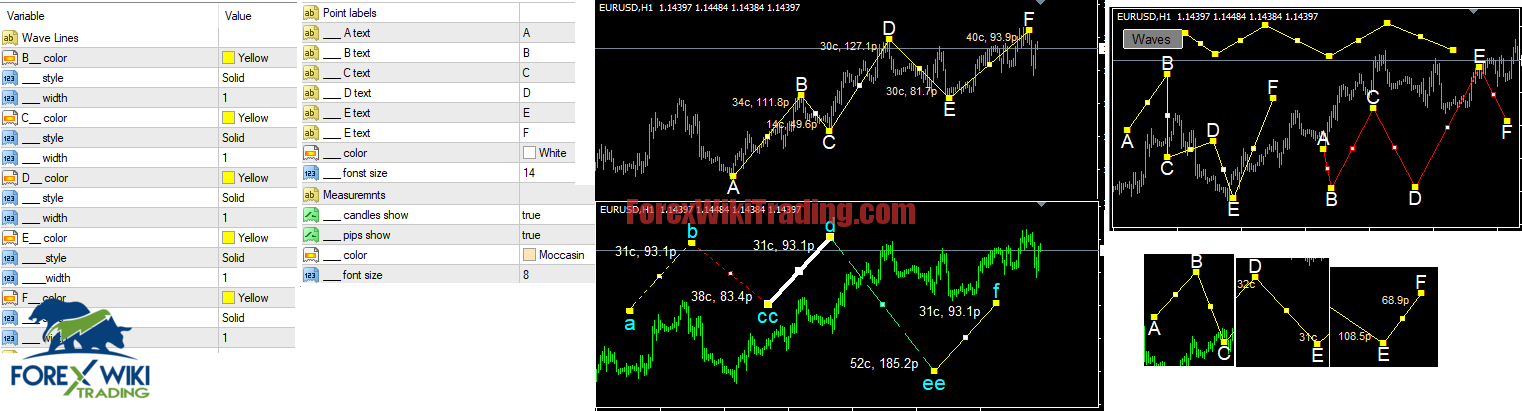

Geometric Tools in the Toolkit:

Geometric Tools in the Toolkit:

- TRG (Trend Reversal Geometric): The TRG tool identifies potential trend reversal points by analyzing geometric patterns and symmetry within price movements. By recognizing these patterns, traders can anticipate market shifts and adjust their trading strategies accordingly.

- TCG (Trend Continuation Geometric): The TCG tool complements the TRG by identifying geometric patterns that indicate a continuation of the prevailing trend. This enables traders to ride the trend and maximize profit potential.

- Wolf Wave: The Wolf Wave tool is based on the principles of wave analysis and identifies patterns resembling a wave formation. It assists traders in forecasting potential turning points and breakouts, offering valuable insights into market dynamics.

- Beck's Emblem: Beck's Emblem is a geometric tool that detects significant price levels and potential support or resistance zones. By identifying these levels, traders can make informed decisions on entry and exit points.

