- June 2, 2022

- Posted by: Forex Wiki Team

- Categories: Forex Trading System, Free Forex EA

Sure Forex Hedging Strategy

The Sure Forex Hedging outlined here is simply...amazing. If you can read a chart and tell when the market is trending, you can make a lot of money with the strategy described below. This is the trading approach we would choose if we had to select only one! With this one, be sure to practice correct position sizing and money management, and you'll have nothing but success!

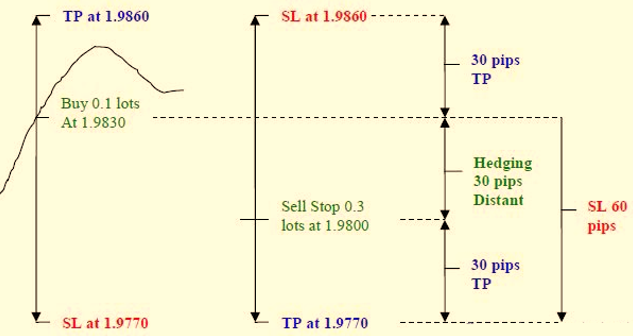

1 - Assume there is no spread to make things simple. You can open a position in any direction. Purchase 0.1 lots at 1.9830. Place a Sell Stop order for 0.3 lots at 1.9800 a few seconds after placing your Buy order. Take a look at the many options...

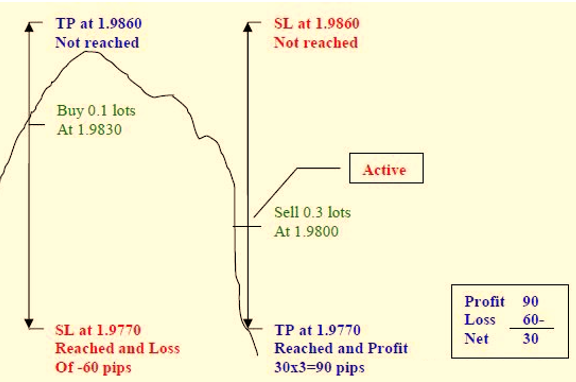

2 - If the TP at 1.9860 is not met, and the price falls below the SL or TP at 1.9770. Then, because the Sell Stop had become an active Sell Order (Short) earlier in the move at 0.3 lots, you had a profit of 30 pips.

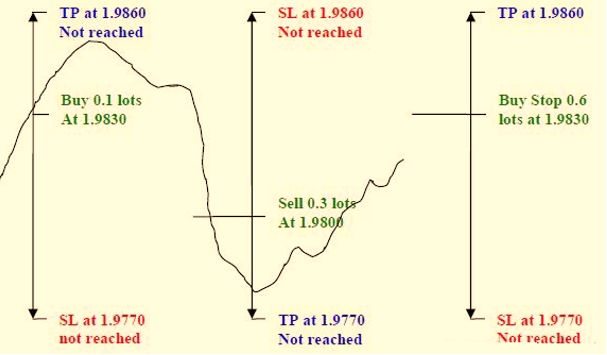

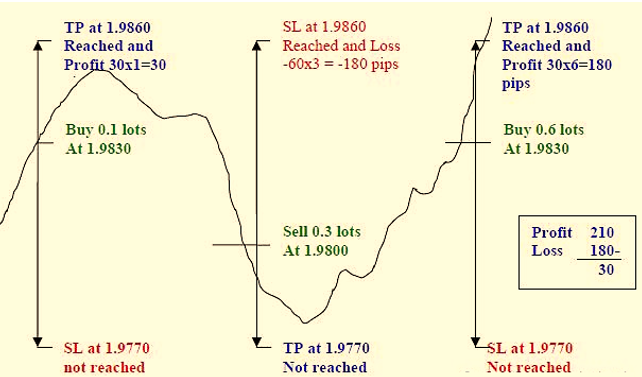

3 - However, if the TP and SL at 1.9770 are not met and the price rises, you must create a Buy Stop order at 1.9830 to anticipate a climb. You must instantly issue a Buy Stop order for 0.6 lots at 1.9830 after the Sell Stop was met and became an active order to Sell 0.3 lots (image above) (picture below).

4 - If the price rises and reaches the SL or TP at 1.9860, you will profit by 30 pips!

5 - If the price continues to fall without touching any TP, place a Sell Stop order for 1.2 lots, then a Buy Stop order for 2.4 lots, and so on... Continue in this manner until you have made a profit. 0.1, 0.3, 0.6, 1.2, 2.4, 4.8, 9.6, 19.2, and 38.4 are the lots.

6 - I've chosen a 30/60/30 setup in this example (TP 30 pips, SL 60 pips and Hedging Distance of 30 pips). You may also go with 15/30/15 or 60/120/60. You may also experiment with 30/60/15 or 60/120/30 layouts to see if you can optimize earnings. profit from your business Any trading approach will work with this strategy. (SEE BELOW FOR COMMENTS)

7 - Now, take into account the spread and select a pair with a narrow spread, such as EUR/USD. The spread is usually approximately 2 pips. The closer the spread is to zero, the more likely you are to win. This looks like a "Never Lose Again Strategy" to me! Allow the price to go anywhere it wants; you'll still make money anyway.

Actually, finding a "time period" when the market will move sufficiently to ensure the pips you need to create a profit is the entire "secret" to this approach (if there is one). Any trading approach will work with this strategy. (SEE BELOW FOR COMMENTS)

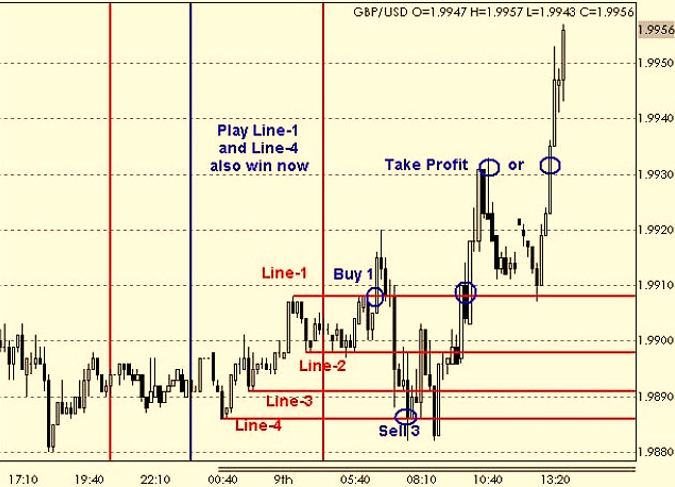

Line-1 and Line-4 are used in an Asian Breakout.

You are free to use any pip range you choose.

All you need to know is when the market has enough movement to create the pips you require. Another thing to keep in mind is that if you have too many open buy and sell positions, you may run out of margin.

COMMENTS: At this point, I hope you can see the enormous potential that this technique offers. To summarize, you take a position in the direction of the current intraday trend. To figure out which way the market is moving, I recommend looking at the H4 and H1 charts. In addition, I recommend that you use the M15 or M30 as your trading and timing windows. You'll meet your initial TP target 90% of the time if you execute it this way, and your hedge position will never need to be triggered. When implementing hedging tactics, as noted in point 7, keeping spreads modestly is essential. However, understanding how to profit from momentum and volatility is much more crucial.

A double martingale variant of the Sure Forex Hedging

This approach is unique, but it's intriguing since you can benefit even if you hit a stop loss! You would buy 1 lot (marked with B1) in the example below with the expectation that it will rise. However, in the event that the price falls, you will sell one lot (at S1, which is the same price as your buy price) at the same time. Then follow the steps outlined in the figure. When one martingale comes to a halt, the other takes over. During instances when the price is ranging, this technique might gain pips. It doesn't make much of a difference in comparison to the other martingale because winning transactions just require one additional lot to be placed into play.

In the preceding example, you purchase 1 micro-lot and sell 1 micro-lot at the same time on the EUR/USD, then put an order to sell 3 micro-lots and buy 1 micro-lot if the pair falls 10 pips. You've "won" if the pair falls 10 pips, and you can start over. However, if the pair increases, you'll put a fresh purchase order for 6 micro-lots and a sell order for 1 micro-lot, and so on. Each time the price reverses direction against your heaviest weighted direction, the lot increments are 1 micro-lot, 3 micro lots, 6 micro lots, 12 micro lots, 24 micro-lots, and so on.

Sure Forex Hedging EA

| Symbol | EURUSD, GBPUSD, XAUUSD |

| Timeframe | M15, M3, H1 |

| Test From | 2018 |

| Settings | Default |

| Brokers | See list below |

| Minimum Deposit | $300 |

| Feature | NOT sensitive to spread, slippage |

Best Brokers List

The Sure Forex Hedging EA works with any broker and any type of account, but we recommend our clients to use one of the top forex brokers listed below:

Sure Forex Hedging EA Setting

Sure Forex Hedging EA Result

Download Sure Forex Hedging EA

We highly recommend trying the Sure Forex Hedging EA for at least a week with ICMarket demo account. Also, familiarize yourself with and understand how this system works before using it on a live account.