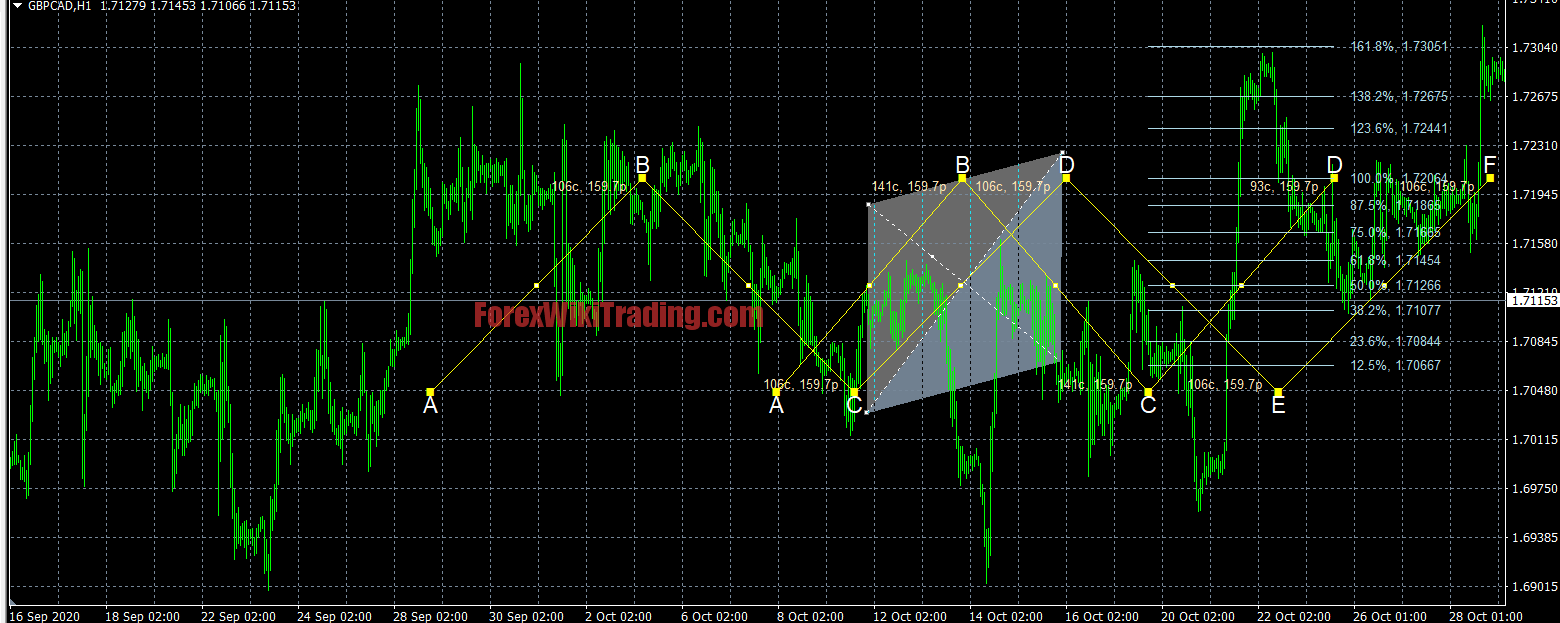

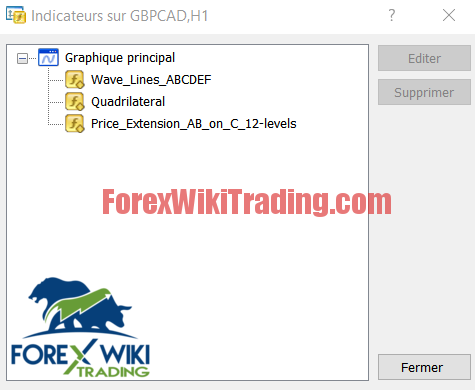

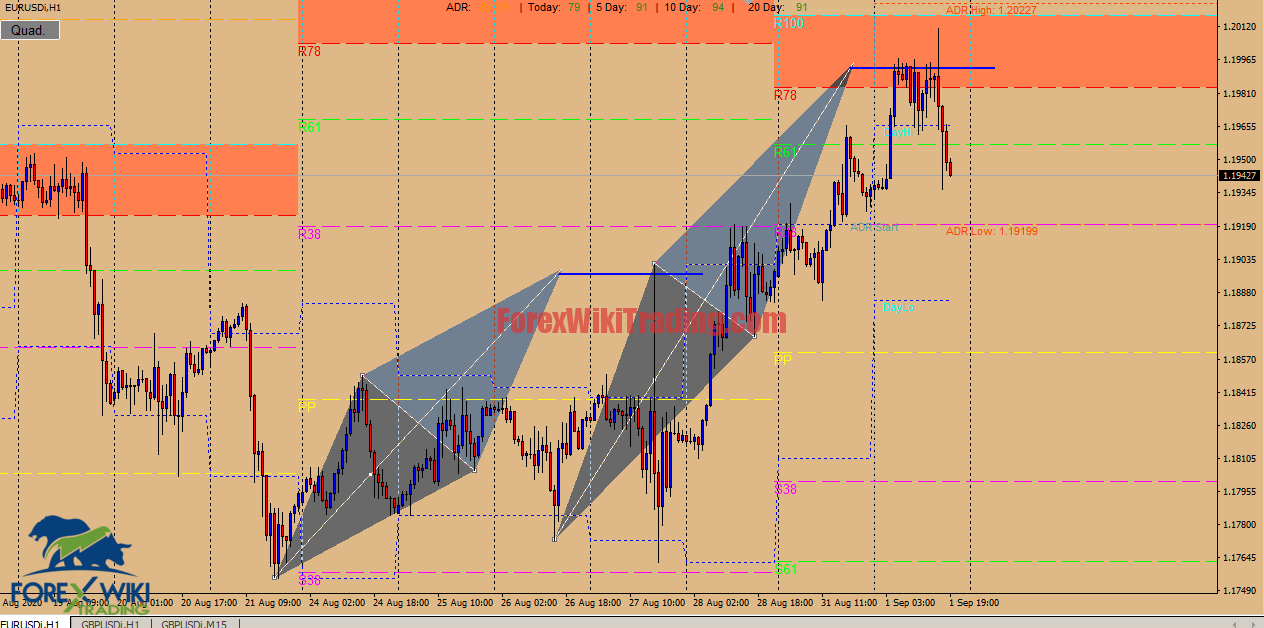

- Quadrilateral: The Quadrilateral tool utilizes geometric shapes to identify consolidation patterns within price movements. It helps traders anticipate potential breakouts or breakdowns from these patterns, providing opportunities for profitable trades.

- Andrews Pitchforks: Andrews Pitchforks are a set of parallel lines that help traders identify potential future support and resistance levels. By projecting these lines based on past price action, traders gain insights into potential price channels.

- Offset Squares (Tetrad): Offset Squares, also known as Tetrad, provide a geometric framework to identify potential turning points in the market. By considering the relationship between price and time, traders can anticipate key market reversals.

- Time Price Vectors: Time Price Vectors combine the dimensions of time and price to identify future market movements. Traders can utilize these vectors to project potential price levels based on time intervals, enabling precise entry and exit points.

- Parallel Lines Circumscribed Objective: This tool utilizes parallel lines to identify important price levels that are likely to act as support or resistance. By observing the interactions of price with these lines, traders can make informed decisions.

- Circumcircle: The Circumcircle tool helps traders identify potential market turning points by utilizing geometric circles. These circles are constructed based on price and time parameters, providing valuable insights into market dynamics.

- Even/Odd Squares: Even/Odd Squares are geometric tools that assist traders in identifying potential symmetry within price movements. By recognizing these patterns, traders can anticipate market reversals and adjust their trading strategies accordingly.

- Dyad/Arc: Dyad/Arc is a geometric tool that uses circular arcs to identify potential support and resistance levels. By analyzing the interactions of price with these arcs, traders can gain insights into future price movements.

- Lunar Cycles: Lunar Cycles integrate the lunar calendar with market analysis to identify potential market turning points. Traders who consider the influence of lunar cycles can gain a unique perspective on market dynamics.

- Hadrian's Wall: Hadrian's Wall is a tool that assists traders in identifying potential strong support or resistance levels. By recognizing these levels, traders can make informed decisions on market entry and exit points.

- Aisha's Trendline: Aisha's Trendline is a powerful tool that helps traders identify and validate trends within price movements. By drawing accurate trendlines, traders can determine the direction of the market and align their trading strategies accordingly.

- ZBD (Zero Balance Zone): The ZBD tool identifies price levels where supply and demand are in equilibrium, resulting in potential market turning points. By recognizing these zones, traders can anticipate trend reversals and capitalize on them.

- Trajan's Trident: Trajan's Trident is a geometric tool that assists traders in identifying potential trend continuation points. By recognizing these points, traders can stay on the right side of the prevailing trend and maximize profit potential.

- Volume and Relative Velocity: In addition to geometric tools, traders should incorporate volume analysis and relative velocity to validate market movements. These indicators provide crucial insights into market participation and the strength of price movements.

- Squaring the High, Squaring the Low, and Squaring the Range: Squaring techniques involve mathematical calculations to identify potential price levels based on the relationship between time and price. These tools can provide valuable insights into future market movements.

- Secret Angle and Flower of Life: Secret Angle and Flower of Life are geometric tools that offer alternative perspectives on market analysis. By exploring these tools, traders can gain unique insights and potentially uncover hidden market patterns.

Conclusion

The Time and Price Forecasting Trading System harnesses the power of geometric tools to project future market moves with enhanced precision. By integrating mathematical principles and probability analysis, traders can anticipate potential turning points, trend continuations, and consolidation breakouts.

However, it is crucial to acknowledge that no trading system is infallible, and market dynamics can be influenced by various factors. Therefore, it is recommended to combine the insights from geometric tools with fundamental and sentiment analysis to make well-informed trading decisions. By adopting a comprehensive approach and continually refining their skills, traders can aim for a successful and sustainable trading career in the forex market.

Download Time and Price Forecasting Trading System

Please try for at least a week an XM demo account. Also, familiarize yourself with and understand how this free forex ea works before using it on a live account.

Disclaimer: Forex trading involves inherent risks, and it is essential to conduct thorough research and exercise caution when using any trading tool or EA. The information provided in this article is for educational purposes only and should not be considered as financial advice. Traders should evaluate the EA based on their individual trading goals and risk tolerance before making any investment decisions.